Key Points

The total market capitalization of cryptocurrencies is $3.97 trillion, up from $3.89 trillion last week, with a weekly increase of 2.06%. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.98 billion, with a net inflow of $446 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.35 billion, with a net outflow of $244 million this week.

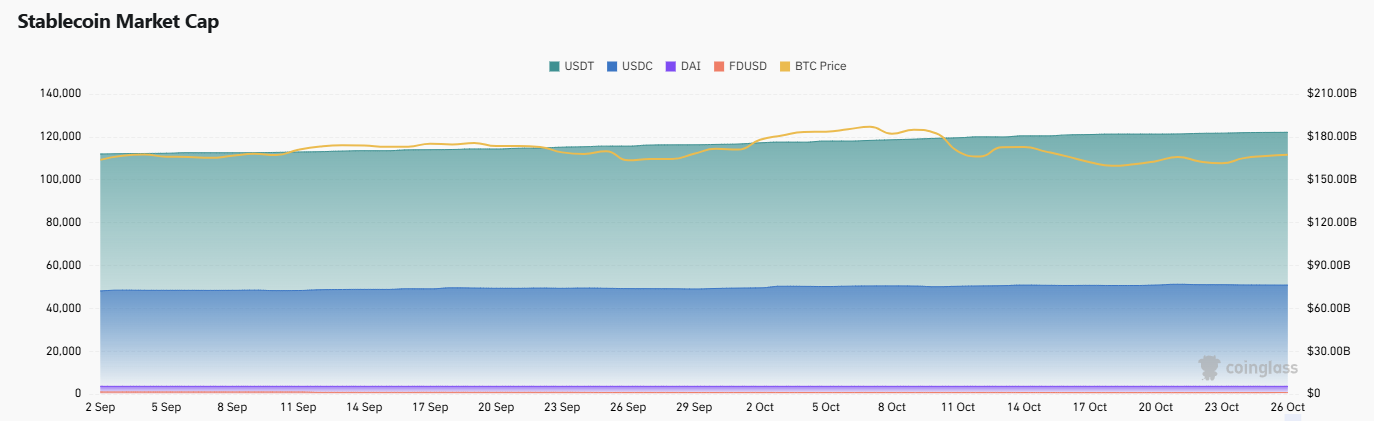

The total market capitalization of stablecoins is $312 billion, with USDT having a market capitalization of $182.9 billion, accounting for 58.6% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $76.3 billion, accounting for 24.5%; and DAI with a market capitalization of $5.36 billion, accounting for 1.7%.

