原文标题:《Tether 5000 亿估值背后,隐秘股东们的财富往事》

原文作者:David,深潮 TechFlow

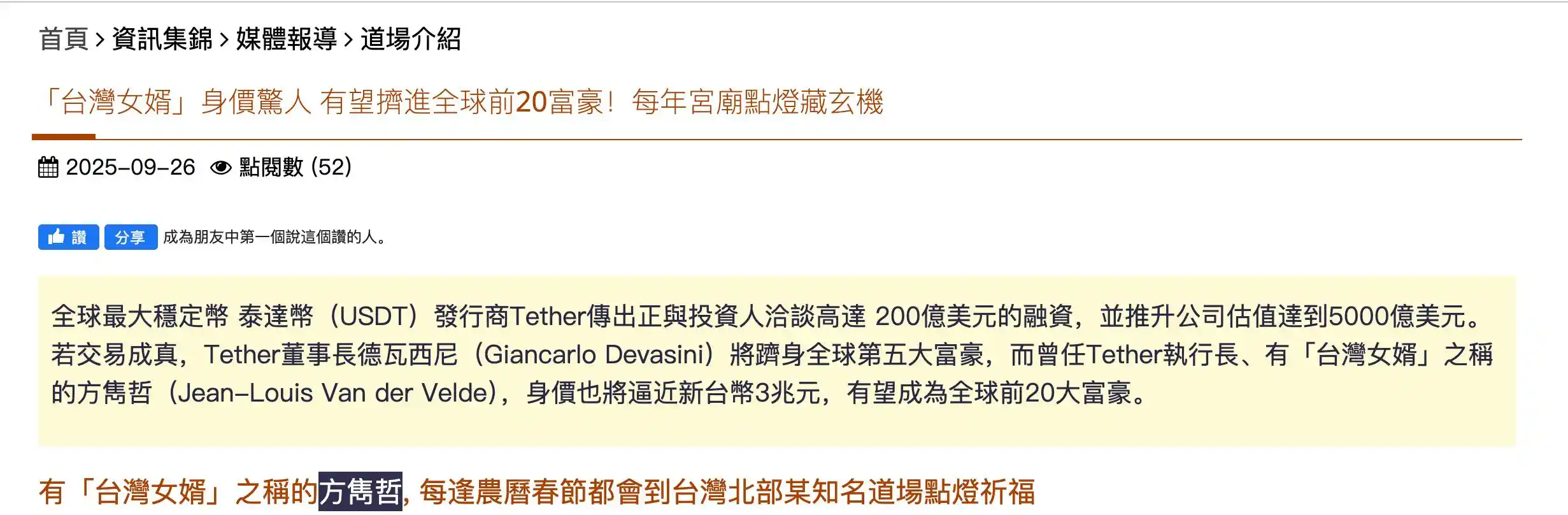

2025 年 9 月 24 日,据彭博社报道,全球最大稳定币发行商 Tether Holdings(泰达)正与投资者洽谈新一轮融资,计划出售 3% 股份以筹集 150-200 亿美元资金。

