The cryptocurrency market is not lacking in smart code; what it lacks is a bottom line that everyone must adhere to.

Written by: Daii

I have always said: the current cryptocurrency market resembles a "wild west."

The most glaring evidence is the "flash crash." It is not metaphysics, but rather the result of deep thinness + leveraged chain liquidations + the preference for on-site matching: prices are violently smashed to your stop-loss level in critical milliseconds, wiping out your position, leaving only a long and thin "wick" in the candlestick chart—like a needle suddenly pricking down.

In such an environment, what is lacking is not luck, but a bottom line. Traditional finance has long written this bottom line into its system—prohibiting trade-through (Trade-Through Rule). Its logic is extremely simple yet powerful:

When there are clearly better public prices in the market, no broker or exchange may turn a blind eye, nor may they execute your order at a worse price.

This is not moral persuasion, but a hard constraint that can be held accountable. In 2005, the U.S. Securities and Exchange Commission (SEC) explicitly wrote this bottom line into Reg NMS Rule 611: all market participants (where trading centers must not trade through protected quotes, and brokers have a best execution obligation under FINRA 5310) must fulfill "order protection," prioritizing the best available price, and leaving a traceable, verifiable, and accountable record of routing and execution. It does not promise "no market volatility," but ensures that amidst volatility, your execution is not arbitrarily "deteriorated"—if a better price is available elsewhere, you cannot be matched at a worse price in this venue.

Many people will ask: "Can this rule prevent flash crashes?"

To be frank: it cannot eliminate long wicks, but it can sever the chain of harm from "long wicks executing against you."

Imagine a scenario that is easy to understand:

At the same moment, exchange A experiences a flash crash, instantly smashing BTC down to $59,500;

Exchange B still has valid buy orders at $60,050.

If your stop-loss market order is executed "on-site" at A, you exit at the needle tip price; with order protection, the routing must send your order to B's better buy price, or refuse to execute at A's worse price.

Result: the wick is still on the chart, but it is no longer your execution price. This is the value of this rule—it's not about eliminating wicks, but about preventing the wick from pricking you.

Of course, the triggering of contract liquidations itself also requires supporting measures like marking prices/indexes, volatility bands, auction restarts, anti-MEV, etc., to govern the "generation of wicks." But in terms of fair execution, the bottom line of "prohibiting trade-through" is almost the only immediate, actionable, and auditable lever to enhance the experience.

