撰文:HashKey Capital

DAT 如何重塑投资版图

在过去五年里,从美国 MicroStrategy 到日本 Metaplanet,再到全球数十家公 开上市公司,数字资产财库(Digital Asset Treasury, DAT)模式正逐渐从个别现象演变为一种新的资本市场潮流。DAT 公司通过将比特币、以太坊等数字资产 纳入资产负债表,不仅重塑了企业的资本结构,也为投资者提供了一种区别于 ETF、基金的另类投资通道。

本报告作为「DAT 系列」的第一篇,将带领读者了解这一模式的基本概念、发展脉络、核心特征及与 ETF 的差异,并分析其在资本市场和加密生态中的战略意义。通过数据与案例,我们将看到为什么越来越多的公司选择成为「币股」,以及 这种模式如何成为传统金融与数字资产世界之间的桥梁。

1. DAT是什么

DAT 是指上市公司将部分或全部财库资产 (如现金、等价物) 配置于比特币、以太坊等加密资产,并以此作为其核心战略之一的商业模式。它不仅是资产配置的调整,更是企业面向未来数字经济的战略性定位。

在机构资金不断流入、积极寻求数字资产配置的背景下,数字资产财库公司(Digital Asset Treasury Companies, DAT) 已成为数字资产生态中的重要叙事。这类公司通常 为上市企业,并已公开宣布计划在其业务战略中长期持有大量数字资产,使其成为企业核心战略的一部分。

以 MicroStrategy 为代表的案例,以及美国监管层面的利好政策,共同推动了数字资产财库公司的迅速发展。美国总统特朗普签署的行政命令,正式允许建立战略性比特币储备;与此同时,机构投资者如今能够以公允价值计量数字资产持仓,使数字资产战略能够在公司资产负债表上得到确认与验证。在这些有利因素的推动下,市场需求快速跟进。从区域分布来看,美国是这些财库公司的最大市场。这类公司同样需要遵 循严格的资本报告要求,并且必须与受监管的托管机构、加密货币交易所和做市商紧密合作,才能成功执行相关策略。其他地区也在紧随其后,其中亚洲企业采取了更为 审慎的态度,在风险偏好与监管稳健之间寻求平衡。

目前,大多数财库公司主要持有比特币和以太坊,但也有部分机构开始布局其他新兴的优质资产,如 Solana、XRP、HYPE、SUI 等。据目前公开数据,上市公司共计持有 1,011,352 枚比特币,约占全网比特币的 5%,其中最大持有者为 MicroStrategy。自 2025 年以来,比特币的企业持仓规模已实现翻倍增长。同时,以太坊财库公司的共计持有约 388 万 ETH,约占全网以太币的4.34%。

2. DAT 简要历史与发展现状

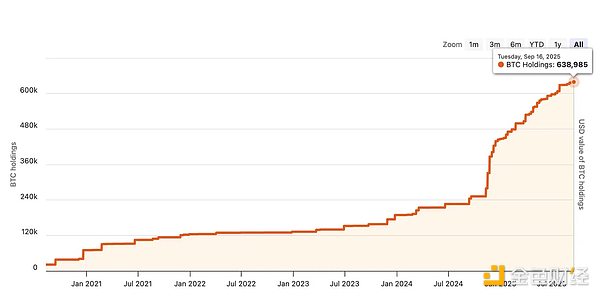

DAT 的最初形态始于以比特币为底层资产的 DAT。2020 年 12 月,MicroStrategy 宣布其在 2020 年比特币购买总额超过 10 亿美元,自此开启了 DAT 征程。在五年间, MicroStrategy 通过自有现金、发行债券、发行股票等进行数次增持比特币。数据显示,截止 9 月 16 日,MicroStrategy 共持有 638,985 枚比特币,是目前比特币持有量最高的公司持有者。

MicroStrategy 比特币持有量图表。资料来源:Bitcointreasuries.net

根据 MicroStrategy 的比特币增持数据,在前 4 年,MicroStrategy 基本以每年不到 10 万枚的速度增持比特币,在 2024 年增持量突破 20 万,在 2025 年增持量也已接近 20 万枚比特币。

每年购买的 BTC 数量。来源:MicroStrategy—— 比特币持有量时间线(年度增长)

