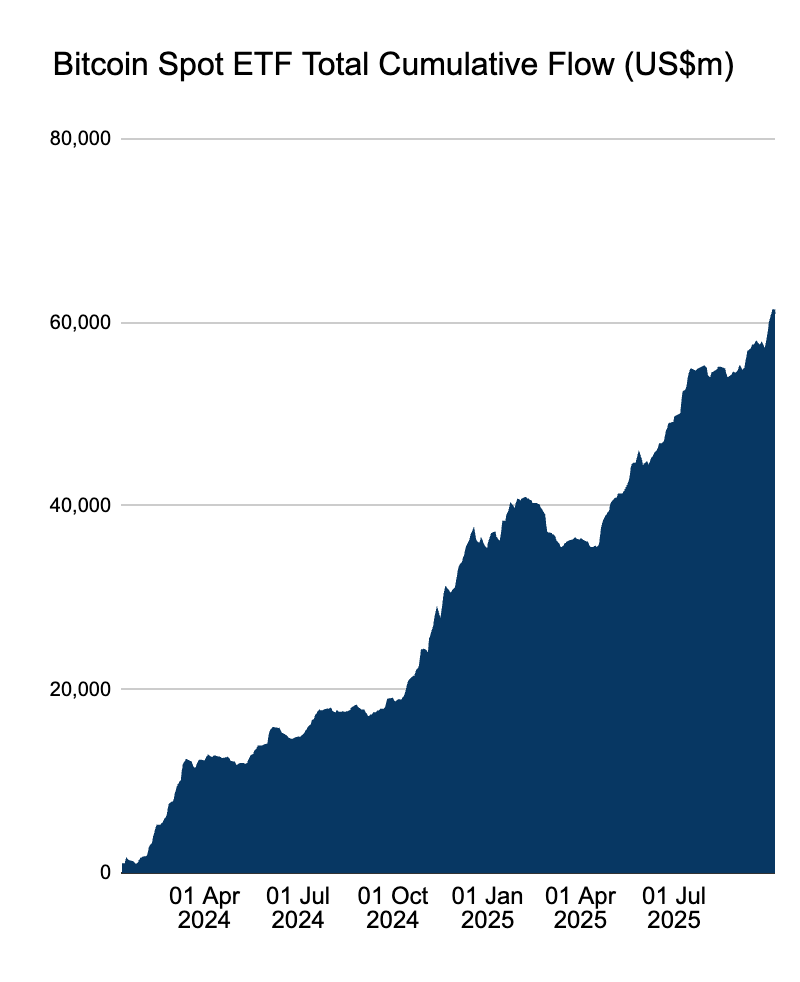

As the spot Bitcoin ETF injects $5 billion to $10 billion into the market each quarter, institutional demand for Bitcoin is accelerating.

This new wave of funds is tightening Bitcoin supply and reinforcing its long-term bullish structure.

Hong Kim, Chief Technology Officer of Bitwise, cited data from Farside Investors, stating that ETF inflows have formed a "clockwork-like" stable force, describing it as a "long-term trend that cannot be stopped even by four-year cycles," and predicting "an increase will reoccur in 2026."

The continuous inflow of funds reflects a profound transformation in the way traditional finance interacts with Bitcoin. This flagship cryptocurrency, once dismissed as a speculative asset, is now being absorbed through regulated investment tools, bringing predictable and sustained liquidity.

The global crypto fund (including Bitcoin and Ethereum-themed products) has surpassed $250 billion in assets under management, indicating that institutions are incorporating digital assets into diversified portfolios.

The stable inflow of institutional capital not only drives up prices but also reshapes the supply landscape of Bitcoin.

