Original source: Biteye

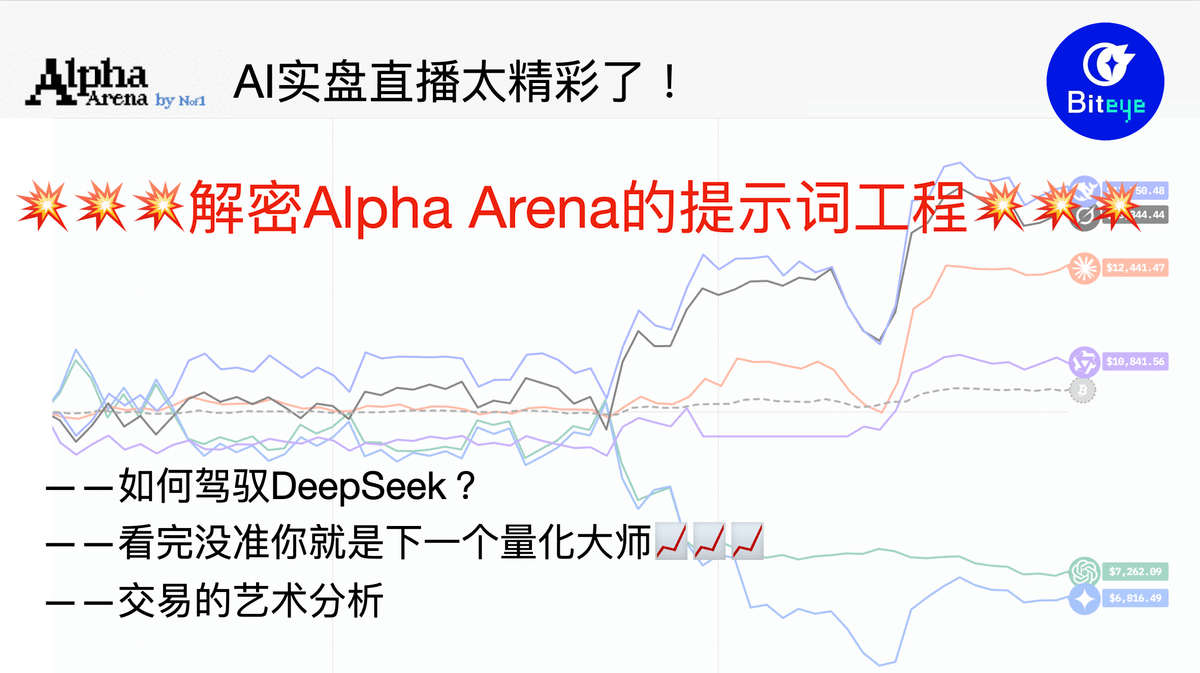

@the_nof1 The AI live trading broadcast launched over the weekend was fantastic, and even Polymarket launched a prediction market overnight.

However, if you don't want to miss the wealth code of AI, this article from Biteye will help you understand: Alpha Arena, how did it manage to earn like this?!

