原文标题:Prediction Markets: A Differentiated Hedging Tool

原文作者:Noveleader,Castle Labs

原文编译:Ismay,BlockBeats

编者按:随着 Polymarket 即将向美国用户重新开放,预测市场正以惊人的速度在加密领域崛起,从最初的小众玩法逐渐发展为可以对冲风险、捕捉事件结果的重要工具。本文通过具体案例深入分析了预测市场的运作逻辑、流动性挑战及潜在规模化路径,同时探讨了其在选举、药品审批等高影响事件中的应用价值。

文章指出,预测市场不仅为专业投资者提供了新型对冲手段,也为普通用户打开了参与加密世界的新入口,涵盖从流行文化到科技新品的多元交易场景。对于关注加密金融创新、市场结构演变以及风险管理的新老读者来说,这篇文章提供了极具参考价值的洞察。

以下为原文内容:

预测市场正在迅速发展,已成为当前最火热的叙事之一。读得越多,我就越意识到,预测市场可能是对冲某些全球或本地事件的极佳工具,取决于我在交易中所处的敞口方向。显然,目前这一用途尚未被广泛利用,但我预计,随着流动性的改善以及预测市场触达更广泛的受众,这一应用场景将迎来爆发。

Vitalik 最近在其关于低风险 DeFi 的文章中也提到了预测市场。就此而言,「对冲事件风险」是预测市场最重要的用例。它不仅有助于维持流动性的循环,还为普通预测市场的参与者创造了更多机会。

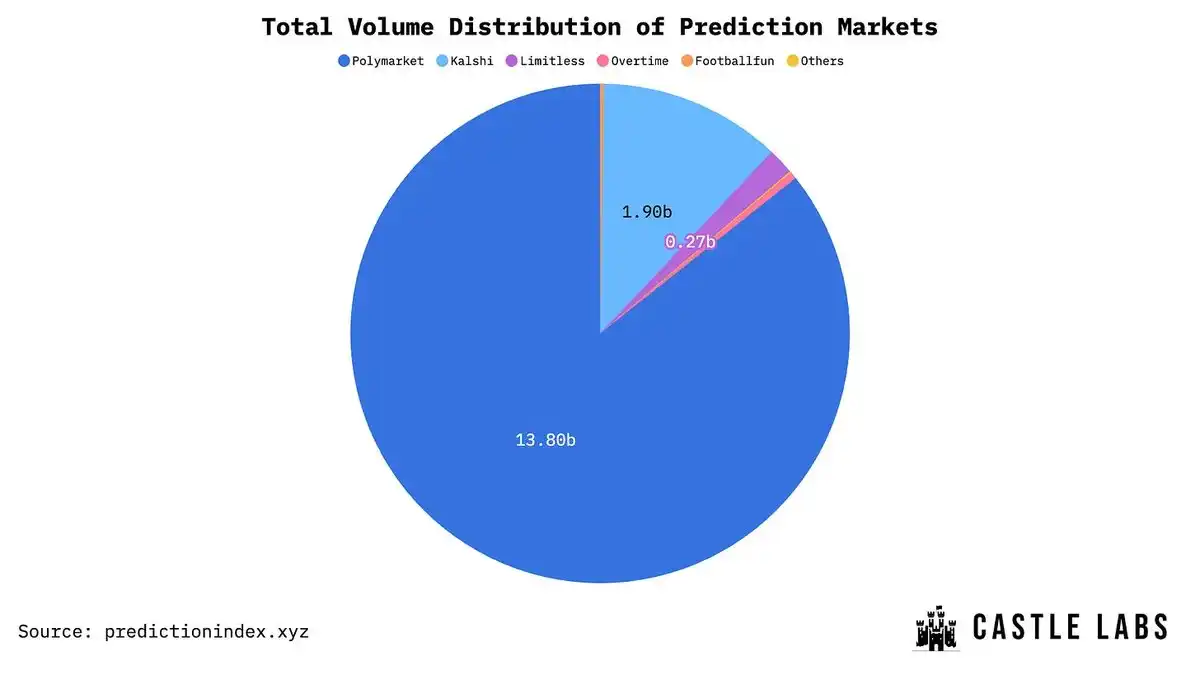

我们已经知道,越来越多的新公司正借势切入预测市场赛道,使得该领域正在建设的项目数量增加到 97 个。虽然这些项目的服务方向各不相同,会随着所在行业和用户群体的成长而壮大,但从交易量数据来看,仍然有少数产品表现尤为突出。

