Author: Ponyo, Four Pillars

Translation: ODIG Invest

Decentralized exchanges (DEX) are one of the most revolutionary innovations in the crypto market. They not only change people's perception of "trading" but also redefine the roles of liquidity, trust, and financial intermediaries.

With performance improvements, Perpetual DEX (decentralized perpetual contract trading platforms) are becoming an important part of the mainstream market.

The decentralized perpetual contract trading platform Hyperliquid has moved the Orderbook model on-chain, which is different from the traditional AMM (automated market maker) model:

In most DEXs (like Uniswap), prices are determined by liquidity pools and algorithms, and the matching mechanism is based on the automatic pricing of the pools; whereas the Orderbook model is closer to the experience of centralized exchanges (CEX), where buyers and sellers trade through orders and matching, allowing for more accurate market depth and lower slippage.

In the Perp DEX space, Hyperliquid also faces challenges. On one hand, the new generation of perpetual DEXs—such as Aster, Lighter, EdgeX, etc.—have rapidly emerged with high incentives, token mining, and airdrop strategies, capturing trading volume and attention; on the other hand, market liquidity is highly dependent on incentive mechanisms, and long-term community cohesion is under test. Emerging competitors rise quickly through incentives, but the real test is: will users stay after the subsidies end?

This article aims to outline the current situation and challenges Hyperliquid faces in competition, analyze liquidity dynamics, strategies of giants, and market rules, and explore how Hyperliquid maintains its lead and resilience amid volatility and uncertainty. It reminds investors: market success is never permanent; only by understanding probabilities and returning to fundamentals can one gain insight into opportunities amid turmoil.

Key Points

Hyperliquid is facing fierce competition from a new generation of perpetual contract DEXs—Aster, Lighter, EdgeX, and others are rising rapidly.

Liquidity is heavily reliant on incentive mechanisms, with short-term funds and trading volumes quickly flowing to new platforms, but Hyperliquid still maintains a lead in open interest and active users.

The perpetual DEX market may move towards consolidation, ultimately forming a pattern of a few winners. With its infrastructure, ecological layout, and HyperEVM, Hyperliquid still has the potential to remain in a core position.

In the market, success does not mean permanence. Whenever a company demonstrates an attractive business model, competitors will swarm in—either by imitation, attracting users with richer incentives, or bringing their own innovations. This pattern is repeated across industries: no advantage remains unchallenged for long. This principle is as old as capitalism, and today, it is playing out in the emerging field of perp DEX.

Hyperliquid is under siege. After successfully validating that its self-developed blockchain-based CLOB model (centralized order book) can operate safely and efficiently, it quickly attracted users and liquidity, becoming an industry-recognized leader. However, recent developments have once again proven—leadership inevitably invites challengers. A wave of new perpetual DEX projects (such as Aster, Lighter, EdgeX, Pacifica, Avantis, etc.) have emerged, adopting almost identical core strategies: token mining, aggressive airdrop promises, and highly attractive incentives.

