作者:Canton Network

TradFi 与 DeFi 之间的抉择由来已久:人们往往需要在传统金融市场的监管框架,与新兴去中心化金融的速度、透明性和可组合性之间做出选择。

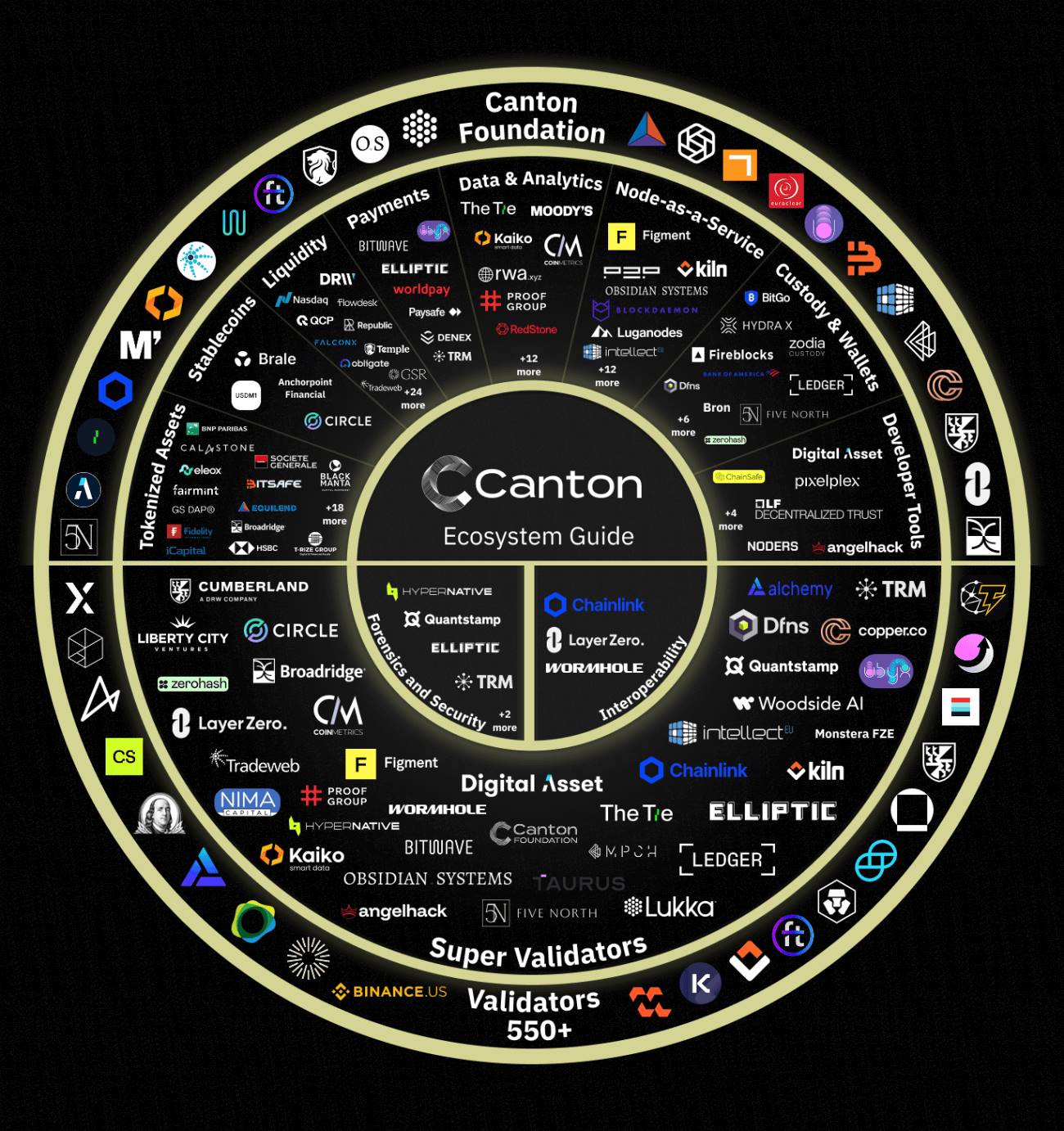

但这其实是一种虚假的对立。现在,Canton Network 生态系统向我们展示,曾经分隔的两个世界之间的壁垒正在小时。而当 TradFi 与 DeFi 交汇,真正的机遇正在涌现。

Canton Network 将机构所需的隐私和监管,与公共区块链的可组合性、去中心化和创新的网络经济相结合,打破了传统金融与去中心化金融之间的权衡取舍。这正是全球金融之力与区块链之力相遇的时刻。

机构和加密资本市场为何纷纷涌向 Canton?

