作者:Nancy,PANews

加密现货ETF终于迎来质押时代。近日,Grayscale(灰度)公布重大进展,在美国推出首个支持质押的现货加密ETF,借助政策与合规路径率先打开链上质押的参与通道,但其资金流入表现相对平淡。与此同时,随着ETP通用上市标准新规落地,现货加密ETF的竞争正加速升级。

灰度率先开放质押,市场反应低于预期

10月6日,灰度宣布旗下以太坊信托ETF(ETHE)和灰度以太坊迷你信托ETF(ETH)正式成为全美首批支持质押功能的现货加密资产ETF。

同时,灰度Solana信托(GSOL)也已启动质押功能,为投资者提供了通过传统券商账户参与SOL质押的独家渠道之一。随着监管批准的推进,GSOL有望成为首批支持质押功能的现货Solana ETP。灰度方面表示,未来计划将质押扩展至更多产品。

根据官方披露,其将通过机构级托管方(如Coinbase和Figment等)与多元化验证者网络进行被动质押,以保障底层区块链协议安全,同时支持网络的长期弹性。在质押收益中的分配方面,ETHE股东可获得高达77%的总质押收益,其余23%则归发行方、托管商及质押服务商;而ETH产品的投资者收益比例更高,达到94%,三方仅收取6%的分成。