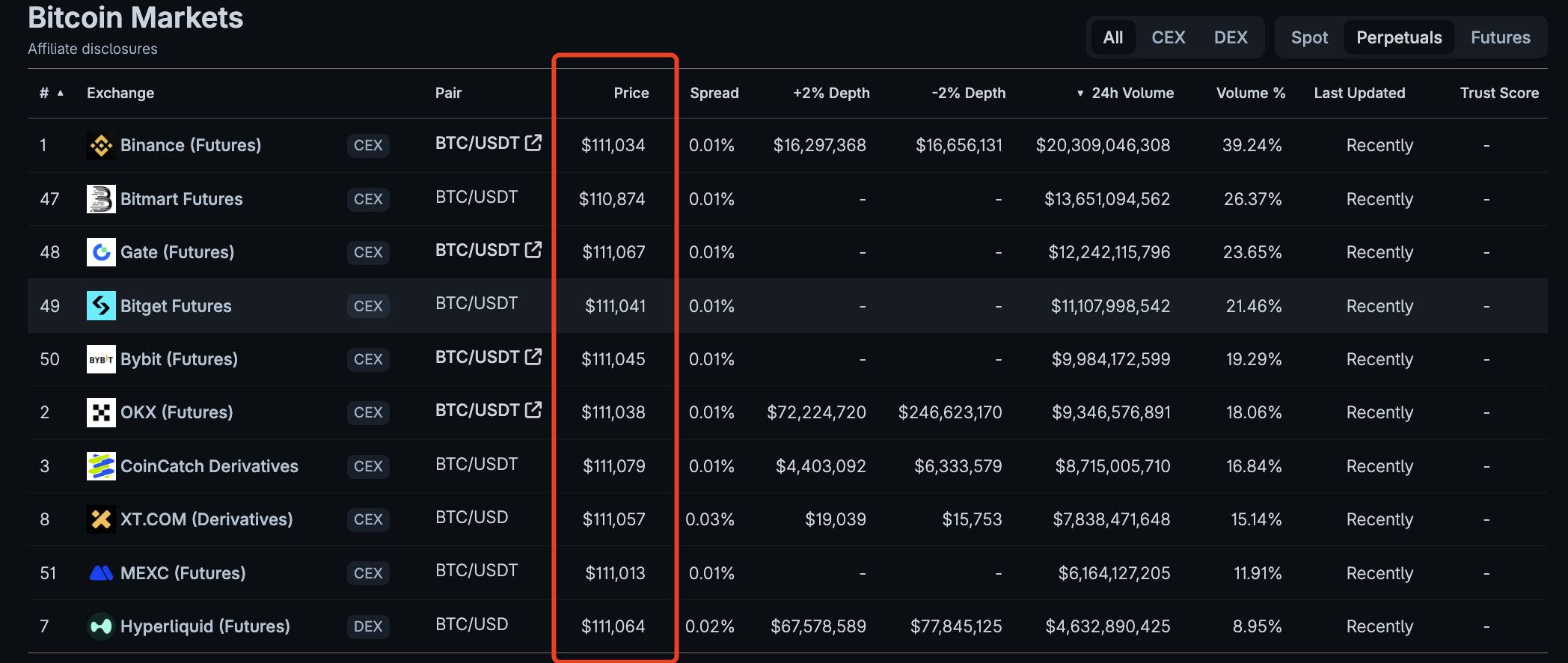

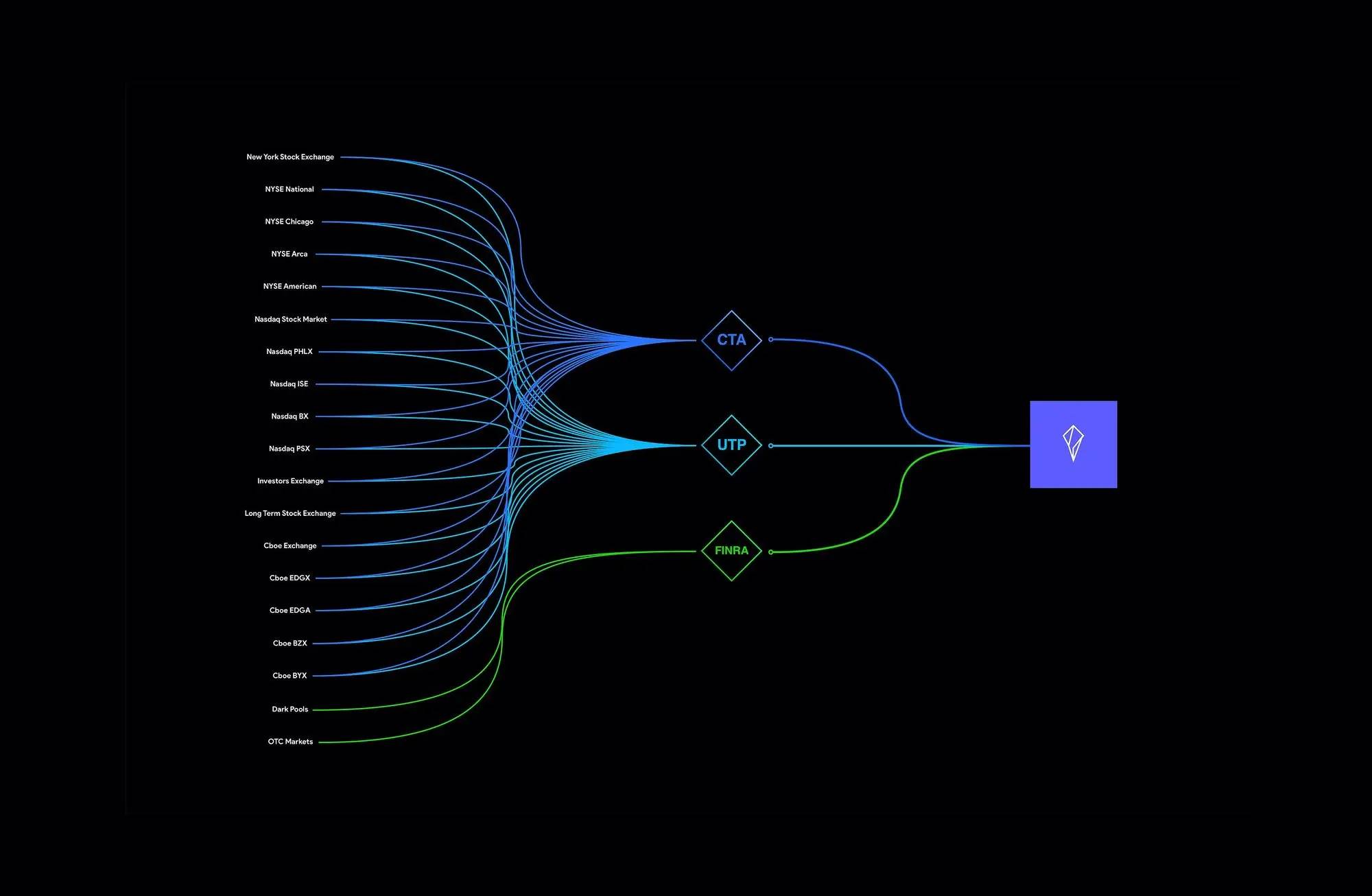

Unfortunately, the cryptocurrency market still lacks such a bottom line. A picture is worth a thousand words:

From the perpetual contract price table for BTC above, you will find that none of the quotes from the top ten exchanges by trading volume are the same.

The current landscape of the cryptocurrency market is highly fragmented: hundreds of centralized exchanges, thousands of decentralized protocols, prices are disconnected from each other, and coupled with the decentralization of cross-chain ecosystems and the dominance of leveraged derivatives, it makes it harder than ever for investors to find a transparent and fair trading environment.

You might be curious why I am raising this issue now?