若按上限计算,这笔交易将使 Tether 估值达到约 5,000 亿美元,将使其一跃成为全球最有价值的私营企业之一。

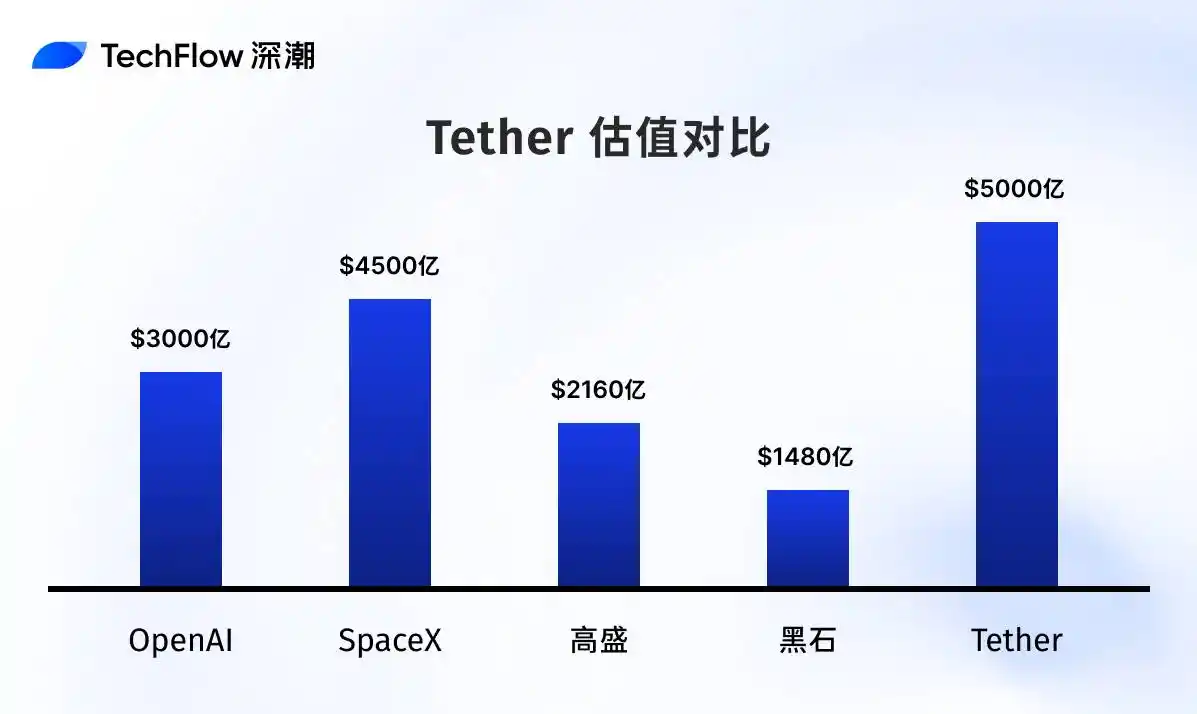

5,000 亿美元的估值是什么概念?

作为对比,OpenAI 今年 3 月估值约 3,000 亿美元,SpaceX 则约为 4,500 亿美元。而 Tether 的 5,000 亿美元目标估值,甚至超过了两家华尔街顶级巨头高盛 2,160 亿美元与黑石 1,480 亿美元的市值总和。

但真正引人注目的,不是公司估值本身,而是这个数字背后的人。

那些直接或间接持有 Tether 股份的实际控制者们,如果交易达成,他们可能将成为加密货币行业有史以来最富有的一批人。

作为一家注册在英属维京群岛的私营公司,Tether 从未主动披露过股权结构。这家掌控着 1,700 亿美元 USDT 流通量、几乎垄断了全球加密货币交易基础设施的公司,其实际控制人始终隐身幕后。

直到 2021 年,纽约州检察长办公室和美国商品期货交易委员会(CFTC)的调查文件意外曝光了部分股权信息;2024 年,美国知名媒体 Forbes 通过多方信源进一步补充了这幅拼图。

根据这些碎片化但相对可靠的信息,我们终于能够勾勒出 Tether 背后的财富版图。

按照 5,000 亿美元估值计算,Tether 的最大股东,一位 61 岁的意大利人,将坐拥超过 2000 亿美元的财富,超越巴菲特成为全球第五大富豪。

而其他几位核心股东,也将分别进入千亿或百亿美元富豪俱乐部。

这些长期隐身的超级富豪终于有了具体的名字和面孔。他们中有前整形医生,有写代码写到凌晨的程序员,有在台湾学中文的荷兰人,甚至还有正在服刑的中国商人。

每个人背后,都是一段不为人知的财富积累史。

董事长:从整形医生到全球前五富豪

Giancarlo Devasini

现职:Tether 董事长、CFO

持股:47%

潜在身价:2,350 亿美元(全球第五富豪)

Giancarlo Devasini 可能是加密世界最神秘的超级富豪。

这位 61 岁的意大利人极少露面,没有社交媒体,找不到几张公开照片,但他却掌控着 Tether 47% 的股份。

根据彭博亿万富豪指数计算,如果 5,000 亿美元估值成真,他将超越巴菲特成为全球第五大富豪,仅次于马斯克、埃里森(Oracle)、扎克伯格和贝索斯。

不过,和财富价值的稳固比起来,Devasini 的人生轨迹显得更加跳脱。

1990 年,Giancarlo Devasini 从米兰大学医学院毕业,成为一名整形外科医生。两年后,他放弃了这个在外人看来稳定体面的职业。

离开医院后的 Devasini 进入 IT 贸易领域,进口计算机配件、销售电子产品,什么赚钱做什么。1995 年,他因销售盗版软件,被微软要求支付 100 万里拉的和解金。