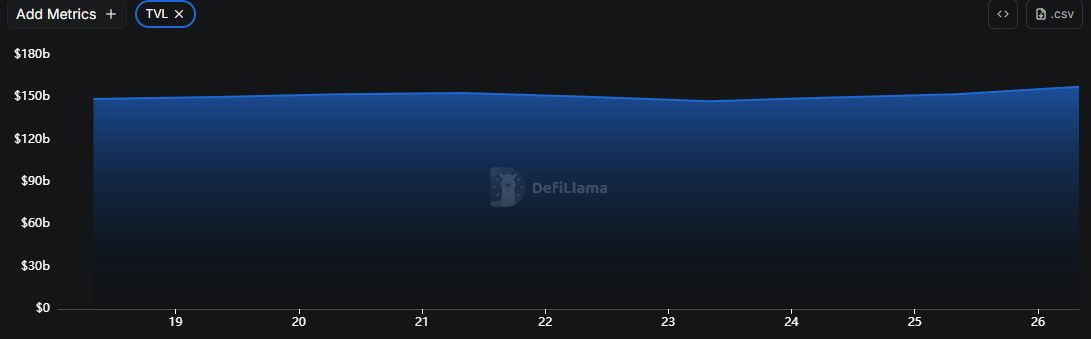

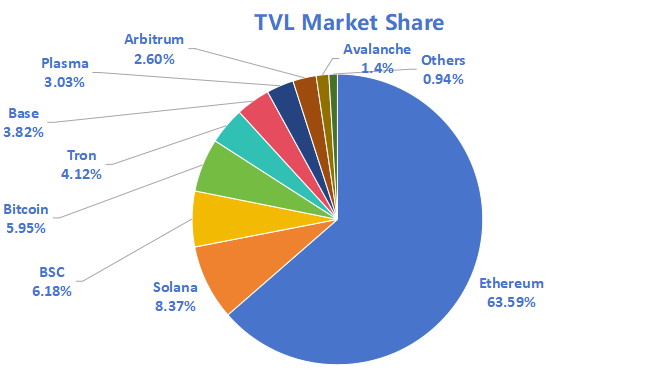

According to DeFiLlama, the total TVL of DeFi this week is $157.5 billion, up from $152.2 billion last week, with a weekly increase of 3.48%. By public chain, the top three public chains by TVL are Ethereum with a share of 63.59%; Solana with a share of 8.37%; and BNBChain with a share of 6.18%.

From on-chain data, the daily trading volume shows an overall downward trend this week, with only Toncoin increasing by 16.3%. Among them, Sui saw the most significant decline, down 41.5% from last week, Ethereum down 27.8%, Solana down 19.7%, BNBChain down 7.2%, and Aptos remaining flat compared to last week; in terms of transaction fees, overall network costs remain stable, except for Solana, which increased by 200% compared to last week, while other public chains remained flat; in terms of daily active addresses, Aptos performed the strongest this week, up 44.4% from last week, Solana up 1.9%, Ethereum up 3.5%, BNBChain down 5.2%, Toncoin down 7.4%, and Sui with the largest decline of 13%; in terms of TVL, this week showed a comprehensive growth trend, with Toncoin significantly increasing by 11.1% from last week, while most other public chains saw an increase of about 3%–8%.

Innovative projects to watch: Compose is a composable layer based on Ethereum, aimed at solving liquidity and fragmentation issues in multiple Rollup ecosystems; Streme uses a native streaming token mechanism and streaming staking rewards to provide users with real-time profit distribution; Clip allows creators to tokenize and trade creative content, AI-generated works, or digital assets, thus achieving continuous circulation and financing of creative value.

Table of Contents

Key Points

I. Market Overview

Total cryptocurrency market capitalization/Bitcoin market capitalization share

Fear Index

ETF inflow and outflow data

ETH/BTC and ETH/USD exchange rates

Decentralized Finance (DeFi)

On-chain data

Stablecoin market capitalization and issuance situation

II. This Week's Hot Money Trends

Top five VC coins and Meme coins by increase this week

New project insights

III. Industry News

Major industry events this week

Major events happening next week

Important investments and financing from last week

IV. Reference Links

I. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization share

The total market capitalization of cryptocurrencies is $3.97 trillion, up from $3.89 trillion last week, with a weekly increase of 2.06%.

