作者:Baheet

编译:深潮TechFlow

在最近的一篇帖子中,我提出了一个问题:在起始资本仅为 100 美元的情况下,交易 Memecoin (通过 Pumpfun 平台)和预测市场,哪一种能为交易者提供更多机会?

在我看来,这就像把国际象棋比赛与赌场老虎机进行比较:两者都可能带来丰厚回报,但一个奖励的是策略,另一个则依赖于混乱和运气。

接下来我们将深入探讨,从可行性、风险、回报、优势以及资本的影响来分析。

市场机制

预测市场

预测市场是结构化的预测工具;顶级平台如 @Kalshi 和 @Polymarket 允许用户根据特定、可验证事件的结果进行交易,例如选举结果、经济数据发布或特定价格变动。

预测市场上合约的价格反映了市场对某一事件发生概率的感知。例如,一份交易价格为 0.80 美元的合约表明“是”结果的概率为 80%。

此外,这些市场因其“群体智慧”效应而备受赞誉,参与者的集体知识汇聚,提供了惊人的准确预测,这是 Memecoin 领域无法复制的。

预测市场合约的价值与可验证的现实事件挂钩。这种基础赋予了预测市场一定的合法性,也是其与 Memecoin 的核心区别。

Pumpfun 上的 MemeCoin 交易

Pumpfun 平台允许用户通过联合曲线快速创建和交易新代币,随着购买者增多,价格会迅速上涨。这种低门槛吸引了大量未经测试的新 Meme 项目。

Memecoin 的生命周期通常遵循一种可预测但混乱的模式。在达到一定市值后,代币会被部署到去中心化交易所(如 @Raydium),通常会经历一个初始“拉升”阶段。

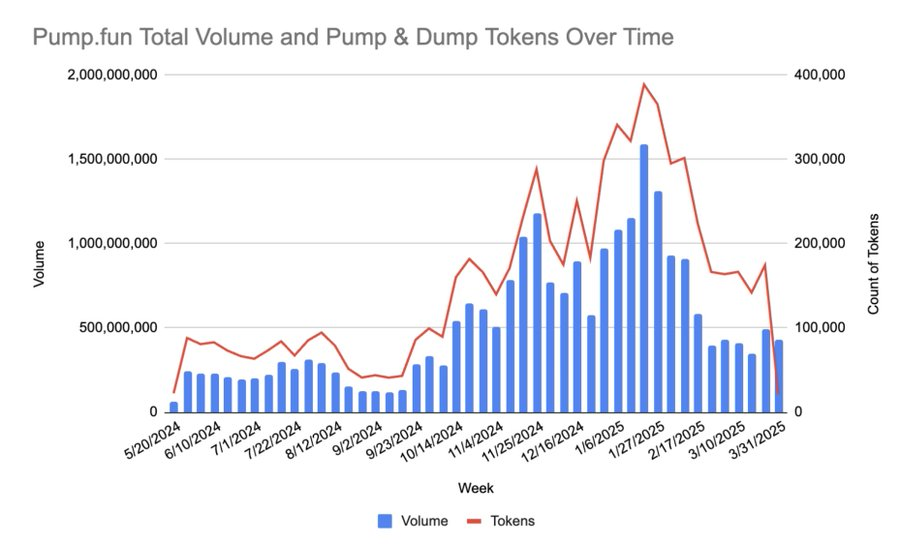

事实上,2025 年 5 月的数据表明,大多数代币在首次发行后失败。

@Solidus_Labs 的报告显示,在 Pumpfun 上推出的 700 万个代币中,98.6% 被认定为“跑路”或操纵性项目。

可访问性

两种市场对小额资金都非常友好,几乎没有门槛。

在 Polymarket 平台上,最低 10 美元的资本即可参与,比如对选举或加密货币价格的事件下注。

如果有 50-100 美元,你甚至可以在 5-10 个事件中分散投资,并通过更好的策略优化下注规模。

Pumpfun 的入门价格更便宜,创建一个Memecoin 的成本约为 0.02 SOL(按当前价格计算约为 3 至 4 美元),并且购买时只需使用 Solana 钱包中的零钱即可。

初始交易通常发生在较小的市值,例如约 4,000 美元,因此 50 至 100 美元可以让您尽早获得可观的份额。

除了网络费用,没有正式的最低要求,这使得它非常适合“疯狂交易”。

风险、回报和现实

预测市场以可量化风险著称;风险明确且与事件结果挂钩。虽然交易者可能在单一合约上损失全部投资,但从一开始就能清楚了解赔率和事件标准。

通过充分研究的预测,潜在回报可能非常高。虽然这些回报不如 Memecoin 的涨幅那么夺目,但通常更可持续且基于信息决策。

预测市场的常见风险包括交易者错误判断概率或市场流动性不足,但如果仅用投资组合的小部分下注,则完全破产是可控的,而且很少发生。

对于大多数交易者而言,一个多样化的预测市场投资组合提供了更结构化的方式来参与高风险交易,并拥有更可预测的结果。

以下是 @Predictifybot 提供的一篇关于如何分散预测市场投资组合的优质文章:

最后,由于有美国商品期货交易委员会(CFTC,负责监管 Kalshi)的监管存在,为参与者增添了一层监督和保护,减少了欺诈和操纵的风险。

另一方面,Memecoin 生态系统充满骗局、操纵以及波动性极大的价格变动。项目可能会“跑路”,开发者抽走流动性,导致投资者手中的代币变得毫无价值。

Memecoin 的价值基于炒作和社会情绪,而非任何基本实用性,因此极易受到社交媒体趋势和“内幕”交易的影响。

虽然许多人期望获得巨额、改变人生的回报,但现实是这样的成功非常罕见。大多数参与者要么亏钱,要么收益微乎其微。

100 美元能做什么?

在预测市场和 Pumpfun 上有效利用小额资本(如 100 美元)需要高度专业化且根本不同的策略。

我认为,在预测市场中最好的策略是找到由于信息不对称而被错误定价的事件,但这几乎无法应用于 Pumpfun 的 Memecoin 。

预测市场:利用信息不对称

100 美元的资本无法影响预测市场,因此你的策略必须像一个精明的分析师一样行事。你的优势来自于发现市场集体忽略的信息。

如何运作:

-

识别信息缺口:市场的赔率基于所有交易者的综合信息。低交易量市场可能没有足够的参与者来真正高效运作,这为小额资本交易者提供了优势。

-

利用被忽视的专业知识:如果你掌握市场中少有人拥有的专业知识,可以利用这些信息。比如对地方选举、特定技术发展、冷门法律案件或比赛结果的深入了解。

-

关注低流动性市场:较大的流动性市场通常更高效,但小额资本可以专注于较小的、交易较少的市场,这些市场的赔率可能尚未反映所有可用信息。

作为小额资本交易者,你的角色是信息套利者,你的目标是寻找由信息不完整造成的市场低效。

Pumpfun:一切为了生存

Pumpfun 上的信息不对称概念完全不同且更难利用。这里更少涉及理性赔率,而更多依赖内幕信息。

如何运作:

-

内幕信息至关重要:在 Pumpfun 中,信息不对称对普通交易者来说通常是不利的。Memecoin 的创建者掌握完全信息,并拥有许多工具来操控交易。

-

社会和情感杠杆:在这个市场中最有力的“信息”是加密货币的病毒式传播潜力。创始人掌控着最初的营销推广,通常依靠有影响力的人和社交媒体策略来营造 FOMO。

-

信息不对称:这里存在一个优势。如果你加入了 Solana meme 社区,或者在代币暴涨前抓住了机会。但不对称现象转瞬即逝,暴涨持续几分钟到几小时,而且 97% 的交易者获利不到 1000 美元。

与预测市场不同,这里没有真正的概率,只有群体的 FOMO。

策略很简单:要么走运,要么出局!你的 Memecoin 策略只有 100 美元,具体如下:

-

抢占先机:DYOR(自行研究) 并迅速获得新代币,希望成为初始势头的一部分。

-

使用专业工具:许多交易者使用机器人监测新代币的上市和市场活动,以获得几秒钟的领先时间。

-

通过谨慎来管理风险:时刻关注价格图表,发现“开发者抛售”的迹象,并准备立即出售。

在 Pumpfun 上,你的 100 美元不是用来利用信息差,而是被投入一个信息被更强大玩家武器化的市场。你的成功与分析无关,更多依赖于运气、时机以及避免成为操纵性骗局的受害者。

最后思考

归根结底,选择预测市场还是 Pumpfun 上的 Memecoin 交易,取决于交易者的风险偏好。

虽然两者都提供高回报的潜力,但它们通过根本不同的机制实现这一目标。

预测市场具有可验证的结果和潜在的监管监督,为高风险投机提供了一种更加结构化和基于信息的方法。

而 Memecoin 交易更像是在高风险、无监管的赌场中赌博,虽然可能获得巨额利润,但由于骗局和极端波动性,亏损风险巨大。

以下是一篇来自 @tradefoxintern 的优秀帖子,讨论为什么预测市场将取代 Memecoin :

因此,对于那些更喜欢计算、研究驱动方法的人来说,预测市场是明确的选择。

而对于那些寻求巨额、类似彩票般回报,并愿意在成千上万的骗局中穿行的人来说,Pumpfun 仍然是一个选择。

就这样结束!

John Wang:记住我的话,预测市场的规模将是 Memecoin 的 10 倍!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。