AI代币和机构购买推动加密市场复苏

加密市场在周一强劲反弹,在经历了周末的剧烈抛售后,过去24小时上涨了4.96%,抹去了近8000亿美元的市场价值。此次反弹反映了技术修正、机构参与者信心的恢复以及以AI为重点的代币的激增。

加密市场在重大周末崩盘后反弹

根据市场分析师的说法,这次反弹是由于一次巨大的空头挤压,发生在一波大规模清算之后,许多资产进入了超卖区域。当市场变得稳定时,AI驱动的山寨币成为了焦点。ChainOpera AI上涨了70%,Bittensor上涨了超过35%,成为数字资产行业最新的轮换明星。

还有机构活动也促进了市场信心的重建。Marathon Digital积累了400 BTC,估计价值4600万美元,表明尽管近期波动,关键参与者仍然看好市场的长期机会。

比特币重新获得动能,交易价格超过115,000美元,结束了周末的下跌。以太坊也显示出轻微的复苏,徘徊在4100美元附近。币安币(BNB)成为当天的主要赢家之一,涨幅超过15%,突破1300美元水平。

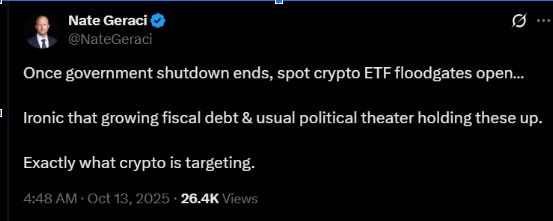

美国政府停摆拖延ETF审批

随着美国政府进入停摆的第三周,加密市场仍然处于紧张状态。由于联邦机构仅有少量工作人员在工作,所有待审的加密交易所交易基金(ETF)在SEC的审查已被暂停。

这已拖延了16个ETF申请,另外21个在10月初提交的申请仍在等待审议。长期停摆始于10月1日,当时立法者未能就资金协议达成一致,暂停了大部分非必要的政府职能。

SEC也没有采取任何行动,这打破了加密行业一个重要的里程碑月份。在10月,许多分析师曾预计数字资产的转折点,ETF的批准有可能带来新的机构投资。

但是,由于未能及时做出决定,投资者的乐观情绪正在减弱。要结束停摆,国会需要批准一项资金法案,并由唐纳德·特朗普总统签署,以恢复正常运作。

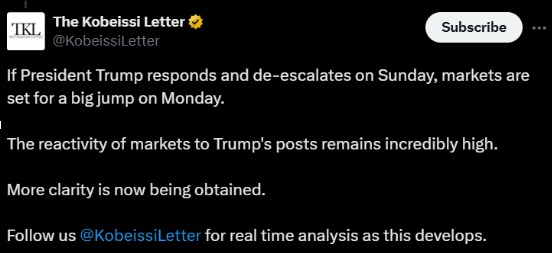

美中关系出现改善迹象

在影响全球市场的另一个发展中,美国和中国官员表示他们正在努力缓和近期的贸易紧张局势。本月初,这种摩擦加剧,中国对稀土矿物实施出口管制,而特朗普则对中国进口征收100%的关税。

在周末,中国商务部表示其准备进行谈判,特朗普在Truth Social上发文暗示软化立场。

市场分析师认为,这样的外交举动将有助于增强投资者信心,并可能推动加密市场。比特币最近再次测试其黄金交叉结构,这是一种通常伴随强劲反弹的技术指标,可能在全球金融市场中享有更好的风险情绪。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。