2025 年,Canton Network的采用率激增。

目前已有约 600 个验证节点活跃运行,每月使用 Canton Coin 的交易量超过 1500 万笔。传统机构、应用开发者和加密市场领军企业正携手 Canton,以大规模推动市场变革。

Canton 获得了高盛、法国巴黎银行、汇丰银行、Broadridge 和 Circle 等行业领袖的信赖,是首个也是唯一一个能够让传统金融和 DeFi 类商业模式在同一平台上大规模协同运作的网络。

如今,Canton 上的应用已处理超过 6 万亿美元的链上资产,以及每日超过 2800 亿美元的美国国债回购交易。

消除 TradFi 或 DeFi 的界限,Canton 是首个全金融区块链。这是机构和加密货币原生开发者将现实世界金融与加密货币速度相结合的有效途径,而无需强行采用一刀切的模式。

探索 Canton 生态系统

Canton 生态发展迅猛,想要驾驭它并非易事。

以下简要指南将帮助您快速了解 Canton 丰富多元、相互关联的应用程序、资源、服务提供商和贡献者世界。

代币化资产

在 Canton 平台,当资产被代币化时,它们成为法律认可的资产,存储在一个作为可信链上账本和记录的 L1 上,这些账本和记录可以被发行者、托管方和监管机构作为真实来源。

链上资产意味着直接所有权,而不仅仅是资产的合成表现。这意味着发行方、投资者以及所有相关方的权利和义务都可以在协议层面得到执行和保障。

此外,Canton 还允许对资产进行精细化的隐私控制,从而实现资产转移。正因如此,机构选择在 Canton 平台上发行资产,越来越多的数字资产也正在「被 Canton 化」。

从债券、回购协议、货币市场基金、贷款承诺、保险、抵押贷款和私募股权等现实世界金融资产,到寻求机构用途的加密资产(例如 CBTC),Canton 上的资产可以在网络上的各种应用程序中进行组合,并日益得到网络钱包和托管生态系统的支持。

最终,Canton 生态将实现流畅的工作流程,同时兼顾隐私保护,从而释放资产效用并增强投资者信心。

社区可以【点击此处】探索 Canton 生态链上资产和代币化平台(在「Network Utility」下拉菜单中搜索「Tokenized Assets」)。

稳定币

Canton 网络作为一个隐私和互操作性层,为符合监管标准的稳定币提供支持,扩展了稳定币在企业工作流程和用例中的大规模实用性,以及用于保护隐私的支付和结算。

无论是在资金管理、跨境支付、加密衍生品保证金交易,还是在全天候市场融资中,隐私始终是稳定币普及的关键所在。正因如此,机构选择在 Canton 上使用稳定币(例如 USDC、Brale、M1)来解锁基于链上美国国债的融资,以克服这一核心挑战。

Canton 上的稳定币应用不仅受益于与机构级真实资产的可组合性,还受益于整个网络的广泛集成:从领先的合规服务提供商到交易和保证金管理应用,以及托管机构,使其成为机构稳定币流动增长的可靠平台。

如需深入了解稳定币为何在 Canton 上获得广泛关注,欢迎阅读 The Tie 发布的相关论文。

社区可以【点击此处】探索 Canton 生态链上资产和代币化平台(在「Network Utility」下拉菜单中搜索「Stablecoins」)。

托管

Canton Network 生态系统拥有一系列服务提供商,无论需求如何,都能让传统企业和加密原生企业轻松安全地持有和使用链上资产,包括机构级托管和钱包基础设施、高度安全的密钥管理解决方案等,Canton Network 都能满足需求。

社区可以【点击此处】探索 Canton 生态链上资产和代币化平台(在「Network Utility」下拉菜单中搜索「Custody」)。

流动性

拥有强大的分发能力和高效的流动性,数字资产才能真正发挥作用。从领先的做市商、加密货币流动性提供商,到新兴的交易平台和交易所,一个不断壮大的企业生态系统正在推动 Canton 上的全网流动性。

QCP、DRW、GSR、FalconX、Flowdesk 和 B2C2 等做市商已加入 Canton,为跨资产类别的深度、可组合流动性奠定了基础。这些公司激活了链上工具的流动性,并在 Canton 上利用隐私资产,Canton 生态进一步开辟了新应用场景,从自动化保证金管理到利用以前无法使用的资产进行全天候融资。

社区可以【点击此处】探索 Canton 生态链上资产和代币化平台(在「Network Utility」下拉菜单中搜索「Liquidity」)。

钱包

Canton Network 的代币标准 CIP-56 确保钱包和资产之间的无缝组合,从而实现更优用户体验,并支持使用 Canton 原生资产(从 Canton Coin 到 CBTC、USDC、SBC 等)开展日益丰富的活动。

Canton 生态支持多种钱包类型,从自托管钱包到托管钱包,从企业级钱包到消费级钱包,以及热密钥或冷密钥存储,使应用程序能够吸引任何类型的用户,无论是企业客户、高净值人士还是消费级终端用户。

新兴的消费级钱包,例如 Five North 的 Loop,旨在提供流畅的注册体验和日常资产交互。专注于高净值人士和中小企业的钱包包括 Bron,而领先的自托管钱包和硬件钱包(例如 Ledger)也即将投入生产。

开发人员还可以受益于钱包工具,这些工具使用 Digital Asset 的钱包 SDK来加速构建自定义钱包体验的上市时间,从而更轻松地与 CIP-56 代币标准集成。