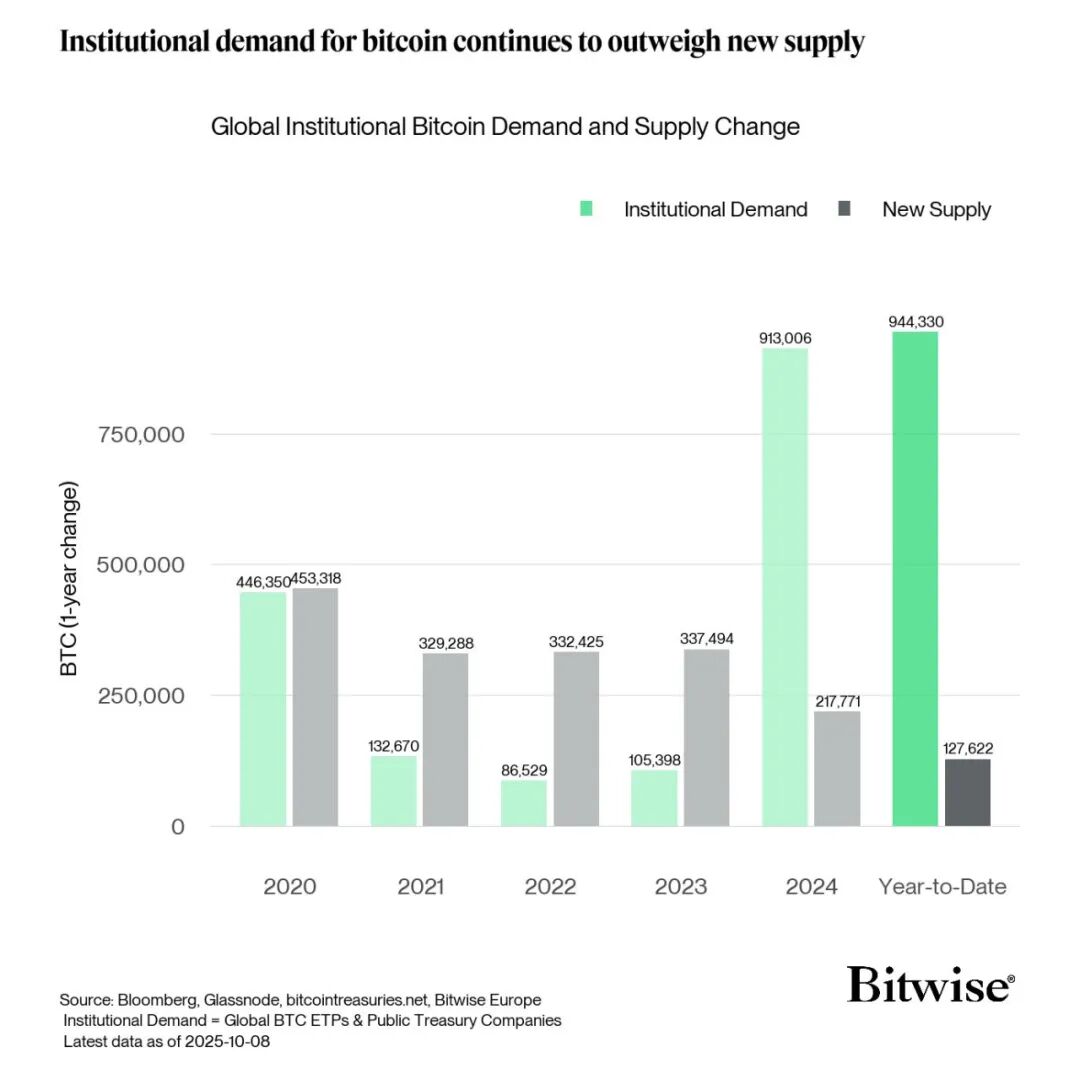

Andrei Dragosh, Head of Research for Bitwise Europe, revealed that institutions have accumulated 944,330 Bitcoins by 2025, surpassing last year's total of 913,006.

In contrast, miners have only produced 127,622 new coins this year, with institutional purchases being 7.4 times the new coin supply.

This imbalance stems from the final approval of the spot Bitcoin ETF by the U.S. Securities and Exchange Commission in 2024.

The approval triggered a structural shift: the demand from regulated funds suddenly outpaced supply, reversing the low institutional participation seen from 2020 to 2023 due to policy uncertainty.

BlackRock's entry through the iShares Bitcoin Trust is symbolic, prompting other giants to follow suit.

As U.S. policy signals warm and the recognition of Bitcoin as a treasury reserve asset increases, this trend is expected to continue into 2025. Some government-backed enterprises have begun to directly include Bitcoin on their balance sheets, highlighting its growing institutional credibility.

Given that there are still nearly three months left in the year and fund inflows show no signs of slowing down, analysts expect the Bitcoin supply shortage to intensify.

The gap between issuance and demand indicates that ETF-driven asset accumulation has changed the market fundamentals, causing Bitcoin to gradually shed its speculative nature and transform into a global financial instrument with sustained institutional demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。