Author: @traderalvin1_

Previously, I introduced the dynamic conversion mechanism of @RiverdotInc, which was officially retweeted by @RiverdotInc. The article is very detailed, and I recommend those who have not read it to do so first. Behind this seemingly simple dynamic conversion mechanism lies a wealth of excess profit opportunities.

Market Data:

- $RIVER: $3.7 → $10.1, a 172% increase over 6 days

- River Point: $0.0148 → $0.035, a 136% increase over 6 days

The increase in River Point is slightly lower than that of $RIVER due to the time premium N shrinking as the price of $RIVER rises, reducing the investment payback period from the original 20 days to the current 4 days. In other words, it is currently an excellent opportunity to go long on River Point, as long as the price of $RIVER remains unchanged for four days, one can break even.

At the same time, this also gives rise to a new trading opportunity: arbitrage between $RIVER and River Point.

Don't Want to Chase High Prices? Participate in the $RIVER Market Through Arbitrage

If you believe that the price of $RIVER is already high but still want to share in this round of market gains as a USD-based trader, you can refer to this strategy. By using USD-based arbitrage, you can currently achieve an annualized return of nearly 1000%.

Before proceeding, please be sure to read the following risk warning carefully:

Risk Warning:

All analyses in this article are merely records of personal operations and thoughts and do not constitute any financial advice. This arbitrage strategy is not "risk-free arbitrage" and still carries risks. Participants must assess their own financial situation, risk tolerance, funding rates, potential losses, and unknown black swan events. Please conduct independent research and take responsibility for your own trading actions.

Arbitrage Operation Method

Review of the Dynamic Conversion Mechanism

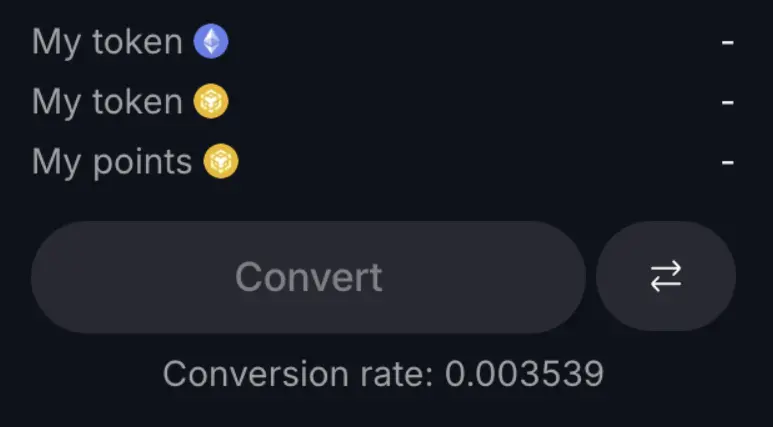

Users can convert River Point to $RIVER at any time, with the conversion ratio gradually increasing over time. The current exchange rate is 0.00355. After 180 days from the token generation event, the exchange ratio will peak, reaching 1 River Point = 0.03 $RIVER, nearly a 10-fold return!

Core Mechanism of Arbitrage

The core of arbitrage is always simple and direct: go long on River Point + short $RIVER contracts.

I understand that many investors are concerned about the risks of being short-squeezed or liquidated, but this falls under personal risk management. This article only discusses why I believe arbitrage with $RIVER has significant advantages compared to other targets.

This is merely a personal opinion share, and everyone may hold different views.

This Method Has Been Quietly Used by Market Participants

This strategy is not only recognized by me. Since the evening of October 22, it is evident that skilled traders have entered the market to attempt to capture fixed returns.

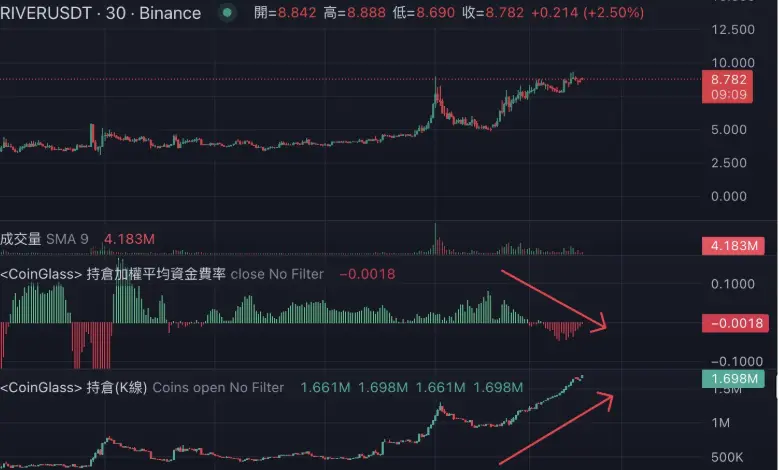

From the chart below, the following phenomena can be observed:

- The price of $RIVER has been rising steadily

- Funding rates have been continuously declining

- The volume of open contracts has increased

Combined with the continuous rise in River Point prices, it largely indicates that there are large arbitrage players going long on River Point while shorting $RIVER contracts on exchanges like @binance, actively engaging in arbitrage operations.

