SUI ETF 增加质押,确认与 Coinbase 保管的纳斯达克上市

21Shares 在美国加密领域进行了一项重大举措。该公司用一份新的文件替换了其与证券交易委员会(SEC)提交的 SUI ETF 申请。

新的申请包含有关质押的信息,明确 ETF 将在纳斯达克上市,并确定现金和数字资产的保管人。这一举措可能使 ETF 吸引希望在持有代币的同时积累奖励的投资者。

质押在 21Shares SUI ETF 中到来

在 10 月 23 日收盘后提交的 修订 S-1 申请 中,包含一个新部分,标题为“信托资产的质押”。它描述了交易所交易基金将如何实施质押,包括质押资产的解锁期、赎回要求、信托规模以及观察市场条件。

21Shares US LLC 已与 Coinbase Crypto Services 合作进行质押。Coinbase 将负责在接下来的两年内验证、批准和创建交易所交易基金的交易区块。

截至目前,申请仍不完整,基金的股票代码和管理费用尚未确定,可能会在未来的更新中形成。

纳斯达克上市和保管人已确认

申请确认将上市纳斯达克。纽约梅隆银行将担任现金保管人,而 Coinbase Custody 将保管数字资产。

这些合作旨在提供受监管的安全资金处理,这可以增强投资者的信心。

其他细节,如转移代理和营销代理,尚未披露。如果获得批准,该基金将使用 CME CF Sui Dollar 参考利率跟踪代币的价格,这是一个广泛认可的代币表现基准。

市场反应

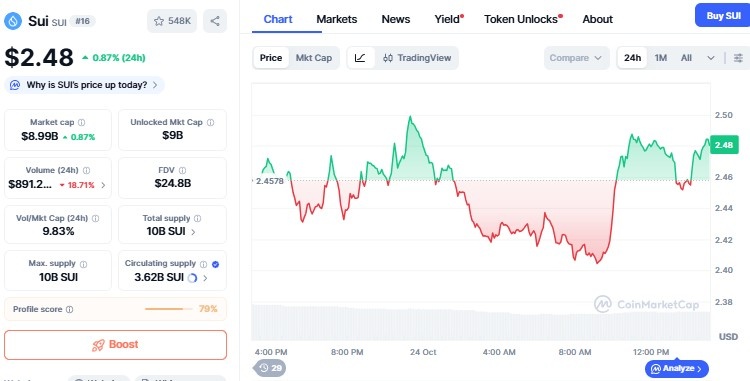

在申请提交后,SUI 代币价格 上涨了 2.5%,达到 2.47 美元。期货交易也获得了一些动力,未平仓合约在一小时内增加了 3%,达到 8.23 亿美元的高点。

来源:CoinMarketCap

目前交易价格为 2.48 美元,过去 24 小时上涨了 0.88%,而交易量减少了 18.64%,达到 8.917 亿美元。

这对加密 ETF 的重要性

这发生在 SEC 继续审查 加密 ETF 申请的背景下。大多数决定被搁置,因为 SEC 正与交易所合作建立现货加密 ETF 的标准化规则。通过引入质押并确保纳斯达克上市,21Shares 正在使其 SUI ETF 成为美国市场的独特产品。

结论

21Shares SUI ETF 的修订展示了数字货币与传统金融的最终融合。通过质押、值得信赖的保管人以及在纳斯达克上市,这一加密投资产品可能使投资者接触到加密货币及其潜在奖励。市场现在等待 SEC 的进一步行动。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。