Because on September 18, the U.S. Securities and Exchange Commission (SEC) will hold a roundtable discussion on the trade-through prohibition rule, discussing its gains and losses and whether it should remain in the National Market System (NMS).

This matter seems to be related only to traditional securities, but in my view, it also serves as a wake-up call for the cryptocurrency market: if even in the highly concentrated and mature U.S. stock system, the trading protection mechanism needs to be reconsidered and upgraded, then in the more fragmented and complex cryptocurrency market, ordinary users need the most basic protection line even more:

Providers in the cryptocurrency market (including CEX and DEX) must never ignore better public prices at any time, nor allow investors to be executed at worse prices when it could have been avoided. Only in this way can the cryptocurrency market transition from the "wild west" to true maturity and trustworthiness.

This may seem like a pipe dream now, and it would not be an exaggeration to call it a fantasy. However, once you understand the benefits that the establishment of the trade-through prohibition rule has brought to the U.S. stock market, you will realize that even if it is difficult, it is worth a try.

1. How was the Trade-Through Rule established?

Looking back, the establishment of this rule went through a complete chain: from legislative authorization in 1975, to the inter-exchange trading system (ITS) interconnection experiment, to the comprehensive electronic leap in 2005, and finally phased implementation in 2007. It is not about eliminating volatility, but ensuring that amidst volatility, investors can still obtain the better prices they deserve.

1.1 From Fragmentation to Unified Market

In the 1960s and 70s, the biggest problem facing the U.S. stock market was fragmentation. Different exchanges and market-making networks operated independently, making it impossible for investors to determine where they could obtain the "best price" in the entire market.

In 1975, the U.S. Congress passed the Securities Act Amendments, which first explicitly proposed the establishment of a "National Market System (NMS)" and required the SEC to lead the construction of a unified framework that could connect various trading venues, aiming to enhance fairness and efficiency【Congress.gov, sechistorical.org】.

With legal authorization, regulators and exchanges launched a transitional "interconnected cable"—the inter-exchange trading system (ITS). It acted like a dedicated network cable connecting exchanges, allowing different venues to share quotes and routing, preventing better prices from being ignored when executing at worse prices in a given venue【SEC, Investopedia】.

Although the ITS gradually faded with the rise of electronic trading, the concept of "not ignoring better prices" had already been deeply embedded.

