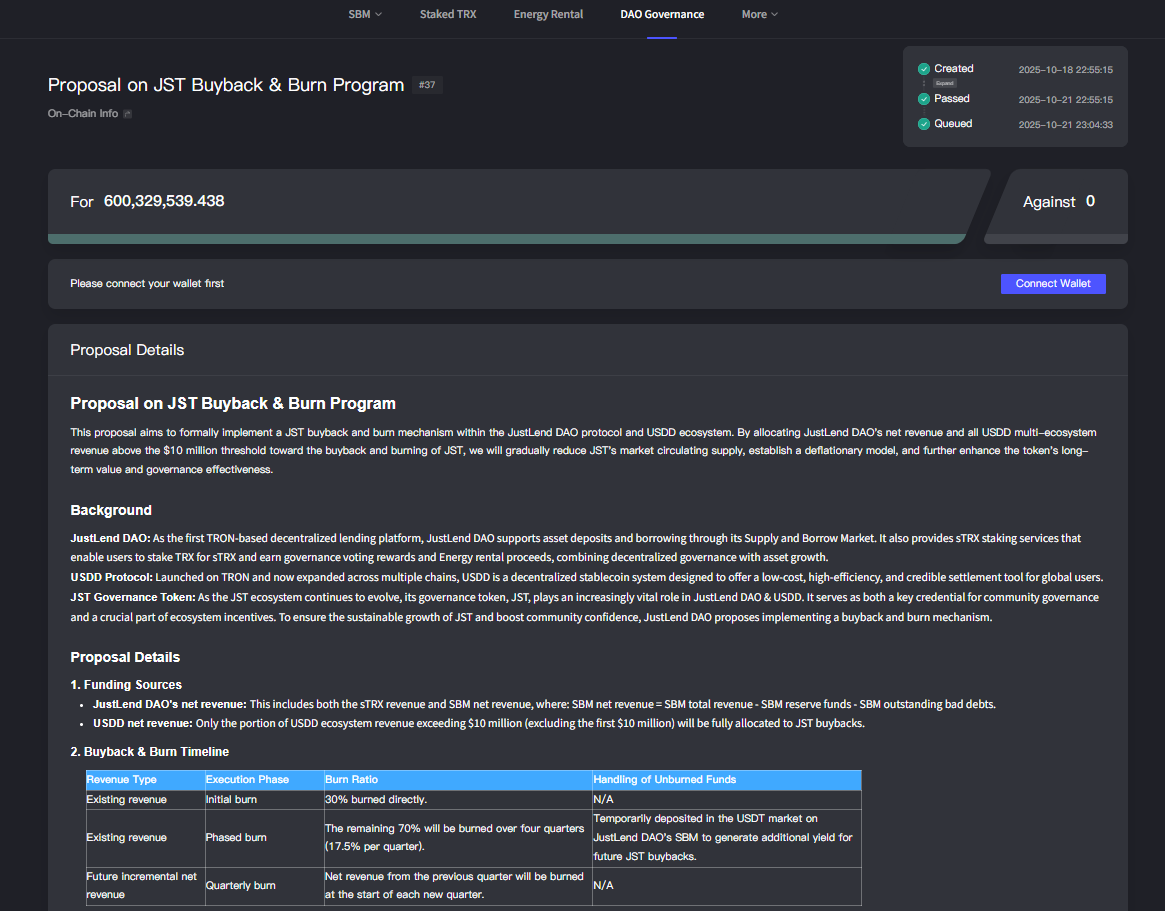

10月21日晚(SGT),波场TRON生态核心借贷协议JustLend DAO社区就“JST回购销毁”提案完成投票,最终以高额赞成票正式通过,标志着JST的通缩机制正式落地执行。

随着提案的落地执行,JST 的通缩动力将与JUST生态内的JustLend DAO 与 USDD 两大核心生态组件深度绑定:前者JustLend DAO作为稳居全球前四的借贷协议,稳定的收益能力为JST销毁提供持续资金;后者USDD作为波场 TRON 生态第二大稳定币,增量收益将进一步充实回购池。二者的持续收益,将共同转化为 JST 的 “通缩动力”,最终打通 “生态收益—代币通缩—价值提升” 的正向循环,助力 JST 释放长期价值潜力,开启新一轮价值上升通道。

值得重点关注的是,JustLend DAO 平台当前累计收益约 6000 万美元,这笔资金将分批定向投入JST回购销毁计划中:首批销毁现有收益的30%,剩余 70%则分四个季度逐步释放,确保通缩效应平稳且持续。

