本期看点

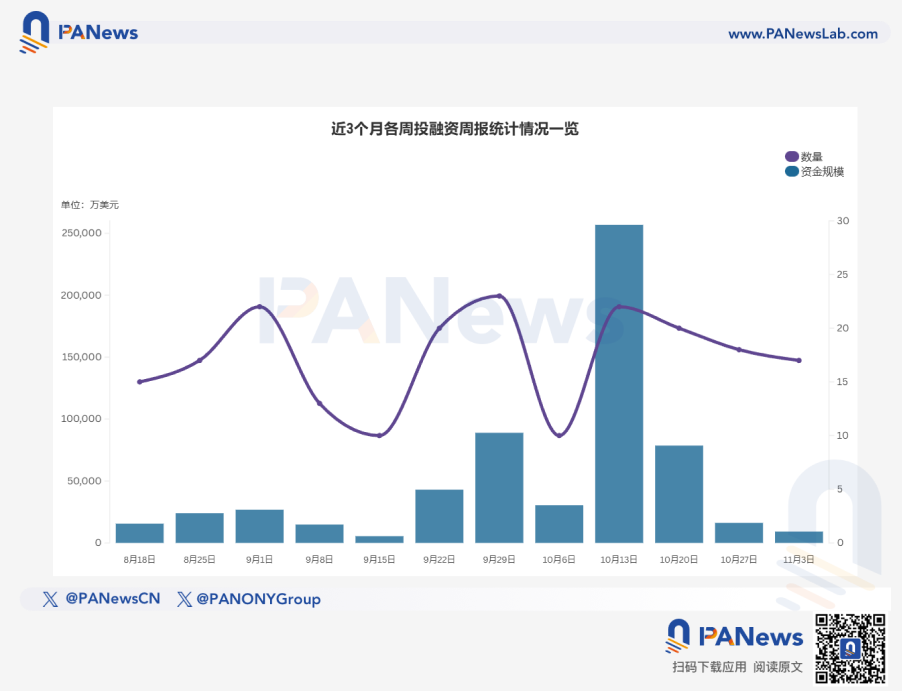

据 PANews 不完全统计,上周(10.27-11.2)全球区块链有17起投融资事件,资金总规模超0.92亿美元;此外,上市公司加密资产储备融资总额超4.68亿美元,概览如下概览如下:

- DeFi方面公布了1起投融资事件,Accountable完成750万美元融资,Pantera Capital领投;

- Web3+AI赛道公布了3起投融资事件,其中AI 支付公链项目 Kite AI 宣布获得 Coinbase Ventures 战略投资;

- 基础设施&工具领域公布了4起投融资事件,其中自托管平台Bron Labs完成约1500万美元融资,投资者包括LocalGlobe等;

- 中心化金融领域公布了4起投融资事件,其中巴基斯坦稳定币公司ZAR完成1290万美元融资,a16z领投;

- 其它Web3应用方面公布了2起投融资事件,其中HEALTH完成250万美元种子轮融资,Gemhead Capital 与 Castrum Istanbul联合领投;

- 此外,有2家上市公司完成融资用于加密财库战略,纳斯达克上市航运公司OceanPal完成1.2亿美元PIPE;

- GameFi赛道公布了3起投融资事件,其中KapKap宣布完成1000万美元融资,种子轮由Animoca Brands领投

DeFi

加密信用基础设施Accountable完成750万美元融资,Pantera Capital领投

Accountable完成750万美元融资,Pantera Capital领投,OKX Ventures、Onigiri Capital、KPK参投。Accountable定位为“非足额抵押”加密信用基础设施,曾于2024年底融资230万美元,现计划扩充团队(现有18人),推进与机构合作并加速产品落地。CEO Wojtek Pawlowski称公司将面向新型银行与交易所提供可嵌入的收益产品。项目已上线测试网,主网预计于11月中旬推出。