1. Competition Arrives

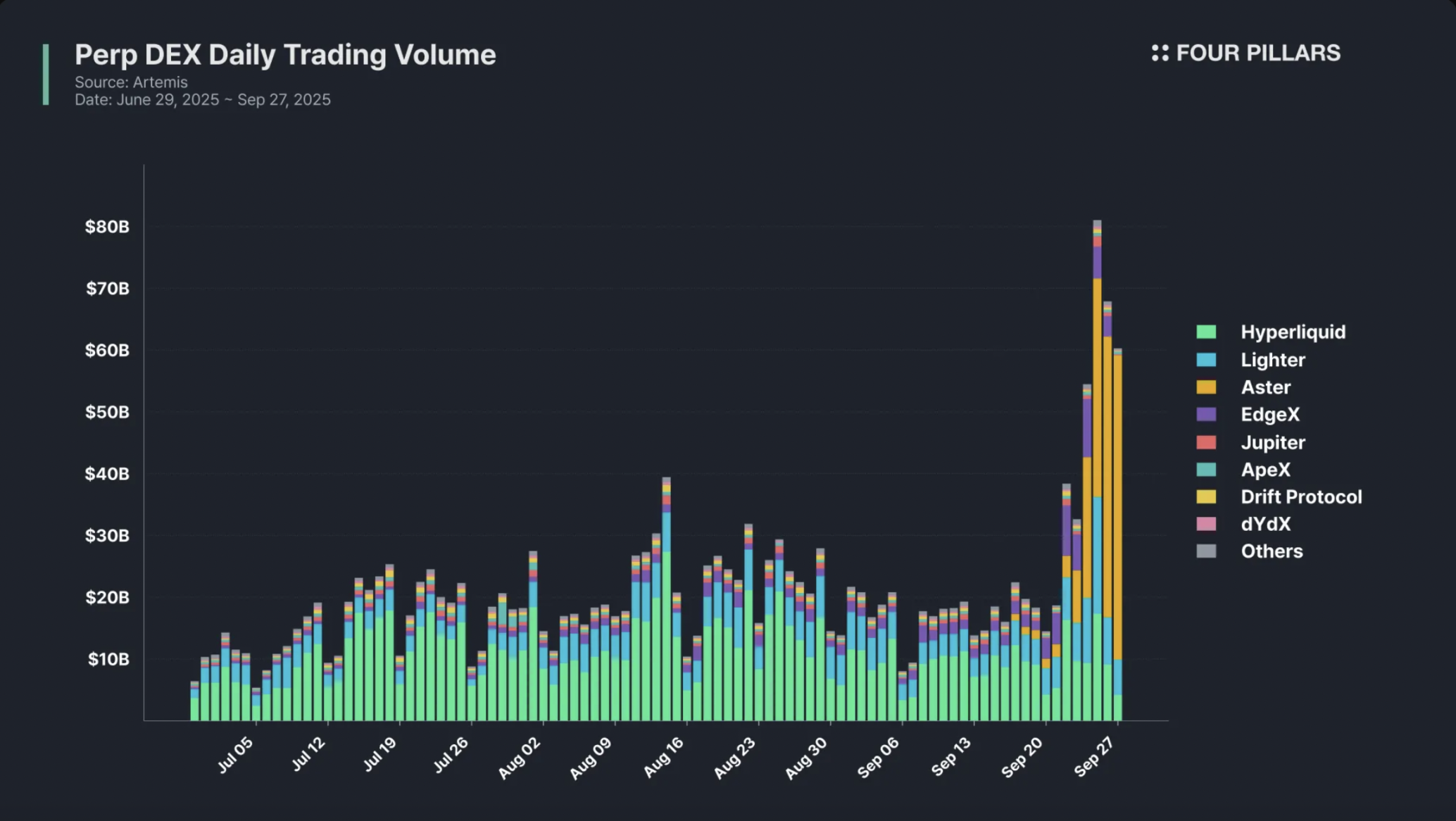

On a day at the end of September, Aster and Lighter achieved daily trading volumes of $42.8 billion and $5.7 billion, respectively, both surpassing Hyperliquid's approximately $4.6 billion. For outside observers, this "seems" to indicate that Hyperliquid has been dethroned. Just a few months ago, it controlled over 70% of the entire on-chain perpetual contract market, but now its ranking has dropped to second or even third.

But context is important. In the same month, Hyperliquid's trading volume remained close to $300 billion, a scale that all newcomers have yet to approach long-term. When looking at active user numbers and open contract volumes (which better reflect the degree of capital investment than daily trading volume), Hyperliquid still leads by a wide margin.

2. The Nature of Liquidity

Liquidity is essentially transferable. Traders seek not only the best execution efficiency but also optimal incentive returns.

In the crypto market, token incentives often far exceed trading fees, leading to a "mercenary" characteristic of capital—flowing to the most profitable venues.

However, this does not mean all liquidity is the same. Some liquidity is opportunistic, coming for profit and leaving quickly; another part is more "sticky," stemming from trust in the platform's infrastructure, reputation, and long-term value. For Hyperliquid, the key question is: how much of its liquidity is "mercenary," and how much is "durable"?

The traditional view holds that once incentives decrease, "Farmers" will exit, and established platforms will eventually reclaim their share.

But this also raises a new consideration: what if "nomadic liquidity" (constantly cycling between platforms that have not issued tokens) becomes the new market norm?

In such an environment, platforms that have issued tokens may fall into a paradox—original advantages may become burdens.

3. The Role of Giants

The challenges Hyperliquid faces come not only from emerging competitors but also from resource-rich strategic opponents—most notably, Binance and its founder CZ.