1.2 Regulation NMS and Order Protection

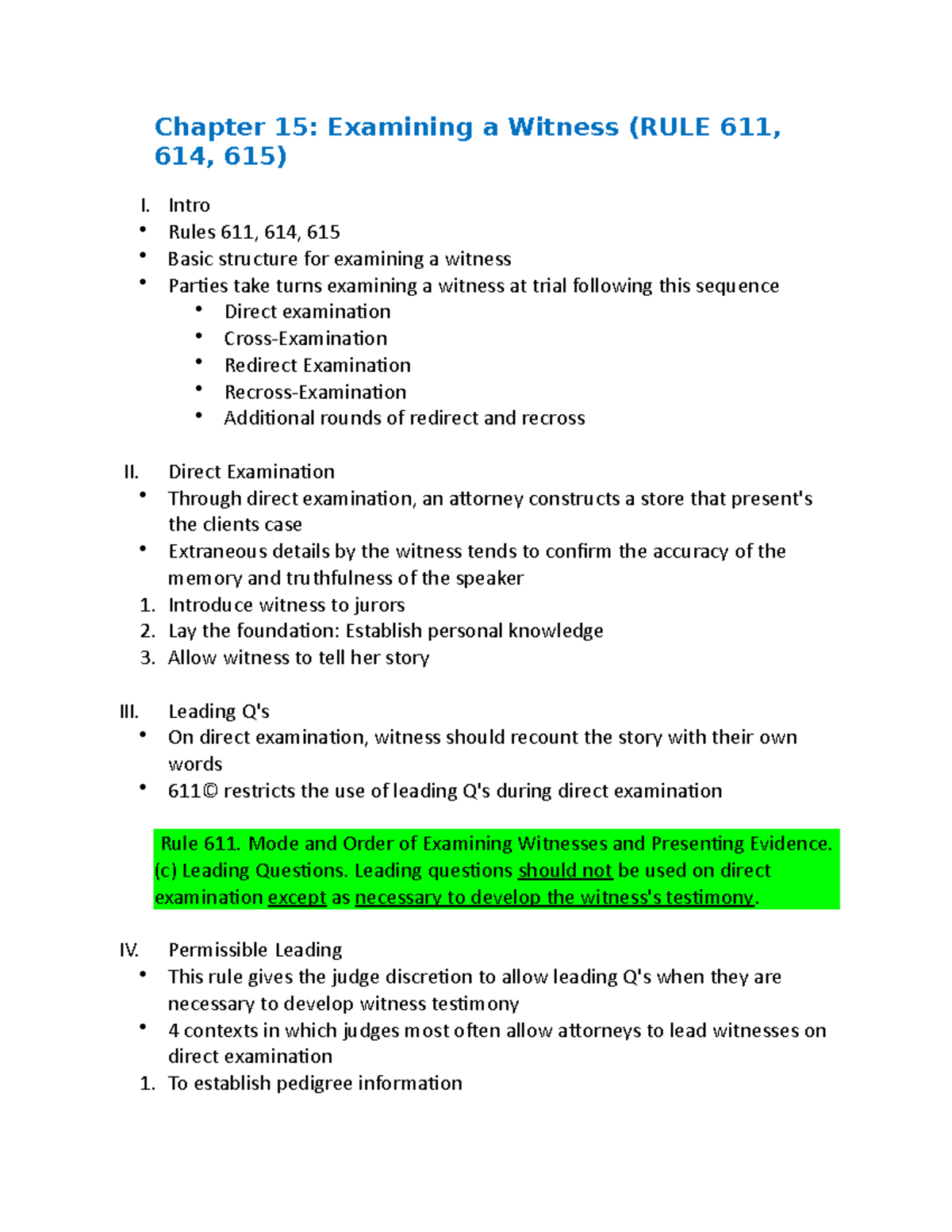

Entering the 1990s, the internet and decimalization made trading faster and more fragmented, and the old semi-manual system could no longer keep pace. In 2004-2005, the SEC introduced historic new regulations—Regulation NMS. It includes four core provisions: fair access (Rule 610), prohibiting trade-through (Rule 611), minimum quotation increments (Rule 612), and market data rules (Rule 603)【SEC】.

Among them, Rule 611 is the well-known "order protection rule," which can be explained in simple terms: when other venues have already posted better protected quotes, you cannot match your order at a worse price here. The so-called "protected quotes" must be immediately executable quotes, not slow orders processed manually【SEC Final Rule】.

To ensure that this rule is truly actionable, the U.S. market established two key "foundations":

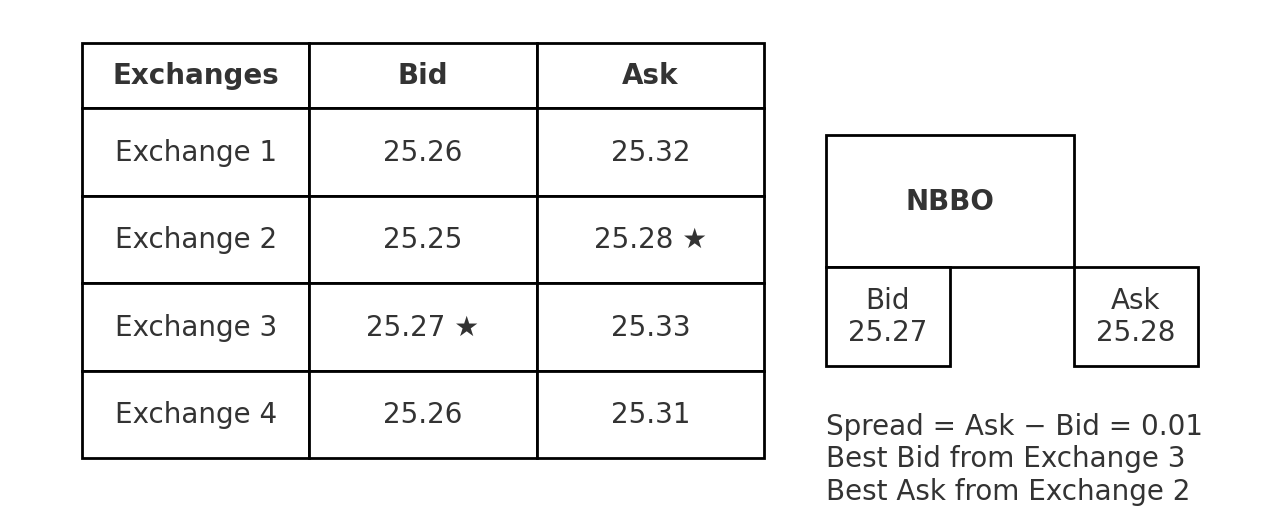

NBBO (National Best Bid and Offer): combines the best buy and sell prices from all exchanges, serving as a unified standard for measuring whether a "trade-through" has occurred. For example, in the image above, Exchange 3's 25.27 is the best buy price, and Exchange 2's 25.28 is the best sell price.

SIP (Securities Information Processor): responsible for real-time aggregation and publication of this data, becoming the "single source of truth" for the entire market【Federal Register, SEC】.

Reg NMS (Regulation National Market System) came into effect on August 29, 2005, and on May 21, 2007, Rule 611 was first implemented on 250 stocks, and on July 9 of the same year, it was fully rolled out to all NMS stocks, ultimately forming an industry-wide operational habit of "not trading through better prices"【SEC】.

1.3 Controversy and Significance

Of course, this was not a smooth journey. SEC commissioners Glassman and Atkins raised objections at the time, arguing that focusing solely on displayed prices might overlook the net costs of trading and could even weaken market competition【SEC Dissent】. However, most commissioners still supported this rule for a clear reason: even amidst debates over costs and efficiency, "prohibiting trade-through" at least ensures a fundamental bottom line—

Investors will not be forced to accept worse prices when better prices are clearly available.

