文章来源:话李话外

在 10 月 17 日的文章中,我们主要是基于宏观因素、美元强弱、链上数据、历史周期规律等不同的维度探讨了 2026 年 Q3/Q4 加密市场阶段性熊市的概率问题,并且在文章的最后部分,我们还简要补充了 2026 年的市场可能需要重点关注的一些方面。

有个别小伙伴可能是看了文章后有点想法,于是在后台留言:你说的这些有点远了,我等不到明年,我 xx 的成本买了 xxx 山寨币,能不能直接告诉我今年还有希望回本吗?我现在应该是继续拿着等还是先割肉卖掉等明年再抄底?……

其实类似这样的留言问题,我已经反反复复见过太多了。每个人的资金体量、风险偏好、投资目标等均不相同,与其找别人要一个对方也不知道的答案,你直接摇骰子赌该怎么操作可能会更好一些,这样一旦你赌输了还可以直接找到理由,比如可以怪骰子不给力或者自己手气不好。

很多人总是喜欢去预测短期行情的涨跌,也总是喜欢给短期的涨和跌找各种理由,其实涨跌有时候很简单,涨多了就需要跌一下,跌多了就需要涨一下,仅此而已。过去的这 8 年多时间里,给我的最主要收获之一就是,这个市场的长期赚钱逻辑其实很简单,总结起来就一句话:买比特币,然后拿住。

但大部分的人依然是想赚快钱,不过这也是好事,如果这样的人少了,那么拿住的那少部分人也很难赚到更多钱了,这个角度来看,我们还应该感恩那些内心浮躁的人才对。

市场是无情的,我们也应该“无情”地去参与市场,在一个需要彼此博弈的游戏规则里面,不要轻易把自己发财或一夜暴富的梦想直接建立在别人(尤其是陌生人)身上,否则最后受伤(不仅仅是资金亏损,也包括心态心理方面的受伤)的只能是你自己。

当然了,如果你喜欢做分析,而不是单纯地为了涨跌去找理由,那么我们10 月 17 日文章最后提到的那些方面是值得进一步去拓展和研究的。今天,我们不妨挑选其中的 1 个角度,即基于“美元指数和比特币”的关系进行分析,继续展开来给需要的伙伴做个简单的举例(也算是对 10 月 17 日文章的一次补充):

通常来讲,美元的强弱影响着全球资金流动性的变化,比如美元走强,那么资金往往会回流美国,一些风险类的资产(包括加密货币)可能就会面临下行压力。反之亦然。

我们都明白,目前比特币虽然已经被越来越多的人赋予了“数字黄金”的概念,但相较于黄金或其他资产类别而言,比特币依然属于更高风险的资产类型,对流动性的变化可能会更敏感。

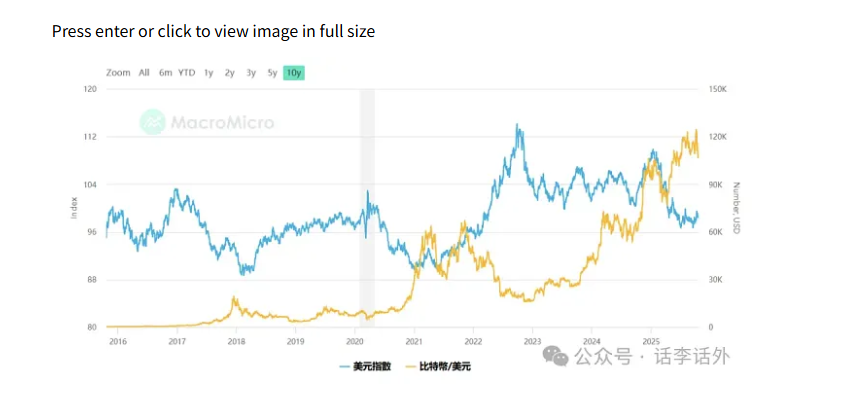

我们一边看图一边来分析:

如上图所示,抛去一些特殊因素的影响可能有部分的时间段(比如2024年9月到2025年1月期间)美元指数与比特币价格短暂正相关外(类似的问题我们在7 月 15 日的文章中已经有过一些分析),我们能够明显地看到,整体上而言,加密市场每一轮的大牛市都伴随着美元指数在相对底部区间徘徊。

我们继续把时间拉近一些看,比如从 2025 年的年中以来,美元指数基本维持相对低点区间徘徊(96–98之间),而对应的,比特币处于一个相对高位的区间(10–12万美元)进行横盘整理(同时伴随着轻度回调)。

而如果你希望借助这个角度预测一下比特币接下来的短期走势,就可以比较容易做出如下的结论:

- 假如未来几个月美元指数继续走弱,比如跌破目前 96 的低点,那么理论上,如果没有其他突如其来的黑天鹅事件影响,比特币还会出现一波儿上涨的机会,比如继续推高并涨到 13- 14 万美元。

- 假如未来几个月美元指数反弹走强,比如回到 100 上方并持续稳住,那么理论上,比特币可能会继续陷入回调,不过这个期间对于比特币最好的结果是横盘震荡(因为本轮有机构资金会持续托底)。

- 假如未来几个月美元指数持续反弹,那么理论上,资金的风险偏好就会持续下降,比特币不仅仅是面临回调的问题,而是可能会直接跌到机构的成本价附近,目前微策略的成本价是 7.4 万美元左右,那么我们这里盲猜一下就是,即可能会跌到 7–8 万美元附近。

上面的三种结论,分别会对应不同的概率,而我们要做的事情就是,尽量去超大概率的方向操作,同时做好 PlanB 计划(即一旦操作失败,或者过程中遭遇黑天鹅事件,我们的应对策略是什么)。

既然有了不同的结论,那么接下来,你需要继续去进一步分析一个新的问题:未来几个月美元指数可能会怎么走?

