作者:tradinghoe

编译:深潮TechFlow

Memecoins 是骗局?

大家都这么说,但实际上,Memecoins 是加密领域中最诚实的一部分。它们在每一个市场叙事中持续存在,这揭示了一个令人不安的事实:或许它们才是信号,而其他的一切都是噪音。

加密货币承诺要实现金融民主化。这一目标确实实现了,只是方式超出了所有人的预期。

所谓的“民主化”并不是每个人都可以访问去中心化金融(DeFi)原语或参与治理,而是任何人只需要几枚 SOL(视具体区块链而定)和一点讽刺精神,就能发行一种代币,追随当前流行的叙事,并可能赚得比那些真正构建基础设施的工程师还多。

在 memecoins 的投机行为——充满骗局、百倍收益的赌注——这一切在每一次熊市、每一次监管打击、每一篇“这是顶点”的深度分析文章中都能幸存下来。为什么?因为他们破解了加密货币的本质:一个全球赌场,赌场永远开放,而叙事就是产品。

并且该产品有配方。

当你观察研究具体的案例时,这个公式就不言而喻了。三个叙事,三波 memecoins ,每次都遵循同样的剧本。

-

@Plasma 于 2025 年 9 月推出,是一个为稳定币设计的高速、EVM 兼容的 L1 区块链,提供零费用转账和比特币支持的安全性。他们通过公开发售和多轮融资筹集了超过7000万美元。

