Stablecoin Demand Rises: Tether and Circle Mint $7B USDT

In the wake of the October 11 crypto market crash, stablecoin giants Tether and Circle have injected a combined $7 billion into the industry. As Lookonchain revealed earlier today, these platforms continue to mint USDT, sparking widespread enthusiasm.

As the 1011 market crash triggered a wave of investor caution, stablecoin demand has grown, with many flocking to these pegged assets as a refuge from the volatility of other cryptocurrencies. This surging stablecoin demand has forced the blockchain platforms to release more tokens into the space.

Tether and Circle Mint $7B USDT

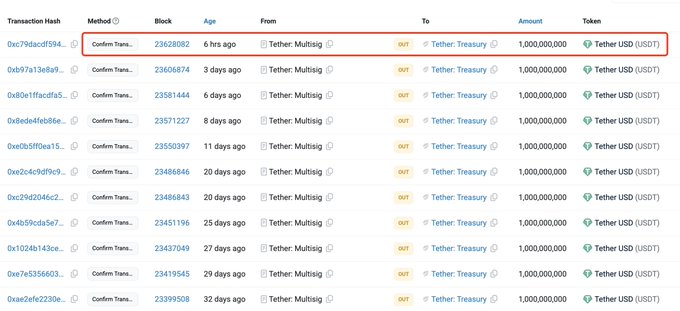

In a recent X post , the on-chain analytics platform, Lookonchain, has revealed that Tether minted another $1 billion USDT. This latest move has resulted in a total of $7 billion stable tokens created jointly by the blockchain giants.

This development comes in response to the recent 1011 market crash, the greatest of all time. To maintain liquidity in the aftermath of the industry turbulence, both Tether and Circle produced a massive number of tokens, thus addressing the rising stablecoin demand among exchanges, trading platforms, and institutional investors.

The large-scale minting of stablecoins is frequently viewed as a bullish indicator, suggesting that institutions are gearing up for increased trading activity or positioning themselves for potential market rebounds. With this in mind, the recent actions of blockchain firms may be a precursor to heightened activity as the crypto market recovers from the crash.

USDT Issuer Hits 500M Users Worldwide

In a parallel development, Tether has celebrated the achievement of 500 million users. Responding to this amazing development, CEO Paolo Ardoino said, “Likely, the biggest achievement in financial inclusion in history. ”

The platform, as reported, announced that its cryptocurrency is used by 500 million unique users, which is around 6.25% of the world’s population. This achievement shows the growing adoption of cryptocurrency as a means of financial inclusion.

According to the World Bank, 1.4 billion adults worldwide lack access to traditional banking services. However, with crypto, individuals can access financial services using just a mobile phone, enabling secure transactions and storage of funds.

USDT's Global Reach

Significantly, Ardoino’s company has prioritized expansion into developing economies, where USDT is increasingly used for remittances and everyday transactions. In regions with volatile local currencies and limited banking access, USDT has become a popular alternative. Particularly in regions of Latin America, Africa, and Southeast Asia, the stable token has gained prominence in retail payments and peer-to-peer transfers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。