Hyperliquid 结盟做市商,提供 HyperCore 的初始流动性,但这一切都建立在对 $HYPE 的预期上,即做市商会得到更长期的利润分成。

上文提到过,HyperBFT 的节点逐步扩大的方式是换仓,即基金会的代币份额转移至做市商节点手中,以利益换取他们的长期流动性承诺。

$HYPE 由此成为 Hyperliquid 的负债,需要同时满足做市商、HLP 和代币持有人的各项需求,需要注意,三者需求并不完全一致,如果 $HYPE 价格长期不涨,散户持有人必然抛售,造成做市商利益受损,但是涨的过快也不行,过高的价格轻则引发巨鲸抛售,重则经济学崩溃。

合理的 $HYPE 价格应该是 $BNB 的 10% 即 100 美元,但是均价 $50 的震荡行情,反而为价格留了足够的升值空间,以及熊市行情下较低的下跌起点,减缓承压。

安全性售出之前

直接卖流动性就是 MM 的价格,一定要包裹成屠龙少年。

币圈的任意产品/生意/模式,核心都要解决两个问题:

1. 把什么作为资产在售卖

2. 用什么样的方式去售卖

在 HyperEVM 启动前,面临市场中心化程度过高的“指责”,Hyperliquid 团队开始扩展 HyperBFT 节点,逐步引入外部参与方,并且 2 月初推出 HyperUnit,便于外部资金进入 HyperCore,为外部公链和 HyperEVM 打通埋下伏笔。

一如 2024.10 上线 Builder Codes,直至 2025.7 集成 Phantom 引爆市场流量。

图片说明:HyperEVM 主要节点

图片来源:@zuoyeweb3

2025.2 月,HyperEVM 上线,随后,读写 HyperCore 和 HyperEVM 的预编译合约在 4-7 月逐步成型,之后便是生态项目的逐步上线。

真正给我们启发的是,在 31% 的代币份额空投分发之后,此时埋下 Hyperliquid 换仓的巨大抛压,在 HyperCore 空投 3 月后便上线 HyperEVM,如果没有预研是说不过去的,更合理的解释是挑了个时机去做:

1. 此时 $HYPE 节点稍微分散一些满足大众预期;

2. 并且价格在 25 美元以下徘徊,对于参与节点的各方而言价格相对可以接受;

3. 对于 Hyperliquid 团队“拉盘”压力较小。

节点分散,换仓开启,把安全性作为资产的方式卖给节点,在将 HyperCore 安全性迁移至 HyperEVM 之前,$HYPE 完成第一阶段大额交易。

项目创造在链上,资产发行在交易所。

加密网络效应可以约等于公链和 CEX 两种,稳定币是唯一跳出加密走向传统世界和人群的离群点。

纵观 FTX 崩溃后的加密时间线,ETH L2 的重点不是 ZK,而是 MegeETH 等“Solana”化的高性能 L2,Monad/Berachain/Sonic(Fantom) 等都是围绕自身主网代币刺激流动性,流动性对其并无长期偏好。

在交易所竞争中,如何面对币安是 OKX/Bybit/Bitget 等离岸所,Coinbase/Kraken 等合规所,以及新锐 Robinhood 的主线任务,不约而同选择是“交易一切”,Robinhood 选择 L2、预测市场和 $CRV 等山寨币,Kraken 走向钱包、L2、USDG 和上市,Bybit 扶正 Mantle,OKX 重设计 XLayer,以及来搞笑的 Bitget UEX(全景交易所)。

无论交易所还是公链,都希望打通流动性和代币的循环,发币之前,代币单向刺激流动性相对简单,发币之后,流动性赋能代币,进而代币反哺流动性的双向循环大多不成立,从 Berachain 到加密之王 AC 的 Sonic 莫不如是。

一切加密货币的历史都是创造资产的历史,自比特币以来,公链成为资产创造、发行网络的发生地,但是高昂的进入成本,让 CEX 这种完全不中心化的平台成为拉新人、上新币的超强中介,甚至据此发展出交易所公链这类依附性产物。