在短短一周内,Plasma 吸引了 55 亿美元的总锁仓价值(TVL),其 XPL 代币市值飙升至 23 亿美元。从各项指标来看,这是一次成功的发布。

但投机行为并不关心你的路线图。

这就是 memecoin 交易者的优势所在:他们不是在分析 Plasma 的技术,而是在统计词频。

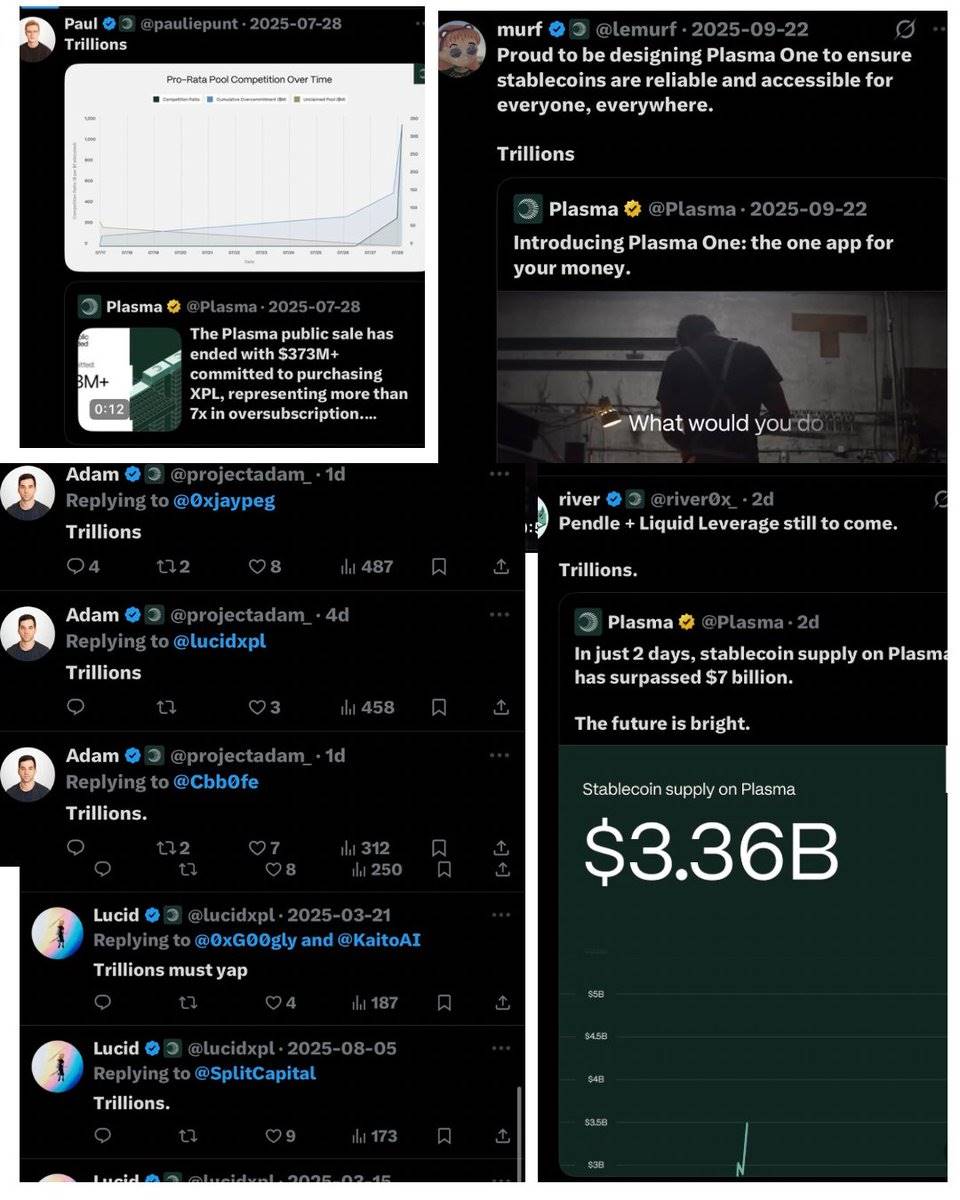

在 Plasma 发布的那一周,“trillions”(万亿)这个词在团队账号、文章、公告、KOL 报道中出现了无数次。“万亿级稳定币交易量。”“万亿次交易。”

图:“万亿(TRILLIONS)”这个词成为了 Plasma 叙事的代名词

Memecoin 交易者看到了一个简单的等式:高叙事速度(稳定币)+ 重复的流行梗 + 新鲜的流动性 =注意力套利

几天之内,$TRILLIONS 上线了。这是一种除了存在于 Plasma 上并承载该链最常重复词汇之外什么都不做的 memecoins 。

图:这就是叙事速度转化为一个代币符号

他们的优势不在于技术分析,而在于模式识别:发现叙事,捕捉流行梗,在炒作周期达到顶峰之前进行部署。

这就是注意力套利;交易叙事速度,而不是技术基础。

去中心化交易所(DEX)之战:三个竞争对手,一个memecoin

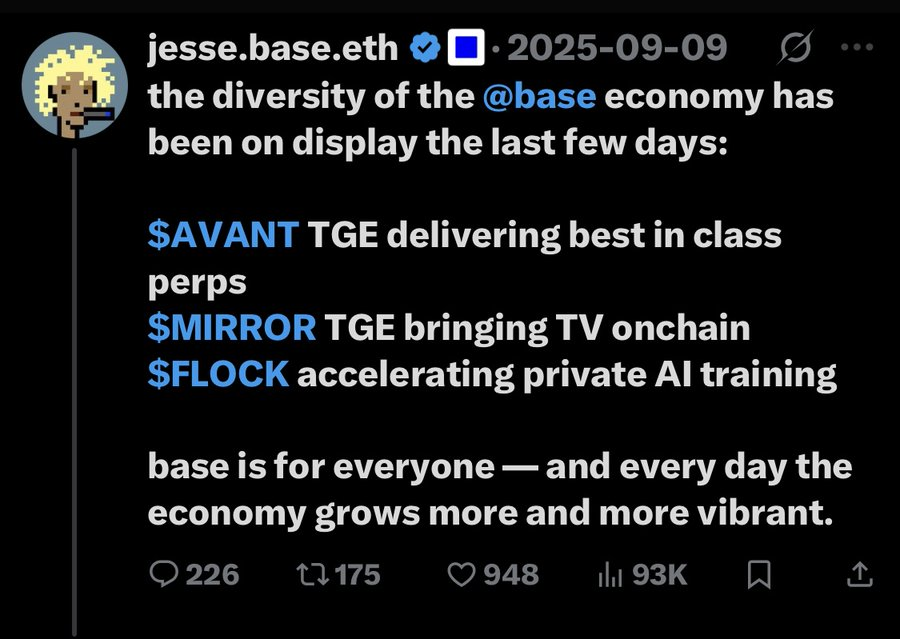

在 Plasma 上线之前,三个永续合约 DEX 相继出现,每个都获得了主要交易所的支持:

1.@avantisfi(Base/coinbase 生态系统)

-

在 Coinbase 的 Base L2 上线

-

获得 Pantera Capital 支持

-

被誉为“Base 的顶级永续合约 DEX”

-

上线时锁仓总额(TVL)达 2300 万美元

图:Coinbase 创始人 Jesse 发推称赞 AVNT 是 Base 上的顶级永续合约 DEX

2.@Aster_DEX(BNB 链 / 币安生态系统)

-

由 Yzi Labs 支持

-

前 Binance 团队开发,币安创始人 CZ 担任顾问

-

交易量达 460 亿美元,一度超越 Hyperliquid

-(Bybit生态系统)