从数据维度看,JST 当前市值仅约 3 亿美元,仅仅JustLend DAO首批销毁的收益,所对应的代币数量就占JST总供应量的5.6%以上,而该平台全部收益累计接近6000万美元,按照市场当前的JST价格计算,累计可销毁的代币总量将占总供应量约 20%。

JST通缩进程正式启动:JustLend DAO将约6000万美元收益投入回购销毁,累计销毁将超总供应量20%

JST回购销毁计划的成功落地,将推动其正式迈入通缩时代。这一计划的实施,有望为 JST开启新一轮价值上升通道,释放出长期价值,也让市场对 JST 的未来充满无限遐想。

10月21日晚(SGT), JustLend DAO社区关于 “JST回购销毁”的提案,最终以高额赞成票正式通过。这标志着 JST 的通缩机制从规划进入执行阶段,JustLend DAO与USDD生态内将正式建立起JST定向回购与销毁机制。这一机制的建立,推动 JST 正式进入通缩时代,为新一轮价值上升与长期增长潜力释放奠定基础。

“资金可持续+销毁力度大”可谓是此次JST回购销毁计划的两大亮点,JST回购资金来源清晰明确且具备强大的可持续性,可为回购销毁计划提供了源源不断的动力,资金主要来自两部分:一是 JustLend DAO 的现有及未来净收入(含 sTRX 收益、SBM 净收入),实现 “存量收益 + 未来增量收益” 双覆盖,为回购销毁提供了坚实的资金保障;二是 USDD 多链生态盈利突破 1000 万美元后的增量收益,当 USDD 多链生态盈利迈过这一重要门槛后,增量收益将为 JST 的通缩进程注入新的活力。

自10月11日JustLend DAO社区发布JST回购销毁提议后,就引发社区高度关注,主要原因在于其直接关联JST的代币经济逻辑与价格预期。如今,JST回购销毁开始落地执行,这意味着,JST的价值将与JUST生态的两大核心组件——JustLend DAO(位列全球前四大借贷协议)与USDD(波场TRON生态第二大稳定币)深度绑定,这两大核心组件如同 JST 价值飞行的双翼,二者的持续收益将直接转化为 JST 的“通缩燃料”。

这一回购销毁机制的引入,不仅优化了 JST 的经济结构,也提升了其作为治理代币的权重与价值锚定能力,成为推动价格上行的关键变量。通过定期从市场中回购并销毁流通中的 JST,逐步减少流通量,构建健康的通缩效应,稀缺性也进一步增强,从而强化其价值基础,推动 JST 生态步入可持续发展轨道。

从销毁节奏来看,JustLend DAO 当前累计存量收益约 6000 万美元,将按照“分批执行、持续发力” 的原则投入回购销毁。首批将销毁JustLend DAO现有收益的 30%,剩余 70%将分四个季度逐步释放,每季度销毁 17.5%,确保通缩效应平稳且长期落地。每次回购和销毁后,JustLend DAO 都会在其官方网站上发布公告,其中包含全面的交易详细信息,包括交易哈希、日期、回购金额和销毁的代币。

JST发行总量为99亿枚,自2023年第二季度起已实现全流通。这意味着JST回购销毁计划的执行将直接且持续缩减其流通量,为通缩效应提供坚实基础。此外,JST 现市值约3亿美元,持币地址数突破44万,并已上线币安、HTX、OKX、UPbit、Bithumb、Kraken 等约数十家全球主流交易平台。

按JST当前 3 亿美元市值计算,仅 JustLend DAO 平台的现有收益,按照当前JST市场价格计算,可销毁的代币数量占JST 总供应量约 20%,首批销毁量占比超5.6%。可见 JST 本次回购销毁力度之大,远超市场同行举措。这般强劲的回购销毁力度,预计会显著增强 JST 代币稀缺性,为其价值攀升筑牢根基、提供强力支撑。

尤其值得一提的是,作为波场TRON生态中深耕多年的老牌DeFi协议,JustLend DAO自2020年上线以来,它不仅在产品端持续迭代升级,更始终保持零风险运营的行业佳绩,这份长期稳健的表现在行业内尤为难得。即便在DeFi市场整体表现低迷的背景下,JustLend DAO仍能基于其稳健的盈利能力和财务积累,动用近6000万美元收益实施JST回购销毁。这一举措不仅彰显了其雄厚的资金实力与执行力,也进一步印证了其商业模式的可续性与生态价值的扎实根基。

