作者:BruceLLBlue

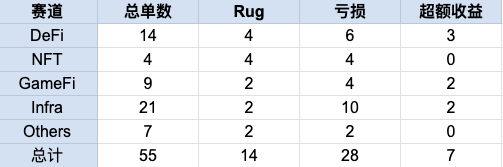

最近twitter上热热闹闹,一波华语KOL晒“过去一年赚了多少”的帖子刷屏:数百万、数千万、1024亿(玩梗的别跑)……看完只想说,牛逼!但作为曾经的VC投资负责人( GP,General Partner),我只想吐槽一下:最近当了几年的Crypto VC,亏了数千万美金。不是随便水,是实打实的血泪史,3年55+投资,27笔亏本(包含rug),15笔直接归零,同时还投资了9只比较头部的VC。

其中NFT相关的项目全军覆没,GameFi rug了33%,Infra则是重灾区,不少项目剩下10%-20%估值。晒收入的KOL以及尊贵的Crypto交易员们,恭喜你们抓住了二级风口;普通专注一级投资的VC呢?天天舔项目方;解锁等3-4年,结果往往是“投早了、投对了,却退不了”。为什么反着来晒亏?因为这不是哭穷,而是醒脑帖。Crypto VC本来就很难,熊市熬死人,牛市被项目方“收割”。但我相信,现在这个新的周期,继续做VC(或进化它)不一定是个超级好时机,虽然目前机构的大资金入场、监管明朗、AI+链上工具重塑退出路径,但是我认为有更好的方式和路径去实现自我价值。分享我的血泪课,大家共勉之。

1️⃣ 第一课:统计赤裸裸,55单的“胜率”真相

从2022年8月加入Crypto VC,到2025年7月离职,我亲手操刀了55单直接投资+投资了9个基金。

Rug占比14/55(25.45%):重灾区是NFT项目,全线归零,一个背靠大IP的“明星项目”,早期NFT火爆,但团队Web3经验浅薄,创始人是顶流明星对发币兴趣缺缺,核心成员出走后soft rug;另一个“音乐+Web3”项目,从巨头出走做了几年项目,啥都没落地,悄无声息凉凉。还有Dex项目的“高管创业梦”:创始人让团队打黑工自己收钱,核心员工跑路;某高校实验室出的“潜力股”,基本都挂了。

亏损占比28/55(50.1%):其中一个GameFi项目,上线5x后一地鸡毛(剩20%成本,阴跌了99%);另一个“北美大厂背景团队出品”的GameFi项目,高峰12x,现在仅成本的10%;还有个GameFi项目,被某CEX的Launchpad坑了许多筹码抛压,热不起来直接挂掉。Infra领域更惨:生态无突破,技术无创新,热度过后,剩10%成本的比比皆是;假如没有及时进行对冲的话,简直尸骨无存;另外还有一个MOVE生态的socialfi项目,直接倒在2024年的牛市前夕。

那么基金的投资呢(FoF,母基金)?投了@hack_vc @Maven11Capital @FigmentCapital @IOSGVC @BanklessVC等9家欧美头部基金;这些基金基本上参与了这个周期中非常知名的项目的早期投资,如 @eigenlayer @babylonlabs_io @MorphoLabs @movementlabsxyz @ionet @alt_layer @MYX_Finance @solayer_labs @ethsign @0G_labs @berachain @initia @stable @monad @ether_fi @brevis_zk @SentientAGI。账面看起来还行有2-3x,看似体面,但实际DPI(已实现回报)估算下来可能仅有1-1.5x。为什么会有这样的预期呢?主要原因还是因为项目的解锁慢、市场的流动性差,假如遇到了熊市或者是类似FTX崩盘的话,手上的头寸可能会瞬间血崩。

2️⃣ 第二课:坑多深,人性更深——几个让我“动容”的惨案

最扎心的是“投人”翻车:一个Dex项目,创始人表面有CEX高管光环,实际让团队外包黑工,把收入装进自己口袋;GameFi 的“北美大厂梦”,上线12x后一路阴跌,价格从来没有回过头。某个 @0xPolygon 的创始人出来做的Infra项目,生态突破遥遥无期,就仅剩投资的15%估值了;好几个大热的Infra项目,首发上了韩国双雄(Upbit和Bithumb),此后一路狂泻,压根就没有雄起过。甚至有个“音乐NFT”项目,创始人是腾讯音乐高管,玩了几年后soft rug,啥都没做出来。

华语区的VC更痛:语言/思维模式/资源天生就是劣势,欧美基金的玩法天生不一样,他们是拼体量赚管理费,我们短视的Quick Flip和Paper hand。知名项目融巨资后,找全球外包落地roadmap(我接触过几家,钱管够就行),创始人只需搞社区+融钱。VC呢?最弱势的群体,有些项目方通过空投出货,通过U盘和韩国交易所进行交易(开盘拉高到目标价后一起分钱,这就是为什么韩国交易所经常出现开盘溢价的原因),投资人压根没有办法核查查。每家VC都觉得自己牛逼,去查查这些基金的IRR和DPI,还不如做USDT/USDC的定存。

3️⃣ 第三课:亏了这么多,我学到“退出为王”的进化论

做VC是真的难,要熬过熊市、还要赌人心、看透人性、手上没有币要等解锁,3-4年一个周期轮回,假如没有在二级市场进行对冲/流动性管理,超额收益基本是完全不可能。经我总结,其实赚到超额收益的项目项目大多在FTX崩后的2022-2023年底进行投资的,核心的原因是:项目估值不高、创始人的信念强、投资的时机对(项目有足够的时间探索并在牛市来的时候及早进行TGE)。其他的项目为什么收益不佳或者亏钱呢?主要的原因无非是:要么太贵、要么太早、要么解锁错位。

仔细回想,这些都是宝贵的经验啊!而且现在 $BTC 一直在创新高,传统巨头机构/华尔街正在跑步进场,留给普通人的暴富窗口其实实在慢慢缩窄的,机构的投资回报正在向Web2的风险投资靠拢(很难再回到2021年之前的呀野蛮生长的时代了)。

新一代的投资人:他不一定是VC,更有可能是一些个人的天使投资人或者是一些超级Kol,他们通过自己的影响力和资源,往往能够拿到比VC更好的解锁方案以及更价格的筹码。而且不只是要投早、投对,还得全链路捕获一级+二级+期权/可转债+空投交互+做市对冲 + Defi 套利。其实东西方是存在严重的认知错位和差异的,这其实也是套利的金矿。

🔵 转身敲起键盘,用内容输出alpha的尊严之路

亏掉数千万的Crypto VC岁月,让我看清一件事:天天舔项目方、熬代币解锁、赌人心和人性,换来的是“VC狗”的卑微标签以及背后金主的埋冤,项目方能够空投偷偷出货,投资人就只能干瞪眼。够了!现在,我选择转身开始写写文章:靠天天敲键盘,输出行业见解和alpha洞见,不再纠结和等项目解锁,而是直接提前布局、捕获项目机会。比起VC的被动等待,这条路更有尊严,自由输出价值,复利是读者的信任和转发。

最终这几年的经历,终于明白了:耐心>机会,运气>专业,FOMO=自杀。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。