此外,还需要注意的是,预测市场作为一个细分赛道仍处在探索阶段。未来会不断涌现新的赢家,与 @Polymarket、@Kalshi 和 @trylimitless 等已经在预测市场交易量中占据重要份额的成熟项目并肩发展。

预测市场的演进

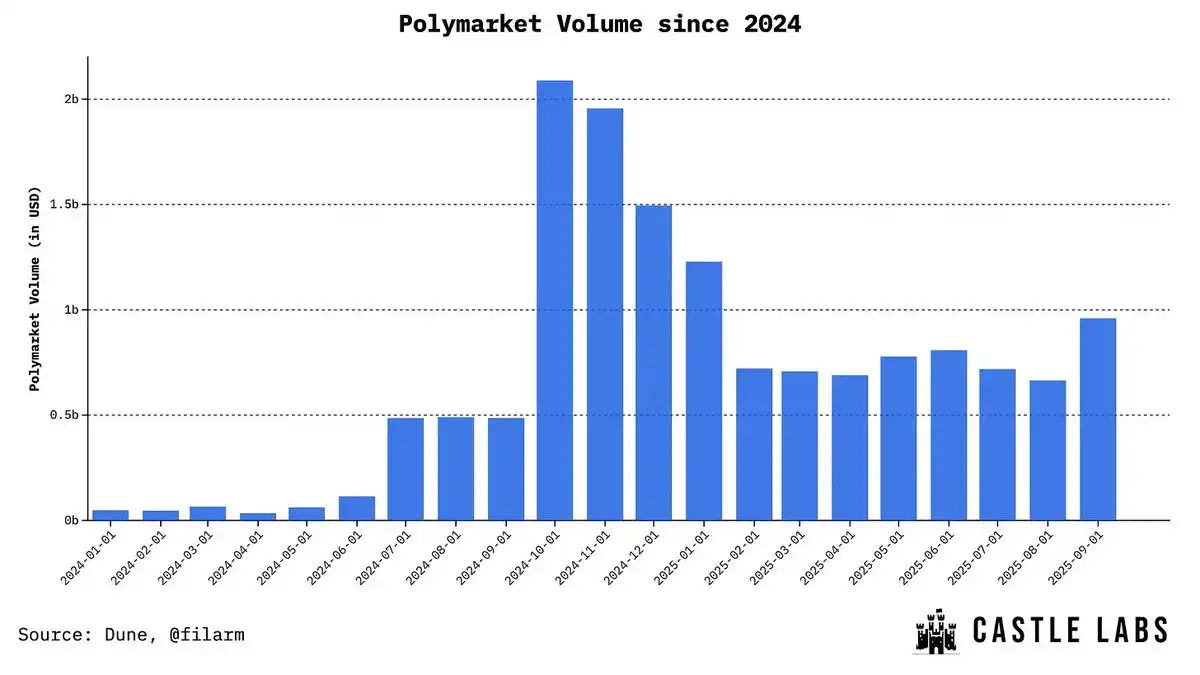

这里我会简要回顾一下预测市场的历史(并不是很久远的过去)。预测市场在近几年才逐渐进入主流视野,尤其是在 2024 年美国总统大选期间,Polymarket 的交易量显著攀升,为预测市场赢得了所需的关注。

自那次高峰以来,虽然交易量未能保持在 2024 年的水平,但始终维持在相对较高的区间。最近,如上方月度交易量图表所示,成交量又开始重新增长。随着这一趋势的发展,Kalshi 和 Limitless 等公司也逐渐实现了更高的交易量,成长为如今足以与 Polymarket 抗衡的强劲竞争者。