This is why, to this day, Rule 611 is still regarded as one of the cornerstones of the "best execution ecosystem" in the U.S. securities market. It transformed "better prices cannot be ignored" from a slogan into a reality that can be regulated, audited, and held accountable afterward. This bottom line is precisely what the cryptocurrency market lacks but is most worth emulating.

2. Why does the cryptocurrency market need this "bottom line rule" even more?

Let’s clarify the issue: in the cryptocurrency market, at the moment you place an order, there may not be anyone "scanning the entire market" for you. Different exchanges, different chains, and different matching mechanisms act like isolated islands, with prices singing their own tunes. The result is that—despite better prices being available elsewhere—you end up being "matched on-site" at a worse price. This is explicitly prohibited in the U.S. stock market by Rule 611, but there is no unified "bottom line" in the crypto world.

2.1 The Cost of Fragmentation: Without a "Market-Wide Perspective," It’s Easier to Be Executed at a Worse Price.

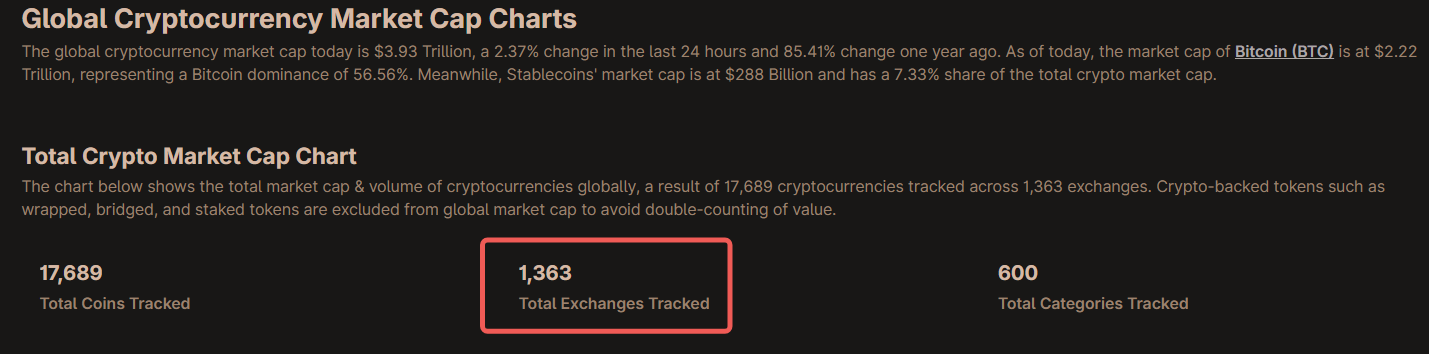

Currently, there are thousands of registered cryptocurrency trading venues globally: CoinGecko's "Global Chart" shows that it tracks over 1,300 exchanges (as shown below); CoinMarketCap's spot rankings also consistently display over 200 active reporting exchanges—this does not even include various derivatives and long-tail on-chain DEX venues. Such a landscape means that no one can naturally see the "best price in the entire market."

Traditional securities rely on SIP/NBBO to synthesize a "market-wide best price range"; however, in crypto, there is no official merged price range, and even data institutions openly state that "crypto has no 'official CBBO'." This makes it so that "where is cheaper / more expensive" becomes something only known after the fact. (CoinGecko, CoinMarketCap, coinroutes.com)

2.2 Dominance of Derivatives and Amplified Volatility: Flash Crashes Are More Likely to Occur and Have Greater Impact.

In crypto trading, derivatives have long dominated.

Multiple industry monthly reports indicate that the proportion of derivatives fluctuates between ~67%–72%: for example, CCData reports have shown readings of 72.7% (March 2023), ~68% (January 2025), and ~71% (July 2025).

The higher the proportion, the more likely it is to experience extreme instantaneous prices ("flash crashes") driven by high leverage and funding rates; if your platform does not compare prices or calculate net prices, you may be executed at a worse price at the same moment when a better price is available.

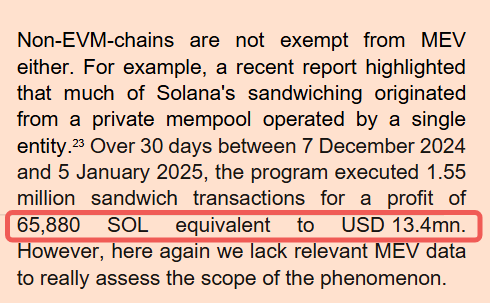

On-chain, MEV (Maximum Extractable Value) adds another layer of "implicit slippage":

According to a report from the European Securities and Markets Authority (ESMA) in 2025, there were 1.55 million sandwich trades in just 30 days from December 2024 to January 2025, yielding profits of 65,880 SOL (approximately $1.34 million); (esma.europa.eu)

Academic statistics also show over 100,000 sandwich trades per month, with related Gas costs in the millions of dollars.

For ordinary traders, these are real "execution losses" in hard cash. (CoinDesk Data, CryptoCompare, The Defiant, CryptoRank, arXiv)

If you want to understand how MEV attacks occur, you can check out my article "A Comprehensive Analysis of MEV Sandwich Attacks: The Fatal Chain from Ordering to Flash Swaps," which details how an MEV attack caused a trader to lose $215,000.