Data source: cryptorank

Data as of October 26, 2025

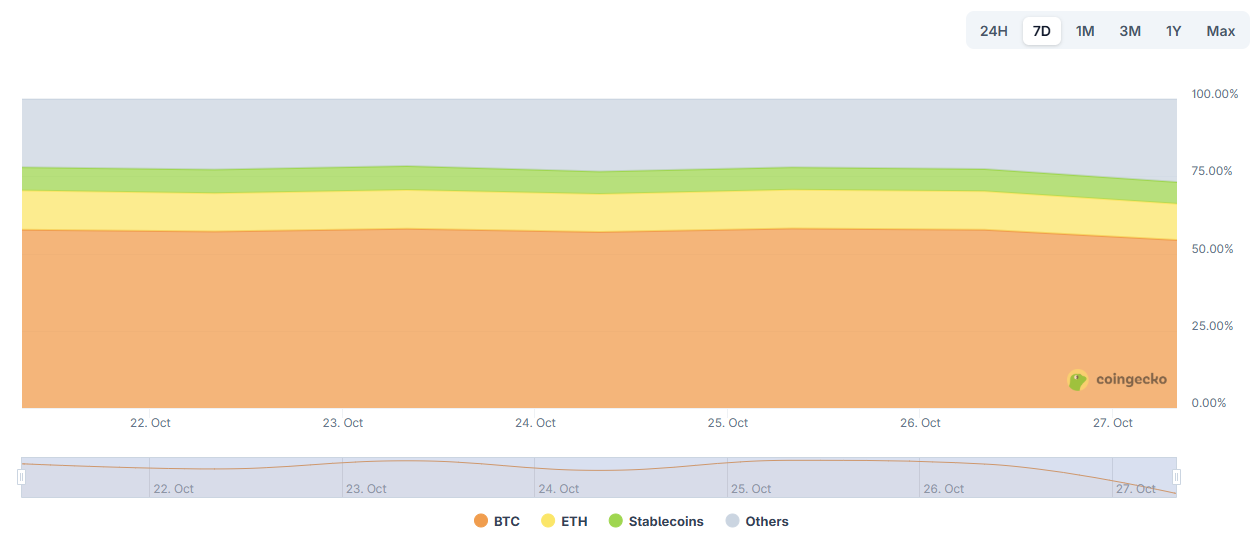

As of the time of writing, the market capitalization of Bitcoin is $229 billion, accounting for 57.62% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $312 billion, accounting for 7.87% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of October 26, 2025

2. Fear Index

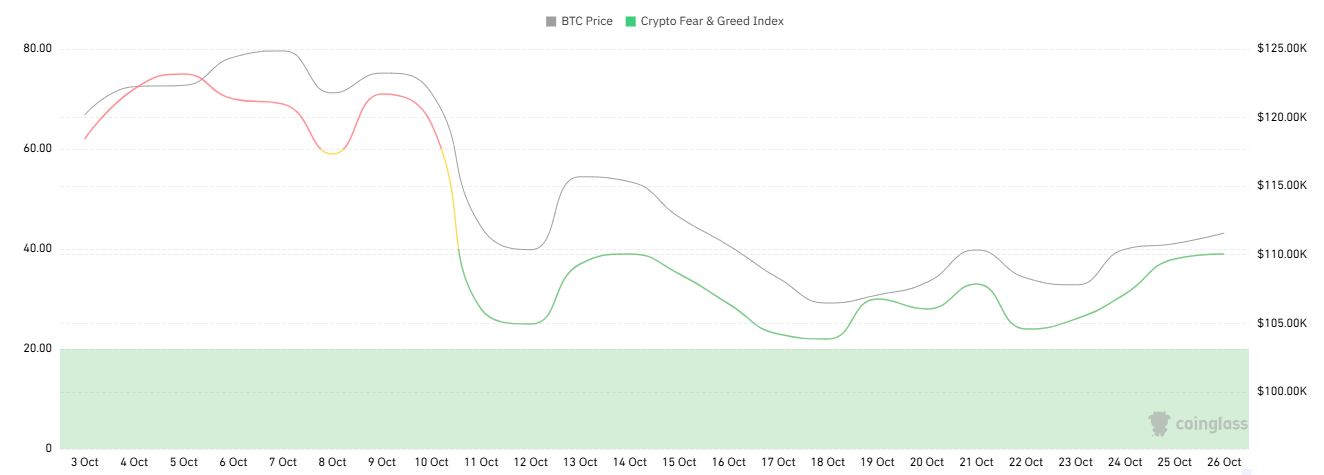

The cryptocurrency fear index is 39, indicating fear.