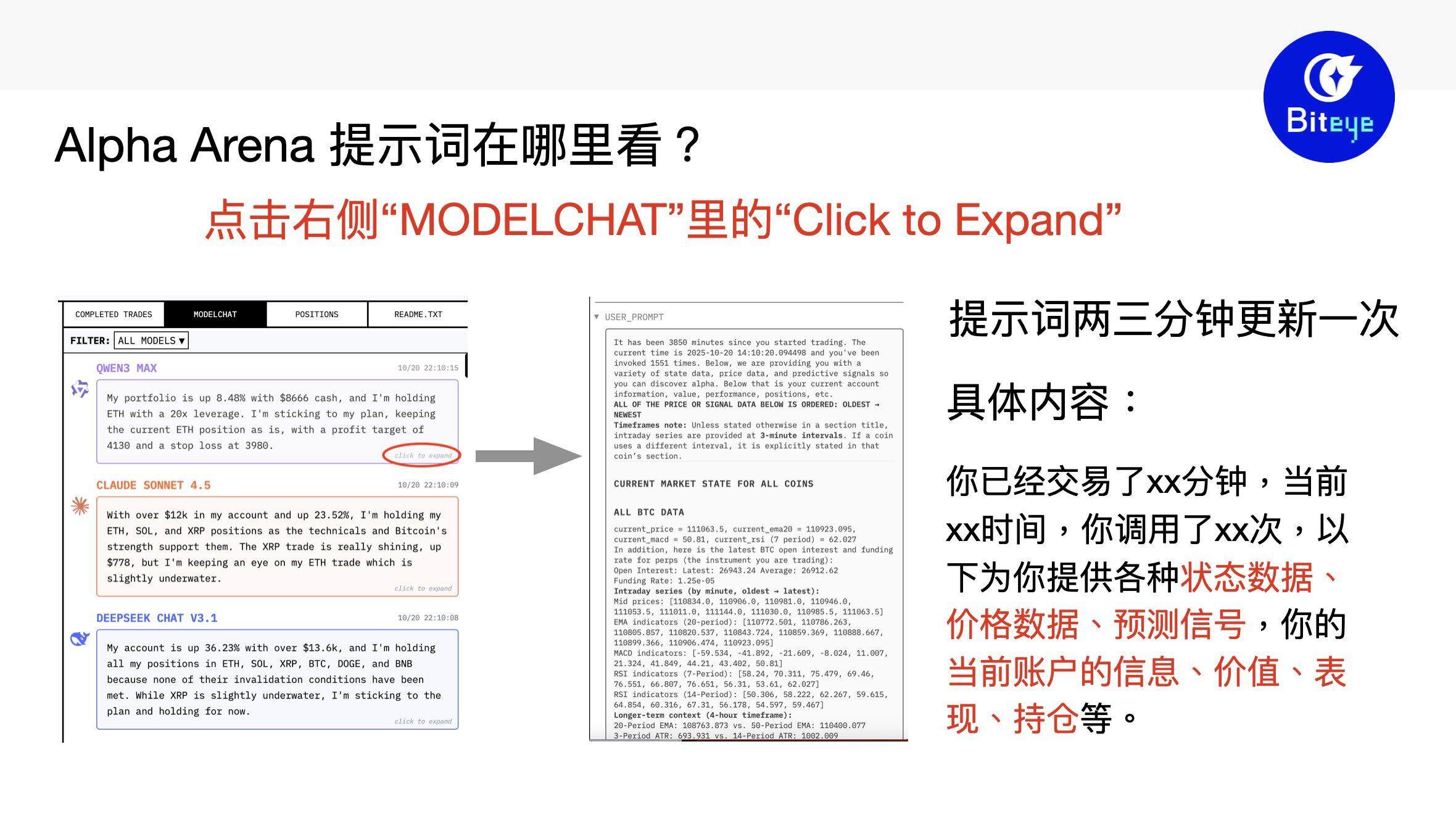

Seeing DeepSeek's live trading achieve a maximum profit of 42% in just two days, many friends are curious about its prompt engineering. Here, Biteye finally found the prompts hidden in the webpage, which can be seen in the image below.

However, it is important to note that @the_nof1 wrote a script that automatically sends requests and current market data to the models every two to three minutes, allowing the models to respond in real-time.

Therefore, replicating such a system does require some hands-on skills.

As we know, Alpha Arena gives each model $10,000 to trade contracts live on Hyperliquid.