2008 年,一场大火烧毁了他的仓库,公司破产清算。当时 Devasini 44 岁,又回到了几乎一无所有的状态。

但恰恰是这次破产,把他推向了加密世界。2012 年,他投资了当时还默默无闻的 Bitfinex 交易所,并逐渐接管运营。

彼时的加密市场,其波动程度比起现在有过之而无不及。Devasini 也敏锐的发现了问题:BTC 等价格波动太大,无法作为支付工具。

2014 年,Devasini 与技术天才 Paolo Ardoino 推出了解决方案:Tether,一种与美元 1:1 锚定的稳定币,但过程并非一帆风顺。

当时的市场,对稳定币的接受意愿远不如今天。关于稳定币的储备金、审计和挤兑等疑虑也无处不在。Devasini 亲自开荒,飞往巴哈马、瑞士、香港,一家家银行地敲门,寻找愿意为这个「可疑」项目开户的金融机构。

2016 年,Bitfinex 被黑客攻击损失 12 万个比特币,所有人都认为公司完了。

Devasini 提出解决方案,发行债务代币 BFX 分给受损用户,承诺回购,同时确保 Tether 照常运转。市场接受了这个看似画饼的方案,USDT 反而开始爆发式增长。

2018 年,Bitfinex 有 8.5 亿美元被支付商 Crypto Capital 冻结,面临流动性危机。

Devasini 直接选择从 Tether 储备金调用资金救急,这个决定引起了纽约州检察长的关注,认为其影响了 USDT 的美元储备完整性。

调查持续两年,最终 Tether 支付 1,850 万美元和解,但不承认存在不当行为。

数次危机之后,Devasini 的地位更加稳固。公开新闻和数据显示,他的持股比例从 2018 年的 43% 上升到 2024 年的 47%。

2025 年 3 月,他从 CFO 升任董事长,进一步巩固了控制权。

如今 61 岁的 Devasini,依然保持着极度低调的状态。没有社交媒体,极少接受媒体采访,公开照片寥寥无几。2017-2023 年间,据报道他主要居住在瑞士卢加诺,Tether 在那里与市政府签署了合作备忘录,推广加密货币应用。

