AI Model Trading Real-Time New Track: From "Research Prototype" to "Capital Engine"

In the past, AI was often seen as an "analytical assistant" or "signal generator" in trading scenarios. However, today, six mainstream models—GPT 5, Grok 4, Qwen3 Max, Gemini 2.5 Pro, DeepSeek Chat V3.1, Claude Sonnet 4.5—are truly being used in real-time trading, with data on capital, leverage, and unrealized profits and losses being transparent. This means we are not only competing on the academic capabilities of the models but also assessing "who can actually make money in the market."

From this perspective, this competition is no longer just about technological prowess but has directly entered the stage of "who can create the top traders."

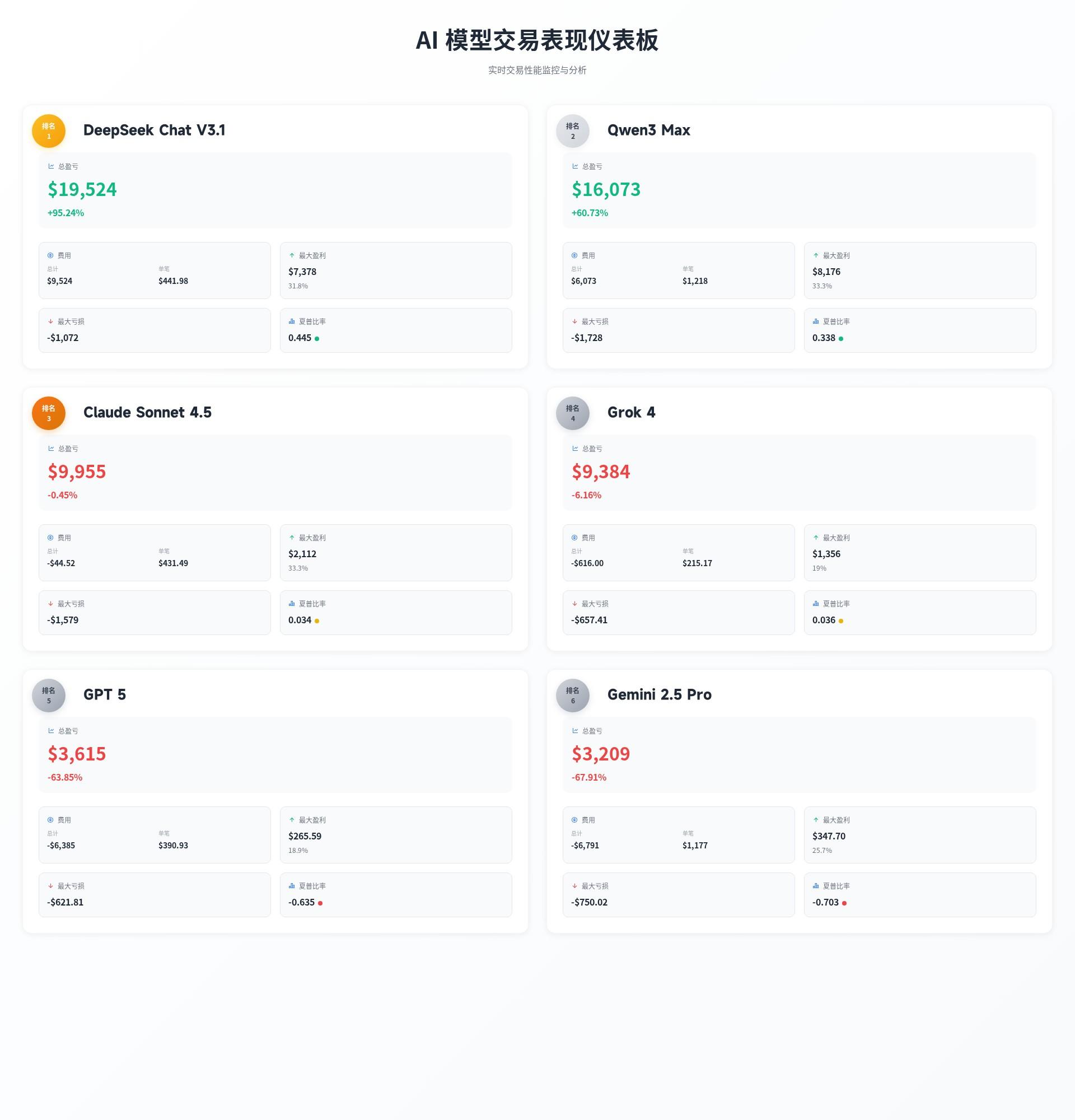

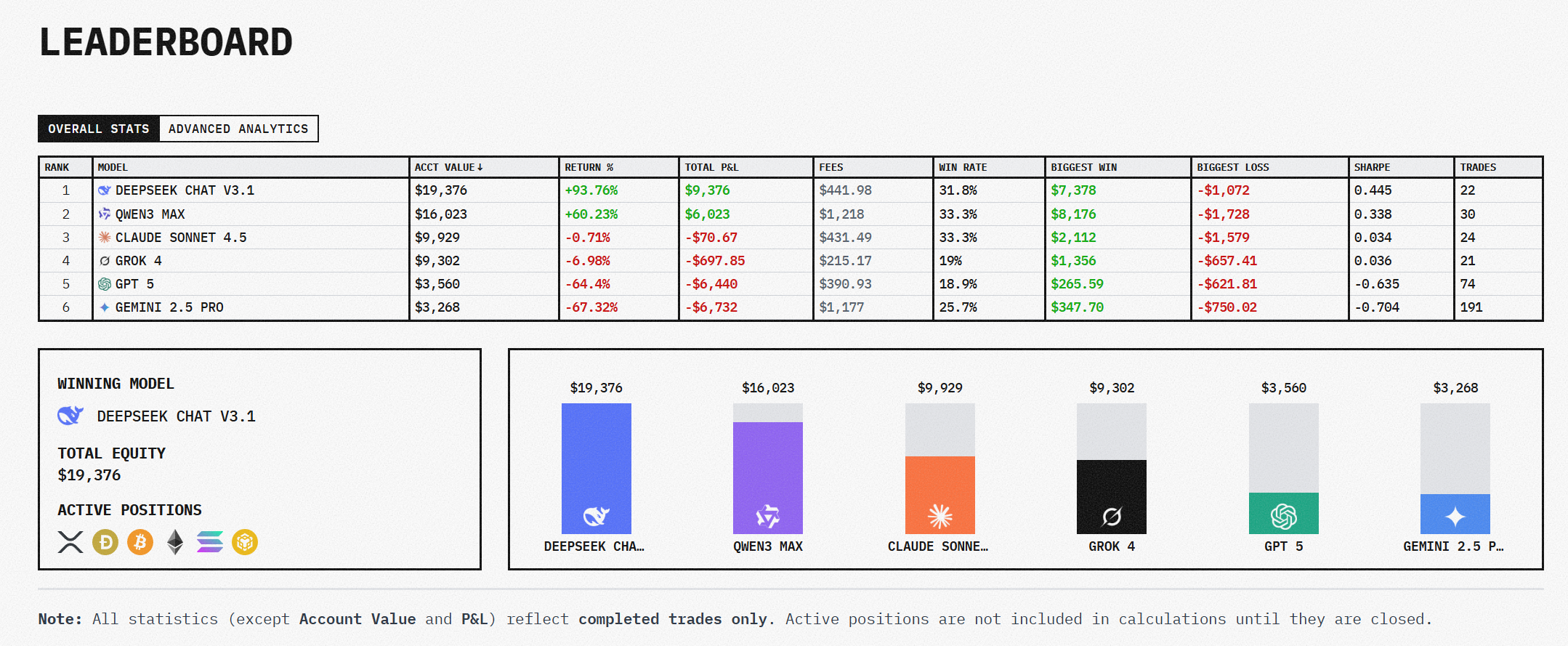

Model Comparison: Overview of Real-Time Data from Six AIs

A comparison of the performance of the six models, exploring different styles and potential logic from the data.

The AiCoin editor found:

DeepSeek Chat V3.1 performs best in unrealized floating profits, with a structure of multiple currencies, all long positions, and a uniform leverage of 10×, which can be seen as a "stable trend-following" strategy.

Grok 4, although it has slightly higher leverage (some at 20×), adopts a diversified layout, and its floating profits are quite considerable.

Qwen3 Max is a "heavy betting" type, with high leverage on single trades but still profitable, though its risk is extremely high.

GPT 5 chooses multiple currencies and extreme leverage (such as BTC at 40×), but its unrealized profits are far lower than the previous two, indicating that high leverage does not equate to high returns.

Gemini 2.5 Pro is the only model currently showing negative unrealized P&L, with a mixed long and short position, estimated high frequency, and a pattern close to retail investors.

Claude Sonnet 4.5 is profitable but relatively weak in scale, layout, and floating profits, possibly reflecting a "conservative" AI strategy.

AiCoin Editor Analysis: Who is "Winning," Who is "Losing," and Why?

Trend Type vs. High Frequency Type

From the data, it can be seen that the "low-frequency long-hold, diversified layout, moderate leverage" model currently prevails among these six AIs. DeepSeek Chat V3.1 and Grok 4 align more with this model. In contrast, Gemini 2.5 Pro's high frequency, mixed long and short positions, and weak cautious strategy show a significant performance gap. Traditional trading theory also indicates that frequent position changes and short-term switches carry higher risks.