JST背后依托JUST生态,占据波场TRON全网TVL的46%

JST不仅是JustLend DAO的核心治理代币,更是 JUST 生态的原生治理代币,其背后依托的是波场 TRON 生态中核心的 DeFi 体系 JUST 生态,天然与整个生态的发展深度绑定,享有来自生态底层的全方位赋能与坚实支撑。

JUST是波场TRON生态内的一站式DeFi解决方案,专注于构建基于波场TRON网络的DeFi协议。自2020年上线以来,JUST始终以“打造一体化DeFi生态”为核心,陆续上线了稳定币、质押、跨链等多种产品与服务,致力于为用户提供低门槛、全场景的一站式DeFi服务体验。

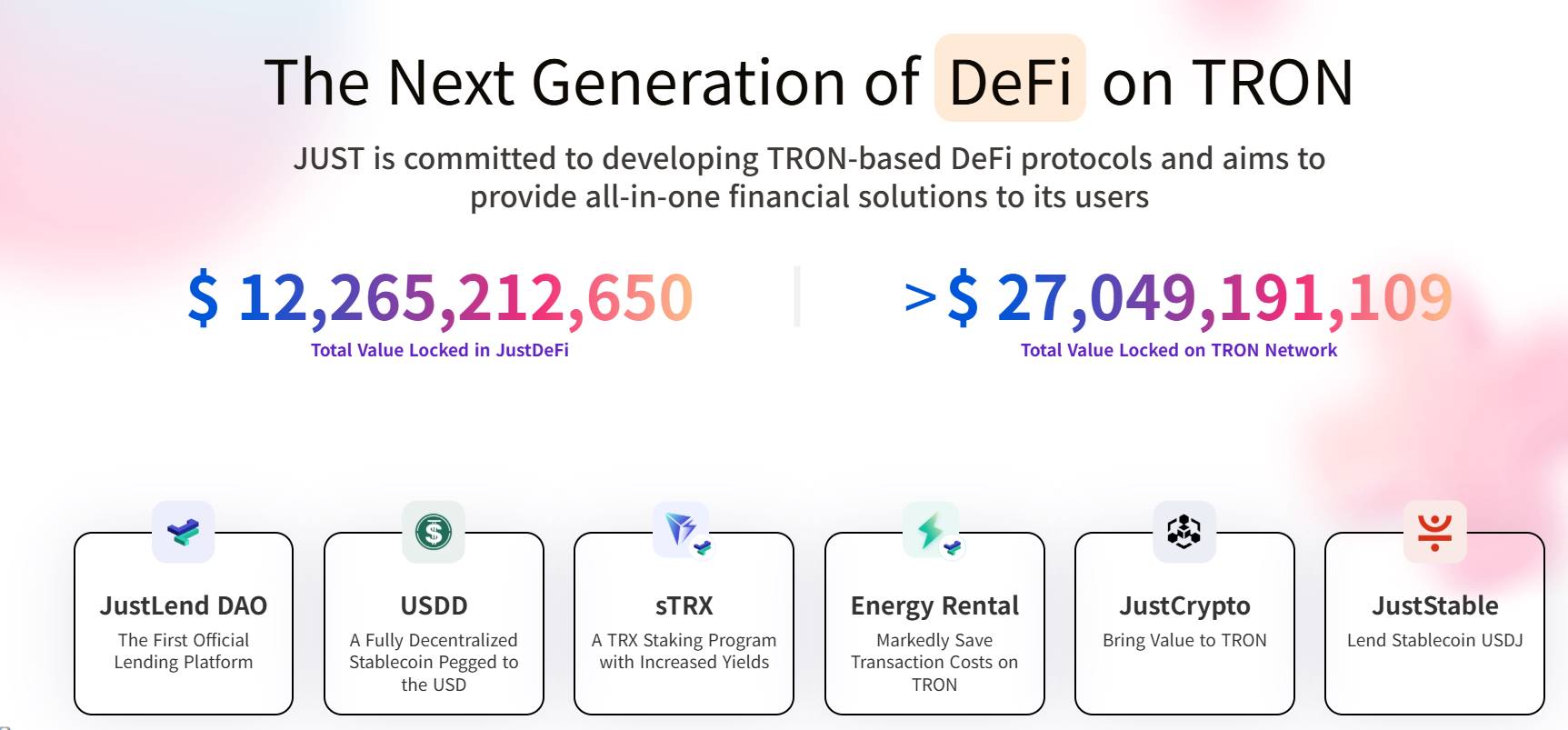

作为波场TRON生态的核心DeFi系统,JUST生态实力强劲,尤其在资产沉淀上成绩尤为亮眼。其中,10月19日官方数据显示,波场TRON全网总锁仓价值(TVL)高达270亿美元,其中JUST生态TVL约122亿美元,在整个波场TRON网络中占比高达46%。这意味着近半数波场TRON链上加密资产选择沉淀在JUST生态,充分彰显了其作为波场DeFi“压舱石”的不可替代地位。可见,JUST不仅是波场TRON生态中TVL最高的DeFi系统,更是驱动其整体发展的关键力量。

