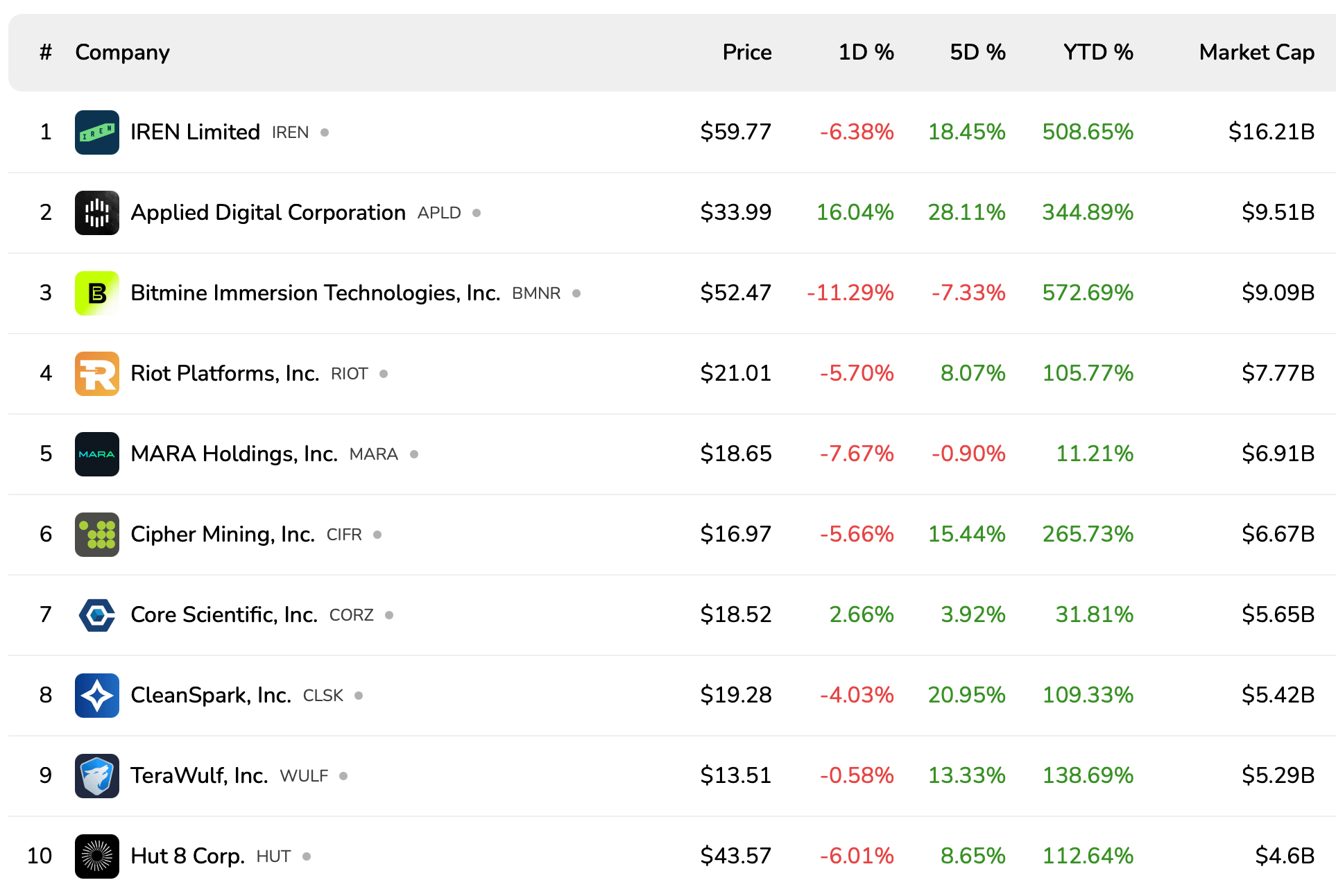

Amid yesterday’s downturn, bitcoinminingstock.io stats show IREN Limited (IREN) retained its position as the leading bitcoin mining company by market capitalization at $16.21 billion, even after its stock fell 6.38% to $59.77. Applied Digital Corporation (APLD) stood out as a rare gainer, surging 16.04% to $33.99 and lifting its valuation to $9.51 billion.

Bitmine Immersion Technologies (BMNR), the ETH treasury firm, saw one of the sharpest daily declines, tumbling 11.29% to $52.47 with a $9.09 billion market cap. Riot Platforms (RIOT) and MARA Holdings (MARA) also saw steep declines of 5.70% and 7.67%, respectively, closing at $21.01 and $18.65 on Friday afternoon.

The top ten publicly-listed bitcoin mining firms by market cap according to bitcoinminingstock.io.

In the mid-cap range, Cipher Mining (CIFR) fell 5.66% to $16.97 with a $6.67 billion valuation, while Core Scientific (CORZ) managed a modest 2.66% gain to $18.52, bringing its market cap to $5.65 billion. Cleanspark (CLSK) dipped 4.03% to $19.28, maintaining $5.42 billion in market value, and Terawulf (WULF) slipped slightly by 0.58% to $13.51. Hut 8 Corp. (HUT) declined 6.01% to $43.57, closing the top ten with a market cap of $4.6 billion.

Among smaller-cap miners, Bitdeer Technologies (BTDR) suffered the steepest decline of the day, down 13.31% to $17.78 with a $3.77 billion valuation. Bitfarms (BITF) provided a rare positive note, rising 0.71% to $4.20. HIVE Digital Technologies (HIVE) dropped 5.02% to $6.61, while Northern Data AG (NB2.DE) slipped 1.74% to $19.73. Bit Digital (BTBT) lost 6.46% to $3.76, and American Bitcoin Corp. (ABTC) fell 9.16% to $5.95.

Further down the list, Cango Inc. (CANG) decreased 7.01% to $4.31, Bitfufu Inc. (FUFU) dropped 4.34% to $3.74, and Canaan Inc. (CAN) saw a sharp 10.65% fall to $1.09. Digi Power X Inc. (DGXX) defied the broader market downturn, climbing 15.53% to $3.05, though it remains the smallest firm in the group with a $136.36 million market cap.

Overall, a majority of the 20 leading bitcoin mining stocks ended the day lower, signaling renewed investor caution toward high-volatility sectors following global equity losses. Despite the pullback, several miners—particularly Applied Digital and Digi Power X—showed resilience, suggesting that select players continue to attract investor confidence amid ongoing market turbulence.

💬 What caused the $1.65 trillion sell-off?

The drop stemmed from a broad risk-off sentiment across global markets, driven by trade war concerns between China and the U.S., unclear monetary policy, and weakening macroeconomic indicators.

📉 Why are Bitcoin mining stocks affected by general market movements?

Publicly traded miners are tied to both bitcoin’s price performance and broader market liquidity. When global equities fall, mining stocks often mirror that volatility due to high capital intensity and investor risk perception.

⚙️ Which companies performed best on Friday?

Applied Digital Corporation (APLD) rose 16.04%, while Digi Power X (DGXX) gained 15.53%, making them the day’s top performers in the publicly traded bitcoin mining sector.

🚨 Which firms saw the biggest declines?

Bitdeer Technologies (BTDR) and Bitmine Immersion Technologies (BMNR) posted the sharpest single-day losses, down 13.31% and 11.29%, respectively.

📊 What is the total market value of the top 20 miners?

Combined, the top 20 publicly traded Bitcoin miners represent around $89 billion in market capitalization, though this figure fluctuates with bitcoin’s price and market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。