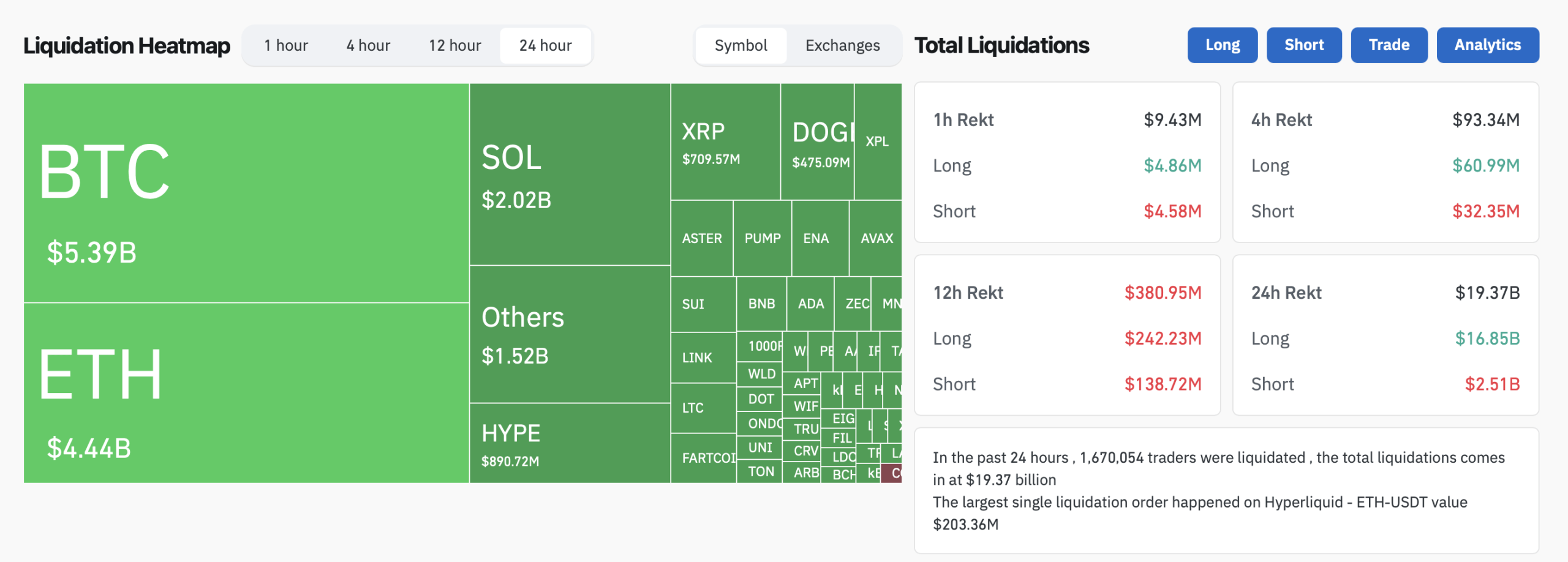

周五对加密市场来说是一场过山车,因为数字资产在经历了有记录以来最动荡的交易日之一后,努力恢复。来自衍生品平台的数据表明,近200亿美元的多头和空头头寸在24小时内被清算——这标志着加密历史上单日清算的最大规模,突显了杠杆如何使即使是最强劲的反弹变得脆弱。

每个周期,当市场下跌时,类似的社交媒体帖子便会爆发。名字变化,截图不同,但公式保持不变:一些鲸鱼或主要交易所的转账,一张血红的图表,以及瞬间的指控。这些帖子吸引了成千上万的点赞,因为它们触及了交易者内心最深处的不安——相信其他人秘密掌控着局面。但区块链的透明性并不等于理解;相关性并不等于因果关系。

问题在于,钱包数据看起来戏剧化,但缺乏背景。对主要平台的大额存款可能是内部再平衡,而不是清算准备。场外交易台通常会移动资金以满足客户的赎回或套利机会。如果没有与执行交易相关的时间戳,链上流动仅讲述了一半的故事。而当半个故事与恐慌结合时,就会滋生神话。