目前,JUST已构建起完整的DeFi产品矩阵,涵盖核心产品借贷协议JustLendDAO,去中心化稳定币USDD、TRX质押产品sTRX、能量租赁Energy Rental、跨链产品JustCrypto以及稳定币系统JustStable等多种链上金融工具,可一站式实现用户从“资产增值”到“灵活配置”的全需求覆盖。

其中,借贷协议JustLend DAO是JUST生态的核心产品,也是波场TRON 生态TVL排名第一的DeFi应用,TVL长期稳居全球借贷赛道前四。

稳定币USDD则由JUST DAO与波场TRON DAO 联合推出的去中心化超额抵押稳定币,今年1月升级2.0版本后,USDD流通量已从0增长至突破5亿美元,成为波场TRON生态内仅次于USDT 的第二大稳定币。目前,USDD流通量4.76亿美元,锁仓的加密资产价值(TVL)超5.25亿美元。

JST是JUST生态的原生治理代币,总发行量为99亿枚,已于2023年第二季度实现全流通。JST赋予持有者参与JUST生态治理与关键决策的权利,如新增提案、系统升级等重要事项进行投票。

由此可见,通过核心产品JustLend DAO的借贷基础、USDD的稳定币支撑、质押sTRX与能量租赁等生态服务,JUST已构建起“存储、借贷、质押、跨链、能量租赁”等完整链上金融闭环。对于用户而言,JUST无需跨平台切换,就可一站式参与波场TRON生态的资产存借、质押等服务,是用户参与波场TRON生态DeFi的首选一站式入口。

当前,JST 的回购销毁计划已与JUST 生态的两大核心支柱JustLend DAO(全球前四大借贷协议)与 USDD(波场 TRON 生态第二大稳定币)绑定。这意味着,整个 JUST 生态将从收益供给、场景拓展、资源协同等多维度,为 JST 提供稳定且强大的支持。

盈利引擎JustLend DAO:平台累计收益约6000万美元,TVL长期稳居全行业Lending赛道前四

作为 JST 本次回购销毁计划的核心资金来源,JustLend DAO本身具备稳定且可观的盈利能力,此前累计约6000 万美元的收益已印证其造血实力。DeFiLlama数据显示,JustLend DAO在Q3季度捕获的费用收入接近200万美元,其强劲盈利能力不仅是本次销毁的关键支撑,更潜藏着长期反哺 JST 的巨大价值。

作为JUST生态系统的核心支柱产品,JustLend DAO自2020年上线以来,已从最初的借贷服务,逐步演进为集“借贷、质押、能量服务、智能钱包“等多种功能于一体的“DeFi全能枢纽”。其总锁仓价值(TVL)长期稳居全球借贷赛道前四,是波场TRON生态不可替代的金融核心。

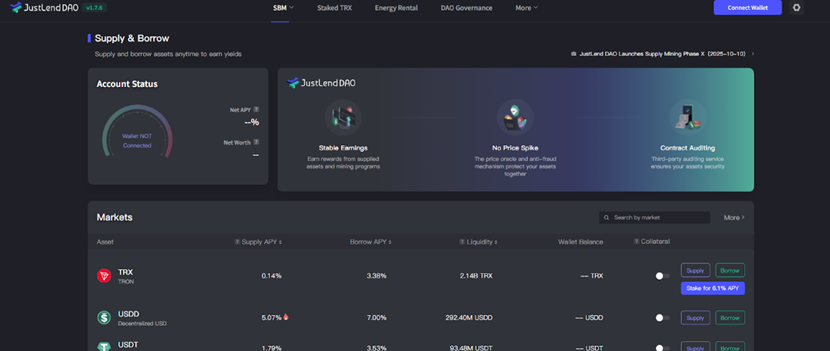

其中,借贷是核心根基业务,JustLend DAO依托智能合约实现借贷全流程自动化,系统通过算法实时监测资产供需并动态调整存借利率,确保资金市场始终处于高效平衡状态。目前,用户可在JustLend DAO中灵活进行资产配置:既可存入闲置加密资产获取稳定利息,也可通过抵押资产借出其他币种,实现杠杆操作与灵活投资,满足从“稳健增值”到“高效配置”的多元需求。