首先,你要知道影响美元强弱的因素有哪些,也就是说,美元的强弱可能会受到什么宏观因素(变量)的驱动。

影响美元强弱的因素其实总结起来会比较多,这里我们认为最重要的一个变量就是:美联储的利率政策。

目前从市场的普遍预期来看,本月(10月)的降息几乎是板上钉钉的事情,如下图所示,除此之外,今年估计还会再降息一次。

那么,这对于美元是利好利空呢?

很简单,理论上来讲,如果美联储的降息步伐加快,那么就会导致美元的利差收窄,进而会使美元的吸引力下降,因此,中短期来看,这是利空美元的。

也就是说,如果美联储的降息计划按市场预期落地,同时明年(2026)初继续出现新的降息预期,那么也就不排除年底前或明年第一季度美元指数可能会继续低位震荡并回落到 96 以下。

这时候你在对应上面的 3 种结论,应该就会有个大致的结果(猜测):比特币(包括黄金)年底前或明年的第一季度可能还会有一波儿反弹的机会。

当然了,上面仅是一个比较简单地单一链条维度推导过程。

严格来讲,美联储的降息并不一定就会立刻导致美元走弱,美元走弱也并不一定会立刻就导致比特币上涨,这里面也会存在一个提前预期问题,也许,今年第四季度 2–3 次的降息预期已经提前(部分)反应到了近期的上涨价格里面。另外,还有一方面我们在8 月 8 日、8 月 27 日的文章里面也分享或提及过,如果美联储未来的降息是基于美国经济可能会出现衰退考虑,那么则不一定就会利好风险资产了(尤其是加密货币这样极高风险的资产)。

因此,如果你想让自己的结果(猜测)更有辅助意义,那么可以基于上面的思路继续去做的拓展,比如,你可以进一步去分析下美债的收益率走势、美国的就业数据、美国政府的财政支出和赤字、甚至日本及欧洲等国家的货币政策……感兴趣的伙伴可以自行举一反三进行研究,这里我们就不再赘述了。

总之,不同的人,会有不同的偏好,也会有对应的不同分析思路,有人喜欢从宏观的角度进行分析、有人喜欢利用链上数据进行分析、有人喜欢结合消息面进行分析、有人喜欢直接在 K 线里面找出机会……分析的方法或思路本身没有好和坏之分,重点是我们每个人都应该形成或建立起一套适合自己的方法或者策略,进行必要的 DYOR,然后基于概率并结合自己的风险偏好(仓位管理)做出对应的选择,这样才可以增加自己的胜率。

文章的最后,我们再额外聊聊关于时间的话题:

我们经常在网络上或者一些博主的文章里面看到诸如“短期”、“中期”、“长期”、“中短期”、“中长期”等这样的描述,比如上文中我们就提到了一个“中短期”的说法,那么,我们所谓的中短期具体时间有多长呢?

就我个人而言,因为我更像是一个Position Trader,因此,我所谓的短期一般是指 1–3 个月、中期一般是指 3–6 个月,标的拿着几年不动这才能叫长期持有。

但不同的人可能对此会有不同的定义,比如,一个 Day Trader 的所谓短期可能是指几分钟或者几个小时,中期可能也就是几天,超过一周对他们而言就算长期了。再比如,Swing Trader 眼里的短期可能只是几天到几周,中期是指几周到几个月,超过半年对他们来说就算长期了。

而对于有些机构 Investor,他们所谓的短期可能是 1–2年,长期可能是几年、甚至十几年。巴菲特从十年前起就持有苹果公司的股票,这对于巴菲特而言也许才能算得上是长期持有。

因此,不是说你看到某个博主说,比特币短期可能会上涨,于是你就“很听话”地买入了比特币,结果等到当天下午或第二天发现比特币反而跌了,于是就赶紧割肉卖掉、并去博主的主页里面留言骂对方是垃圾。

比较正确的做法是:首先,你需要想想想自己是偏什么类型的交易者。其次,在去寻找和阅读某些博主文章的时候、需要了解博主自身是什么类型的交易者。这样,你们的学习或交流才可能会更有意义。

今儿就聊这些吧,正文中涉及到的图片/数据引用来源已经补充和备份到了「话李话外 Notion 交流群版」里面,以上内容只是个人角度观点及分析,仅作为学习记录和交流之用,不构成任何投资建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。