TL;DR:

- 资金费率呈现可预测性: 它们倾向于在一定范围内波动,受到资金费率公式固有偏差产生的“结构性下限”和套利者的“资本上限”的影响。识别这种结构可以成为交易策略的基础。

- Boros的资金费率期货允许交易者现在押注资金费率的波动,并利用杠杆来放大回报,或对冲仓位中资金费率敞口。

- 在 Boros 上交易可以提供两种盈利方式: 1) 交易所资金费率与boros上隐含费率之间差异产生的资金费率收入,以及 2) 交易变化产生的价差。

- 成功的交易取决于 3 个关键因素: 1) 合约的到期时间(较短的期限有利于投机,较长的期限有利于趋势跟踪),2) 交易所的选择(波动性大的交易所可能提供捕捉费率飙升的机会,而更稳定的交易所可能更适合产生收益),以及 3) 入场时的隐含费率,这应与整体市场展望(无论是看涨、看跌还是中性)保持一致。

引言

我们的第三季度衍生品报告《锚点与上限:理解资金费率的结构》分析了定价资金费率的结构与逻辑,专门研究了它的结构性力量:资金费率公式对0.01% /8hr 的引力以及利用高资金费率的巨额机构资本。这揭示了资金费率市场有明确的边界,而且通常可以预测,而正是这种效率不高的地方,被交易者们看作是能持续获利的机会。

理解基本机制至关重要,但真正的挑战在于将其应用于交易。本文直接建立在我们的结构性发现之上,提供了一个关于如何将资金费率期货作为一种新型交易工具的实用交易策略。它将涵盖从场所选择到在 Boros 上执行资金费率期货交易的所有内容。

如何看待比特币/以太坊的资金费率:下限与上限

我们之前的报告指出,资金费率公式对于预测费率在某些市场条件下的惊人行为至关重要。我们的分析揭示了一个由结构性下限和资本强制上限定义的引力区。

1. 结构性下限:设计上的正向偏差

资金费率公式本身提供了一个强大的“下限”。回顾公式:F = P + clamp(I - P, -0.05%, 0.05%),其中 I 在交易所(如BitMEX、币安和 Hyperliquid)中为 0.01%/8 小时。这个公式本身就产生了正向偏差。为了说明这一点,考虑一种看跌情绪下,永续合约低于现货价,溢价 (P) 为 -0.02% 的情况。

- clamp 函数变为:clamp(0.01% - (-0.02%), ...) = clamp(0.03%, ...) = 0.03%

- 最终资金费率仍然是:F = -0.02% + 0.03% = +0.01%

即使永续合约处于折价状态,资金费率仍是正值。这种机制提供了强大的结构性下限,解释了为什么在尽管上个季度价格走势大多不呈趋势且一度下跌 >10%,BTC 的资金费率仍有超过 93% 的时间为正。负费率需要显著且持续的抛售压力才能克服这种内置的正向偏移。

2. 来自套利机构的上限:很难突破年化10.95%

如果资金费率公式提供了下限,那么套利机构就提供了上限。基准的资金费率年化为 10.95% APY。这大约是美元货币市场基金能提供的100% 以上,使其对 Ethena 等大型参与者具有吸引力。当溢价将费率推高到远高于此水平时,就成为大规模资金费率套利的明显机会。

Ethena 等参与者拥有数十亿随时可部署的资金,通过做空永续合约并购买现货资产来捕捉这种 delta 中性收益。这种巨大的资本力量充当了硬上限,积极地将任何费率飙升推回到 0.01% 的锚点。