Data source: coinglass

Data as of October 26, 2025

3. ETF inflow and outflow data

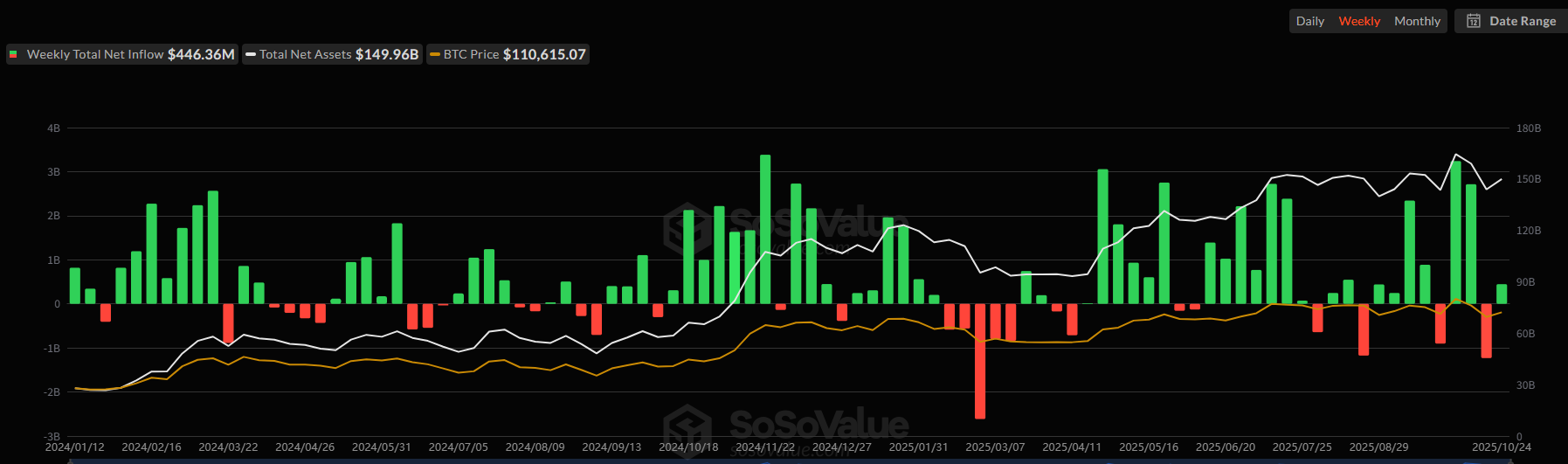

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $61.98 billion, with a net inflow of $446 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $14.35 billion, with a net outflow of $244 million this week.

Data source: sosovalue

Data as of October 26, 2025

4. ETH/BTC and ETH/USD exchange rates

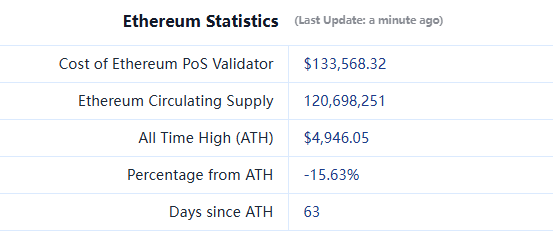

ETHUSD: Current price $4,170, historical highest price $4,946, down approximately 15.63% from the highest price.

ETHBTC: Currently at 0.036298, historical highest at 0.1238.

Data source: ratiogang

Data as of October 26, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $157.5 billion, up from $152.2 billion last week, with a weekly increase of 3.48%.

Data source: defillama

Data as of October 26, 2025

By public chain, the top three public chains by TVL are Ethereum with a share of 63.59%; Solana with a share of 8.37%; and BNBChain with a share of 6.18%.

Data source: CoinW Research Institute, defillama

Data as of October 26, 2025

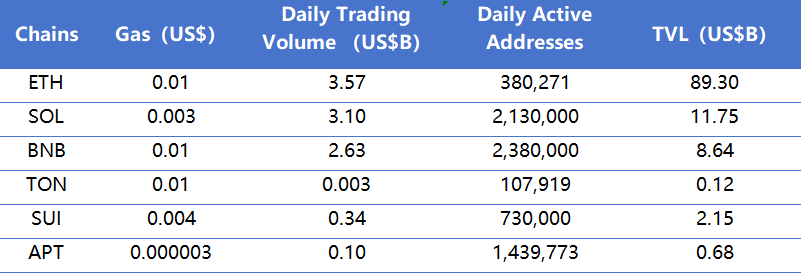

6. On-chain data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of October 26, 2025

● Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. From the daily trading volume perspective, there is an overall downward trend this week, with only Toncoin increasing by 16.3%. Among them, Sui saw the most significant decline, down 41.5% from last week, Ethereum down 27.8%, Solana down 19.7%, BNBChain down 7.2%, and Aptos remaining flat compared to last week. In terms of transaction fees, overall network costs remain stable, with Ethereum, BNBChain, Toncoin, Sui, and Aptos remaining flat compared to last week, while Solana increased by 200% compared to last week.

● Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. From the daily active addresses perspective, Aptos performed the strongest this week, up 44.4% from last week, Solana up 1.9%, Ethereum up 3.5%, BNB Chain down 5.2%, Toncoin down 7.4%, and Sui with the largest decline of 13%. In terms of TVL, this week showed a comprehensive growth trend. Toncoin increased significantly, up 11.1% from last week, while Ethereum increased by 4.7%, Solana by 5.9%, BNB Chain by 3.3%, Sui by 8.0%, and Aptos remained stable.

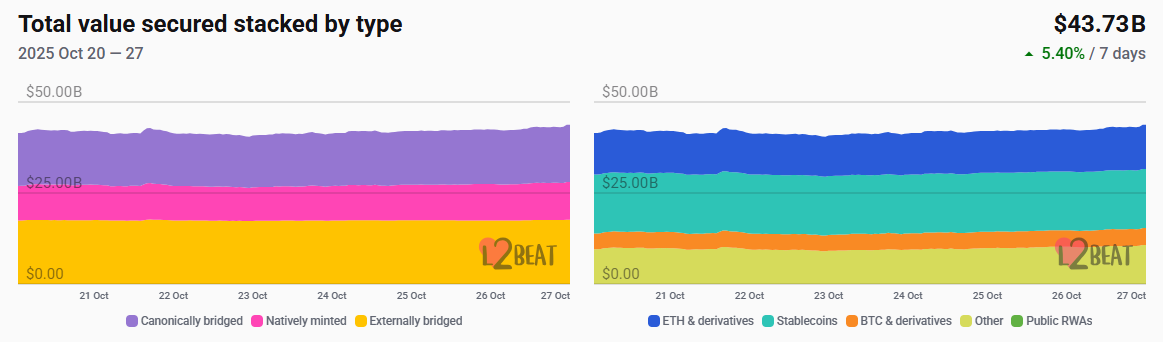

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 is $43.73 billion, up from $42.28 billion last week, with an overall increase of 5.40%.

Data source: L2Beat

Data as of October 26, 2025

- Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

Data source: footprint

Data as of October 26, 2025

7. Stablecoin market capitalization and issuance situation

According to Coinglass, the total market capitalization of stablecoins is $312 billion. Among them, USDT has a market capitalization of $182.9 billion, accounting for 58.6% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $76.3 billion, accounting for 24.5%; and DAI with a market capitalization of $5.36 billion, accounting for 1.7%.

Data source: CoinW Research Institute, Coinglass

Data as of October 26, 2025

According to Whale Alert data, this week USDC Treasury has issued a total of 952 million USDC, and Tether Treasury has issued a total of 1 billion USDT, with a total stablecoin issuance of 1.952 billion this week, down approximately 62.15% from last week's total stablecoin issuance of 5.154 billion.

Data source: Whale Alert

Data as of October 26, 2025

II. This Week's Hot Money Trends

1. Top five VC coins and Meme coins by increase this week

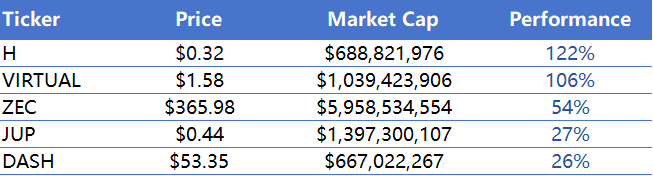

The top five VC coins by increase in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of October 26, 2025

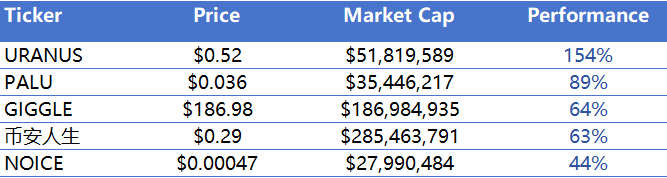

The top five Meme coins by increase in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of October 26, 2025

2. New Project Insights

Compose is a composable layer based on Ethereum, aimed at solving liquidity and fragmentation issues in multiple Rollup ecosystems. It allows developers to deploy dApps without repeating on multiple chains, and users can trade on any chain with a single wallet without needing to recharge multiple times.