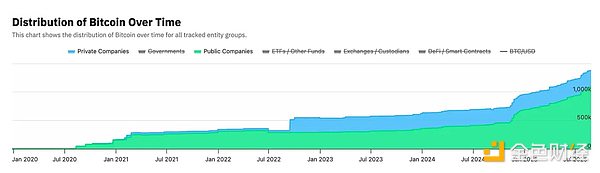

从公司持有 BTC 的发展情况来看(如下图),除了 MicroStrategy 每年增持比特币之外,有越来越多的公司加入持有比特币,据报道,持有比特币的上市公司从 2024 年底到 2025 年上半年新增了 64 家,目前共计 190 家上市公司、64 家非上市公司正在或曾经持有过比特币,总计持有分别为 1,011,352 枚和 299,207 枚比特币。

比特币持有历史趋势图显示,上市公司比特币持有量的增长在 2021 年初和 2024 年底 实现跳跃,主要推动为 MicroStrategy 的数笔操作 。非上市公司的比特币持有量在 2022 年下半年猛增,其主要推动为当年 9 月份 Block.one 公开持有 16.4 万枚比特币。

比特币随时间分布情况,来源:Bitcointreasuries.net

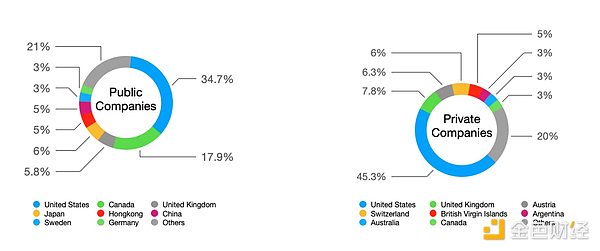

这些比特币持有公司覆盖多个不同国家,如数据图所示,上市公司中有一半来自美国与加拿大,非上市公司中近一半来自美国。

各国比特币持有公司分布。资料来源:Bitcointreasuries.net;HashKey Capital 整理。

可以看到比特币 DAT 的发展呈现多公司、多区域、稳步增长发展特色。

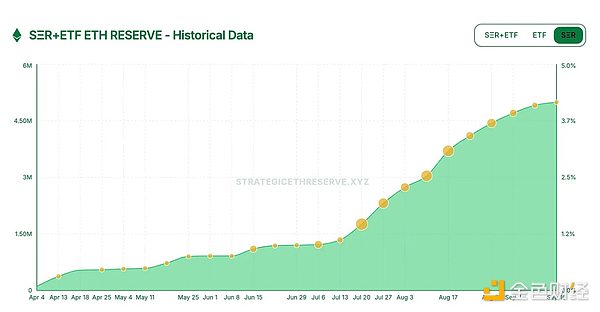

过去五年,DAT 的标的资产差异化逐渐明显,逐渐将 BTC 之外的数字资产囊括在 内,比如 ETH、SOL 等,这些标的资产多为高市值主流山寨币。以太坊 DAT 始于今年 4 月份,且在 7、8 月份以近乎翻倍的速度快速增长。

以太 DAT 持仓趋势图,来源:strategicetherreserv

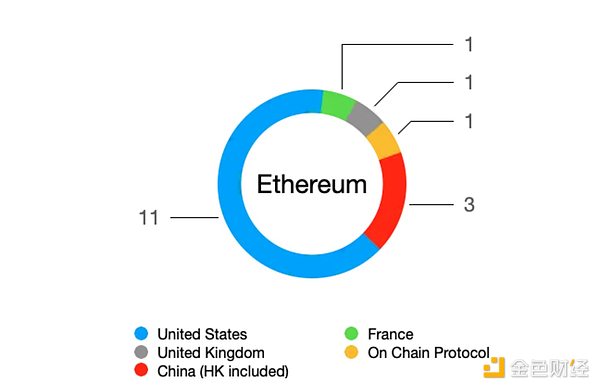

相较于比特币 DAT,以以太坊为标的资产的 DAT 主体据统计为 17 家,总共持有 3.88M 枚 ETH。17 家以太坊持有主体有 15 家上市公司,1 家准备上市,1 家为链上协议。上市公司中有 12 家美国公司,3 家中国(香港)上市公 司。这种分布与比特币 DAT 相比存在明显差异,尤其是存在链上协议 ETH Strategy 这 一个主体,其代币为 STRAT 在 Uniswap 发行。这一情况源于以太坊与比特币技术层面 的差异,以太坊的智能合约允许构建复杂的 DApp,因此生态也更加丰富。