AI

Web3+AI项目PoobahAI完成200万美元种子轮融资

无代码人工智能平台PoobahAI宣布,已从FourTwoAlpha Ltd获得200万美元种子轮融资。新资金将为PoobahAI在人工智能-Web3融合领域的积极发展路线图提供资金支持,同时推动市场拓展计划。据介绍,其旗舰产品MCP Server将一个人工智能代理直接接入区块链的基础设施层,可实现无缝多链操作,将静态区块链转变为动态、自给自足的系统。

AI 支付公链 Kite AI 获 Coinbase Ventures战略投资

AI 支付公链项目 Kite AI 宣布获得 Coinbase Ventures 战略投资。据官方信息,本次融资是 Kite 近期由 PayPal Ventures 和 General Catalyst 领投的总额为 3300 万美元的融资的延续,新资金将用于支持其自主 AI 智能体支付基础设施的开发,并与 Coinbase 合作共建,加速推进 x402 协议的大规模采用。

据悉,Kite 自设计之初即实现 Coinbase 的 x402 智能体支付标准实现原生集成。作为最早一批完整实现 x402 兼容支付原语的 Layer 1 区块链之一,Kite 使 AI 智能体能够通过标准化的意图授权直接发起、接收并对账支付,这确立了 Kite 作为 x402 协议及新兴智能体经济的原生执行层与结算层的地位。

去中心化 AI 推理路由网络 DGrid AI 获得种子轮投资

DGrid AI 宣布已获得Waterdrip Capital、IoTeX、Paramita VC、Cacher VC、4EVER Research、Zenith Capital、Abraca Research 等机构的种子轮投资支持。DGrid AI 是一个去中心化的 AI 推理路由网络,为开发者和应用提供低成本、可验证且无需信任中介的 AI 能力。DGrid 核心依托 “AI RPC + LLM 推理 + 分布式节点” 架构,致力于打破中心化 AI 平台的垄断格局,为 Web3 生态提供开放、可信且低成本的 AI 能力支撑。融资资金将主要用于节点网络搭建与生态合作伙伴拓展。

YZi Labs已领投对教育领域AI软件VideoTutor的1100万美元种子轮融资

YZi Labs宣布已领投对教育领域AI软件VideoTutor的1100万美元种子轮融资。本轮融资还吸引了JinQiu Fund(字节跳动关联基金)、Baidu Ventures、Amino Capital、BridgeOne Capital等机构的参与。这是YZi Labs今年早些时候扩大投资范围以来,在人工智能软件领域的首笔投资。

VideoTutor是一款“教育AI代理”,能将任何问题转化为个性化动画课程,让优质辅导服务触手可及。VideoTutor由20岁的企业家Kai Zhao创立,该平台采用大语言模型(LLM)+ Manim动画渲染流程,可生成精准、适应性强的AI教学视频。目前,其服务已覆盖全球2万名用户,并收到超过1000份API集成请求。

(该融资不计入本期融资周报统计)

基础设施&工具

Copper创始人推出Bron Labs专注数字资产安全,已完成约1500万美元融资

总部位于伦敦的加密货币托管Copper Technologies Ltd.创始人Dmitry Tokarev创立新公司Bron Labs,以应对数字资产自托管的安全风险。据悉,Bron Labs是一款自托管平台,旨在为消费者和专业人士提供此前仅大企业可享的高级安全保障。Tokarev透露,Bron Labs今年早些时候完成约1500万美元融资,投资者包括LocalGlobe、Fasanara Digital和GSR等约140位个人与机构。

Semantic Layer完成500万美元融资,Greenfield Capital领投

据Semantic Layer官方消息,其完成由Greenfield Capital领投的A轮融资,总融资额达500万美元,旨在推动链上AI自治及代理、dApp和资产的排序主权。此外,Binance Alpha已上线Semantic Layer(42)。此前,MEV基础设施开发商Semantic Layer曾完成300万美元种子轮融资,由Figment Capital领投,用于开发核心产品并提升ASS市场知名度,包括赞助研究及开发者活动。