2.3 Having Technology but Lacking "Principle Safeguards": Turning "Best Price" into a Verifiable Commitment.

The good news is that the market has developed some "self-rescue" native technologies:

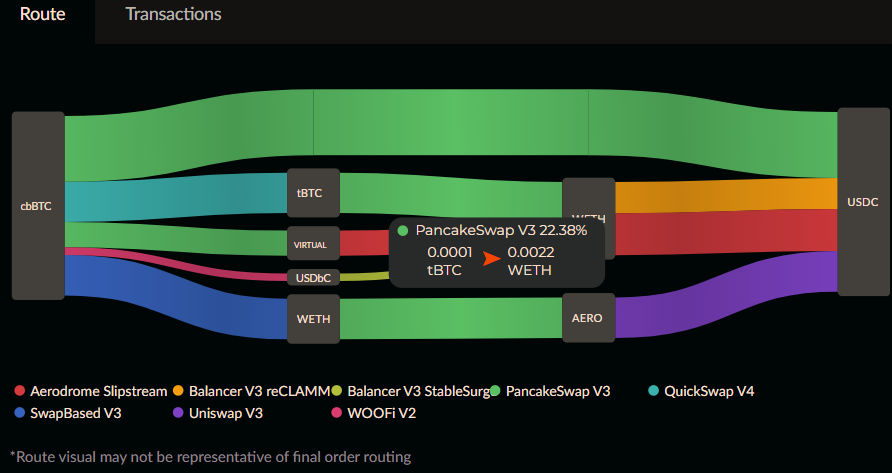

Aggregators and smart routing (like 1inch, Odos) scan multiple pools/chains, split orders, and factor in Gas and slippage into the "real execution cost," striving to obtain a better "net price"; (portal.1inch.dev, blog.1inch.io)

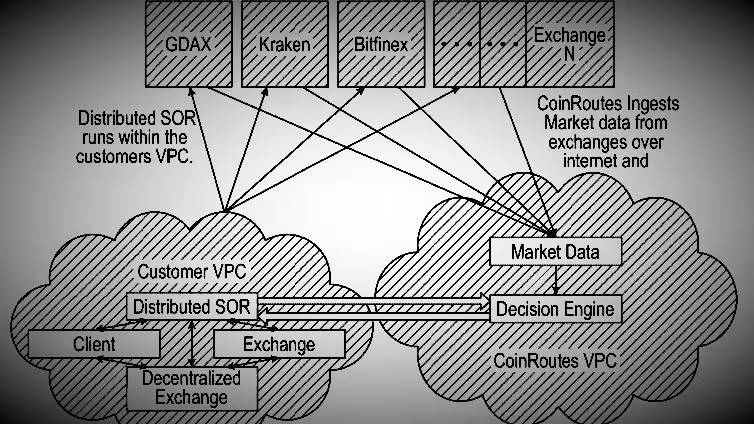

Private "merged best price ranges" (like CoinRoutes' RealPrice/CBBO) combine the depth and fees of dozens of venues in real-time to create a "tradable, billed reference net price," which has even been adopted by Cboe for indices and benchmarks. These prove that "finding better prices" is technically feasible. (Cboe Global Markets, Cboe, coinroutes.com)

But the bad news is: without a "prohibition on trade-through" bottom line, these tools are merely voluntary choices; platforms can completely ignore comparisons and match your order "on-site."

In traditional securities, best execution has long been written as a compliance obligation—not only looking at price but also weighing speed, likelihood of execution, costs/rebates, and conducting "regular, rigorous" execution quality assessments; this is the spirit of FINRA Rule 5310. Introducing this "principle + verifiability" into crypto is the key step to truly turning "better prices cannot be ignored" from a slogan into a commitment. (FINRA)

In summary:

The more fragmented, 24/7, and derivative-driven the cryptocurrency market is, the more ordinary people need a bottom line rule of "not ignoring better public prices."

It does not necessarily have to replicate the technical details of the U.S. stock market; but at the very least, it should elevate "not trading through" to an explicit obligation, requiring platforms to either provide a better net price or give verifiable reasons and evidence. When "better prices" become a verifiable, accountable public commitment, the unjust losses caused by flash crashes can truly be mitigated.

3. Can the Trade-Through Rule Really Be Implemented in the Crypto Space?

Short answer: Yes, but it cannot be applied mechanically.

Copying the mechanical version of "NBBO + SIP + mandatory routing" from the U.S. stock market is nearly impossible in crypto; however, elevating "not ignoring better public prices" to a principle obligation, along with verifiable execution proof and market-based merged price ranges, is entirely feasible and there are already "semi-finished products" in circulation.