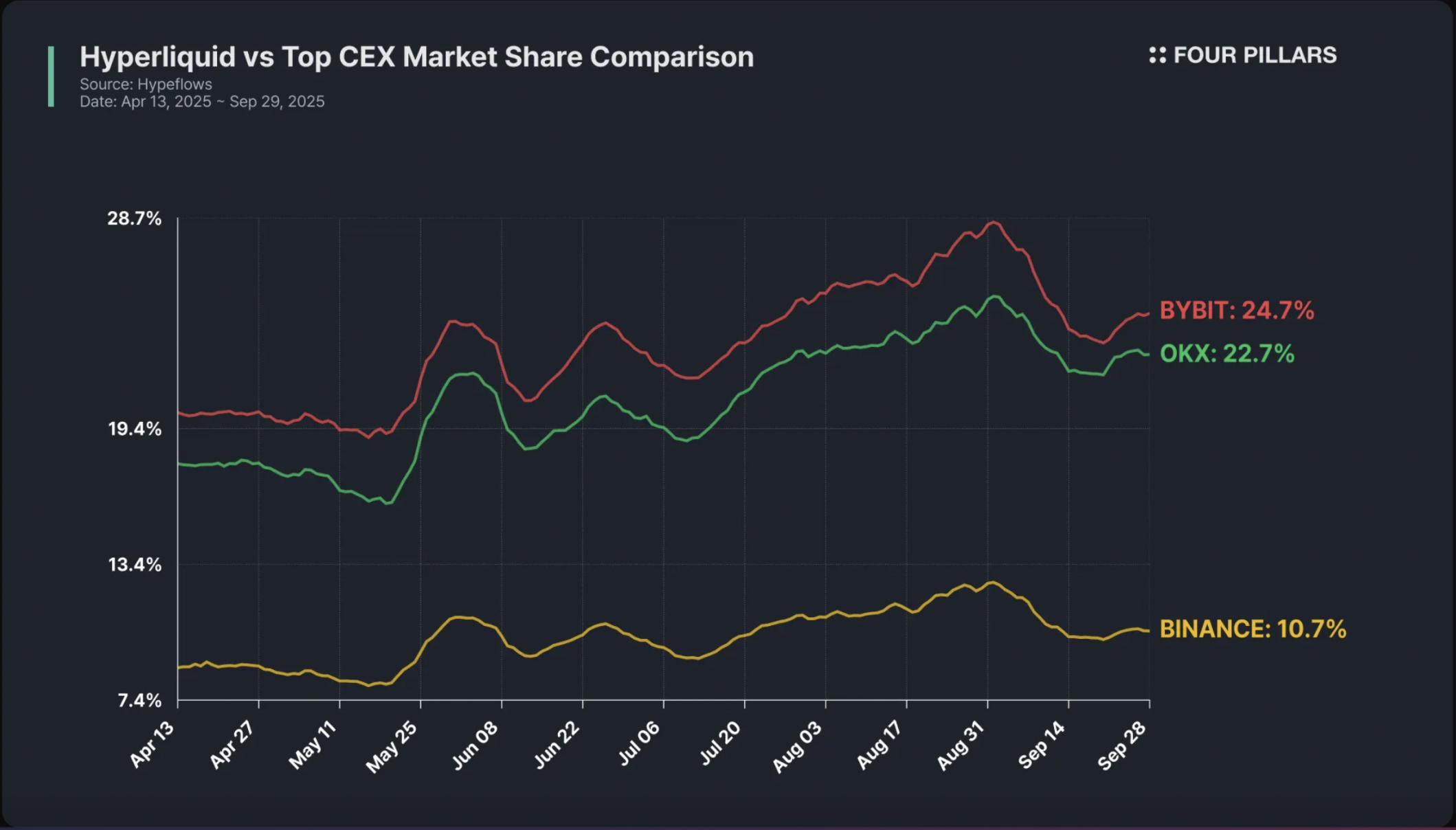

It is well-known that Binance has always been characterized by an aggressive competitive style. Many believe its strategy accelerated the collapse of FTX to some extent. Now, with Hyperliquid's trading volume stabilizing at over 10% of Binance's, it is only natural that CZ would take notice.

His first move was to launch the $JELLYJELLY perpetual contract at the peak of the event—this action was seen by the market as an intention to increase volatility, creating pressure on Hyperliquid's liquidity pool (HLP) by raising margin and liquidation risks.