在产品功能创新上,JustLend DAO一直在不断突破。2023年4月,JustLend DAO同步上线“TRX质押(sTRX)”与“能量租赁(Energy Rental)”两大功能,进一步拓展服务边界。

- sTRX是波场TRON生态的流动性质押产品,支持用户通过质押TRX获得流动性质押凭证sTRX。截至10月22日,该平台质押的TRX数量约90亿枚,参与质押的地址数超过9970,当前年化收益为6.05%,是波场TRON生态首选的TRX质押入口。

- 能量租赁(Energy Rental)则基于波场TRON网络独有的“带宽+能量”Gas机制而产生,传统获取能量方式需通过质押或燃烧TRX,存在价格高、流程复杂等问题,JustLend DAO的能量租赁服务支持用户 “随租随用、按需归还”,无需长期质押TRX,成本较直接燃烧TRX可降低约 70%,大幅降低了中小用户的链上操作门槛。

为进一步优化用户链上交易体验,JustLend DAO又创新推出GasFree智能钱包新功能,支持链上转账手续费均可直接从转账的代币中扣除,彻底打破链上转账现有持有网络原生代币来支付Gas费(如TRX)的限制。目前,使用GasFree,用户可直接使用USDT等稳定币支付Gas费,配合JustLend DAO同步推出的90%费用补贴政策,现每次转账USDT实际仅需支付约1USDT,进一步提升了链上操作的便捷性与经济性。

目前,JustLend DAO平台已完成多个核心DeFi模块的集成,涵盖借贷市场(SBM)、流动质押sTRX(Staked TRX)、能源租赁(Energy Rental)与智能钱包(GasFree)等,成为波场TRON生态中名副其实的“一站式DeFi服务入口”。未来,平台将持续整合更多生态协议,通过简化操作流程与深化功能集成,在单一应用程序中推动波场TRON网络DeFi生态的整体增长。

正如JUST去年3月发布的《JUST生态系统概述与规划》中所明确的,JUST已围绕核心借贷协议JustLend DAO构建了“借贷+质押+能量租赁”等复合型服务体系。用户无需切换多平台,仅在JustLend DAO单一协议内就可完成“存借生息+质押挖矿+能量租赁交易”等多样化链上操作,彻底打破传统DeFi“多平台切换”的低效壁垒。

而JustLend DAO的“枢纽”价值不仅体现在产品功能整合层面,更在于其链接全球资源与机构资金的能力。今年6月底,波场TRON美股上市公司Tron已将持有的3.65亿枚TRX通过 JustLend DAO 完成质押,这意味着该平台已成为传统资金进入波场TRON链上的重要通道,未来有望吸引更多机构资金流入;同年7 月,JustLend DAO 与币安钱包完成全面集成,用户通过币安生态即可无缝进入平台,完成借贷、质押等操作,借助币安的全球流量进一步扩大用户覆盖,提升整体生态影响力。

根据 DeFiLlama 数据,截至10 月 22日,JustLend DAO总锁仓价值(TVL)超45亿美元,长期稳居全球借贷赛道前四。值得强调的是,JustLend DAO的优异成绩仅依托波场TRON单链部署,却能与多链运营的Aave、SparkLend 等跨链头部借贷协议同台竞技时,数据表现丝毫不逊色。

这一成绩不仅印证了 JustLend DAO 强大的产品竞争力与运营效能,也凸显了波场TRON生态的高活跃度与用户粘性。从“单一借贷工具”发展为“DeFi 全能枢纽”,JustLend DAO 已成为波场TRON生态金融体系中的关键基石,其价值将随着波场TRON生态的持续扩张而进一步释放。

JustLend DAO不仅将为 JST 当前的回购销毁提供了扎实的资金保障,更意味着未来随着生态扩容,它将持续为 JST 通缩与价值提升输送动力,成为 JST 长期发展的 “盈利压舱石”。

JST代币价值与生态收益深度挂钩,有望开启新一轮增长周期

随着JST回购销毁计划的持续推进,JST代币价值正式与JUST生态系统两大核心组件JustLend DAO与USDD的持续收入深度绑定。在步入明确通缩机制的同时,依托JUST整体生态的全面发展,JST的长期价值也将逐步显现。

