$5.3B Crypto Options Expiry Favor Bitcoin ETF Inflows or ETH Spot ETF?

What happens when Bitcoin ETF Inflows keep rising but billions of dollars in crypto trades are about to end quickly? That’s what traders are watching this Friday. Around $5.3 billion crypto options expiry is approaching tomorrow, while money is still flowing into ETH Spot ETF and $BTC ETFs. This mix can bring big price moves in the crypto market. Let’s uncover how?

Crypto Options Expiry Meets ETF Momentum: What Will Happen?

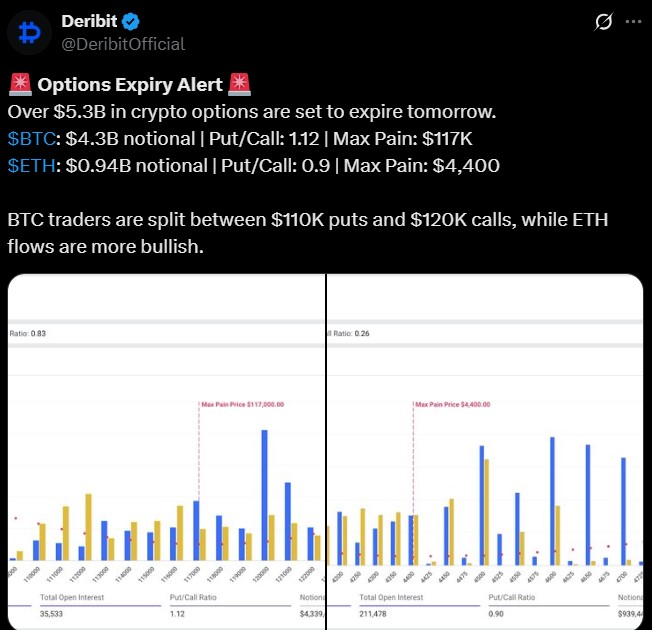

According to Deribit data , more than $5.3 billion in crypto options will expire on Friday, October 10:

-

Bitcoin Options Expiry $4.3B: Put/Call ratio 1.12, max pain $117,000. The above 1 call shows that people are betting on prices going down.

-

Ethereum Options Expiry $940M: Put/Call ratio 0.9, max pain $4,430. Its call is below 1, which means people are betting on bullish momentum.

“Max pain” is the price level where most option buyers lose and sellers win. Prices often move close to this level during the maturity date. So, Traders are eyeing the $BTC crash, while ETH looks a bit more bullish going into Friday.

Will Inflows Keep Fueling the Fire or Hold Soon?

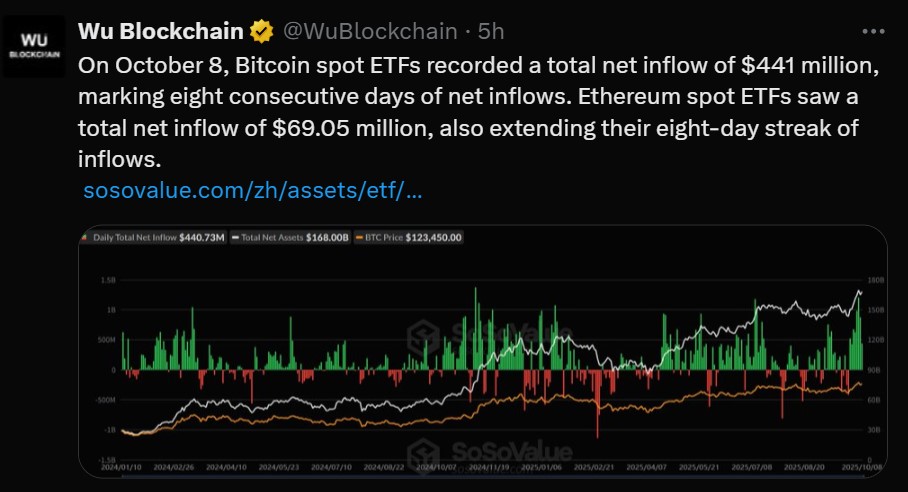

While expiry is coming, Bitcoin Ethereum ETF Inflows are still strong. According to Wu Blockchain :

-

Bitcoin ETFs inflows got $441 million on October 8.

-

Eth spot ETFs received $69.05 million, also their 8th straight day of influx.

This shows institutional investors are putting in more money. Strong capital influx can push both the asset’s price up. Analyst Crypto Rover pointed out that Ethereum often bull run exchange traded funds inflows increase, which means it could bounce after Friday.

How Friday’s Crypto Options Expiry Could Move the Market

ETH Spot ETFs hint post-expiry rebound for world’s biggest altcoin: Ethereum. Right now, it trades at $4,353.28, down 3.23% in 24 hours, along with $43.72B trading volume, reflecting a decrease of 23.13%.

Its $940M expiry shows a bullish momentum for the asset. There’s strong support between $4,300–$4,350. If the influx continues, it may climb back toward $4,750. But if it falls below $4,300, prices may correct further.

On the other hand, Bitcoin price is trading around $122,242.14, moving sideways after falling from $124,000. Its trading volume now sits at $58.13B, down 29.28% from the past 24 hours.

As per my TradingView price chart analysis, the RSI is at 64 which should mean the asset is not overheated yet, and there’s still room to grow. It is stuck between $122,000–$123,000.

However, With $4.3B in BTC options expiring and max pain at $117K, market makers may push prices down to reduce payouts.

With $4.3B expiring and max pain at $117K, market makers may push prices down to reduce payouts, so short-term dips toward $120K or below might happen tomorrow.

The only bullish thing for now is, Bitcoin ETF Inflows is still giving support to the asset.

Conclusion: Quick Outlook After Friday

Friday’s $5.3B crypto options expiry is a big test for both the top cryptocurrency assets. While expiration may pull prices toward max pain levels, Bitcoin ETF Inflows show that large investors are still buying, but if support doesn't hold then it will fall back to $117K.

On the other hand, ETH Spot ETF inflows are increasing, giving the asset stronger support. If $4300 holds, then a move towards $4750 may be imminent.

The way prices close on Friday may decide how October’s cryptocurrency trend plays out.

Disclaimer: This article is for informational purposes only and does not support any financial advice. The cryptocurrency market contains risk, so always do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。