下限和上限共同创造了一个可预测的范围,偏离这个区域通常代表着交易机会。

下限和上限共同创造了一个可预测的范围,偏离这个区域通常代表着交易机会。

构建交易框架

理解结构性下限和上限是第一步。下一步是将这些知识应用于交易。这需要更深入地了解 Boros 的机制以及考虑时间、交易场所和隐含费率的战略框架。

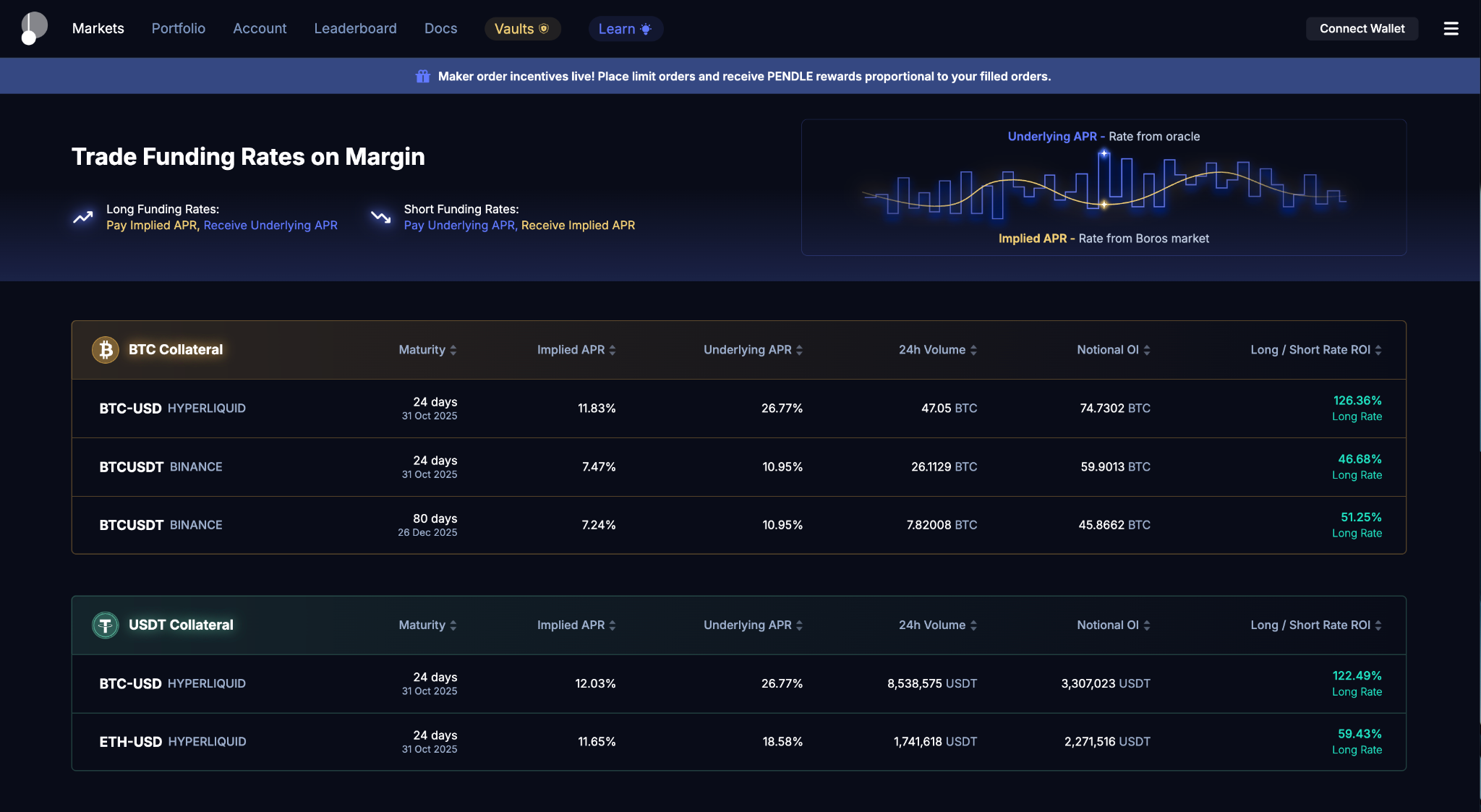

什么是 Boros?