社区可以【点击此处】探索 Canton 生态链上资产和代币化平台(在「Network Utility」下拉菜单中搜索「Wallets」)。

开发者工具

Canton 的开放生态系统包含一套强大的开发者工具,无论新手还是经验丰富的开发者,都能借助它更快地构建、测试和发布应用。

对于学习者,AngelHack 近期推出了 Canton Core Academy,提供互动式且简洁的学习课程,帮助开发者在 Canton Network 上构建机构级金融应用。通过 Academy 的「边学边赚」任务,您可以深入了解 Canton 的架构、DAML 入门以及如何构建机构间资产转移应用。

对于准备构建应用的开发者,Canton 的生态系统还包含一系列全面的框架、SDK 和库,帮助您更快地在网络上构建、部署和测试应用,从而加速产品上市。

Digital Asset 的 Canton Network Utilities是一套强大的构建模块,使数字资产发行方及其客户能够快速将资产迁移到 Canton Network。快速入门指南向开发者介绍 Canton 的代币标准,并提供一个模板,帮助开发者动手实践,学习如何构建全栈应用。

节点即服务 (NaaS)

越来越多的企业级「节点即服务 (NaaS)」提供商提供一站式连接、部署和验证器管理服务,使机构能够专注于为客户创造价值,而无需承担运营节点的繁琐开销。

从提供 DevOps 工具的纯托管服务,到提供额外 DeFi 产品、服务和集成的加密原生提供商。

社区可以【点击此处】探索 Canton 各种可供选择的提供商,或找到您心仪的合作伙伴。

数据与分析

Canton 生态包含一套全面的区块浏览器、仪表盘和分析工具,可实现全栈可观测性,这为机构用户提供了所需的透明度,以便观察、审计和分析链上活动,同时保障 Canton 的隐私承诺。

一些关键工具包括:

The Tie’s Public Dashboard,可提供对整体实时网络活动、代币经济模型和特色应用采用情况的可见性,使生态系统参与者能够随时了解网络的整体健康状况。

Node Fortress 的专用 Canton 网络浏览器,使用户能够监控治理行动和提案。

Coin Metrics 的 Canton Intelligence App 是一个强大的分析平台,可提供关键洞察,例如验证者奖励、费用流、应用激励和子账户变动。

Proof Group 的 CantonScan 使用户能够按参与者浏览和搜索区块链,跟踪单个代币的活动,为机构级可审计性奠定基础。

RWA.xyz 是一个领先的代币化现实世界资产 Dashboard,它与 Canton 服务提供商 Kaiko 集成,帮助用户深入了解 RWA 的发行方式以及其在链上的运行情况。

5N Lighthouse 则允许您探索来自超级验证者和验证者的实时数据,跟踪治理决策,实时监控交易,并了解精选应用如何与网络交互。

社区可以【点击此处】查看 Canton 完整的数据和分析平台列表。

支付

Canton Network 的架构支持即时且自动化 PvP 工作流程,旨在将各种现实世界的支付方式上链,包括:B2B 支付、工资发放、汇款、跨境交易、资金管理等等。

与其他公共 L1 区块链不同,Canton 是一个公共网络,其隐私保护工作流程可防止机构向全世界广播敏感的支付数据。

Canton Network 包含一系列不断增长的支付垂直领域应用,增强了数字支付网络的安全和可靠性,其中包括 B2B 跨境支付网络 Bitwave、全球领先的支付平台 Paysafe 以及全球支付技术提供商 Worldpay。

社区可以【点击此处】查看 Canton 支付垂直领域的完整列表。

验证与安全

越来越多的合规和验证服务提供商已集成到生态系统中,以支持合规和交易监控,其中包括:

Elliptic,其提供受监管机构信赖的链上反洗钱监控解决方案。

TRM Labs,其提供区块链分析解决方案,用于检测和调查与加密货币相关的欺诈和金融犯罪。

链上反洗钱监控功能使各个运营商能够定义自己的合规参数,从而确保符合监管要求和机构风险管理。结合Canton的选择性披露功能,Canton提供了一种完善的监管监督和合规方法。

社区可以【点击此处】查看 Canton 完整的取证与安全服务提供商列表。

互操作性

Canton 是 Canton 生态系统内所有应用和网络互操作性的基石,它利用安全合规的基础设施连接全球金融领域分散的系统。

Canton 生态系统目前正在引入来自 Chainlink、LayerZero 和 Wormhole 等领先互操作性解决方案的跨链互操作性服务,进一步开放其他生态系统的访问权限,使其能够受益于 Canton 网络的独特功能、特性和应用。

社区可以【点击此处】查看 Canton 完整的互操作性提供商列表。

准备好在 Canton 生态建设了吗?

欢迎利用 Canton 生态的最新功能,创建高度可组合的应用,支持 7 x 24 链上资本市场和支付,并享受机构级隐私保护:

【点击此处】查看不同的参与方式并开始使用

【点击此处】按不同赛道探索 Canton 网络生态系统

【点击此处】使用快速入门指南加速您的 Canton 应用开发

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。