撰文:深潮 TechFlow

就在今天,Binance正式宣布第52个HODLer空投项目——ENSO,将于10月14日09:00 UTC正式上线交易。

这次空投释放175万枚ENSO代币(占总供应量1.75%),另有50万枚用于上线后的营销活动。更引人注目的是,Binance Alpha平台还将同步开启积分兑换空投,为早期参与者提供双重获利机会。

虽然BNB持仓快照期(10月7-9日)已过,HODLer空投资格已定;但 Binance Alpha 的积分兑换通道仍然开放。与常规空投不同的是,ENSO采取社区优先的设计:

公募买家享受 100% TGE 即时解锁,而VC和团队则面临1年cliff+2年线性解锁;至少在明面上有点先散户后VC的感觉。

之前,ENSO在CoinList的公募价格为$1.25/枚,对应$125M全流通市值(FDV)。

如果你并不了解这个项目的来龙去脉,下面是一些关键信息。

空投机制解析

-

HODLer 空投已确定

资格要求:在10月7-9日快照期间,将BNB存入以下产品:

-

Simple Earn活期/定期产品

-

链上收益产品(如质押)

-

需完成KYC认证且位于支持地区

分配逻辑:根据快照期内平均每日BNB余额按比例分配175万ENSO。无最低持仓要求,但持仓量越高获得越多。

-

Binance Alpha空投(仍可参与)

ENSO 是 Binance Alpha 平台上的本周五大新币之一,其他的为CLO、RECALL、WBAI、LAB。用户可用Alpha积分兑换 ENSO 空投份额,具体规则可等待活动上线后查看

参与步骤:

-

确保已完成Binance KYC 认证

-

通过Alpha平台交易、推荐等活动累积积分(往期活动门槛约195积分)

-

10月14日上线后访问Alpha Events页面,用积分兑换ENSO

-

先到先得,兑完即止(往期窗口期通常5小时)

项目介绍

解决什么问题?

当前区块链生态面临严重的碎片化困境:1000+条链、4100万+智能合约、各自独立的标准和调用方式。开发者要为DApp集成每条链,需要更多的开发成本和集成时间。这种割裂严重阻碍了Web3的大规模应用。

ENSO的解决方案:将所有区块链抽象为统一的API/SDK接口,通过两个核心概念实现“一键跨链操作”:

-

Actions(模块化交互):将每个智能合约功能抽象为标准化"动作"(如Aave的

deposit、Uniswap的swap) -

Shortcuts(组合工作流):像乐高积木一样组合多个Actions,实现复杂跨链操作。如“从任意链提取资产→跨链桥接→在目标链存入借贷协议”。

这有点像 iOS 统一了所有App的开发接口,ENSO统一了所有区块链的调用方式。开发者无需了解每条链的底层细节,只需表达意图(Intent),ENSO网络自动规划最优路径并执行。

一些实际用例:

-

Berachain主网启动:公开信息显示,2025年2月,Berachain 通过 ENSO 处理了$31亿交易量,使用了84个预构建的Shortcuts。这一数字让Berachain成为启动最成功的L1之一。

-

Ether.fi跨链金库:用户可从任意链(Ethereum、Arbitrum、Base等)一键存入,ENSO在后台自动处理桥接、兑换、存款的全流程,无需用户手动切换网络或多次签名。

-

Uniswap LP 迁移:据The Block 报道,ENSO 与 LayerZero 达成合作,为Uniswap V4迁移到Unichain构建的工具。用户通过一笔交易可以完成 Uniswap V2/V3版本 LP流动性的提取 → 跨链桥接 → 重新部署到V4 LP的全流程。

ENSO 当前协议合作情况汇总:

代币经济学

供应结构与解锁机制

总供应量:创世时1亿枚,最大供应1.273亿枚,计算方式为初始年化8%通胀,10年后降至0.35%。

初始流通:2059万枚(20.59%),包括:

-

CoinList公募400万枚(100%解锁)

-

Binance HODLer空投175万枚(100%解锁)

-

额外50万枚ENSO将在现货上市后用于市场活动(100%解锁)

-

生态系统部分释放约1434万枚

从明面上的信息看,公募买家(Coinlist 上 $1.25买入的)在TGE当天100%可交易,而 VC/团队必须等待1年后才开始2年的逐块线性释放。

这意味着至少在理论上,到2026年10月之前,56.8%的代币(VC+团队+顾问)被锁定,市场抛压主要来自流通盘。

估值对标:

融资背景和团队

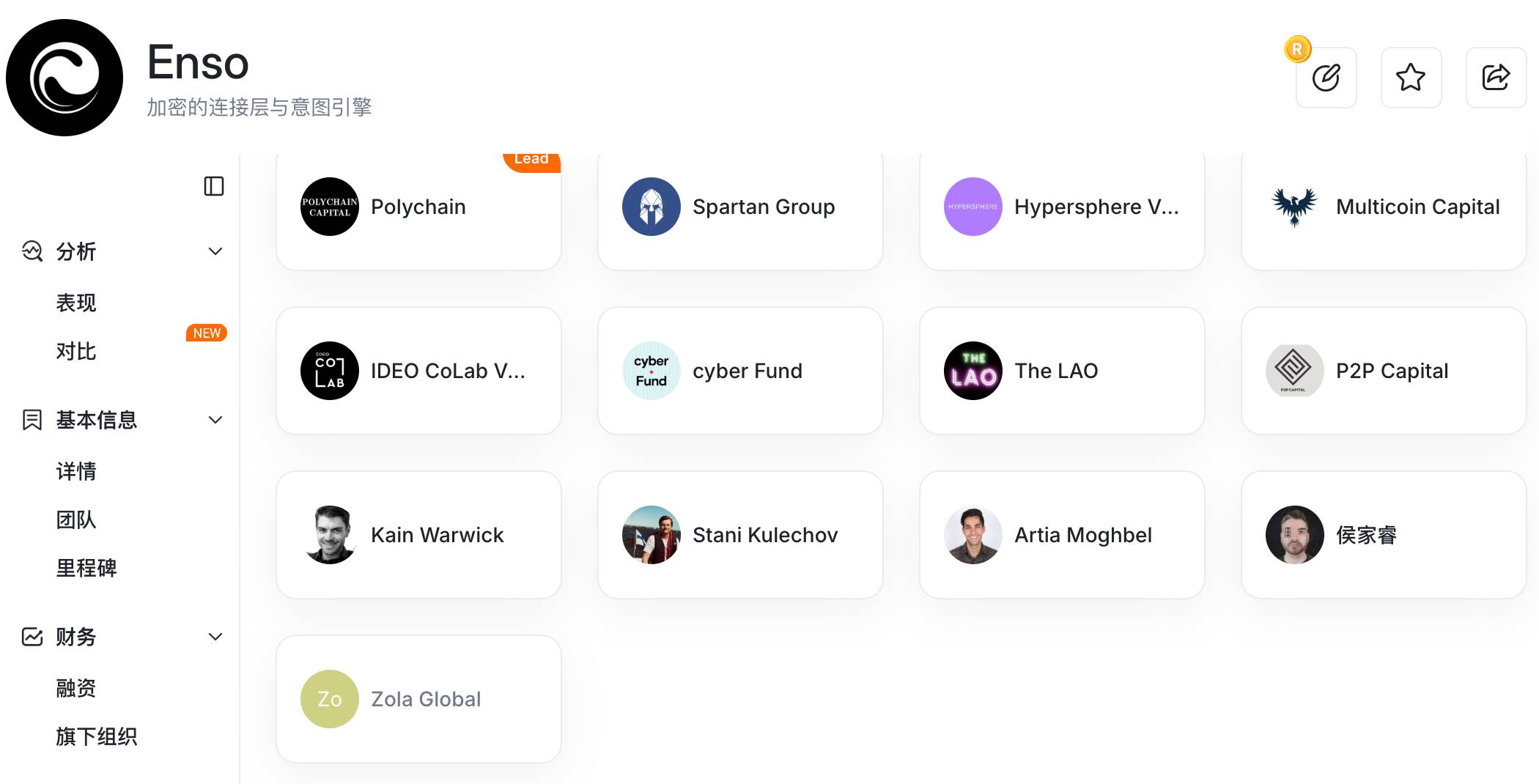

VC阵容与融资历程

公开信息显示的总融资额:$1420万,分3轮完成

-

2021年战略轮($500万):由Spartan Group领投,Polychain Capital、Multicoin Capital、The LAO、P2P Capital、Zora跟投。用于核心引擎开发

-

2024年未公开轮($420万):IDEO CoLab Ventures、Hypersphere Ventures领投。推动意图中心化扩展

-

2025年CoinList公募($500万):社区轮,4%代币以$1.25价格售出

天使投资人阵容(70+位):包括Naval Ravikant(AngelList创始人)、来自LayerZero、Safe、1inch、Yearn、Flashbots、Dune、Pendle等项目的核心成员。

团队:以太坊原教旨主义者

Connor Howe(创始人/CEO):2012年比特币早期开发者,2016年参与以太坊早期建设;曾就职Sygnum(瑞士首家加密银行),负责数字资产银行业务,包括稳定币、多签和代币化产品。

核心技术团队 Milos Costantini、Peter Phillips 和 Lindy Han 分别对应Solidity核心开发、后端架构师和业务发展负责人。

总体看团队基因更像以太坊背景+传统金融合规经验的结合,使ENSO在技术创新和机构对接上都具备优势。

Connor的加密银行托管经验尤其关键,这解释了为何Ether.fi、Infinex等机构级项目选择ENSO作为底层。

抓住流量,理性参与

对不同的参与者来说,如果已持有BNB并参与快照,可保留部分空投代币观察项目的进一步发展和变化;而如果通过Alpha参与,首日追高或许并不是一个合理选择,可以等待空投抛压释放后再进行布局。

对链抽象和跨链而言,这些并不是新叙事,也不在近期市场注意力的焦点上;如果看好这个赛道,更多的可以将 ENSO 当做链抽象主题中的一部分进行配置,而非 all in 单币。

切记任何新币上线都伴随极高波动,币安的 Seed 标签更是一把双刃剑。做好风险管理,永远只投资你可以承受损失的资金。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。