Subsequently, CZ further supported Aster, the decentralized exchange on the BNB Chain in which he invested. However, Aster's success may only be a secondary goal. A more reasonable speculation is that CZ's true intention is to disrupt Hyperliquid's growth momentum, forcing market capital and attention to be dispersed among multiple competitors. Even if Aster cannot reach Hyperliquid's scale, as long as it can serve as a "distraction," the strategic objective is achieved.

From Binance's perspective, this strategy is highly rational: a dispersed competitive landscape can prevent any single on-chain rival from amassing too much power. "Divide and conquer" has always been a classic tactic in business warfare.

4. Facing Fear

The Bene Gesserit order's admonition is: "I must not fear. Fear is the mind-killer. Fear is the little death that brings total obliteration."

The market often confirms this wisdom—damage caused by fear is often deeper than fundamentals.

Today, the greatest risk Hyperliquid faces may not be from a specific competitor, but from a gradually spreading perception: loyalty no longer has rewards. If traders begin to believe they must constantly chase the next airdrop, then Hyperliquid's long-term community cohesion will weaken. At this point, the real opponent is not competitors, but FOMO (fear of missing out).

For investors, it is more important than ever to distinguish between short-term disturbances and long-term erosion. The wise approach is not to deny fear, but to acknowledge it, let it flow naturally, and then return to fundamentals.

5. Emerging Markets

That said, it is worth remembering that this market is still young. Today's decentralized perpetual exchanges (Perp DEX) may be similar to centralized exchanges (CEX) from late 2010 to early 2020, when Binance, Huobi, Gate.io, BitMEX, Bybit, and OKX were still vying for market dominance.

As time goes on, we are likely to see a similar consolidation pattern emerge among decentralized exchanges, with a few ultimately standing out as giants. The current incentive battle is not the end of the industry, but merely part of its growing pains.

DEXs are entering their own competitive era.

6. Probabilities, Not Certainties

The battle for liquidity is far from over. Hyperliquid faces severe tests from opportunistic rivals and well-established giants. However, several factors indicate that its odds still lean favorably:

Outstanding infrastructure and development ecosystem: Hyperliquid is a complete L1 chain, with an industry-leading CLOB engine and a strong developer community built on HyperEVM. Competing as an independent DEX is difficult to replicate this foundation.

Trend-setting initiatives: From HIP-3 to local stablecoins, Hyperliquid has been setting the industry's pace. The USDH token auction is one of the most fiercely competitive events in the crypto space, attracting all major players, with the local market ultimately winning. 50% of USDH revenue is allocated for buybacks and AF, making Hyperliquid unique in the L1 ecosystem, able to gain stablecoin revenue while collecting protocol fees across multiple fronts through HIP-3.

More "sticky" liquidity: Despite fluctuations in daily trading volume, Hyperliquid still dominates in open contract volume and active user numbers. This indicates that a loyal core group of traders remains deeply engaged with the platform.

Third-quarter incentive program (speculative): Updates to the incentive page show that a new season (Season 3) plan is about to launch. Incentive distribution has always been a strength of Hyperliquid, with 38.8% of the $HYPE token supply reserved for community rewards, currently valued at approximately $5.8 billion. No competitor can match this incentive pool.

HyperEVM TGE: The upcoming HyperEVM tokens (such as UNIT, Kinetiq, Felix, etc.) will bring liquidity back to the ecosystem and deepen the role of $HYPE. This evolution from a pure DEX to a broader L1 platform may present significant revaluation opportunities.

As with all investments, we are discussing probabilities, not certainties. The expectation for Hyperliquid is that when today's turmoil subsides, it will continue to lead the market with a stronger and wiser presence.

····································

As emphasized in the original article: success gained in the market is not permanent. Even industry leaders like Hyperliquid face challenges from innovative competitors.

Investors need to understand that any platform can be disrupted; the key is to assess probabilities and time windows, and to return to fundamentals such as technological strength, user stickiness, and profitability, which are more important than short-term trading volume. The competition among perpetual contract trading platforms essentially reflects the entire cryptocurrency industry's shift from "barbaric growth" to "refined operations." While Hyperliquid faces challenges, its technological accumulation and user base remain significant advantages.

For investors, the key is to understand competitive dynamics and seek opportunities amid changes, rather than clinging to a single judgment. Ultimately, just like the development history of the internet industry, only those platforms that truly create value for users and possess sustainable business models can stand out in fierce competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。