Boros 实现了链上资金费率交易。通过 Boros 市场,交易者可以对冲其资金费率敞口,并投机资金费率的波动和走势。自推出不到 3 个月以来,交易量已超过 26 亿美元,它是一个新兴的 DeFi 协议,有潜力进入更大的永续合约市场。

理解 Boros 的机制:两种收益来源

在 Boros 上交易与简单持有永续合约不同。交易者的盈亏来自两个主要来源:

- 费率差: 这是现金流部分。对于每个资金费率间隔(例如,BitMEX 上的 8 小时),您要么支付,要么收到交易所的实际资金费率与您在 Boros 上交易的隐含资金费率之间的差额。如果您做多隐含费率,而实际费率最终更高,您将收到付款,反之亦然。

- 价差: 这是价格部分。Boros 上的隐含资金费率由其自己的订单簿决定,并根据交易者预期波动。如果您以 15% APY 的隐含费率做多,而市场情绪将其推高到 20% APY,您的头寸价值就会增加,从而在您出售时产生资本利得的机会。

交易策略

一个稳健的策略考虑三个主要变量:时间、交易场所和隐含费率的入场点。

1 – 时间(到期日很重要): Boros 上的每个隐含资金费率市场都有一个到期日。这是头寸对短期费率变化敏感程度的关键因素。

- 较长到期日: 距离到期还有数周或数月的合约对单次资金费率支付的敏感度较低。它们代表了市场对整个期间平均资金费率的预期。这些更适合押注长期趋势或结构性转变。

- 较短到期日: 接近到期的合约对接下来几次资金费率支付高度敏感。这些更适合对即时费率飙升或下跌进行投机性、短期押注。

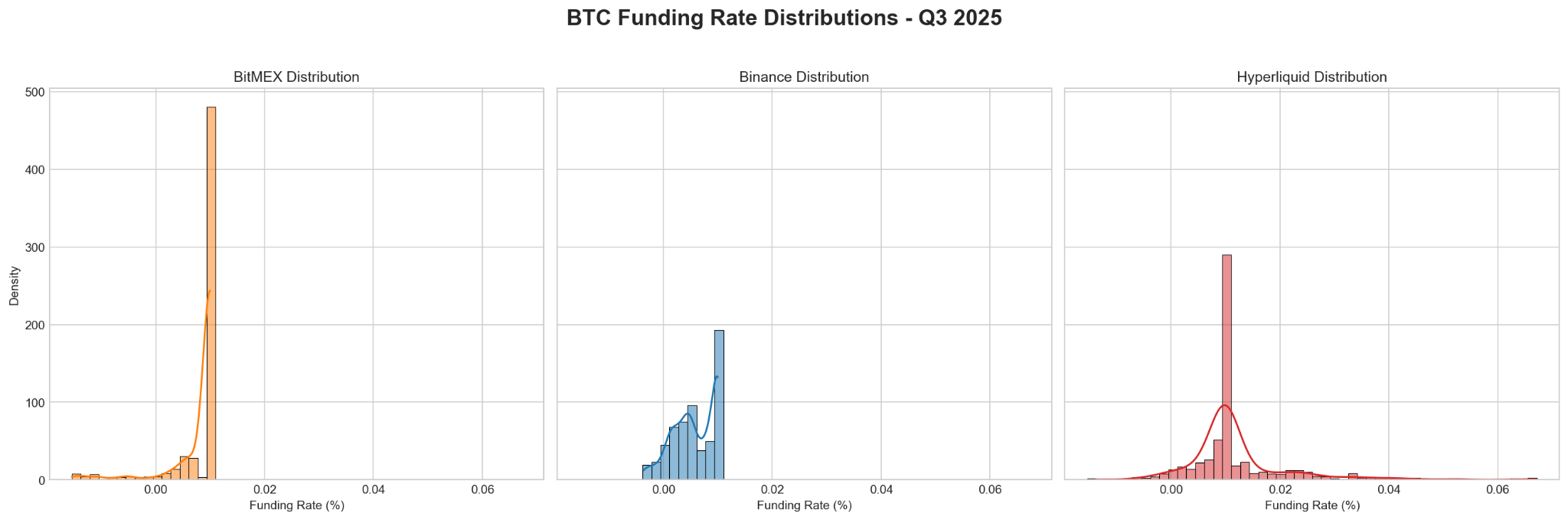