3.1 Step One: Assessing Reality: Why Is It Difficult in Crypto?

The challenges mainly include three aspects:

There is no "unified display" (SIP/NBBO). The reason the U.S. stock market can prevent trade-throughs is that all exchanges feed data into the Securities Information Processor (SIP), providing the entire market with a "national best bid and offer" (NBBO) as a "common measure"; however, crypto lacks an official price feed, and prices are fragmented into many "information islands." (The market data and merged tape of Reg NMS were continuously refined from 2004 to 2020. (Federal Register, U.S. Securities and Exchange Commission))

The "finality" of settlement is different. Bitcoin typically requires "6 confirmations" to be relatively secure; Ethereum's PoS relies on epoch finality, requiring some time to "pin down" blocks. When defining "protected quotes as immediately executable," the meanings and delays of "executable / final" on-chain must be clearly rewritten. (Bitcoin Wiki, ethereum.org)

Extreme fragmentation + dominance of derivatives. CoinGecko tracks over 1,300 exchanges, while CMC's spot rankings consistently show around 250; adding DEXs and long-tail chains makes the upstream and downstream even more fragmented. Derivatives consistently account for 2/3 to 3/4 of trading volume, with volatility amplified by leverage, making "flash crashes" and instantaneous deviations more frequent. (CoinGecko, CoinMarketCap, Kaiko, CryptoCompare)

3.2 Step Two: Identifying Opportunities: Existing "Components" Are Already in Motion.

Don’t be intimidated by the "lack of an official price feed"—there are already nascent forms of "merged price ranges" in the community.

CoinRoutes RealPrice/CBBO: Combines the depth, fees, and quantity constraints of over 40 exchanges in real-time to create a tradable merged best price; Cboe signed an exclusive authorization back in 2020 for use in digital asset indices and benchmarks. This means that "routing dispersed prices to better net prices" is technically mature. (Cboe Global Markets, PR Newswire)

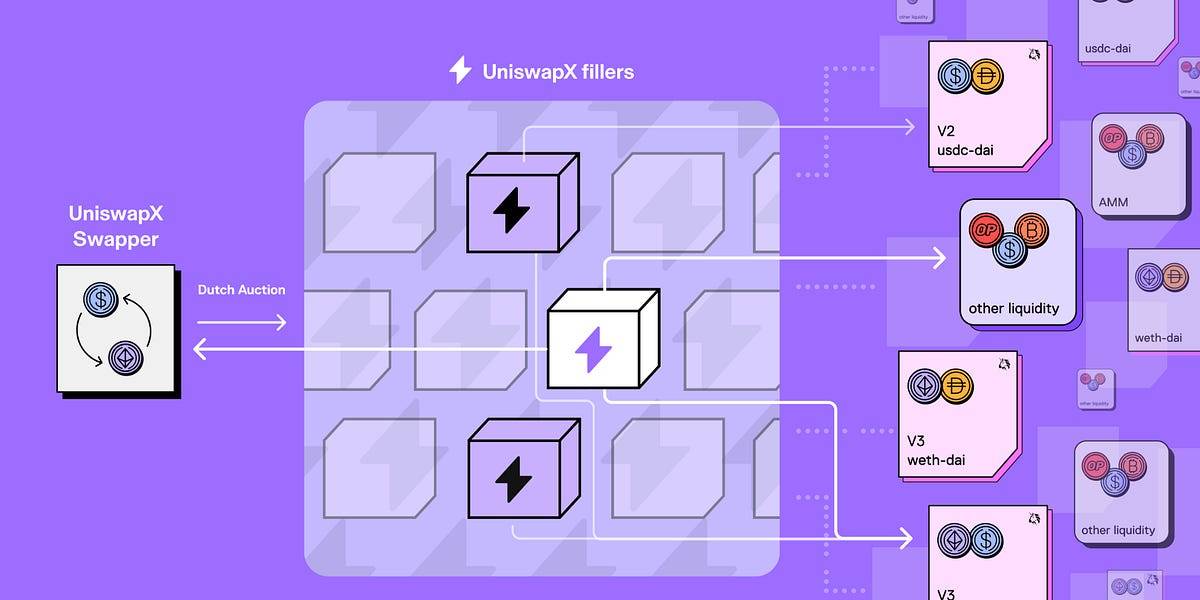

Aggregators and smart routing (as shown above): Split orders, find paths across pools/chains, and factor in Gas and slippage into the real execution cost; UniswapX further uses auction/intention aggregation for on-chain + off-chain liquidity, incorporating zero-cost failure, MEV protection, and scalable cross-chain capabilities, essentially pursuing "verifiable better net prices." (blog.1inch.io, portal.1inch.dev, Uniswap documentation)

3.3 Step Three: Establishing Rules: Don’t Force a "Single Bus," but Set "Bottom Line Principles."

Unlike the U.S. stock market, we do not forcibly create a global SIP; instead, we advance in three layers:

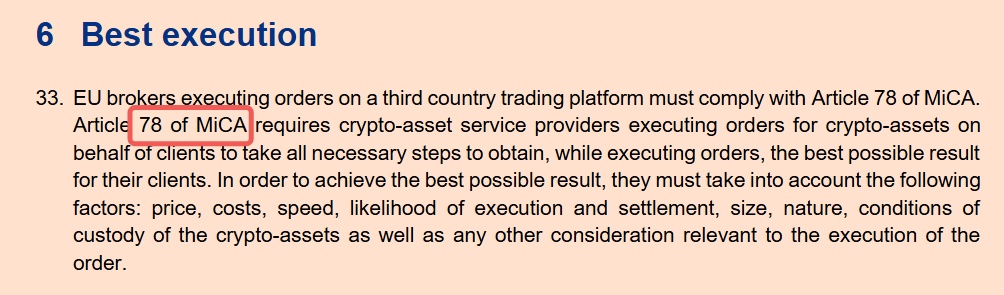

Principle First (Same Compliance Circle): Establish a clear obligation of "not trading through better public prices/net prices" among compliant platforms/brokers/aggregators within a single jurisdiction. What is "net price"? It not only considers the nominal price on the screen but also includes fees, rebates, slippage, Gas, and costs of retrying failures. Article 78 of the EU MiCA has already codified "best results" into a statutory list (price, cost, speed, likelihood of execution and settlement, scale, custody conditions, etc.); this principled approach can serve as an anchor for a "crypto version of trade-through prevention." (esma.europa.eu, wyden.io)

Market-Based Merged Price Ranges + Random Checks: Regulators recognize multiple private "merged price ranges/reference net prices" as one of the compliance baselines, such as the aforementioned RealPrice/CBBO; the key is not to designate a "single data source," but to require methodological transparency, coverage disclosure, conflict explanation, and conduct random comparisons/external audits. This avoids "monopoly" while providing practitioners with a clear, verifiable standard. (Cboe Global Markets)

"Best Execution Proof" and Periodic Reconciliation: Platforms and brokers must leave a trace: which venues/routes were searched at the time, why a better nominal price was abandoned (e.g., uncertainty in settlement, high Gas), and the difference between the final executed net price and the estimate. Referencing traditional securities, FINRA Rule 5310 requires "per-order or 'periodic and rigorous'" execution quality assessments (at least quarterly, by category), and crypto should adopt a similar level of self-certification and disclosure. (FINRA)

3.4 Step Four: Boundaries of Innovation Should Not Be "Stifled."

The principle is "not to ignore better public prices," but the path to achieving it should be technologically neutral. This is also the insight from the recent reopening of Rule 611 roundtable discussions in the U.S.: even in the highly concentrated U.S. stock market, order protection is being reconsidered for upgrades, and we cannot implement a "one-size-fits-all" approach in crypto. (U.S. Securities and Exchange Commission, Sidley)

So, what would implementation look like? Here’s a "hands-on" scenario (imagine this):

You place an order on a compliant CEX/aggregator. The system first queries multiple venues/chains/pools, referencing private merged price ranges, accounting for fees, slippage, Gas, and expected finality time for each candidate path; if a certain path has a better nominal price but does not meet finality/fee standards, the system clearly states the reason and retains evidence.

The system selects a route with a better comprehensive net price that can be executed promptly (splitting orders if necessary). If it does not route you to a better net price at that time, the subsequent report will highlight this in red, marking it as a compliance risk point, requiring explanation or even compensation if audited.

You can see a concise execution report: optimal available net price vs. actual net price, path comparison, estimated vs. actual slippage/fees, execution time, and on-chain finality. Even the most sensitive novice to "flash crashes" can determine: was I executed at a "local worse price"?

Finally, let’s clarify the "concerns":

"Is it impossible without a global NBBO?" It is not necessary. MiCA has already placed the "best execution" principle on crypto service providers (CASPs), emphasizing multiple dimensions such as price, cost, speed, and likelihood of execution/settlement; the self-certification + audit tradition from the U.S. stock market can also be applied. By using multiple merged price ranges + audit reconciliation, a "consensus price range" can be established, rather than forcing a "central tape." (esma.europa.eu, FINRA)

"With MEV on-chain, will there still be slippage?" This is precisely the issue that protocols like UniswapX (as shown above) aim to solve: MEV protection, zero-cost failures, and cross-source bidding, returning the margins that were originally taken by "miners/validators" as much as possible to improve prices. You can think of it as a "technical version of order protection." (Uniswap documentation, Uniswap)

Conclusion in One Sentence:

Implementing "trade-through prevention" in the crypto space is not about copying the mechanical rules of the U.S. stock market, but rather anchoring it with MiCA/FINRA-level principle obligations, combined with private merged price ranges and on-chain verifiable "best execution proof," starting from the same regulatory fence and gradually expanding outward. As long as "better public prices cannot be ignored" becomes an auditable, accountable commitment, even without a "global bus," we can mitigate the harm of "flash crashes" and strive to recover the money that retail investors deserve from the system.

Conclusion | Turning "Best Price" from a Slogan into a System

The crypto market is not lacking in smart code; what it lacks is a bottom line that everyone must adhere to.

Prohibiting trade-through is not about tying down the market but about clarifying responsibilities: platforms must either route you to a better net price or provide verifiable reasons and evidence. This is not "restricting innovation"; rather, it paves the way for innovation—when price discovery is fairer and execution is more transparent, truly efficient technologies and products will be amplified.

Let’s not treat "flash crashes" as a fate of the market. What we need is a set of technology-neutral, verifiable results, and layered approaches to a crypto version of "order protection." Transforming "better prices" from a possibility into an auditable commitment.

Only when better prices "cannot be ignored" can the crypto market be considered mature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。