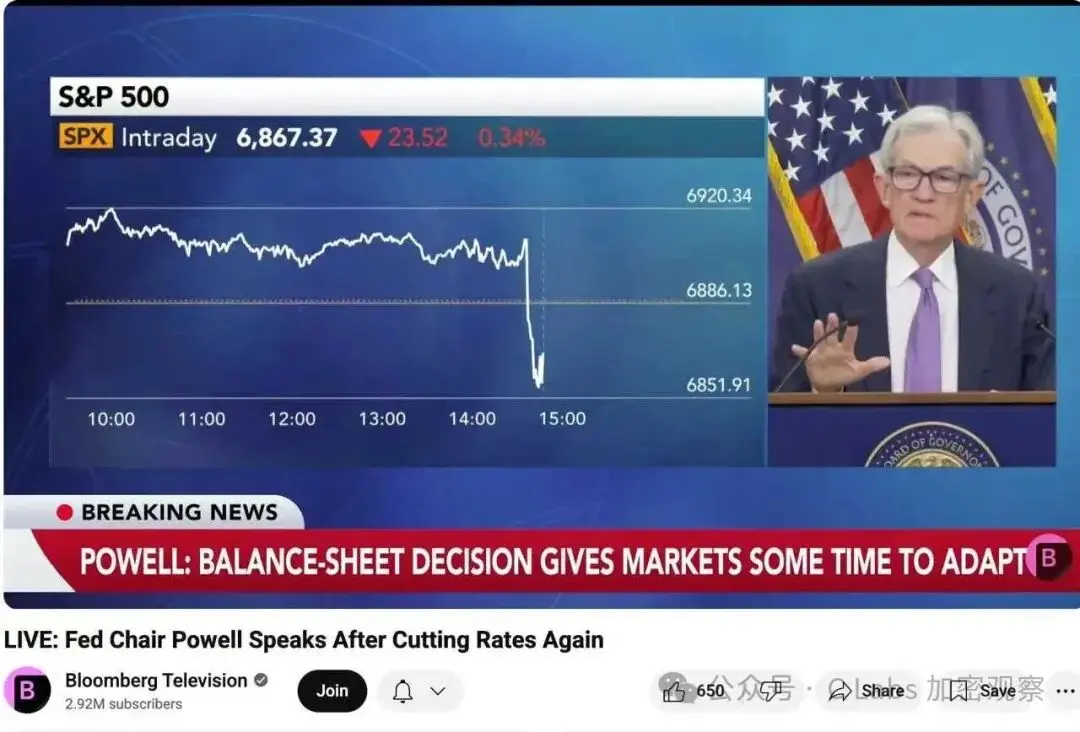

In the early hours of today Beijing time, the Federal Reserve announced a 25 basis point interest rate cut, lowering the federal funds rate range to 4.00%–4.25%.

At the same time, the Federal Reserve also stated that quantitative tightening (QT) will officially end on December 1.

Logically, this should have been a "positive" development: interest rate cuts, ending balance sheet reduction, and improved liquidity expectations. However, the result has left many puzzled—why did the stock market, cryptocurrencies, and even gold not rise, but instead experienced a broad decline?

01. The Market's "Positive Expectations" Have Already Been Exhausted

In fact, the market had already "bet" on this interest rate cut at the beginning of this month. According to CME FedWatch data, before the meeting, the market believed:

The probability of a 25bp rate cut was as high as 95%, and about 40% of investors expected the Federal Reserve to immediately announce the initiation of QE (quantitative easing).

As a result, the Federal Reserve only chose a "moderate" rate cut.

In other words:

This rate cut is not a "new positive," but rather "below expectations."

When expectations are met but without surprises, the market often chooses to take profits. This is also a typical "buy the rumor, sell the news" scenario.

02. Ending Balance Sheet Reduction ≠ Starting to Inject Liquidity

Many people see "QT ending" and assume it means "massive liquidity injection" is coming. However, the Federal Reserve's statement this time is very cautious:

"We will end balance sheet reduction, but will not initiate a new asset purchase program for now."

In other words:

We are transitioning from the "tightening" phase to the "wait-and-see" phase.

In the language of financial markets, this means:

Liquidity is no longer worsening, but there is also no improvement.

For the investment market to rise, merely "stopping the decline" is not enough—there also needs to be "incremental funds." This is currently the biggest gap.

03. The Rate Cut Has Not Transmitted to "Actual Funding Rates"

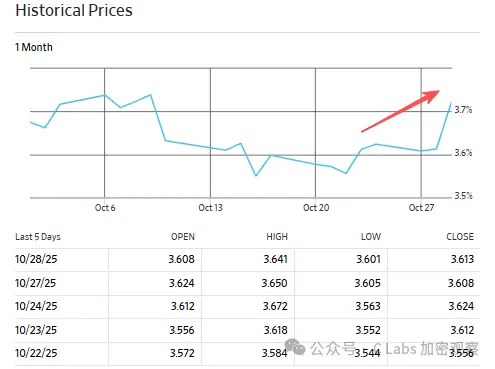

In theory, a rate cut should lead to a decrease in short-term rates, reducing funding costs. However, this situation is somewhat special—although the nominal policy rate has been cut by 25 basis points, medium- to long-term funding costs have not decreased in tandem.

For example, the yield on five-year government bonds rose from 3.6% to 3.7%:

The yield on ten-year government bonds even soared to over 4%:

What does this indicate? It indicates that the real liquidity in the market remains tight, and investment institutions do not feel that "money has become more abundant." The Federal Reserve's rate cut is still at the "verbal" level and has not truly "flowed into the market."

04. The Hidden Concerns Behind the "Rate Cut": Economic Downward Pressure Remains High

From a more macro perspective, the Federal Reserve's rate cut is actually a form of "defensive operation." Recent U.S. economic data shows:

- Real estate and manufacturing have experienced two consecutive quarters of negative growth;

- The job market is slowing, with the unemployment rate rising back to 4.6%;

- Corporate profit growth has nearly stagnated.

This means that the Federal Reserve has chosen to slightly ease monetary policy to buffer downward risks between "maintaining growth" and "controlling inflation."

However, this operation also releases a signal:

The U.S. economy may have entered a "slowdown phase."

In this situation, the market prefers to lock in profits first and is hesitant to easily increase positions in risk assets.

05. Conclusion: Rate Cut ≠ Bull Market, Liquidity is the Core Variable

This rate cut has led to a market reaction that provides the clearest logic:

Short-term policy easing ≠ Abundant liquidity ≠ Asset price increase.

What can truly drive a comprehensive reversal in the stock market and cryptocurrency market is the central bank restarting asset expansion (QE) or fiscal stimulus combined with large-scale capital inflows.

Until then, the rate cut is merely "neutral to warm"—it can stabilize confidence but is not enough to spark a new bull market.

What the market wants is not a 25 basis point rate cut, but a real liquidity injection.

Until then, 'risk assets' will have to wait a bit longer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。