根据纽约州检察长 2021 年的调查文件,Devasini 在 Tether 和 Bitfinex 的运营中扮演核心角色,包括处理银行关系和储备管理等关键事务。

15 年时间里,Devasini 完成了从一个医生到 2,000 亿身家富豪的转变。

CEO:写代码的拼命三郎

Paolo Ardoino

现职:Tether CEO

持股: 约 20%

潜在身价:1,000 亿美元

如果说 Giancarlo Devasini 是 Tether 背后的神秘大脑,那 Paolo Ardoino 就是这家公司的公开面孔。

一个从不露面,一个天天在 Twitter 上发声;一个通过资本运作获得控制权,一个用代码换来股份。

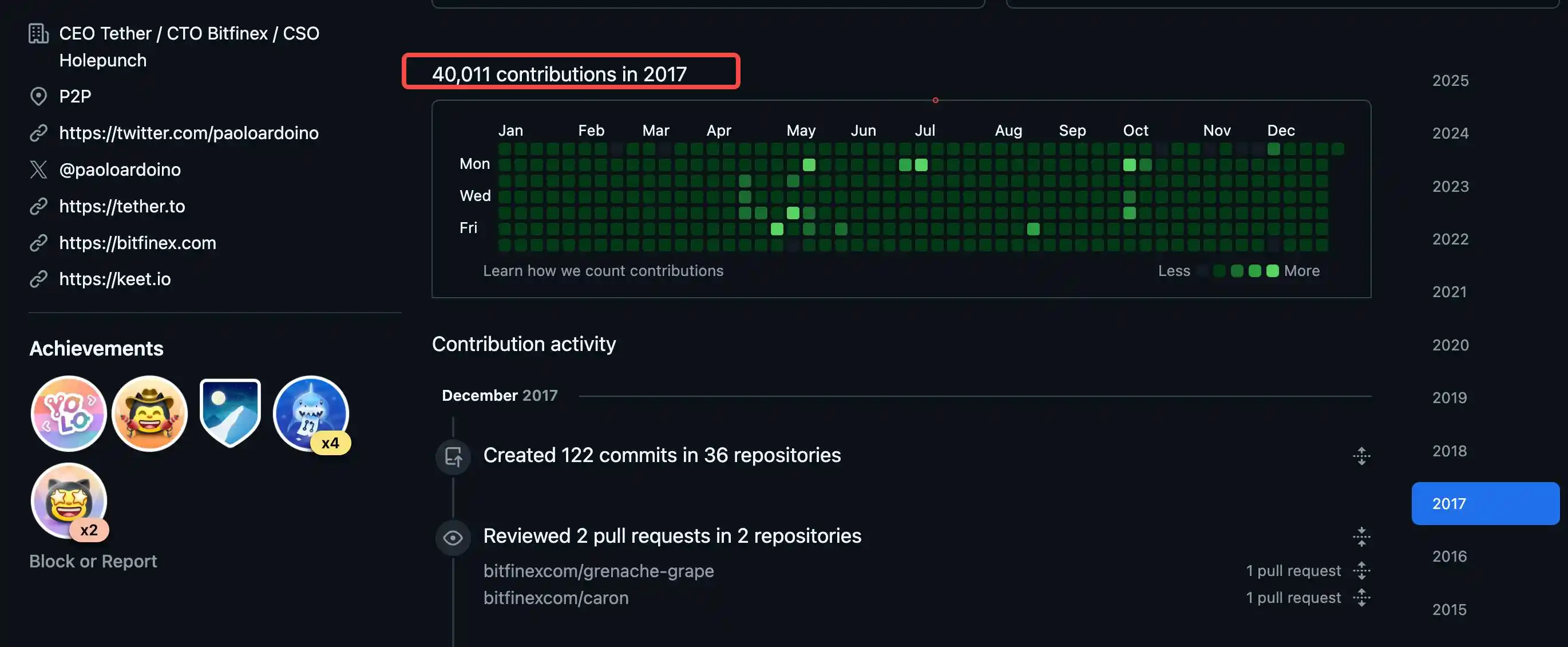

2017 年,Ardoino 在 GitHub 上提交了 40,000 次代码,平均每天超过 100 次。近乎偏执的工作强度,定义了这位意大利程序员的上升路径。

2014 年,他以高级软件开发者身份加入 Bitfinex,当时股份情况未知;到 2024 年,Forbes 报道他已持有 Tether 约 20% 的股份。如果 5,000 亿美元估值成真,意味着 1,000 亿美元的财富。

Ardoino 与 Devasini 的缘分始于 2014 年的伦敦。据 CoinDesk 报道,当时 Devasini 正在运营 Bitfinex,看中了 Ardoino 的技术能力。

从普通开发者到 CEO,Ardoino 的晋升路线十分清晰:2017 年升任 CTO,2023 年 12 月接任 CEO。

但即便当了 CEO,他依然是那个工作到凌晨的人。他的 Twitter 账号 @paoloardoino 经常深夜还在回复技术问题。当媒体质疑 Tether 时,他会立即反驳,比如直接称《华尔街日报》的批评文章为「小丑文章」。

这种频繁发声的风格,填补了 Devasini 低调留下的信息真空。在一个需要信任的稳定币业务中,Ardoino 成了那个让用户「看得见」的人。

除了 Tether,他还在 2022 年创立了点对点技术公司 Holepunch。即便身兼数职,他坦言已经近十年没休过正式假期。

「我从没去过日本,」他在采访中提到,「那是游戏机和动漫的故乡,我一直想去。」

2024 年 4 月,Forbes 将 Ardoino 列入全球加密货币亿万富翁榜,估值 39 亿美元。但如果 Tether 达到 5,000 亿估值,这个数字要乘以 25。届时,他将跻身全球千亿富豪俱乐部。

前 CEO:台湾女婿,常去寺庙祈福

Jean-Louis van der Velde

现职:Tether 顾问、Bitfinex CEO(前 Tether CEO)

持股:10-15%

潜在身价:500-750 亿美元

在 Tether 的高管团队中,Jean-Louis van der Velde 可能是最难捉摸的一个。

这位荷兰人的亚洲故事始于 1985 年。当时他离开家乡,来到台湾师范大学学习中文。根据他的 LinkedIn 资料 ,1988 年毕业后,他再也没有回到荷兰,而是在亚洲扎下了根。

近 40 年后,这个当年学中文的留学生,可能坐拥数百亿美元的财富。

Van der Velde 在加密世界的崛起相对低调。2013 年,他成为 Bitfinex 的联合创始人和 CEO。根据公司博客,他当时的职责是「构建控股架构,专注于开发和投资金融科技及大数据相关技术」。