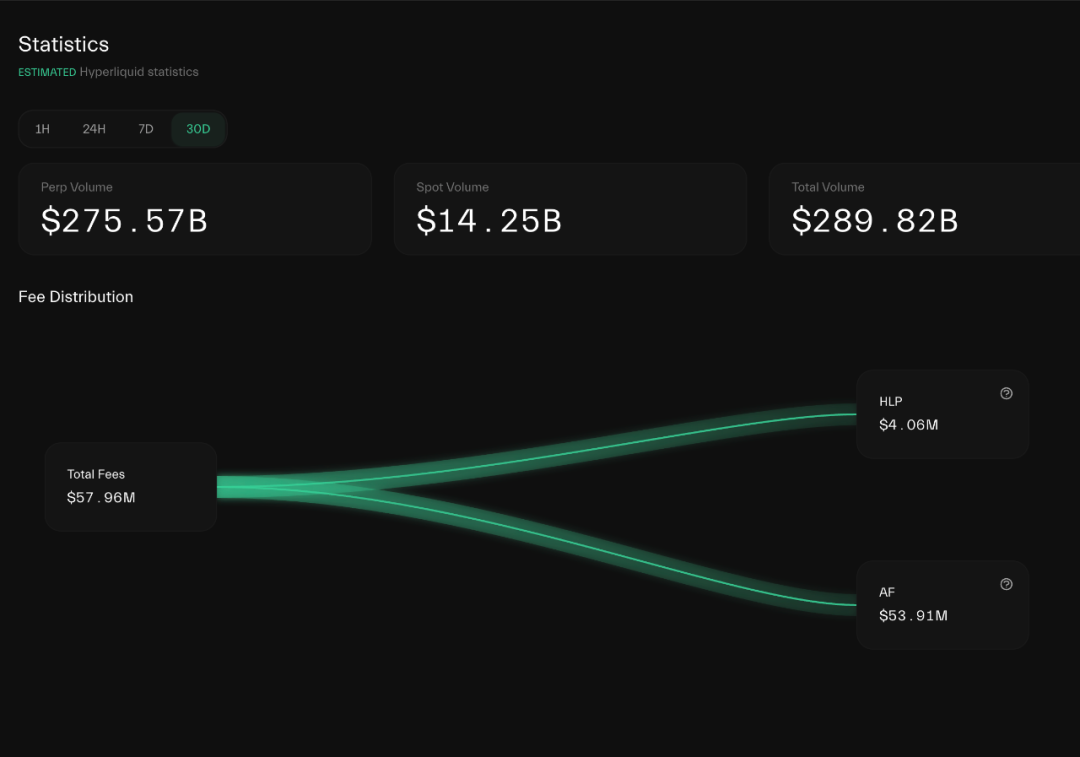

图片说明:Hyperliquid 手续费流向

图片来源:@hypurrdash

如果只观察 $HYPE 的市场表现,很难将其和代币刺激的项目区分开来,毕竟 92% 以上的收入都用于简单粗暴的回购。

Hyperliquid 的流动性也是刺激而来,但是通过较为平缓的换仓模式,以及团队自身的克制,加上无传统 VC 的集中解锁抛售机制,稳住了 HyperCore 的流动性和 $HYPE 价格的相对稳定。

所以 HyperCore 在复刻 CEX 的流动性之后,必须走向开放公链架构,让 $HYPE 变得更像 ETH 一样,成为具备真实消费场景的“货币”,目前来看,远未做到这一点。