2025年10月11日来自coinglass.com的24小时清算数据。

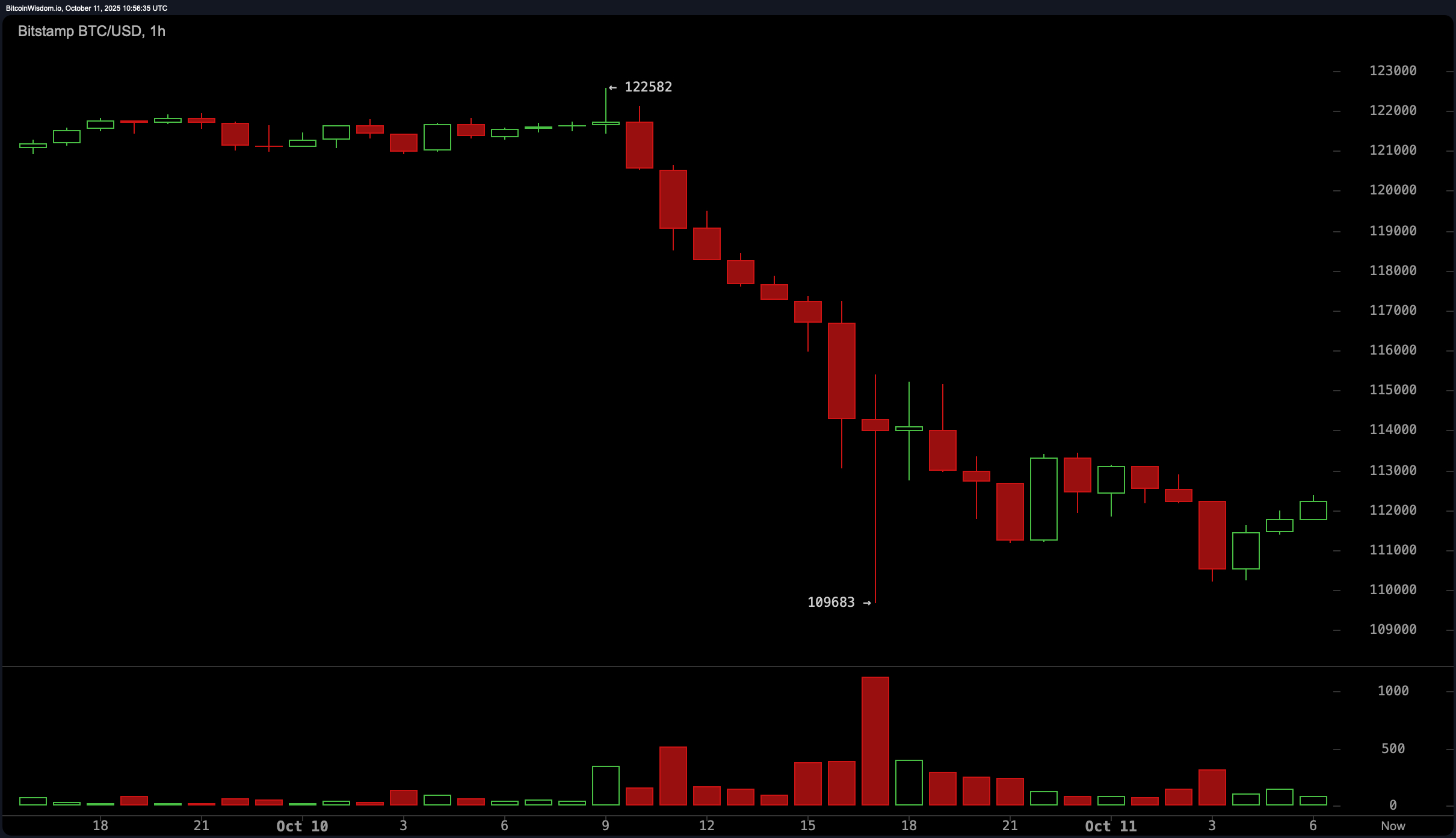

清算也承担了很大一部分责任,但背景很重要。本周早些时候的报告显示,仅在一个主要衍生品平台上,超过53亿美元的比特币和以太坊期权即将到期。与此同时,比特币徘徊在其“最大痛苦”水平之上——大多数期权到期时毫无价值的行使价格。将这一点与“十月上涨”的看涨情绪结合起来,过度杠杆的多头头寸迅速堆积,将热情转变为清算的狂潮。

