What happened on October 11, 2025

Source: CoinGlass

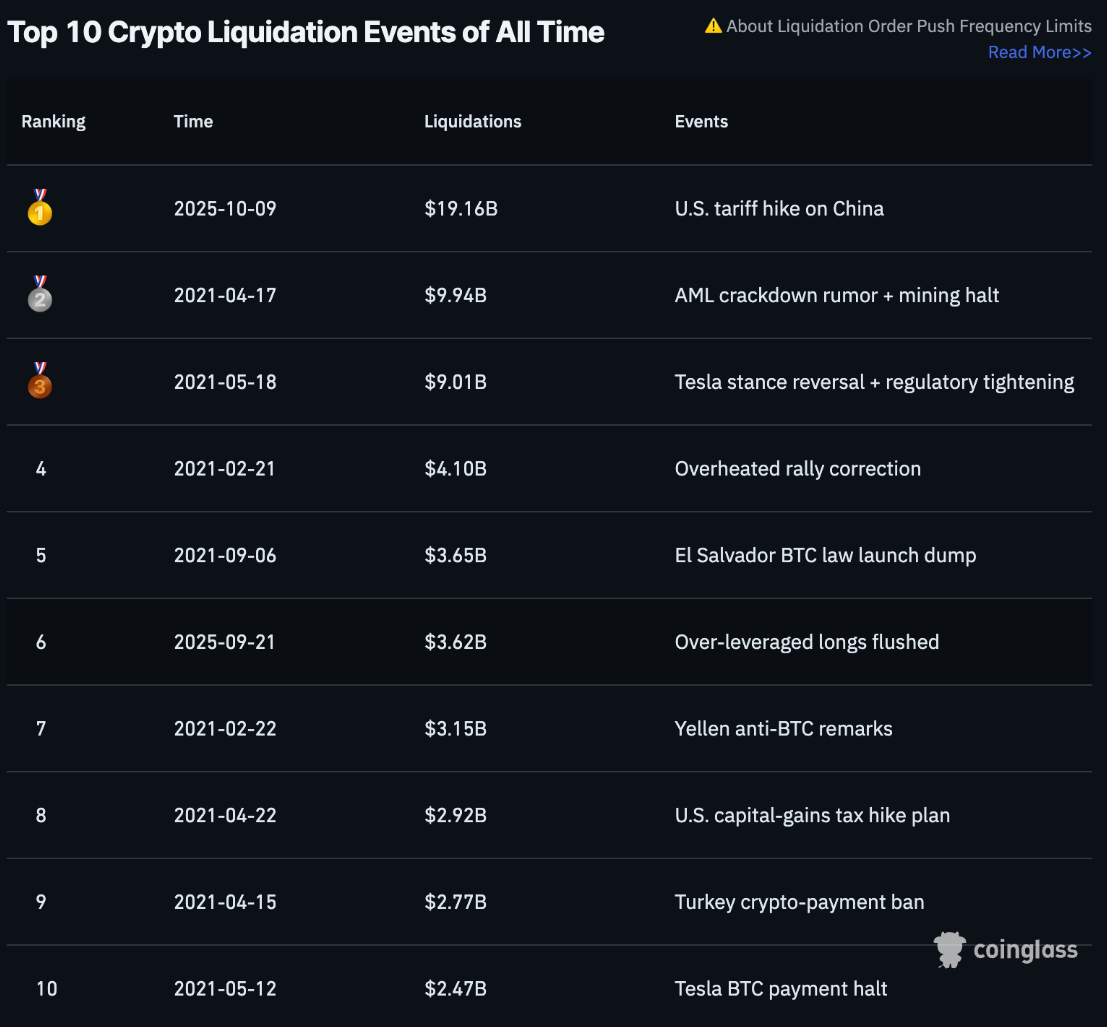

Last Friday, the cryptocurrency market experienced a dramatic and historic sell-off, resulting in the largest single-day liquidation event ever recorded. Over $19 billion in leveraged positions were liquidated on major centralized exchanges, affecting more than 1.6 million traders globally. This unprecedented chain liquidation was triggered by a combination of macroeconomic shocks and the technical vulnerabilities of exchange infrastructure.

