期货和期权市场闪现出重仓和谨慎乐观的迹象。根据 coinglass.com 的统计,比特币期货未平仓合约(OI)目前约为738亿美元,显示出尽管现货略有回调,交易者仍然积极参与。

CME 继续保持期货未平仓合约的重量级地位,掌控着167.9亿美元,占总量的22.7%。币安以126.9亿美元紧随其后,OKX 为38.4亿美元,Bybit 为75.9亿美元,Gate 为76.7亿美元。其余的排行榜 — Kucoin、Bitget、WhiteBIT、BingX 和 MEXC — 组成了竞争激烈的第二梯队。

在过去的24小时内,大多数主要交易所的未平仓合约出现了1.6%到10%不等的温和收缩,暗示着一波获利了结。但 BingX 和 MEXC 逆势而上,分别上涨了28.5%和5.25%,证明市场中仍然有大量的投机活力。

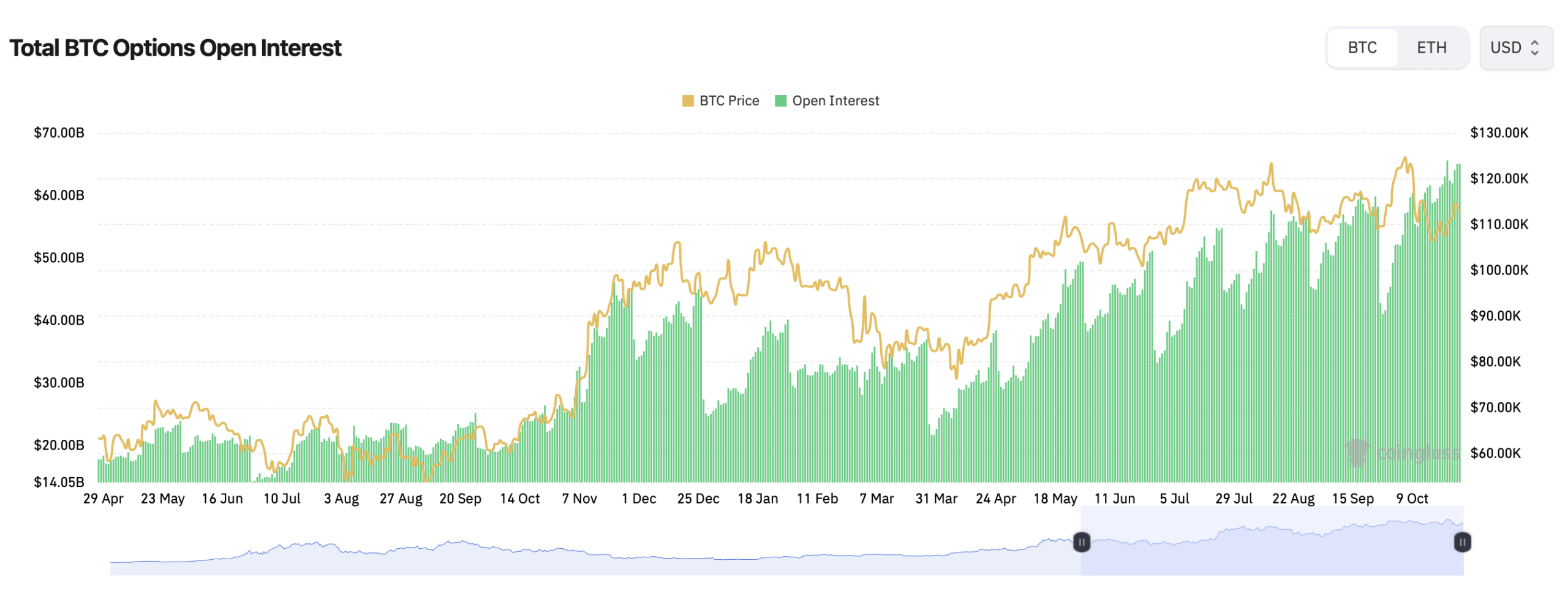

在所有交易所中,比特币期货未平仓合约自6月以来稳步上升,反映出去年的看涨布局。该指标与价格的稳步攀升反映出市场充满信心 — 以及杠杆。交易者显然在等待宏观催化剂和美联储政策动向的同时,积极迎接波动性。

比特币的期权市场现在比以往任何时候都更加活跃,名义未平仓合约达到了创纪录的650亿美元。Deribit 在这个市场中占据了90%以上的份额,显示出对看涨期权(60.2%)的健康倾斜,相比之下看跌期权为(39.8%),这意味着大多数交易者押注价格会上涨而不是下跌。

根据 coinglass.com 的数据,截至2025年10月29日,比特币期权未平仓合约。

简单来说,看涨期权是一种看涨合约,如果比特币上涨则获利,而看跌期权是一种看跌合约,如果价格下跌则获利。这个比例表明了看涨的倾向,但并非没有谨慎 — 交易者仍持有大约20万个比特币的看跌期权,作为一项可观的对冲,以防涨势消退。

比特币期权市场中最大的押注远在未来,合约直到2025年12月才到期。交易者关注的价格目标高达140,000美元、150,000美元,甚至200,000美元每枚 — 明显表明一些市场重量级人物在考虑长期投资。

目前最受欢迎的押注是 Deribit 上的140,000美元看涨期权,单独占据了超过12,000个比特币的未平仓合约。简单来说:大玩家正在为下一个重大反弹布局,而不仅仅是下周的反弹。

另一方面,短期活动显示出在114,000美元到118,000美元的看涨期权周围有强劲的交易量,暗示交易者正在为本月结束前可能的反弹进行布局。

比特币的最大痛点 — 期权买家损失最多而卖家(通常是机构)获益的价格 — 徘徊在114,000美元左右。这正是现货价格的水平,暗示着多头在113,000美元区间防守与期权卖家在到期时微笑之间的意志之战。

比特币可能已经远离其高点,但其衍生品生态系统比以往任何时候都更火热。期货头寸仍接近创纪录的水平,期权交易者像收藏品一样大量购买长期看涨期权。无论比特币的下一步是上涨还是下跌,有一点是确定的 — 华尔街和加密原住民都深陷衍生品市场。

- 比特币目前的期货未平仓合约总额是多少?比特币期货未平仓合约大约为738亿美元,主要由CME和币安主导。

- 期权未平仓合约水平为什么重要?它们显示了在比特币期权市场中有多少资本被锁定 — 这是投机活动和市场情绪的关键指标。

- 比特币期权中的“最大痛点”是什么意思?这是大多数期权交易者在到期时亏损的价格水平,而市场做市商往往会获利。

- 目前交易者的情绪是更看涨还是看跌?整体情绪偏向看涨,约60%的未平仓期权是看涨期权,押注价格会上涨。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。