-

由 Bybit 支持

-

代币回购计划

叙事:交易所之间争夺 DEX 主导地位,每家都试图在其生态系统中复制 Hyperliquid 的成功。

memecoin 交易员看到的是::到处都是“Hyperliquid 竞争者”。三个类似的项目,相同的定位,都在竞争成为“Hyperliquid 杀手”。

交易者对无休止的 Hyperliquid 竞争者比较以及三者之间不断轮换的关注感到疲惫。

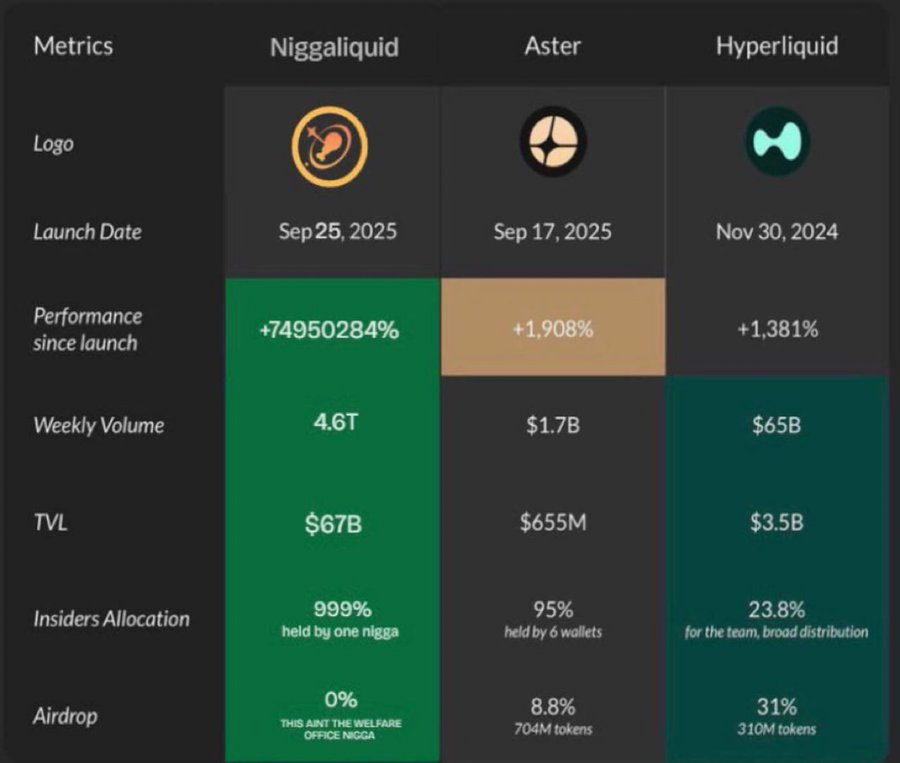

几天之内,@niggaliquidx在 Solana 上线。

图:这就是 NiggaLiquid:一个笑话就是个产品

没有任何支持,不是 Hyperliquid 的竞争者。它只是 Solana 上的一个 memecoin,利用了当前围绕 DEX 战争的注意力经济。

这是最纯粹形式的注意力套利:DEX 战争通过真正的开发活动吸引了注意力;AVNT 在 Base 上构建,Aster 达到 460 亿美元交易量(由于流动性挖矿),Apex 与 Bybit 集成。

而 NiggaLiquid 仅仅通过在 DEX 战争讨论高峰期作为 memecoins 存在,就在几个小时内就吸引了同样的关注。它只是一个恰好在“Hyperliquid 竞争者”疲劳高峰时出现的代币符号。

结论

优势:同时玩转赌场的两面。

注意力套利交易者的优势在于:他们并不在基本面和 memecoins 之间做选择,而是同时进行两种操作。

最优秀的 memecoins 交易者并不是对 DeFi 或加密领域的事件一无所知;他们比大多数人理解得更深刻。他们阅读了 Plasma 的文档,关注了合作伙伴关系公告,监控了团队账号。不是因为他们在投资基础设施,而是为了确定注意力具体会集中在哪里以及何时达到顶峰。

这是很多交易者忽视的注意力不对称:

-

DeFi 基本面分析师:花费数月研究新技术,分析代币经济学并等待合适的入场时机。但当他们投资时,注意力窗口已经开启又关闭了。他们的目标是几年内实现 2-5 倍回报,当然,对于一些规模的平台来说,这已经很不错了。

-

Memecoins 狂热者:追逐涨幅却不了解涨幅背后的原因。没有叙事背景,没有模式识别,仅仅是盲目投机。他们有时能实现 100 倍收益,但大多数时候还是将利润还给市场。

注意力套利交易者则两者兼备:他们拥有研究者的信息优势,同时具备 memecoins 狂热者的执行速度。

>他们可以分析 Plasma 55 亿美元的 TVL 增长,同时部署 $TRILLIONS 或者抢在其他交易者之前进行交易。

图:一位 $trillions 早期买家

>他们可以比较 Hyperliquid 的竞争者,同时推出 NiggaLiquid。

他们对叙事的理解足够深刻,知道“trillions”(万亿)何时会成为 Plasma 的热词。他们密切关注 DEX 之战,能够发现“Hyperliquid 竞争者”疲劳何时达到顶峰。他们不会等待基本面发挥作用;而是抢在注意力由基本面生成之前行动。

投机行为不会消亡,因为他们与“按成规行事的加密(serious crypto')”并没有区别,他们是同一群人,玩着不同的游戏。

公式很简单:发现叙事 → 识别机会 →在炒作达到顶峰之前抢先 → 在注意力转移之前退出→重复

成功属于那些关注一切却不执着于任何事的人。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。