Author: 1kx network

Compiled by: Tim, PANews

1kx has released the most comprehensive on-chain profit report for the crypto market to date: "1kx On-Chain Revenue Report (First Half of 2025)." The report summarizes verified on-chain fee data from over 1,200 protocols, clearly depicting user payment paths, value flows, and the core factors driving growth.

Why are on-chain fees crucial?

Because they are the most intuitive signal of real payment demand:

- On-chain ecosystem = open, global, and investment-worthy

- Off-chain ecosystem = restricted, mature

Data comparisons reveal development trends: on-chain application fees increased by 126% year-on-year, while off-chain growth was only 15%.

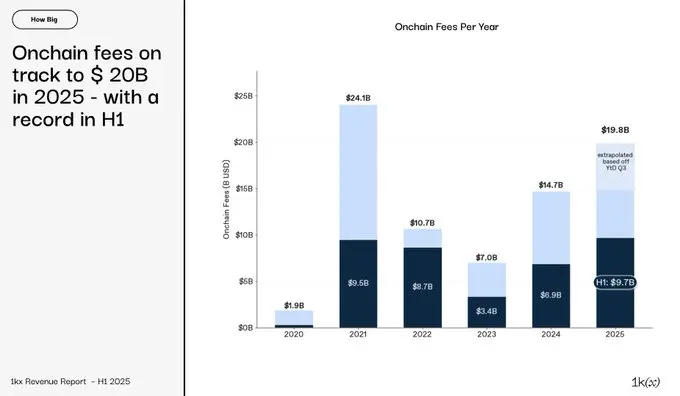

How large is the market?

In 2020, on-chain activities were still in the experimental stage, but by 2025, they have developed into a real-time measurable $20 billion economy.

Users are paying for hundreds of application scenarios: trading, buying and selling, data storage, cross-application collaboration. We have recorded that 1,124 protocols have achieved on-chain profitability this year:

How are fees generated?

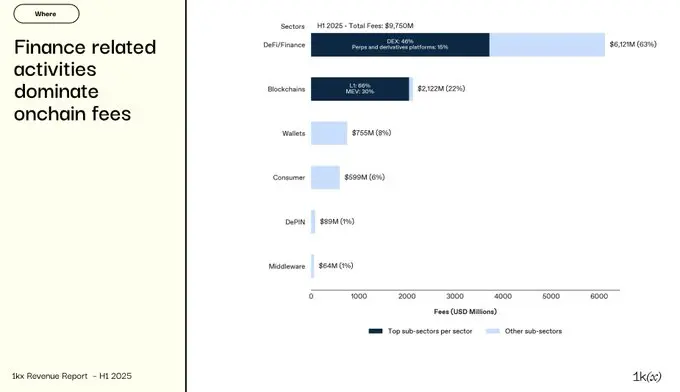

DeFi remains the core pillar, contributing 63% of total fees, but the industry landscape is rapidly evolving:

- Wallet services (up 260% year-on-year) are turning interaction interfaces into profit centers

- Consumer applications (up 200%) are directly monetizing user traffic

- DePIN (up 400%) is bringing computing power and connectivity services on-chain

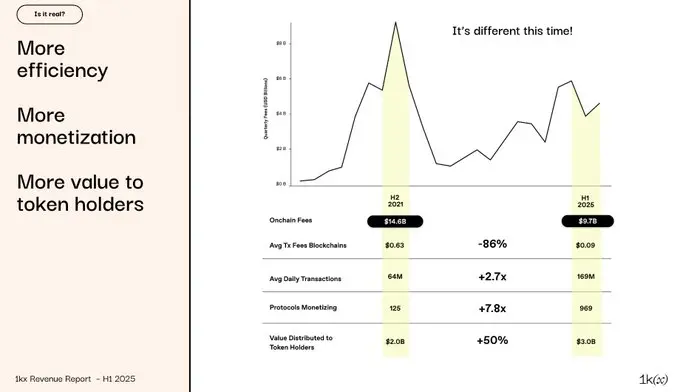

Does the on-chain economy really exist?

Although the total fees have not exceeded the peak in 2021, the health of the ecosystem is stronger than ever:

- At that time, ETH on-chain fees accounted for over 40%; now transaction costs have decreased by 86%

- The number of profitable protocols has increased eightfold

- The scale of token holder dividends has reached an all-time high

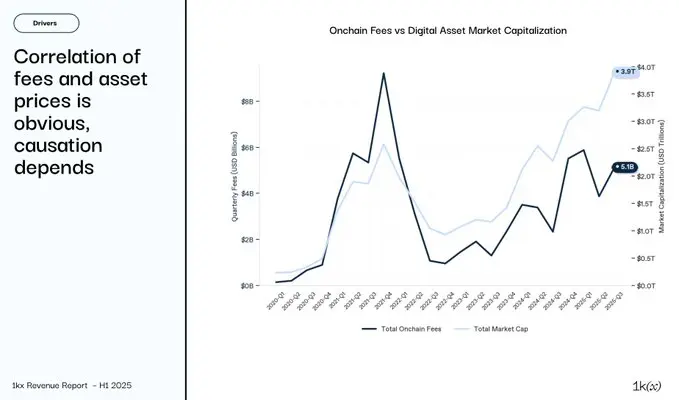

What are the core driving factors?