The immediate catalyst was the announcement by the United States of a 100% tariff on Chinese imports, which sent shockwaves through global financial markets. Investors rushed to de-risk, with crypto assets being particularly hard hit as they are often viewed as highly speculative. Bitcoin plummeted from around $121,000 to a low of $101,000 before slightly rebounding; Ethereum fell nearly 30%; and Solana dropped over 40%.

The world's largest cryptocurrency exchange bore the brunt of the liquidation tsunami, with a single platform accounting for over $14 billion in losses. Analysts pointed out that its collateral pricing mechanism had flaws that may have accelerated the chain reaction of liquidations. Another decentralized exchange also saw billions of dollars in forced liquidations. The event ultimately exposed systemic risks in margin and leverage management at exchanges, sparking calls for reform and more robust protective mechanisms.

Despite the chaos in the market, some participants believe this pullback represents a healthy reset. As excessive leveraged positions were cleared, analysts noted that the market might be better positioned for sustainable growth. However, the scale of losses and the speed of the decline served as a stern reminder: financial markets are highly volatile, and the risks of excessive leverage are particularly acute.

As the crypto market evaporated over $19 billion in a single day, the operational resilience and transparency of major exchanges in the industry were put to the test. Bybit, the second-largest cryptocurrency exchange by trading volume, demonstrated significant stability amid the volatility, becoming a case study in exchange resilience under pressure.

Which tokens rebounded first after this historic liquidation?

We witnessed a strong rebound in mainstream tokens following this landmark liquidation, with broader crypto market trends reflecting a recovery in traditional stock markets. Notably, the "TACO (Trump Will Always Chicken Out)" strategy regained attention, indicating that the market is digesting and stabilizing from recent volatility.

Bitcoin and Ethereum, the two leading assets by market capitalization, led the rebound, supported by ongoing institutional buying. As sentiment shifted, investors gradually recognized that this sell-off may have been exaggerated, driven more by technical and structural factors rather than macro fundamentals.

Source: Bybit

Interestingly, platform tokens (such as the native token MNT of Mantle Network) outperformed most altcoins during the rebound. This performance may be related to the market's broad recognition of Bybit's resilience during turbulent times, thereby strengthening confidence in the Mantle ecosystem.

Why is Bybit more stable than other platforms?

In this $19 billion liquidation wave, Bybit demonstrated exceptional operational resilience, maintaining 100% online status for trading, deposits, and withdrawals throughout. Its infrastructure can handle up to 1.35 million transactions per second (TPS), allowing users to place orders and manage positions without delay even in extreme market conditions. This smooth experience under high pressure solidified Bybit's reputation as a reliable exchange.

Bybit has also set a new benchmark in transparency, updating real-time liquidation data at a frequency of 500 milliseconds, recording $4.6 billion in liquidations, far exceeding competitors that update only once per second. Its API infrastructure ensures complete visibility into market dynamics, helping traders and analysts assess risks more accurately and enhancing trust in its data integrity.

The integration of Bybit with USDe further stabilized trading during the turmoil. While other platforms experienced severe decoupling, USDe on Bybit remained relatively stable, maintaining a range of $0.92 to $0.95. The platform handled over $300 million in redemptions to USDT with manageable impact, thanks to its collaboration with Ethena Labs, which supports 1:1 minting and redemption of USDe on the platform. This stability ensured liquidity and confidence, highlighting Bybit's advantages in managing high-volatility environments.

Riding the waves of volatility

Like other investment assets, cryptocurrencies typically exhibit higher volatility during turbulent times, a characteristic that is unlikely to change in the short term. Their hedging properties against traditional assets make them more prone to sharp price fluctuations when the market is under pressure.

The core takeaway from this turmoil is clear: diversification. This includes not only diversification in asset allocation but also in trading platforms. Just as one would not keep all cash in a single bank account, spreading your crypto trading and custody across multiple reliable exchanges is a rational additional layer of protection.

If you seek more stable returns and stronger risk management, consider obtaining passive income through flexible wealth management and fixed staking, which provide relatively stable returns outside of daily price fluctuations. Additionally, make good use of advanced risk control tools, such as stop-loss, take-profit, and equity trailing stops, to lock in profits and limit downside.

Finally, choosing platforms with high transparency and robust infrastructure can significantly reduce risk. While volatility is the norm in the crypto space, adhering to disciplined, well-informed strategies is key to safely and sustainably navigating this market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。