Why Crypto Market is Up Today: Bitcoin, Ethereum, BNB Lead Comeback

Why did crypto suddenly bounce back after a shaky weekend? The global crypto market is buzzing again as easing trade tensions, renewed risk appetite, and strong Bitcoin-Ethereum momentum push total market capitalization to $3.98 trillion, up 3.8% in 24 hours. Here’s the full story behind today’s rally and what may happen next.

Bitcoin, Ethereum & BNB Lead a Powerful Rebound

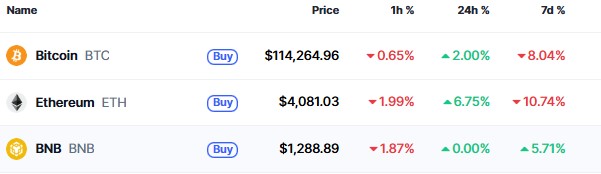

The rally was led by blue-chip assets. Bitcoin (BTC) climbed 2% in a day , trading at $114,247.65 , with a $2.27 trillion market cap and $95.68 billion in 24-hour trading volume. Ethereum (ETH) stole the spotlight with a 7% jump , hitting $4,086.80 and a $493.49 billion market cap. Trading volumes on ETH also spiked to $62.6 billion , signaling aggressive buying.

Source: CoinMarketCap

Source: CoinMarketCap

Meanwhile, BNB briefly broke its previous records , surging over 5% to a new all-time high of $1,370.55 , before stabilizing at $1,291.19 with a $179.7 billion market cap. This synchronized price action across top assets lifted overall sentiment, reversing the fear that dominated the previous week.

Trade Tension Eases, Trump Signals Cooperation

One of the biggest catalysts behind today’s surge is the unexpected cooling of US–China trade tensions . Over the weekend, China clarified that its rare-earth controls weren’t a full ban , calming fears of a supply shock. Shortly after, President Trump posted a reassuring message saying, “Don’t worry about China, it will all be fine,” praising President Xi in measured terms.

Markets interpreted this as a clear signal of de-escalation. “The rebound reflects a softer trade tone and renewed risk appetite,” explained Richard Galvin of DACM , highlighting how the shift flipped sentiment almost overnight. The tariff threat for November 1 remains, but traders viewed this week’s statements as a temporary green light for risk-on positioning.

Liquidations, Sentiment Shift, and Volatility Ahead

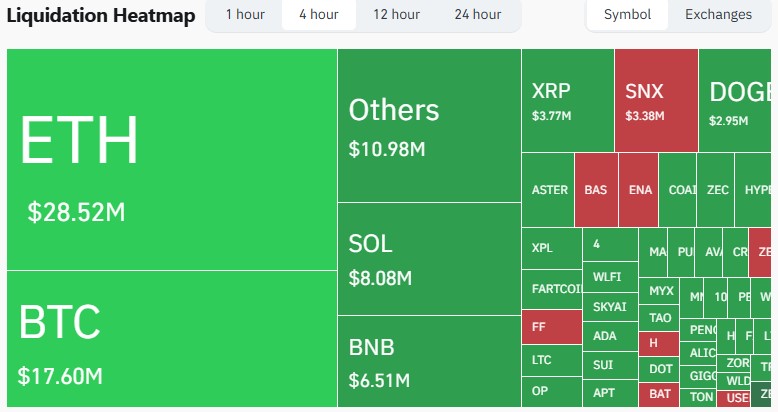

The liquidation heatmap also reveals how the rally gained strength. In the past 24 hours, 208,635 traders were liquidated , totaling $693.29 million . The largest single liquidation was an ETHUSD_260327 order worth $7.04 million on Binance. Within just four hours, $28.52 million worth of ETH positions were flushed out — $23.18 million long , $5 million short — creating the fuel for the rapid upside move.

Source: CoinGlass

Source: CoinGlass

At the same time, the Fear and Greed Index climbed from 24 (Extreme Fear) yesterday to 38 (Fear) today, showing a meaningful sentiment shift. Last week’s greed phase may be distant, but investors are cautiously stepping back in.

However, volatility isn’t gone. Upcoming US economic events , including the OPEC Monthly Report , Fed Chair Jerome Powell’s speech , and key manufacturing indices, could inject fresh movement. Around 10% of S&P 500 firms are set to report earnings, and any surprises could ripple through the crypto.

What’s Next for the Market?

The short-term outlook is cautiously optimistic . If trade headlines remain calm and earnings don’t shock global markets, this relief rally may extend further. But with tariffs still on the calendar and macro data ahead, traders should brace for sharp moves.

Conclusion

The answer to Why Crypto Market is Up Today? lies in a rare alignment of eased geopolitical tensions, strong price action from major tokens, and shifting trader sentiment. While the rally is encouraging, the coming week’s economic triggers will determine whether this bounce turns into a sustainable uptrend or faces another test.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。