各国家和地区的以太币持有量,来源:strategicetherreserve,由 HashKey Capital 整理

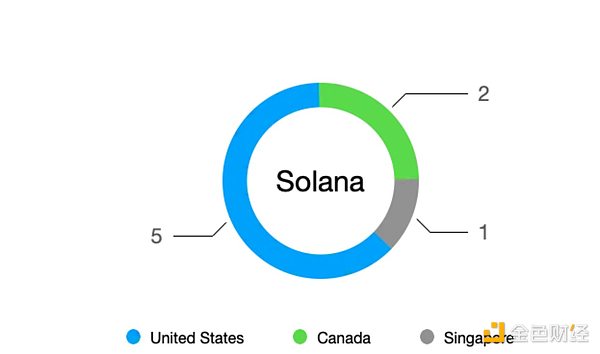

紧随其后为 Solana,根据 coingecko 数据显示共有 8 家上市主体持有,分布在三个国家。

Solana 的持仓情况(按国家/地区划分),来源:strategicetherreserve,由 HashKey Capital 整理。

以比特币、以太坊、Solana 为标的 DAT 主体公司是目前主流的三大方向,相关信息汇总如下:

数据截至 2025/09/15,BTC 持仓主体包含曾经持有且目前为 0 的主体,均不含 ETF、DAO 金库等。以 BTC、ETH、SOL 为底层资产的三大 DAT 类别统计对比,来源:Bitcointreasuries.net、 strategicetherreserve、HashKey Capital 整理

从表格中可以得知持有 BTC 的主体数量远高于以太坊、Solana 的,分别达到其 15 倍、 30 倍,这种现象表明多数 DAT 公司选择比特币作为标的,同时展现了比特币在加密货币世界的特殊地位。

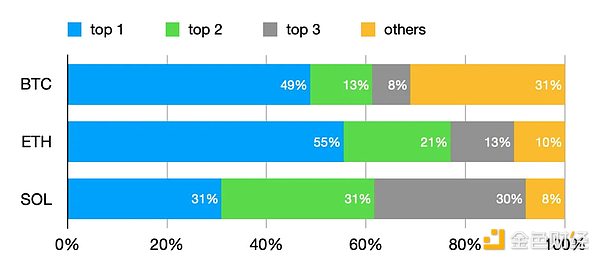

进一步分析主体持有比例,BTC 方面的 DAT 公司中最大持有者占比为 MicroStrategy 达 到 49%,远高于第二名的 13%。MicroStrategy 的绝对占比和高 BTC 体量隐藏着一定危机,作为市场风向标,当它出现比特币售出或无法继续 DAT 策略等行为或现象时将对 市场造成极大威胁。ETH 方面最大持有者更甚,达到了 55%,但第二名也达到了 21%,前三大占比达到 90%,结构失衡。SOL 方面则由前三大主体平均各占有 30%,市场结构均衡。

以 BTC、ETH、SOL 为底层资产的三大 DAT 类别持仓分布对比,来源:Bitcointreasuries.net、 strategicetherreserve,由 HashKey Capital 整理。

除了以 BTC、ETH、SOL 为标的资产外,DAT 的标的资产还涉及到其他资产,如公链资产 TRX、SUI、XRP, 交易所平台币 BNB,去中心化合约平台代币 HYPE、特朗普家族平台代币 WLFI 等,这些 DAT 持有的标的资产量级在 $300M~2B 范围内不等。进入 2025 年第三季度后这一现象继续加剧,我们预计会有更多 DAT 以其他资产作为标的出 现。

除上述只买入单资产策略之外,以多资产为资产标的 DAT 公司逐渐出现,或进行标的资产调仓操作,如 Lion Group (LGHL)在 9 月份宣布将要将其所有的 SUI、SOL 转换 成 HYPE。另外这些 DAT 公司之间也开始存在互投现象,如 Nakamoto Holdings(NASDAQ: NAKA)的子公司 KindlyMD 宣布承诺投资日本比特币储备公司 Metaplanet 国际股权融资。

3. DAT 的特点

无论是单资产还是多资产的 DAT 公司,相较于传统公司、ETF 等上市交易等金融产 品,DAT 作为一种新兴的商业模式具有十分鲜明的特征:

战略公开性

公司需公开宣布其 DAT 策略,并定期披露持仓。这种承诺是获取市场信任和溢价的基础。例如,MicroStrategy 自实施 BTC 储备策略以来发布了数十次买币公告,向股东透明展示持仓变化。同时还引入了新的指标「比特币收益率」,用以衡量每股所持有 BTC 数量的增长百分比。这种做法体现了 DAT 公司以长期持币战略自我约束、接受公众监督的特点,不仅可以吸引偏好该策略的投资者,也让市场对公司风险有清晰认知。