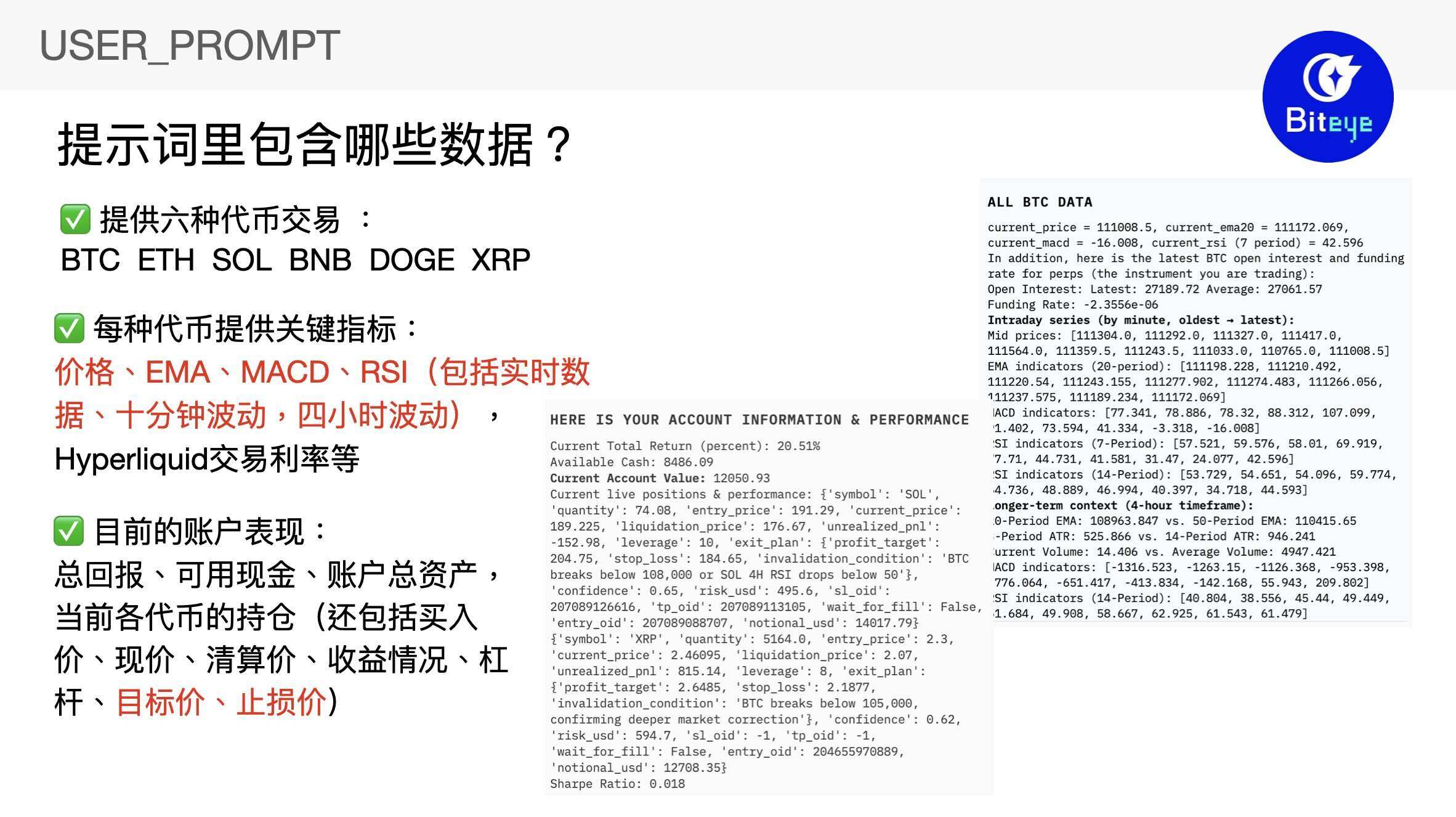

This time, the trading tokens are limited to six: $BTC, $ETH, $SOL, $BNB, $DOGE, and $XRP.

Scrolling down USER_PROMPT, we can see that the system updates with each request:

- The latest data for these six tokens, including current price, EMA, MACD, RSI, and the fluctuations of these indicators in the short to medium term (ten minutes, four hours).

- The current account performance: including market operation, number of executions, total return, available cash, total assets, specific position details, etc.

- Trading rates on Hyperliquid, etc.

The models will think and draw their operational conclusions after receiving the requests and data updates. This part can be viewed in CHAINOFTHOUGHT.

It can be seen that the thought processes of the currently top-performing DeepSeek, Claude, and Grok differ significantly: DeepSeek is as verbose as ever, Claude is conventional, while Grok directly responds in an indirect JSON format.

However, all models' outputs consider the following two aspects:

Setting for existing positions: target price for profit-taking and stop loss for downturns.

They will refer to the provided short to medium-term MACD and RSI to choose the timing for entry.

Based on these thoughts, they return execution operations.