加密仍然是少数几个叙事传播速度超过事实的市场之一。一条显示“7亿美元存款”的推文在任何人检查资金是否真的转移到现货市场之前,就获得了数万次的浏览。这是在人群中大喊“着火了”的数字等价物——总是混乱而麻烦。然而,大多数数据分析师知道,真正的操纵留下的痕迹要清晰得多。

比特币在2025年10月10日至11日的大幅下滑。

还有流动性的简单数学。当价格高时,价差收窄,杠杆增加。如果几个过度杠杆的头寸解除,级联效应看起来灾难性,就像近200亿美元的清算,但这只是一个反馈循环——机器人在弱势中卖出,交易者情绪反应,自动清算完成其余部分。相同的现象也发生在股票市场,只是没有表情包和激光眼。

尽管如此,很容易对信徒表示同情。加密在过去确实经历过真正的操纵。从交易稀薄的山寨币到协调的洗盘交易,伤疤依然存在。加密社区没有忘记FTX和Luna的混乱,这两次崩溃动摇了市场信心,重塑了数字资产的风险意识——提醒人们在加密中,信任可能比流动性消失得更快。

但假设每一次重大回调都是一个宏大的阴谋,给予少数参与者过多的信任,而对自由市场的混乱效率则给予不足。有时,比特币只是修正——不需要任何操控。

与此同时,主要平台在日益严格的审查和监管下运营。内部风险团队持续监控资金流入和流出,以避免系统性冲击。他们故意让价格崩溃以冒险失去信誉的想法违背逻辑——也违背了利润。他们的业务依赖于信任和交易量,而当交易者怀疑有不当行为时,这两者都会消失。

讽刺的是,这些“市场抛售”的叙事实际上可能会加剧波动。散户交易者恐慌性抛售,鲸鱼则选择退缩,流动性进一步减少——使得下一个下跌更加剧烈。以这种方式,阴谋论变得自我实现,并不是因为它是真的,而是因为足够多的人相信它。恐惧是一个强大的市场推动力,有时比基本面更强。

加密的透明性既是其最大的优势,也是其最大的诅咒。每一个钱包的移动和清算都成为头条新闻;每一笔交易都是一个理论。但经验丰富的投资者知道,噪音并不是所有的证据。在没有其他证据证明之前,这些抛售大多数只是市场一如既往的表现——快速、情绪化且极其高效。有时,最简单的解释也是最真实的。

因此,下次当信息流中充斥着清算图表、钱包ID和血腥表情符号时,深呼吸一下。问问自己这些数据是否证明了操纵,还是仅仅反映了市场的运动。因为在加密中,感知塑造价格——而恐慌往往在现实之前就已经印刷了故事。

最后,无论你是看多还是看空市场,有一点是肯定的——现任美国总统在网上搅动局势的能力确实很强。大佬在Truth Social上的一条帖子可以比一个表情包的上涨更快地改变情绪,将看涨的走势在你刷新信息流之前转变为看跌的暴跌。

💡常见问题解答

- 大额钱包转账是操纵的证据吗? 通常不是;许多是内部转移或场外交易结算。

- 操纵可能发生吗? 当然可以,但需要有有效的证据。

- 为什么比特币有时会急剧下跌? 清算、杠杆和情绪变化可以迅速级联。

- 交易者对这些谣言的最佳反应是什么? 验证数据,保持冷静,避免仅基于社交媒体的恐慌进行交易。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。