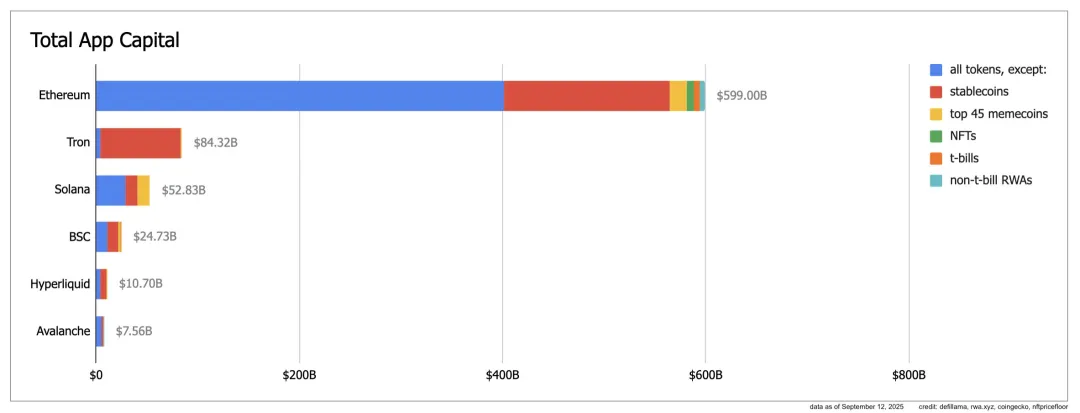

图片说明:App Capital

图片来源:@ryanberckmans

根据 App Capital 指标,以太坊依靠山寨币和稳定币流通规模达 6000 亿美元,Tron 依靠稳定币一枝独秀,Solana 结构较为健康,稳定币、山寨币和 Meme 三分天下,但是规模较小,Hyperliquid 主要是稳定币和山寨币,触及 100 亿规模。

Note

App Capital 衡量公链的真实资金流动规模,不计算主网自身代币的价值,并且只计算其上代币的流通价值,而非 FDV 或者 TVL。

或者可以说,Hyperliquid 上的资产,除了 Unit 桥接而来的 BTC/ETH/SOL 之外,主要是 $HYPE 的赋能,这和不计算主网代币不冲突,因为 Kinetiq 等 LST 包裹而来的 $kHYPE 也是“DeFi”代币,Morpho/HyperLend 主要也是基于 $HYPE 的刺激而进入 HyperEVM 生态。

我们主要来解释后者,在表面上看,HyperEVM 不依靠回购或补贴发展自身生态,但实际上,生态项目呈现出两个特点:

1. LST、借贷、Yield 主要围绕 $HYPE 派生资产发展;

2. DEX 等中立工具无法起量,HyperSwap TVL 很少。

以 Kinetiq 为例,其更像是 $HYPE 的链上再发行商,从 Lido 版 LST 起家,逐步进入借贷、稳定币、Yield 等各产品线,其 TVL 在 25 以美元左右,而 Kinetiq 自身也是 HyperBFT 节点之一。

与之对比,HyperEVM 上的主要 AMM DEX HyperSwap TVL 只有 4400 万美元左右,固然有和 HyperCore 定位冲突之处,但是相较于 Pancakeswap 的 25 亿 TVL,以及 Uniswap 的 55 亿 TVL,还是极端逊色。

这也验证 App Capital 的重要性,HyperEVM 上的资产仍旧是 $HYPE 的再发行渠道,距离成为独立的生态系统还有很远的路。

流动性卖出之后

Choice is an illusion created between those with power and those without.

虽然 Hyperliquid 极力想打造 HyperEVM 的价值闭环,但截止目前,依然在围绕 $HYPE 和 HyperCore 流动性,HyperEVM 自身价值并未与之协同。

这里和我们日常的理念框架有所冲突,在看到的任意资料中,都会提及 HIP-3、Core Writer 和 Builder Codes 的伟大意义,好像这三者让 HyperCore 的流动性无缝迁移至 HyperEVM。

但这是一种“幻觉”,HyperCore 通过以上技术创新,卖出的是一种“流动性”部署权,并不等于为项目提供交易流动性。

更直白一点,Hyperliquid 卖出的是 HyperCore 的技术架构,一如 Aave 的友好分叉。

Tip

Aave DAO 设计友好分叉模式,第三方可直接使用 Aave 的代码进行开发,但是要将部分协议收入分给 Aave,HyperLend 便是一例。

从 Read Precomplies 到 Write Precomplies(即 CoreWriter System),构建起 HyperEVM 上直接读写 HyperCore 数据的能力,这其实是二者打通的通用模式,即开放 HyperCore 的访问权限。

访问权限≠流动性初始化,任意想要使用 HyperCore 流动性的 HyperEVM 项目,都要自行寻求资金引发流动性。

Hyperliquid 不会提供补贴,这就需要项目方各显神通,HyperBeat 寻求外部融资,Hyperlend 坚持社区主导。

这就创造一种不对等关系,Hyperliquid 不会为 HyperEVM 项目提供 $HYPE 激励,但是诱导他们围绕 $HYPE 进行建设,以推动代币的真实使用。