This phenomenon did not occur during the previous surge of $RIVER, perhaps because after the contracts were listed on major exchanges, $RIVER gradually broke out of its circle, attracting enough arbitrage players to participate.

Why Favor Arbitrage Between $RIVER and River Point?

There are few arbitrage opportunities in the market that have limited losses and potentially high returns. The annualized return rate for low-risk mainstream coin futures arbitrage is also relatively low, while the funding rates for arbitraging niche coins may yield higher returns but could face the risk of liquidation overnight.

$RIVER, due to its dynamic conversion mechanism, can reduce maximum risk while obtaining high returns. This is also the arbitrage position where I have currently invested the most of my own funds.

The advantages of the $RIVER and River Point arbitrage strategy are explained one by one below:

Advantage 1: Extremely High Annualized Return Rate, APR Exceeding 1000%

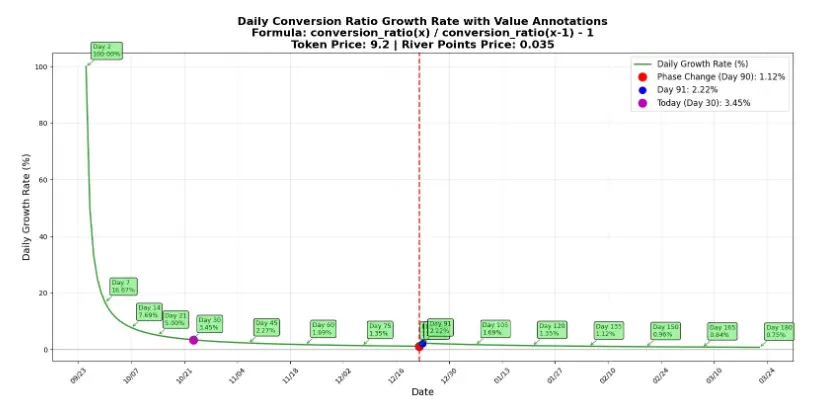

Generally, without using leverage, the annualized return rate of funding rates or futures arbitrage is about 20% to 50%. However, since @RiverdotInc is currently in the early stages of dynamic conversion, the conversion ratio of River Point is rising rapidly. The current daily increase is 3.45%, translating to an annualized return rate of up to 1259%!

(The above calculation does not consider the efficiency of using hedging funds)

Practical case illustration:

Assuming we are currently on day 30, the conversion ratio is 3.45% higher than on day 31. If today your River Point can be exchanged for 10,000 $RIVER, tomorrow it can be exchanged for 10,345 $RIVER.

As long as the funding rate does not exceed 3.45% per day, the longer you hold this position, the more $RIVER you will earn over time.

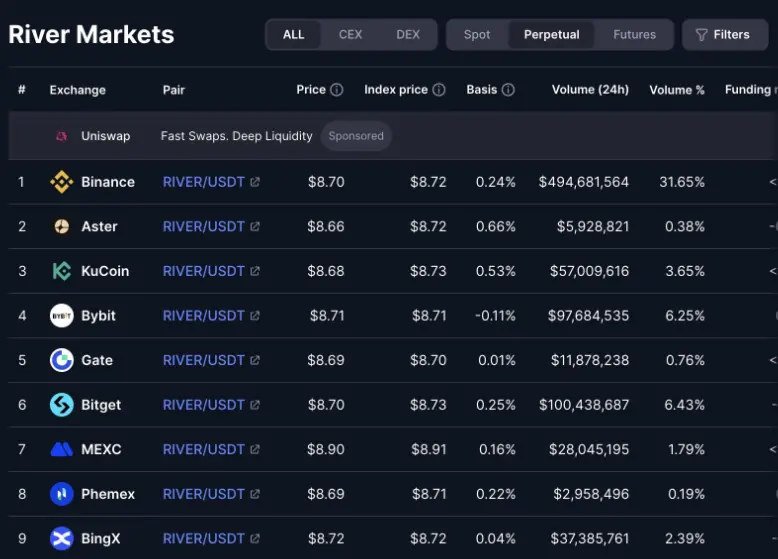

Advantage 2: $RIVER Contracts Available on Major Exchanges, Convenient Hedging

Currently, all major exchanges except Okx have listed $RIVER contracts, including Binance, Bybit, Bitget, MEXC, Kucoin, BingX, etc.