支付基础设施Pieverse获得CMS Holdings 300万美元投资

Web3支付与合规基础设施初创公司Pieverse宣布获得CMS Holdings提供的300万美元资金支持,该笔资金将助力x402b在BNB Chain上的拓展。至此,包括种子轮和战略轮投资在内,其总融资额已达1000万美元。此前10月27日消息,Pieverse推出x402b协议,助力BNB Chain实现无Gas支付。据介绍,Pieverse的链上时间戳协议为Web3补全了缺失的验证层,能够为发票、收据和交易提供可信赖、透明且跨链互操作的加密证明。

DeepSafe完成300万美元种子轮融资,核心技术获IEEE TIFS接收

DeepSafe宣布完成300万美元种子轮融资,投资方包括Antalpha、ViaBTC Capital、Spark Capital、Cogitent Ventures、Sharding Capital、Gate、Satoshi Lab、CKB Eco Fund。其核心去中心化验证技术已被国际密码学期刊IEEE TIFS接收。DeepSafe称网络已处理近1.2亿次交易验证,活跃账户超过265万。项目表示将构建更好的“Trust Layer”。

其它

HEALTH 宣布完成 250 万美元种子轮融资,联合领投方为 Gemhead Capital 与 Castrum Istanbul。HEALTH 称其 PULSE 应用已全球上线,利用 AI 与区块链奖励机制,将日常健康数据转化为价值,目前用户数超 1 万。团队正筹备 TGE(代币生成事件)并计划推出 AI 健康助手,提供个性化洞察与健康管理功能。

Solana生态项目Dare Market完成200万美元融资

基于Solana的挑战平台Dare Market宣布完成200万美元融资,Karatage和Paper Ventures领投。该平台最初于9月推出,允许用户完成其他用户发布的挑战任务。参与者完成挑战后,需在社交媒体上分享完成证明,以换取奖励。用户还可以创建自己的挑战,并承诺在达到特定筹款目标后完成这些挑战。Dare Market对每次成功完成的挑战所获得的赏金收取6.9%的佣金。

DAT

(此类交易不计入本期融资周报统计)

Chijet Motor Company, Inc(NASDAQ: CJET)宣布完成以加密货币计价的私募配售,募资约3亿美元。此次向非美国机构投资者发行单位,每单位含1股普通股(面值0.003美元,定价约0.10美元等值加密货币)及3枚认股权证(行权价约0.12美元等值加密货币,期限3年,可在特定条件下现金less行权)。公司称所得将用于强化加密资产托管基础设施及潜在并购。

OceanPal完成1.2亿美元融资,计划联手NEAR推进AI与加密基础设施

纳斯达克上市航运公司OceanPal完成1.2亿美元PIPE,用于成立全资子公司SovereignAI,携手NEAR Foundation打造基于NEAR的数字资产金库与保密AI云平台。OceanPal计划长期购入NEAR代币,目标持有至少总供给的10%。投资方包括Kraken、Proximity、Fabric Ventures、G20 Group及NEAR Foundation。SovereignAI顾问委员会由Illia Polosukhin等组成。OceanPal将保持干散货与油轮业务,同时布局区块链与AI基础设施。

贝克汉姆支持的Prenetics筹集4800万美元用于推进比特币财库

由大卫·贝克汉姆(David Beckham)投资的健康科学公司Prenetics(PRE)在一轮超额认购的股权融资中筹集了4800万美元,以拓展其健康品牌IM8,并推进其比特币储备策略。

Prenetics在周一发送的电子邮件公告中称,通过行使认股权证,总融资额可能达到2.16亿美元。本轮融资吸引了Kraken、Exodus(EXOD)、GPTX和American Ventures等投资者。首席执行官Danny Yeung表示,这些资金将助力IM8实现全球扩张,同时每日积累1枚比特币,以期在五年内实现收入和比特币持有量均达到10亿美元的目标。数据显示,目前该公司持有268.4枚比特币(价值3090万美元)。