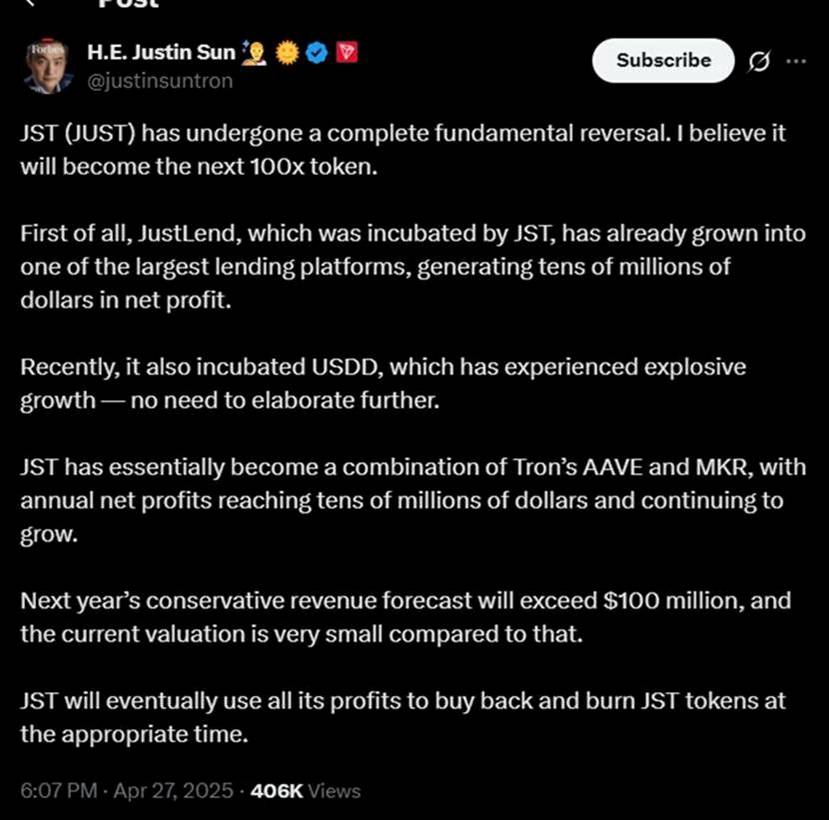

早在今年4月,波场TRON创始人孙宇晨就在社交媒体平台X上指出,JST已实现根本性逆转,有望成为下一个“百倍币”。他进一步强调,JUST孵化的JustLend已成为行业领先的借贷协议之一,年净利润达数千万美元,同时其生态稳定币USDD也呈现强劲增长。JST实质上已成为波场TRON生态中“AAVE”与“MKR”的结合体,年利润持续攀升。据预计,明年营收将突破1亿美元。

如今,随着回购销毁计划的执行,JST 的长期增长潜力正逐步兑现,其核心动力源于 “生态收益与通缩机制的深度协同”: JustLend DAO的现有净收益及其与USDD的未来增量净收益,将直接用于回购并销毁JST。这意味着JST的通缩模型并非空谈,而是建立在真实生态盈利的基础上,形成了生态收益与代币价值深度绑定——JustLend DAO与USDD的收入表现,将直接转化为JST价值成长的内生驱动力。

作为支撑该机制的两大核心产品, JustLend DAO 当前 TVL 约 77亿美元,已整合借贷、能量租赁、sTRX质押等多种功能,用户规模和盈利能力都在同步提升;USDD作为波场TRON生态的第二大稳定币,流通规模接近 5 亿美元,应用场景亦在不断扩展。随着这两大协议收益的不断增长,将会有更多资金将持续注入JST回购池。

与此同时, JUST生态的整体“支撑力”也为JST价值提供了坚实背书:既通过核心租金JustLend DAO与USDD的持续收益反哺代币通缩,强化 JST 的价值基础;也依托生态内丰富的 DeFi 场,拓宽 JST 的应用边界。最终助力 JST 在加密领域进一步夯实价值锚点、拓宽发展空间,实现从代币经济到生态价值的全面提升。

这种“以真实收益为支撑、通过通缩机制传导生态价值”的模式,正是加密领域中“价值型代币”的典型特征,也为JST的长期价值奠定了扎实的叙事基础。随着JUST生态的持续发展,JST的治理价值与经济价值将伴随JustLend DAO的TVL与USDD的流通量同步提升,最终构建起“生态扩张→收益提升→回购销毁→通缩增值”的可持续增长闭环,完美契合加密资产价值积累的核心逻辑。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。