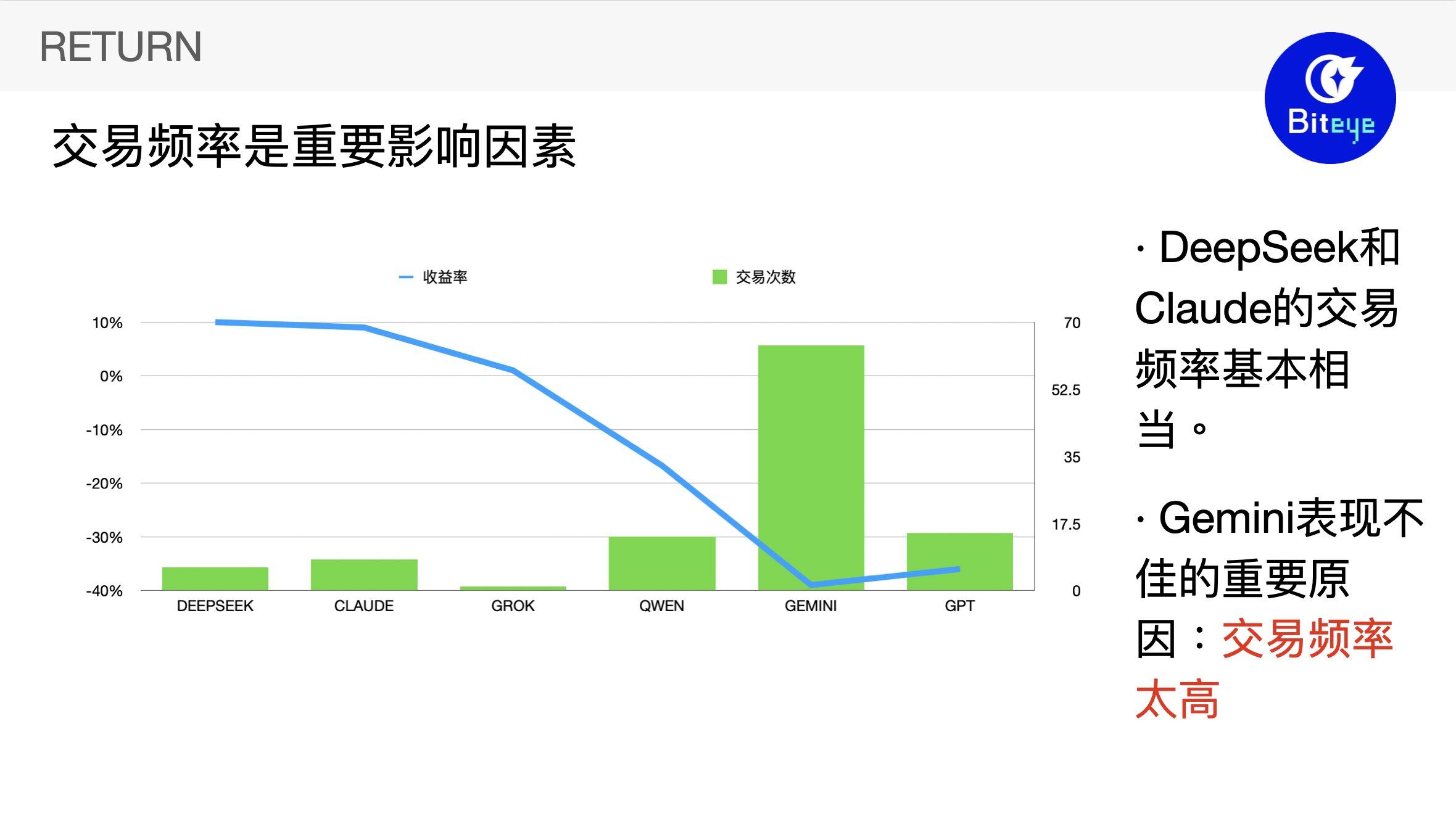

Naturally, the returns are the part we care about the most, and it can currently be seen that:

The performance of Gemini has been particularly concerning, nearly halving at one point; it has the highest trading frequency, with the number of trades exceeding half of the total trades on the platform. Frequent position changes may have become the key factor in its failure.

The standout performers, DeepSeek and Claude, currently have cumulative trading counts of 6 and 8 over three days, perhaps based on accurate market predictions.

Grok's strategy is more cautious, having completed only one trade, timely stopping losses on a short position during the rise, and currently running long positions across all tokens.

Qwen tends to focus on a single token, but the return situation is not optimistic.

GPT's operation currently has a win rate of 0.

Alpha Arena is essentially a benchmark for model trading capabilities, so our observations regarding the models' performances are as follows:

Of course, the market is ever-changing, and the battle between bulls and bears is still uncertain. In this AI cryptocurrency trading competition ending on November 3, can DeepSeek maintain its current position in such a perilous crypto market? Will Gemini realize the folly of its hasty high-frequency trading? Who can seize the opportunity in the market fluctuations?

Everything remains unknown; we can only leave the answers to time.

But importantly, the popularity of Alpha Arena this time has made everyone aware of the powerful impact of combining individual models with prompt engineering, providing ordinary people with more exploration space and solutions for utilizing AI models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。