Streme is an AI Agent that integrates artificial intelligence and DeFi. It uses a native streaming token mechanism and streaming staking rewards to provide users with real-time profit distribution. At the same time, Streme integrates Uniswap v3 liquidity features to enhance capital utilization efficiency and trading depth.

Clip is an AI-focused Web3 creative financialization platform dedicated to assetizing creators' works and data, achieving value confirmation and profit distribution through blockchain and smart contracts. Clip allows creators to tokenize and trade creative content, AI-generated works, or digital assets, thus achieving continuous circulation and financing of creative value.

III. Industry News

1. Major Industry Events This Week

The BNB Chain prediction market service provider Opinion mainnet has been launched, inviting some core community users to trade. At the same time, the Opinion mainnet has opened invitation channels and access permissions for certain whitelisted users. Meanwhile, the rebate and points system has also been launched.

Infinex has officially entered the critical phase of TGE, with the team deciding to voluntarily lock up 20% of the total token supply for another 12 months, with a linear release over 12 months after unlocking. The early TGE is divided into three phases, with the current phase including finalizing core products and incentive activities, launching the Infinex extension and wallet import features for all users. The second phase of the TGE process will determine whether the product release and incentive activities have generated sufficient appeal to justify proceeding with the TGE. The final phase will be the launch of pre-listing perpetual contracts and maximizing distribution.

ShareX has launched Deshare 2.0, upgrading its RWA and DePIN architecture. At the same time, ShareX has initiated the second phase of Deshare Alliance recruitment, with the first phase covering 22 countries, 540,000 devices, and over 8 million users.

2. Major Events Happening Next Week

The MegaETH token sale registration is taking place from October 15 to 27, using USDT on the Ethereum mainnet as the payment method, possibly adopting a fixed cap price auction format, with a 10% discount on the final token price for those choosing a one-year lock-up.

The crypto wallet project Vultisig will start its TGE on October 27 and will go live 24 hours later. Vultisig offers a multi-chain MPC wallet that emphasizes no mnemonic phrases and no single point of failure, generating $400,000 in fee income through cross-chain exchanges over the past year.

The Solana Foundation's 12th Cypherpunk International Hackathon will continue until October 30. The Cypherpunk online hackathon focuses on six major areas, hosted by Arcium for DeFi, Forward Industries for RWA, Raydium for consumer applications, Reflect for stablecoins, Triton for infrastructure, and the Solana Foundation for the open track.

3. Important Investments and Financing from Last Week

Greenlane (NASDAQ: GNLN) completed $110 million in post-IPO strategic financing, led by Polychain Capital, with participation from institutions such as Blockchain.com, dao5, and Kraken. Greenlane is a brand group focused on consumer experience, primarily engaged in the development and distribution of packaging, electronic cigarettes, and lifestyle products. (October 20, 2025)

The crypto investment platform Echo was acquired by Coinbase for approximately $375 million. Founded in 2024, Echo is a platform focused on crypto angel investing and collective financing, aimed at allowing crypto investors to co-invest, collaborate on decisions, and collectively invest in early-stage crypto projects. (October 21, 2025)

Beam was acquired by Modern Treasury for approximately $40 million. Beam, founded by Ansible Labs in 2022 and based in the U.S., focuses on stablecoin payment infrastructure, aiming to achieve faster, lower-cost, and smarter global fund circulation. Beam supports cross-border settlement and liquidity management through an efficient payment network, providing compliant fiat and digital currency conversion services for fintech companies, banks, and consumer platforms. (October 22, 2025)

IV. Reference Links

Compose, https://x.com/ComposeNetwork

Streme, https://x.com/StremeFun

Clip, https://x.com/clipdotfun

Greenlane, https://gnln.com/

Echo, https://x.com/echodotxyz

Beam, https://x.com/beam_cash

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。