从 Invite Code 到 Builder Codes

事实上,这在 Builder Codes 上已经显露端倪,以往的 CEX 返佣凸出设置邀请码区分来源,考验的是地推和社团长的“传销”与转化能力,所以 CEX 会疯狂投放大小 KOL。

但是 Hyperliquid 走的是淘宝返佣模式,并不介意你改头换面,鼓励开发者和项目方围绕 HyperCore 流动性去创业,去建设自己的品牌和前端,HyperCore 甘愿承担流动性供应商的角色。

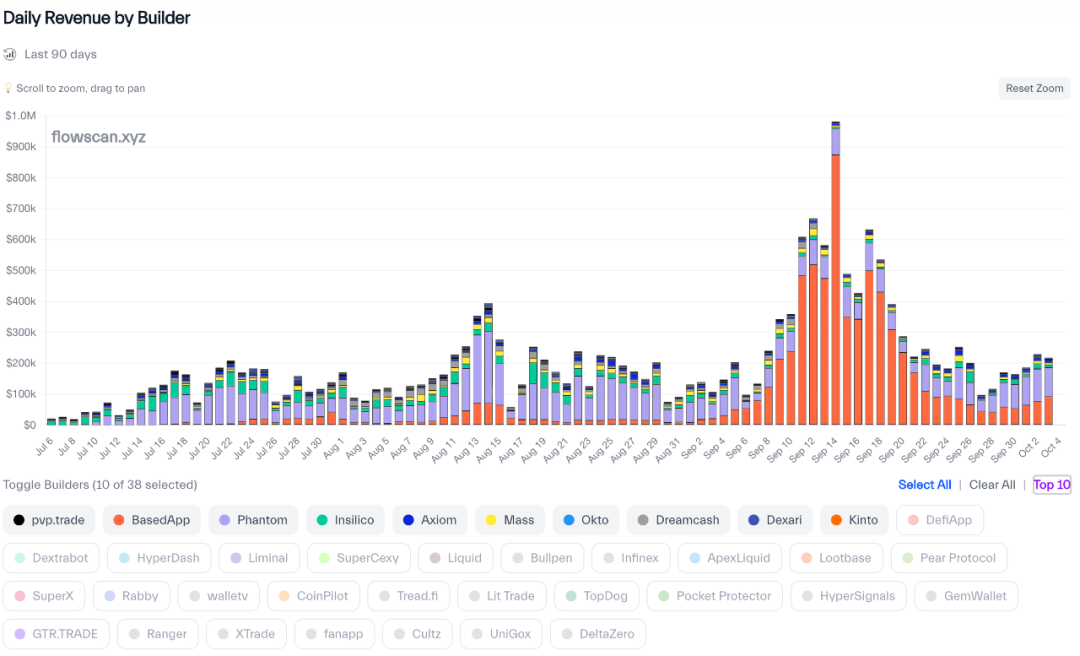

图片说明:Builder Codes 收入排名

图片来源:@hydromancerxyz

HyperCore 提供统一流动性后端,BasedApp 可以打造自己的 Robinhood 体验,Phantom 可将其合约嵌入自身生态,任意定制,分润即可。

从固定合约到自定义合约

仿照 Builder Codes,Hyperliquid 推出 HIP-3 提案,允许用户在 HyperCore 上自建任意合约市场,包括预测市场、外汇或者期权等。

从产品层面而言,这是继现货拍卖后的合约拍卖机制,依然是 31 个小时一轮,无非是要求 50 万枚的 $HYPE 保证金(约 2500 万美元)。

但是,经由 Core Writer 协议的补充,HIP-3 实则在打通 HyperEVM 到 HyperCore 的循环杠杆,HIP-3 本就由 LST 协议 Kinetiq 提出,并且 Kinetiq 自身也运行 HyperBFT 节点。

经由 CoreWriter 和 HIP-3 协议,Kinetiq 引导至 HyperEVM 链上 DeFi 协议的 $HYPE 现在要重新回流至 HyperCore,引发事实上的通缩。