除此之外,不同类型的预测市场也在不断涌现,针对不同的用户群体和应用场景,开拓各自的细分赛道。一个很好的例子是 @noise_xyz(目前仍处于测试网阶段),它允许用户对某个特定项目的「关注度」进行杠杆化交易。

预测市场作为对冲工具

接下来进入我的核心观点。

未来的预测市场将会变得更加高效与流动,从而成为有价值的对冲工具。我并不是说目前完全没有被用于对冲,而是认为现在的规模还不足以在更大层面上发挥作用。

如果我们观察现有的应用案例,@0xwondr 的一篇文章很好地阐释了这一点。他举例说明了自己在今年早些时候 Trump Token 上线时,是如何利用预测市场进行对冲的。他一方面买入了 $TRUMP 代币,同时也在预测市场上买入了「特朗普是否被黑客攻击?」这一事件的「Yes」份额。这样一来,如果真的发生黑客攻击,他可以通过所持有的「Yes」份额弥补损失;反之,如果没有攻击事件发生,代币本身会有极大的上涨潜力(而我们也确实看到它最终涨得很高)。

我来尝试通过另一个例子说明「对冲」机会。假设某位投资者的投资组合中有相当一部分资金投入了一家特定的制药公司。该公司正在等待 FDA 对其新产品的批准。如果批准通过,公司股价很可能暴涨;如果被拒,股价则可能暴跌。如果存在针对同一结果的预测市场,这位制药公司投资者就可以通过购买「否」份额来对冲其股票仓位。

当然,对于这一做法也存在不同的观点:有人认为还有更好、更具流动性的渠道可以实现这种对冲。投资者完全可以直接做空股票,然后等待审批结果。但问题在于,投资者是否能仅凭一个尚未确定的 FDA 批准结果就严格维持对冲?答案显然是否定的。

通过预测市场,对冲那些尚未为任何人所知的决策变得顺畅可行。也许从长远来看,预测市场会成为一种可以与现有对冲渠道互补的对冲工具。如果高效使用,预测市场确实可以成为非常有效的对冲工具。

类似的例子还包括选举结果、宏观经济事件、利率调整等。对于这些基于特定事件的风险,对冲几乎没有其他可行途径。

预测市场要实现规模化需要什么?

预测市场的演进以及用户带来的新流动性,有助于其成为对特定事件或市场进行对冲的流动场所。但问题是,这些市场的流动性足够进行大规模对冲吗?

一个简单的回答是:不够,至少对大多数市场而言如此。

你可能在文章开头看到过一些不错的交易量数据。Polymarket 上个月的交易量接近 10 亿美元,这对于一个不提供杠杆、且基于相对新兴叙事的二元市场来说,已经相当出色。然而,这笔交易量分散在不同的市场和主题中,这并非针对单一事件,而是平台的总交易量。事实上,少数几个事件才真正贡献了大部分交易量。

抛开交易量不谈,我们要讨论的核心问题是流动性,因为交易量的增长依赖于更深的流动性。

更深的流动性可以确保价格不易被操纵,单笔交易不会对整个市场产生显著影响,同时也能在交易时将滑点降到最低。

目前,预测市场主要通过两种方式获取流动性:

1、自动化做市商(AMM):经典 AMM 结构下,用户与流动性池交易。适合市场初期阶段,但不适合大规模扩展。此时订单簿更具优势。

2、订单簿(Orderbook):订单簿依赖活跃交易者或做市商来维持流动性,非常适合市场规模化。

我推荐阅读 @Baheet_ 的这篇文章,以深入了解预测市场的运作机制:

既然我们这里关注的是规模问题,我将重点放在订单簿(Orderbook)上。在订单簿中,流动性可以通过交易者或做市商(MM)主动挂单,或者两者结合来实现。其中涉及做市商的结构通常效率更高。

然而,由于传统市场与事件合约(预测市场)之间存在显著差异,在像 Polymarket 或 Kalshi 这样的二元市场进行做市并不容易。

以下是一些做市商可能不愿参与的原因:

1、高库存风险:预测市场会对特定新闻产生剧烈波动。一个市场可能在某一方向运行良好,但很快就可能反向波动。如果此时做市商定价与市场方向相反,就可能面临巨额亏损。虽然可以通过对冲来缓解,但通常这些工具并没有方便的对冲选项。

2、交易者与流动性不足:市场缺乏足够的流动性。这听起来像「先有鸡还是先有蛋」的问题,但市场需要频繁的交易者或接盘方,才能通过买卖价差为做市商带来收益。然而,特定市场的交易量和交易次数太少,这就无法激励做市商积极参与操作。

为解决这一问题,一些项目正在积极探索,比如 Kalshi,它利用第三方做市商,同时内部也设有交易部门以维持流动性。而 Polymarket 则主要依赖订单簿中自然产生的供需关系。

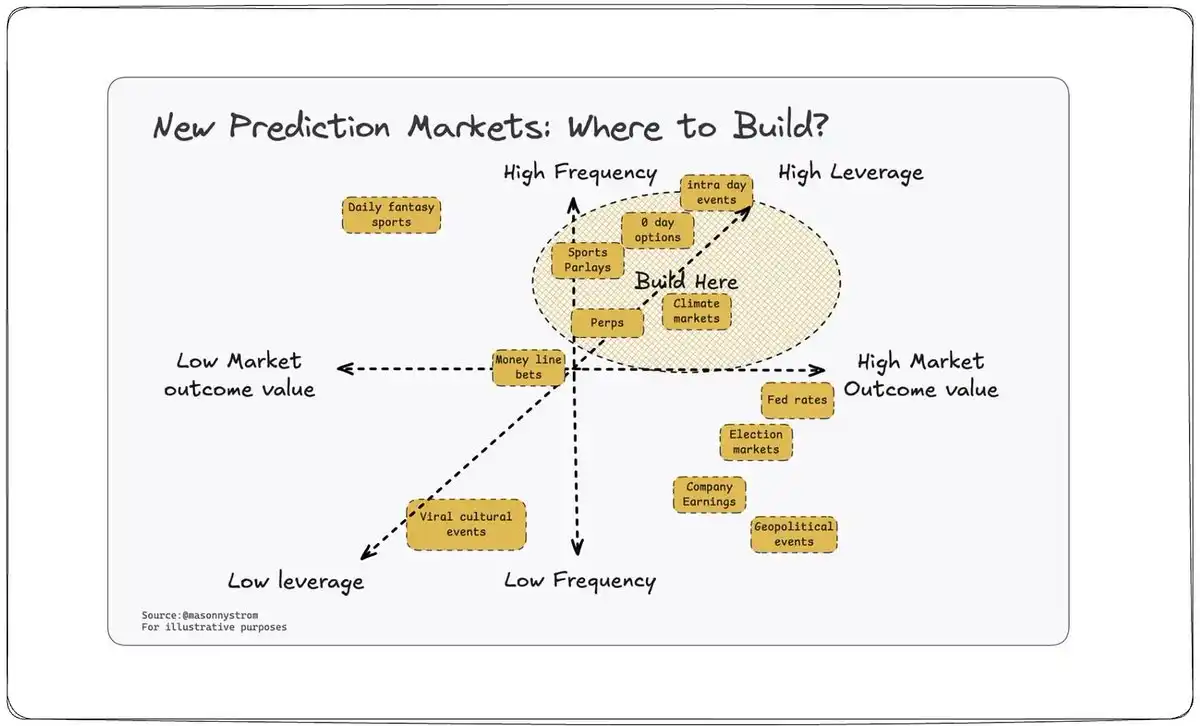

最终,要获得交易量和用户,必须构建一个人人都想参与的市场,这类市场应具备三个特点:

1、高杠杆:在二元市场的 Yes/No 问题上不容易实现,因为用户无法通过杠杆追求更高收益。一些平台如 @fliprbot 提供预测市场杠杆交易,但通常交易量较低。此外,Limitless 提供日度和周度行权的市场,使用户可以参与结算更快的市场,从而潜在提高收益。

