Bitcoin, Ether ETFs Stay Hot, But Solana ETF Steals the Show

Crypto ETFs roared into the spotlight on Tuesday, Oct. 28, extending an already impressive streak of inflows, and welcoming a powerful new player to the mix. Bitcoin and ether ETFs both maintained their winning streaks, while solana made its long-awaited ETF debut in style.

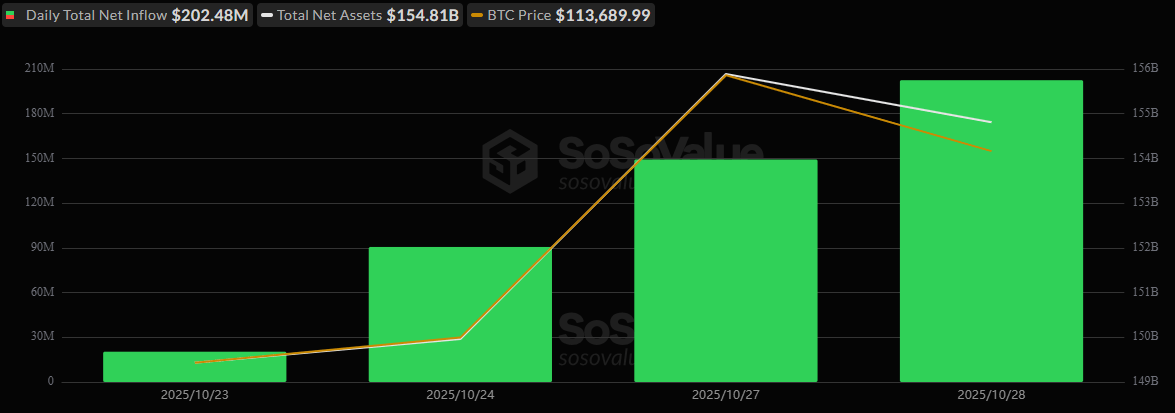

Bitcoin ETFs posted their fourth straight day of inflows, drawing $202.48 million in new capital. The momentum was broad-based, with Ark & 21Shares’ ARKB leading at $75.84 million, followed by Fidelity’s FBTC with $67.05 million, and Blackrock’s IBIT with $59.60 million. For the second consecutive day, no fund saw any outflows, underscoring renewed investor conviction. Trading volume remained robust at $4.18 billion, while net assets steadied at $154.81 billion.

Four days of growing inflows for bitcoin ETFs. Source: Sosovalue

Ether ETFs also mirrored the strength, attracting a total of $246.02 million in inflows across three funds. Fidelity’s FETH dominated with $99.27 million, while Blackrock’s ETHA added $76.37 million, and Grayscale’s Ether Mini Trust contributed $73.03 million. The combined momentum pushed total trading volume to $1.64 billion, with net assets holding firm at $27.66 billion.

But the spotlight didn’t belong solely to bitcoin and ether. Bitwise officially launched its solana ETF (BSOL), setting a new record for a U.S. ETF debut with $69.45 million in first-day trading volume and $288.92 million in net assets. Meanwhile, Grayscale unveiled its own solana ETF under the ticker GSOL, signaling that competition in the Layer-1 ETF arena is about to heat up.

Tuesday’s trading session was more than just another day of inflows; it was a statement. Bitcoin and ether held the line, and solana made history.

FAQ📈

- What drove crypto ETF inflows on Tuesday?

Bitcoin and ether ETFs pulled in a combined $448 million, marking another day of strong institutional demand. - Which bitcoin ETFs led the market?

Ark & 21shares’ ARKB, Fidelity’s FBTC, and Blackrock’s IBIT topped inflows, with no funds reporting outflows. - What made solana ETFs stand out?

Bitwise’s BSOL debuted with a record $69.45 million in first-day trading, the strongest U.S. ETF launch to date. - What does this mean for the crypto ETF landscape?

The synchronized inflows and solana’s historic debut signal growing investor confidence and expanding market diversity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。