进一步,Kinetiq 还提供众筹拍卖服务,大家可以一起组团集资拍创建权,可以设想一下,HyperCore 上质押的 $HYPE,最终成为 HyperCore 的合约保证金。

1. 用户集资或项目方提供 50 万枚 $HYPE 参与竞拍;

2. 项目启动后在 HyperCore 部署,初始交易流动性自行解决;

3. 项目方产生的手续费以 $HYPE 计价分润 50% 给 Hyperliquid;

4. 项目不当行为,Hyperliquid 会按比例罚没质押的 $HYPE;

从更好理解的角度而言,HyperCore 交易量是 $HYPE 的估值基础,HyperEVM 是 $HYPE 的估值放大,让生态去博弈价格基准,并且提升真实的使用量,摆脱对回购的过度依赖。

在双重架构体制下,可控的 HyperCore 需要自由的 HyperEVM,只有补齐开放权限,才能让 $HYPE 的价值螺旋升天。

在 HyperCore 的回购机制下,Hyperliquid 的增长故事只能是成为完全体的币安,HyperEVM 让 $HYPE 本身有成为引发次级流动性的选择。

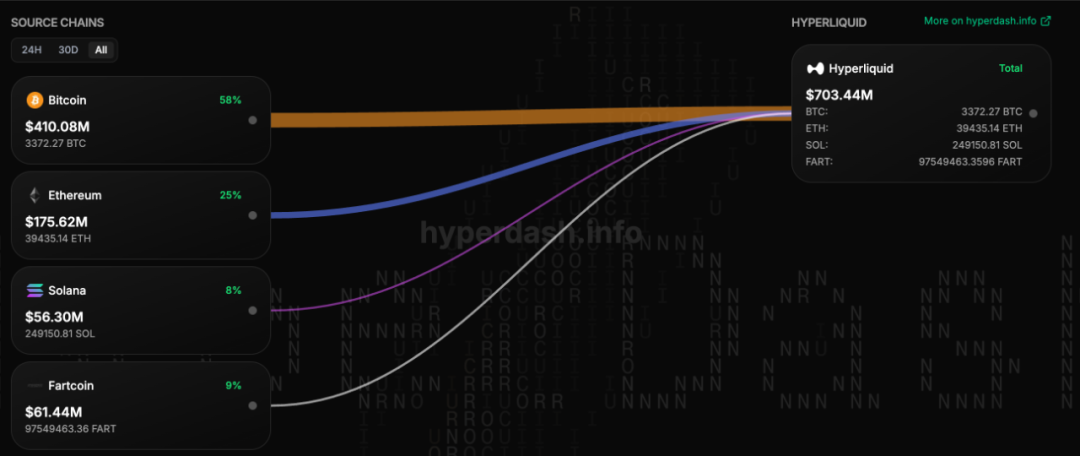

图片说明:Unit 桥接资产分类

图片来源:@hypurrdash

这就类似用 Unit 引入 BTC/ETH 的目的是促进 $HYPE 作为交易手续费的增长,别忘了 $FTT 作为 FTX 主要资产储备的下场是崩溃。

HIP3 和 CoreWriter system 彻底改变 Hyperliquid 的估值和定位,$HYPE 将以完整的公链+交易所状态出击。

结语:从 S1 到 S3

I don’t wear my heart upon my sleeve.

本文侧重拼凑 Hyperliquid 如何组织 HyperEVM 的初始流动性,较少关注 HyperEVM 生态现状。

现在 HyperEVM 基本可以视为 $HYPE 的包裹和杠杆放大器,尚未有真正脱离对 $HYPE 的依赖的项目或机制,大多是对 ETH 项目的迁移或模仿。

突然之间,Hyperliquid 为 Season 2 用户投放 NFT,考虑到 Season 1 考察 Perp 交易量,Season 2 考察现货+Perp 交易量,S3 大概率会考察 HyperEVM 交易量。

在面临 Aster 等竞争对手进攻时,Hyperliquid“补发” S2 NFT,既可以促进 HyperEVM 交易量,还能为 S3 打好前站,环环相扣,真是奇妙。

先做可控的 HyperCore,再做开放的 HyperEVM,你以为链接器是 CoreWriter system ,实则是 $HYPE 的双重作用。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。