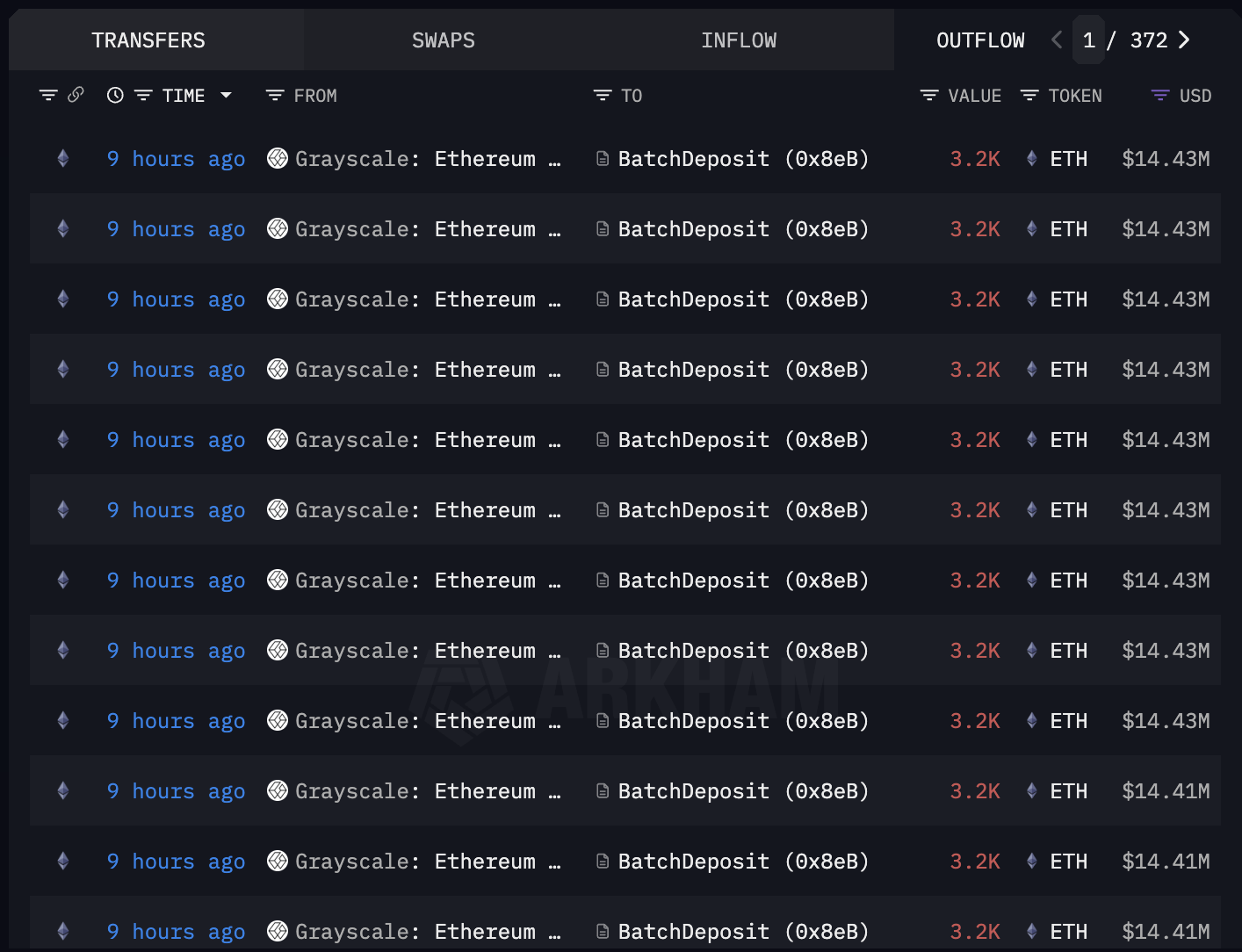

自质押功能开启以来,链上数据显示,灰度已质押超116万枚ETH。其中,ETHE 持有的 ETH 中49.46%已完成质押,ETH中的质押比例则为47.79%。而根据ValidatorQuene的数据,当前排队进入质押的ETH数量约为136万枚,灰度质押的ETH占比达85.4%。

灰度的质押功能引入,被认为填补了以太坊现货ETF产品在质押收益方面的空白,为机构投资者提供了新的被动收益渠道,或将吸引更多资金流入。然而,从资金流动来看,市场反应相对平淡。 SoSoValue数据显示,自10月6日以来,ETHE净流出195万美元,ETH净流入约2417万美元,相比之下同期贝莱德的ETHA却吸金超6.7亿美元。

借政策与合规捷径抢先布局,政府停摆或延缓其他ETF审批进程

在灰度正式开启以太坊ETF质押功能之前,包括贝莱德、富兰克林邓普顿在内的多家发行商,也曾尝试提交增加质押功能的提案,但均多次遭到美国SEC推迟审议。灰度之所以能够先行一步,关键在于其巧妙利用了美国监管框架的结构性差异及近期政策松绑,从而绕过传统审批的漫长流程。

灰度的ETHE和ETH是根据1933年证券法注册的ETF,而非1940年投资公司法管理的基金。与后者需要经过严格运营审批不同,前者只需SEC审查披露文件即可。这意味着ETF可在不直接持有大部分现货资产的情况下(如通过信托结构),灵活调整功能,例如增加质押,而无需额外的SEC绿灯。相比之下,贝莱德和富达等发行方依据1940年投资公司法,增加质押机制需经过完整审批,因此多次遭遇SEC延期。

上个月,灰度面向股东提出了三项修订信托协议的提案,使旗下以太坊现货ETF产品能够质押并获得相应的质押收益,包括授权信托进行以太坊质押、允许发起人收取额外的质押费用以及赋予发起人在特定条件下对信托协议进行修改的权限。这三项提案均以高票通过,其中质押授权提案获得了99.75%的股东支持。

更为关键的是,SEC于今年9月通过了加密ETP通用上市标准,允许交易所(如NYSE Arca)在新产品符合基本条件(流动性、透明度及合规披露要求)时,可自主批准上市和新功能调整,无需再逐案提交19b-4规则变更申请。在新规则生效后,灰度也于9月29日撤回了其质押功能修订申请,并顺利获得SEC批准,使以太坊ETF能够在NYSE Arca通用上市框架Rule 8.201-E下运行,实现无需单独审批的上市和交易。

借助政策与合规路径的灵活性,灰度成功抢先布局,成为市场上率先支持质押的现货加密ETF。而随着SEC对加密资产ETF监管政策的逐步放宽,更多发行商正加紧推出或跟进支持质押功能的产品,引发新一轮竞争。比如,21Shares最新宣布为旗下以太坊ETF引入质押,并提供一年的赞助费豁免;Bitwise设定Solana质押ETF费率为0.20%,低于市场预期等。

不过,美国政府已进入停摆状态,目前SEC仅保留极少数应急人员运作,这意味着加密ETF的审批工作将受到一定限制,短期内可能影响其他ETF质押功能的上线节奏。

相关阅读:美SEC新规后决策日期“失效”:五大候选谁将通关10月加密ETF

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。