This makes hedging easier compared to general small coins, with higher contract liquidity and less susceptibility to manipulation by a single exchange.

Advantage 3: Natural Hard Cap, Lower Risk Compared to Niche Coins

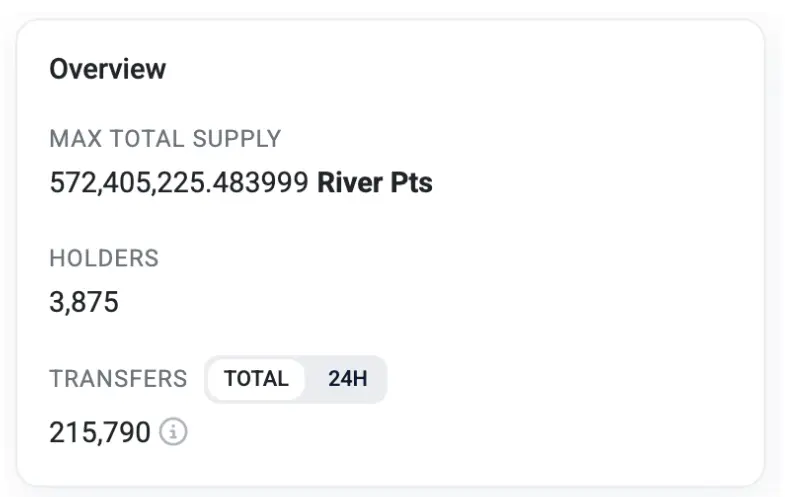

The most concerning aspect of hedging is the risk of project parties or market makers pulling prices indefinitely, which is most common in coins with scarce circulating chips. However, in the token economic model of $RIVER, 30% of the total supply is airdropped to users in the form of River Point, which greatly reduces the possibility of unlimited price pulling.

Currently, there are 572 million River Points in circulation. When the price of $RIVER continues to rise, these 572 million River Points can be converted to $RIVER and sold at any time to realize profits.

Therefore, when $RIVER is being driven up crazily, River Point can potentially convert into circulating chips of $RIVER, which will suppress the rise of $RIVER in the short term and make it less likely to experience extreme surges like high-control coins such as $COAI and $TRB.

For short positions in hedging, this adds an extra layer of insurance.

Advantage 4: Can Close Positions Anytime and Withdraw Funds

With the dynamic conversion mechanism providing a bottom-line guarantee, even in the worst-case scenario, I can still choose to convert River Point to $RIVER and close the arbitrage position through hedging operations.

In contrast, some hedging strategies have obvious disadvantages. For example, during the fourth quarter arbitrage of the $ENA airdrop, if the price of $ENA is driven up indefinitely before actually receiving the airdrop, arbitrageurs basically cannot exit midway unless they are willing to take a loss at a high price or continue to add margin to support until the end.

I believe @Cryptorobber1 should have a deep understanding of this.

The mechanism of @RiverdotInc allows arbitrageurs to exit at any time because each block essentially increases the value of River Point. This reduces the risk faced by arbitrageurs due to liquidation or the need to withdraw funds temporarily.

Conclusion

Compared to general arbitrage opportunities, the arbitrage between $RIVER and River Point has many advantages. While providing an annualized return rate exceeding 1000%, it achieves controllable risk, the ability to withdraw funds at any time, and a lower probability of sudden price spikes, thereby reducing the likelihood of significant losses for arbitrageurs.

The dynamic conversion mechanism of River Point will release $RIVER tokens when the price of $RIVER rises, reducing the risk of arbitrageurs being liquidated due to short-term price increases. Although this may suppress the trend of $RIVER in the short term, in the long run, it significantly reduces the supply of $RIVER.

The deeper I think, the more I can feel the ingenuity of this mechanism design. It provides rich participation methods for arbitrageurs, long-term believers, and short-term traders, which is no wonder that its recent market popularity is so high, leaving people deeply impressed.

I currently hold some arbitrage positions, and this article is merely a personal trading record. If friends are interested in trying arbitrage, please be sure to conduct independent research and only take on risks that you can afford.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。