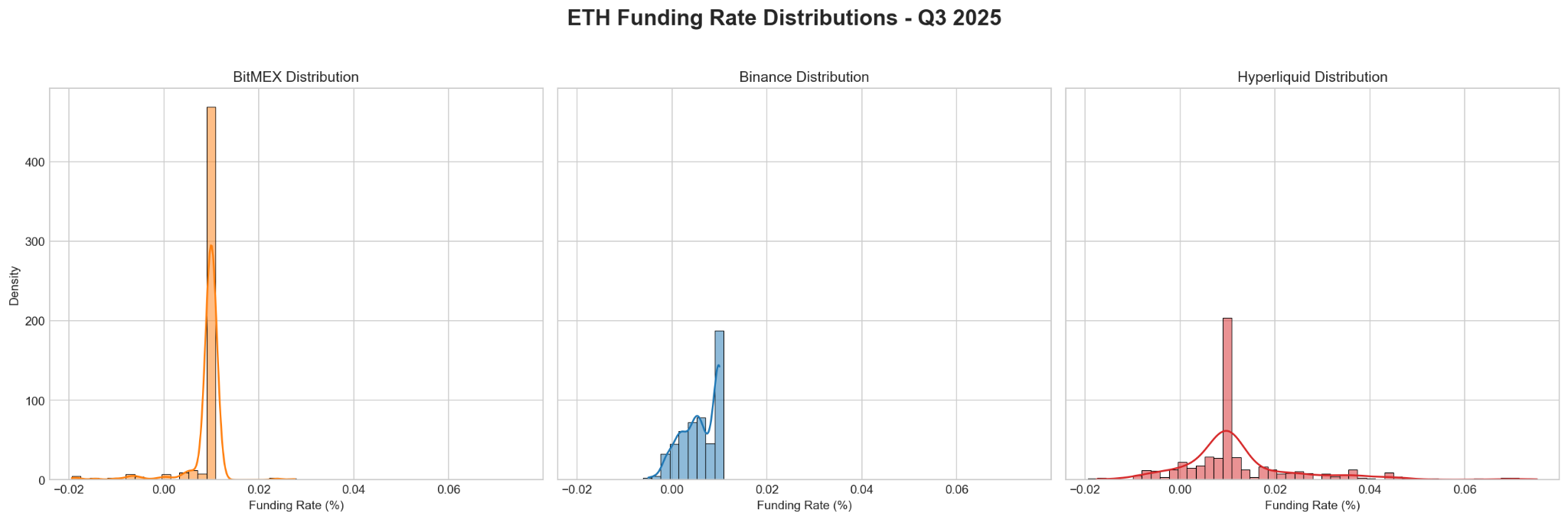

2 – 交易场所(选择你的战场): 正如我们之前的报告所强调的,底层场所决定了费率的行为。

- 为了稳定和收益: 像 BitMEX 这样拥有 8 小时窗口和深厚流动性的场所,为基线收益策略提供了更可预测的环境。

- 为了波动和投机: 像 Hyperliquid 这样拥有 1 小时窗口的场所,旨在实现波动性,并提供更频繁的捕捉剧烈飙升和下跌的机会。

| 指标 | BitMEX(稳定) | Hyperliquid(波动) | 要点 |

| 平均费率 | 0.0090% | 0.0150% | Hyperliquid 具有更高的平均溢价。 |

| 标准差 | 0.0045% | 0.0250% | Hyperliquid 的波动性几乎是 6 倍,创造了更多的交易机会。 |

| 最小值/最大值 | -0.0194% / 0.0276% | -0.05% / 0.10% | Hyperliquid 的交易范围在两端都显著更宽。 |

| 频率 > 0.05%/8 小时 | 1% | ~15% | Hyperliquid 上提供高收益的飙升更为常见。 |

3 – 隐含费率: 选择了时间和场所后,最终的决定是根据市场隐含费率与您的预期来把握入场时机。

| 情景 | 交易 |

| 1:预测市场FOMO | 如果您预期市场会出现牛市狂热期,资金费率可能会走高。 交易:当隐含费率低于 10% APY 时做多。 理由:虽然 10.95% 的锚点产生了强大的引力,但强烈的投机期可能导致费率暂时超过这个上限,从而提供捕捉定期支付和隐含费率上升带来的资本利得的机会。 |