Asset prices determine on-chain fees in USD, which aligns with related expectations, but it is important to note:

- Price fluctuations trigger seasonal cycles

- After 2021, application fees and valuations show a strong causal relationship (fee growth drives up valuations)

- On-chain factors in specific sectors have significant impacts

Who are the winners?

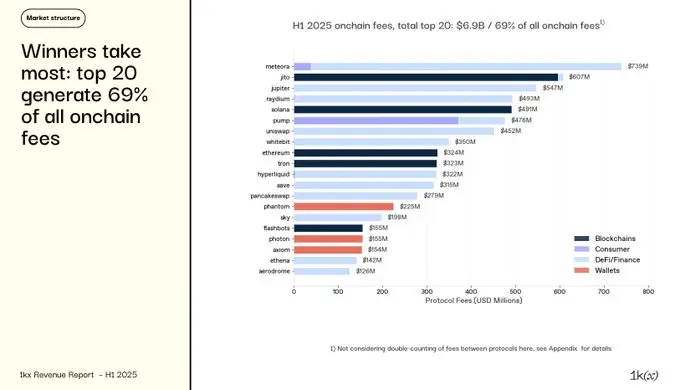

The top 20 protocols account for 70% of total fees, but the rankings frequently change, as no industry can match the disruption speed of the crypto field:

The TOP 5 are: meteora, jito, jupiter, raydium, solana

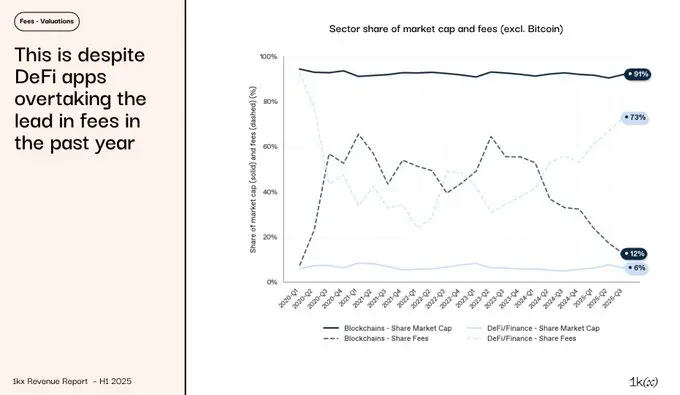

Fees and valuations are diverging: while application projects dominate fee generation, their market share has hardly changed. What is the reason?

The market's valuation logic for application projects is similar to that of traditional enterprises: DeFi's price-to-earnings ratio is about 17 times, while public chain valuations reach as high as 3,900 times, reflecting additional narrative value (store of value, national-level infrastructure, etc.)

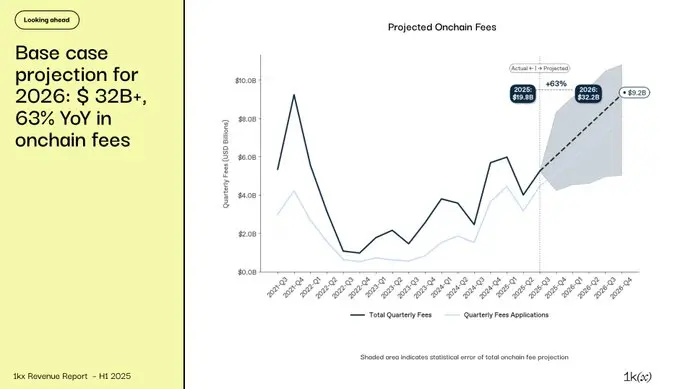

What are the future trends for on-chain fees?

Our baseline forecast indicates that on-chain fees will exceed $32 billion by 2026, a year-on-year increase of 63%, with the main driving force coming from the application layer.

RWA, DePIN, wallets, and consumer applications are entering a period of accelerated development, and as scaling technologies continue to advance, L1 fees will gradually stabilize.

With favorable regulatory developments, we believe this marks the beginning of the maturity phase for the crypto industry: application scale, fee income, and value distribution will ultimately achieve coordinated progress.

Full report: https://1kx.io/writing/2025-onchain-revenue-report

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。