中心化金融

巴基斯坦稳定币公司ZAR完成1290万美元融资,a16z领投

a16z领投稳定币基础设施公司ZAR,后者拟通过街头小店在巴基斯坦普及稳定币。本轮融资共计1290万美元,参投方包括Dragonfly、VanEck Ventures、Coinbase Ventures与Endeavor Catalyst。ZAR平台支持用户用现金换取数字美元并通过钱包与Visa卡进行消费,目标解决该国庞大无银行账户人群的支付需求。若模式成功,ZAR计划于2026年拓展至非洲。

Hercle获1000万美元融资并获5000万美元授信,用稳定币加速跨境支付

Hercle宣布完成1000万美元股权融资,领投方为F-Prime,并获得5000万美元信用额度以支持全球扩张。公司以稳定币整合为支付服务商与企业提供端到端基础设施,目标将跨境结算由数天压缩至数分钟。Hercle称已处理超200亿美元交易,90%在5分钟内完成,拥有200+机构客户,计划在南美、中东、非洲扩张并拓展监管覆盖。

Standard Economics获900万美元种子轮融资,推出跨境支付App“Uno”

Standard Economics宣布完成900万美元种子轮融资,领投方为加密风投Paradigm,Lightspeed及多位天使参与。公司由Evan Jones(曾任职X与xAI)、Payam Abedi(X前员工)及Tyler Carnevale(曾任SpaceX与X)联合创立,计划以稳定币提供跨境汇款与美元获取服务。首款应用“Uno”于10月28日率先在墨西哥上线,支持国内支付与跨境零费率转账,并将扩展至阿根廷、菲律宾及拉美、亚洲多国。公司目前6名员工,尚未产生收入。

稳定币公司Loon完成约 215 万美元种子轮融资,Version One Ventures 领投

加拿大稳定币公司 Loon 完成 300 万加拿大元(约合 215 万美元)种子轮融资,Version One Ventures 领投,Garage Capital 和一批加拿大天使投资人财团参投。据悉,该公司计划推出一款基于加拿大元的稳定币,以减少对美元稳定币的依赖。

GameFi

KapKap完成1000万美元融资,Animoca Brands等领投

KapKap宣布完成1000万美元融资,种子轮由Animoca Brands领投,Shima Capital、Mechanism Capital、Klaytn Foundation、Big Brain Holdings参投;战略轮由Unicorn Verse领投,Rzong Capital、BGX Capital参与。该公司以AI原生Web3为定位,推出KAPS(Key Attention Pricing System)以量化用户“注意力与声誉”并发放奖励;目前月活约170万、日活约2.5万,已与SNK、《The King of Fighters》(拳皇)、《Samurai Shodown》(侍魂)、BAYC及ApeCoin DAO开展IP合作。

Web3潮玩项目Capybobo完成800万美元融资,Pluto领投,Animoca与HashKey参投

Web3潮玩项目 Capybobo 宣布完成 800万美元融资,由 Pluto Vision Labs 领投,该机构由 YZi Labs 支持,并曾打造拥有6300万玩家的 CatizenAI。本轮融资还获得 Folius Ventures、Animoca Brands、HashKey Capital 与 Mirana Ventures 等多家知名机构参投。Capybobo表示,资金将用于加速其线上娃衣(PYBOBO Outfits)产品开发、全球潮玩交易平台建设,以及在欧洲与亚洲市场的品牌推广。Capybobo 是 TON 与 Kaia 生态 的 GameFi 项目,专注于将全球潮玩艺术文化引入 Web3,打造虚拟与现实融合的潮玩IP。

GameFi 项目 MoonClash 完成战略轮融资,Candaq、Becker Ventures 等参投

基于 BNB Chain 构建的塔防策略平台 MoonClash 成功完成战略轮融资,估值达 1 亿美元。本轮融资 Candaq、Becker Ventures、Oasis Labs、BlockPulse 和 Apus Capital 等参投。MoonClash 是一个融合 PVP 对战、PVE 探索、NFT 所有权和链上经济的 Web3 游戏平台。该平台将塔防和策略游戏与区块链技术相结合,允许玩家在月球主题的元宇宙中建造防御设施、升级英雄并参与实时对战。MoonClash 计划在 2026 年初进行社区轮和公开轮融资。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。