| 2:预测中性市场 | 如果您认为市场将相对平衡,那么与 10.95% 的显著偏差可以被视为机会。 交易:如果隐含费率显著低于此锚点,则做多;如果隐含费率过高,则做空,押注其回归结构性费率。 理由:10.95% APY 作为结构性锚点。交易偏离此锚点可以随着隐含费率回归其结构性均值而获利。 |

| 3:预测市场恐慌 | 如果您预期熊市情绪,请记住结构性下限。由于公式的偏差,资金费率仍可能保持正值。这创造了一个不对称的机会。 交易:当隐含资金费率相对较高时(例如,高于 7% APY)做空。 理由:目标不是押注费率变为负值,而是押注其从高正值压缩到较低的、结构性支持的下限(例如,接近 4% APY)。 |

如何在 Boros 上交易资金费率

以下步骤提供了一个基于所讨论概念实施策略的通用框架。

步骤 1:制定计划

在进行任何交易之前,根据结构性框架建立一个清晰的论点。您是预期回归均值、由于市场狂热而飙升,还是压缩至结构性下限?

例如,一个论点可以是:“Hyperliquid 上的隐含费率目前由于短期 FOMO 而升高,我预计它将压缩回其结构性锚点。”

步骤 2:选择您的市场和到期日

根据您的论点,选择合适的交易工具:

- 场所选择: 决定底层市场。如分析所示,资金费率在不同交易所之间可能差异很大。如果您的策略依赖于捕捉剧烈、短期的波动,那么像 Hyperliquid 这样波动性大的场所可能适合。如果您的策略基于赚取可靠的基线收益,那么更稳定的场所可能更可取。

- 时间范围: 选择与您的策略匹配的合约到期日。对于对即时费率变化进行短期投机性押注,选择接近到期的合约。对于对平均费率的长期看法,选择剩余数周或数月的合约。

步骤 3:在订单簿上执行交易

导航到Boros 平台 并连接您的钱包。根据您的论点,您将做多或做空隐含资金费率。

- 做多(预期费率上升): 在 Boros 订单簿上为隐含资金费率下买单。如果隐含费率增加(资本利得)或实际资金费率支付高于您的入场隐含费率(定期支付),则此头寸获利。

- 做空(预期费率下跌): 为隐含资金费率下卖单。如果隐含费率下跌(资本利得)或实际资金费率支付低于您的入场隐含费率(定期支付),则此头寸获利。

步骤 4:监控和管理您的头寸

订单成交后,通过监控两种回报来源积极管理头寸:

- 费率收入/支出: 跟踪底层交易所的实际资金费率与您的交易隐含费率之间差异产生的现金流。

- 资本利得/损失: 监控您在 Boros 上头寸的市场价格。隐含费率将根据市场预期波动,从而在到期前创造获利或止损的机会。

步骤 5:退出策略

您可以通过两种主要方式实现您的盈亏:

- 出售您的头寸: 在合约到期前在 Boros 订单簿上平仓。这非常适合捕捉隐含费率有利波动带来的资本利得。

- 持有至到期: 将您的头寸维持到合约到期。您的最终盈亏将是您在合约生命周期内收到或支付的所有定期支付的总和。

结论:结构重于情绪

直接交易资金费率的能力标志着加密衍生品领域的重大演变。我们的分析表明,在这个新领域取得成功可能更多地来自理解市场结构,而不是预测市场情绪。

通过识别资金费率公式创建的结构性下限和套利资本强制执行的硬上限,交易者可以建立一个稳健的框架。交易策略不再是猜测市场方向,而是识别市场何时偏离其自身的结构性规范。通过系统性地平掉不可持续的溢价或买入恐惧驱动的跌至结构性下限,交易者可以开始掌握资金费率衍生品这个新的、更可预测的世界。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。