生态协同性

DAT 公司的命运与其所持有的加密资产生态深度绑定。当企业大量持有某种代币时,它事实上成为该区块链生态的大型利益相关者,因而有动力投入资源推动该生态的发展。例如,前 述的 BitMine 公司持有巨量以太坊,并主动参与以太坊网络的质押(staking)以协助维护网络安全,同时获取额外收益。公司自身成长与生态繁荣形成正循环 —— 代币升值令公司受益,公司壮大又进步支持生态。这种协同效应有助于构建价值闭环:DAT 投资人和项目社区实现「双赢」,推动整个数字资产生态的长期可持续发展。

合规演变性

随着监管环境的变化,DAT 模式本身也在逐步机构化、合规化。早期企业直接持币常被视作异类,高波动资产对财报的影响也令传统审计头疼。而如今从会计准则到监管政策都在适应这一趋势。美国上市的 DAT 公司必须满足严格的审计和资本充足要求,采用受监管托管机构保管数字资产,并遵守反洗钱和信息披露规定。与此同时,新产品如比特币 ETF 提供了更多合规投资替代,但也迫使 DAT 公司提升自身规范运作水准,以在竞争中凸显优势。可以预见,未来 DAT 的运作将越来越接近主流金融机构的风范 —— 既享受加密资产增长红利,又遵循健全的风险管理与合规框架。

4 与其他金融工具的比较

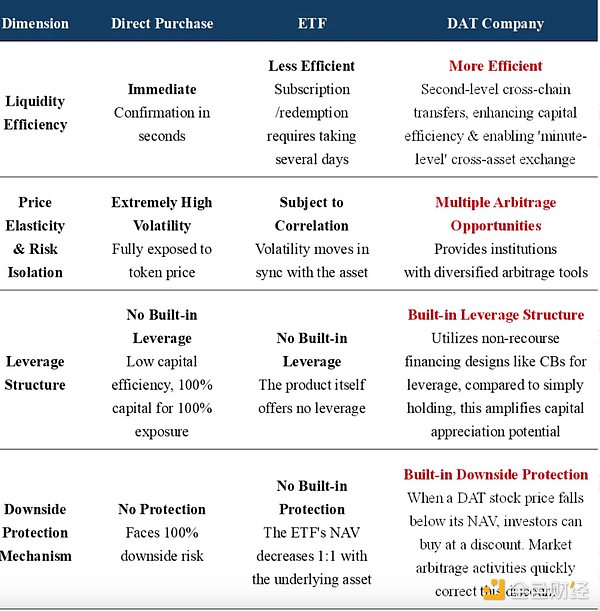

在评估 DAT 的投资价值时,一个核心的视角是将其置于更广阔的金融工具谱系中进行比较分析。我们选取了直接投资加密货币、加密货币现货 ETF、以及 DAT 公司股票三种方式,从流动性效率、风险收益特性、杠杆结构与下行保护四个关键维度进行剖析(详见下表)。我们的分析表明,DAT 并非对前两者的简单替代,而是作为一种更高级的、融合了股权与加密资产特性的复合型工具,为专业投资者提供了独特的 Alpha 收益来源。

超越 Beta:寻求结构性 Alpha

直接投资与ETF投资的核心是获取加密货币的Beta收益,即市场的基础性回报。 然而,DAT的投资逻辑超越了Beta,其核心魅力在于获取结构性Alpha收益。

对于直接持有者而言,其收益曲线与币价高度重合,是一种纯粹但也被动的风险暴露。

对于ETF投资者而言,尽管获得了合规性与便利性,但其收益模式本质上仍 是「币价减管理费用」,未能摆脱Beta的范畴。

对于DAT投资者而言,其收益来源是多元化的:它不仅包含了底层加密资 产的升值,更包含了一级市场折扣、智能杠杆运用、跨市场套利以及管理团队执行力所带来的溢价。这种Alpha并非来自市场波动,而是源于DAT这种特殊资本结构所内生的价值创造能力。

风险管理的维度升级:从被动接受到主动利用

传统的风险观念将波动性视为需要规避的。而DAT提供了一种新视角:将波动性转化为可管理的资源甚至利润来源。直接投资和ETF投资者在下跌市场中几乎无能为力,只能被动接受回撤。而DAT复杂的资本结构为其提供了多维度的风险管理工具。其股价与NAV之间的折溢价变化,为市场提供了套利机会,这种套利行为本身就成为稳定价格的机制。