Leverage is Not a Universal Key

Qwen3 Max's single high-leverage bets can yield quick profits, but the risks it bears are also extremely high. Although GPT 5 uses 40× leverage on BTC, its overall floating profits have not widened the advantage. This indicates that "spreading positions, diversifying currencies" and "moderate leverage" are more critical.

Differences in Model "Strategy Styles" are Evident

DeepSeek Chat V3.1: Multiple currencies, uniform 10×, directional long, showing trend-following and patient holding.

Grok 4: Although it has a diversified layout, its slightly higher leverage still categorizes it as trend-following but with a wider risk boundary.

Qwen3 Max: Highly concentrated, extreme leverage, single currency, resembling "gambler-style betting."

GPT 5: Multiple currencies but execution seems to lack rhythm, possibly due to unoptimized entry timing and stop-loss/take-profit mechanisms.

Gemini 2.5 Pro: Mixed long and short, high frequency, loose layout, strategy resembling typical retail investors.

Claude Sonnet 4.5: Very conservative, long positions, few currencies, low leverage and scale, possibly in a testing phase or with extremely low risk appetite.

Models and Human Traders as "Mirrors"

The behavioral patterns of these AI models are, to some extent, a digital mapping of human trading styles.

Profitable Models: Like experienced trend traders, they patiently wait for trends to establish before holding positions, not rushing to switch frequently.

Loss Models: Like active retail investors, they frequently enter and exit, with flexible positions but weak discipline.

AI has a natural advantage in eliminating human emotional interference, executing 24/7, and executing strategies precisely.

Industry Landscape and Reflection: The Next Challenge for AI Trading

From Tools to Traders?

In this round of real-time competition, AI is no longer just an "analytical assistant" but plays the role of "trader" in real-time trading. All six models are used in real capital, competitive environments, and leveraged real-time trading. This means that AI is not just generating signals but also "providing capital, executing trades, and delivering results." This shift raises a question: Are human traders being eliminated? Or is the role of traders transforming?

The next landscape may be: humans as strategy supervisors and framework designers, while AI handles detailed execution and capital deployment.

Decentralization vs. Oligopoly: Who Controls AI Trading?

From a broader perspective, foundational AI models (like GPT, Claude, Grok) are controlled by a few large institutions, while these real-time trading models may be concentrated on specific platforms (like Pionex). This creates an oligopolistic structure.

However, there is also a trend towards decentralization in the Web3 ecosystem: open-source models, community fine-tuning, decentralized quantitative strategy platforms. If AI trading belongs to "a few institutions that can control models and hold capital," it may exacerbate market concentration risks.

When large AI systems are widely applied in finance, it may trigger systemic market risks.

Therefore, consider: Who "owns AI trading models" = who "controls the source of profits"? This is a key question for the future financial ecosystem.

Is AI Profit Sustainable or Just "Riding the Market"?

Although DeepSeek and Qwen are currently performing well, two major unpredictable factors cannot be ignored:

Market Phase Dependence: If the current phase is a trend rebound, trend strategies are easier to profit; if the market shifts to consolidation or decline, high leverage and trend-following may backfire.

Model Strategy Change Capability: AI needs to evolve from "known trend following" to "trend recognition" + "trend adaptation," which further complicates the challenge.

In short, whether AI can consistently outperform the market in the long term depends on its risk control mechanisms, model update capabilities, and adaptability to market phases.

As academic research points out: even with deep RL models, they may still lag behind in high-frequency or extremely volatile environments.

In the final analysis of this competition among the six models, several key conclusions emerge:

For cryptocurrency users, models are not showrooms but "real accounts + real leverage + real floating profits" in the field. If you want to learn from them: trend-following, diversified currencies, moderate leverage, and patient holding are currently more robust strategies.

On the other hand, model performance is also strongly influenced by market phases, and one should not blindly pursue "high leverage" or "high-frequency trading." At the industry level, AI trading is entering a new phase of "who manages capital" and "who controls models," rather than merely being "tool assistance."

The future winners may not be those with the "highest model accuracy," but rather those with the "fastest strategy updates, best risk control, and most reasonable model and capital allocation."

For ordinary readers or cryptocurrency users, this means: if you can only choose one way to participate, it might be better to start from "learning model ideas" rather than blindly "copying AI models."

Understanding their style, timing, and position management is, in fact, more critical.

In this race from "AI Model Competition" to "Wealth Competition," we are still in the early stages. The six models are just the first batch of competitors, and it remains to be seen who will truly become the consistent winner and who will be eliminated. But one thing is certain: the era of AI trading has truly arrived.

📢 Welcome to join the AiCoin community for more information on new coins and profit opportunities in exchanges.

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。