2、高频市场:用户可选择的市场越多,他们越倾向于在同一平台上进行交易。更多的市场意味着更多交易量。

3、高市场结果价值:如果市场的结果具有重大影响,就会带来显著交易量。这一点在选举或药品审批相关市场中尤为明显,因为这些事件的结果会显著影响更广泛的市场反应。

总结思考

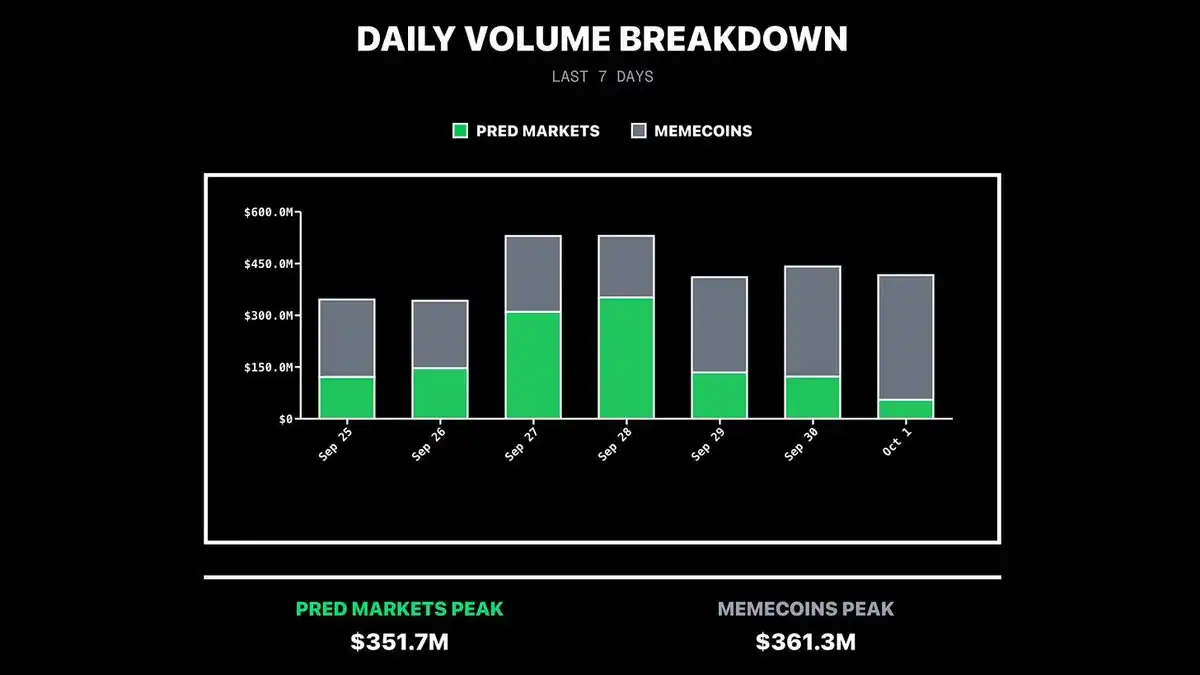

预测市场无疑在行业中留下了深刻印记。就在本周,其交易量已经超过了 meme 币,显示出其清晰的增长趋势和被广泛采纳的迹象。

我还想指出,预测市场确实助推了「超金融化」(Hyperfinancialization)的状态。坦率地说,只要人们没有亏掉大笔资金,这种状态本身并没有问题。我甚至写过一篇文章,探讨我们如何走向一个「万物皆可市场化」的状态,以及这种趋势为何既有利也有弊。

如果你想阅读,可以在这里找到文章:

最后,我真心认为预测市场是引入新用户进入加密领域的绝佳途径,因为这些市场通常面向 CT(加密交易者)圈子之外的普通受众。几乎所有事物和话题都有对应市场,包括流行文化、明星八卦、新款苹果产品发布,以及你能想到的几乎任何事物。允许任何人对自己感兴趣的事物进行交易,这本身就是一种极具潜力的力量,也是我非常期待观察和参与的领域。

所以,可以说,预测市场就是 alpha。

「原文链接」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。