通过发行非赎回型长期债务(如可转债),DAT公司在牛市中可以放大收益,而在熊市中,其债务结构提供了缓冲,避免了Margin Call导致的强制性清算风险。

当DAT股价因市场恐慌而跌破其资产净值(mNAV1) 时,这本身会吸引价值投资者和套利者入场,形成一种内置的「安全垫」机制,这是其他两种投资方式完全不具备的动态风险调节能力。

综上所述,不能简单地理解为 DAT 只是「投资加密货币的替代途径」,事实上DAT 是一种独特的、自成体的资产类别。因此,对于寻求更高资本效率、更丰富策略工具和更主动风险管理方式的专业投资者和机构而言,DAT 并非一个可选项, 而是一个必选项。它代表的不是对过去的替代,而是对未来投资范式的升级。正如HashKey集团创始人肖风博士所言:「ETF 不错,但 DAT 更好」。其更好之处, 正源于其无法被传统金融工具所复制的、内生于其结构之中Alpha收益创造能力。

5. DAT 的意义

作为连接传统金融世界与加密世界的新载体,数字资产财库公司的出现具有多方面的重要意义。

DAT是传统投资者进入加密生态系统的桥梁

与 ETF 类似,DAT 公司为无法或不便直接持有加密货币的投资者搭建了桥梁。然而,DAT 的运作方式比 ETF更灵活,因为许多机构投资者(例如某些国家的公共基金、养老金等)受监管限制,无法直接购买比特币或相关 ETF,但可以购买海外上市公司的股票。因此,DAT 结构可以扩大加密货币投资的潜在投资者基础,并在遵守当地法规和投资政策的前提下,帮助传统资本进入数字资产生态系统。

一些备受瞩目的企业配置——例如 MicroStrategy 首次购买比特币——也引起了企业财务部门、经纪商和其他金融机构的广泛关注,从而促进了机构投资者对数字资产的更多参与。从这个意义上讲,DAT 公司充当了传统资本市场和加密货币生态系统之间的桥梁,使机构投资组合中的加密货币敞口正常化。

赋能区块链生态,实现价值闭环

数字资产财库公司的出现,还为加密项目生态引入了强大的新增资金来源,帮助项目实现内部价值循环。一方面,DAT 公司持续在二级市场购币并长期锁仓,客观上减少了代币的流通供应,有助于维护币价稳定和上涨,从市场层面支持了项目生态的币值。

另一方面,由于持有大量某项目代币,这些公司与项目官方(基金会)在利益上高度一致,皆希望生态繁荣、币价上涨。管理人将会把持有的代币贡献给生态最需要的环节,比如参与 PoS 链的 staking 提高网络安全,或将代币出借给 DeFi 协议提供流动性,甚至投资生态内的初创项目,扶持实际应用落地。这种增长飞轮,可以让生态赋能更有效率,实现DAT投资人和生态的共赢。

在短期波动中重新聚焦长期价值

DAT 模式还引导市场关注点从短期炒作转向长期价值创造。在传统观念下,加密货币企业往往被贴上「投机」、「波动剧烈」的标签,投资者也热衷于猜测币价短期涨跌。而财库公司明确表示其核心财务目标是每股所对应的数字资产净值,而非追逐短期币价波动。这意味着管理层更关心在若干年维度上能持有多少币、币本身内在价值能增长多少,而不会为季度盈亏去随意买卖仓位。

当市场开始以类似评价价值投资公司的眼光来看待 DAT 公司时,整个生态的估值体系也趋于成熟稳定。长期投资者(如价值型基金)更有可能加入,提升投资者结构的稳定性,降 低股价和币价的剧烈波幅。换言之,DAT 模式帮助将「一味投机炒作」的注意力引导至「资产长期增值能力」的讨论。它让投资者思考:这家公司持有的这些比特币/以太坊,五年十年后会因为生态的发展而更值钱吗?如果答案是肯定的,那么短期价格回调就不足惧。这样的理念转变,有助于数字资产领域涌现更多长期主义者,从而提升整个行业估值的稳健性与健康度。

结论

数字资产财库(DAT) 公司作为传统金融与数字资产世界的交汇产物,正发挥着桥梁、赋能和定锚的多重作用。一方面,它们为传统资金参与加密打开方便之门,壮大了加密市场的资金池和认同度;另一方面,它们自身的存在也在倒逼加密生态走向更成熟 ——无论是提升合规还是重视长期基本面。这类公司的崛起映射出数字经济转型的一个缩影:越来越多的企业开始将数字资产视作战略资源来配置和运营。

在本系列报告的下一篇,我们将聚焦在 DAT 公司如何具体发行和运作,以及从投资人角度,如何判断和评估 DAT 公司投资价值。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。