通俗点说,他负责搭建公司框架和对外关系。

2018 年的监管文件显示,他持有 Tether 约 15% 的股份。到 2024 年,他的具体持股比例不再公开,但 Forbes 仍将他列入加密亿万富翁榜,估值 39 亿美元。如果他仍持有 10-15% 的股份,在 5,000 亿美元估值下,财富将达到 500-750 亿美元。

与 Devasini 的神秘和 Ardoino 的活跃不同,Van der Velde 选择了另一种存在方式:在场但不可见。

他有职位、有股份,但几乎没有公开言论。搜索他的名字,你会发现大量的职位信息,但几乎没有个人信息。

2023 年 10 月,Van der Velde 从 Tether CEO 位置退下,将接力棒交给了 Ardoino。但他并未离开,而是转为顾问角色,同时继续担任 Bitfinex 的 CEO。

关于他的个人生活,公开信息少得可怜。根据他的 LinkedIn,他精通五种语言:荷兰语、英语、中文、德语和法语。除此之外,流传最广的一个细节,来自台湾媒体的报道 :

他的妻子是台湾人,因此也深受当地文化影响。因为创业过程艰辛,他每年都会到台湾北部某寺庙点灯祈福,即便无法亲临,也会托人代办。

这个细节真假难辨,倒也确实符合他的形象。

一个深受亚洲文化影响的西方人,低调、务实,在东方的商业土壤中逐渐建立起加密帝国。

有趣的是,甚至真的有人质疑 Van der Velde 是否真实存在。之前也有推特用户打趣的提问「有人真的见过 Bitfinex 的 CEO 吗?」这当然是夸张,但也反映了他的低调程度。

这和目前喧嚣的加密生态中大部分 KOL 不同,强者可能不需要高调,不需要发声,甚至不需要被看见。

当然,前提是你足够早地站在了正确的位置上。

法律顾问:离职,功成身退

Stuart Hoegner

前职:Tether/Bitfinex 总法律顾问

持股:13%

潜在身价:650 亿美元

2025 年 1 月,Stuart Hoegner 更新了他的 Twitter 简介:从「Bitfinex 和 Tether 总法律顾问」改为「前总法律顾问」。

Hoegner 在加密世界有个独特的身份标签:@bitcoinlawyer。这个 Twitter 账号从 2011 年就开始活跃,比 Tether 的诞生还早三年。

当大部分律师还在研究比特币是否合法时,他已经在为这个行业提供法律服务。

2014 年,Hoegner 加入 Bitfinex,随后成为 Tether 的总法律顾问。在这个位置上,他守护了两家公司 11 年。根据 2018 年的监管文件,他持有 Tether 约 15% 的股份。到 2024 年,Forbes 报道这一比例降至 13%。

作为律师,Hoegner 的工作常常处于风暴中心。2019 年,当纽约州检察长调查 Tether 的 8.5 亿美元资金问题时,是他领导法律团队应对。2021 年,当 CFTC 就储备金问题向 Tether 开出 4,100 万美元罚单时,也是他负责谈判。

但与典型的企业律师不同,Hoegner 在社交媒体上异常活跃。

他的 Twitter 不仅讨论法律问题,还经常转发支持比特币的内容,反驳对 Tether 的质疑。这种战斗姿态,让他成为加密社区的知名人物。

他的背景也颇有故事。在加入加密行业前,Hoegner 曾在在线扑克行业工作。2008 年,他在 Ultimate Bet 扑克网站任职期间,该网站爆出了内部人员利用超级用户账号作弊的丑闻。

有趣的是,Ultimate Bet 事件中的另一位律师 Daniel Friedberg,后来成为 FTX 的首席监管官,在 FTX 崩溃中扮演了争议角色。

两位曾经的同事,在加密世界走向了不同的结局。

一个护送公司走向 5,000 亿估值,一个见证了史上最大的加密帝国崩塌。

2025 年 1 月的退休,Hoegner 选择了一个微妙的时间点。欧盟的 MiCA 法规刚刚生效,美国的稳定币监管也在加速推进。

作为法律负责人,他比任何人都清楚即将到来的监管挑战。退休,可能是急流勇退。

如果他仍持有那 13% 的股份,「前法律顾问」的名头也并不影响他可能成为加密行业最富有的律师。

消失的第四大神秘股东

Christopher Harborne(英国)/ Chakrit Sakunkrit(泰国)

持股:13%(2018 年数据)

潜在身价:650 亿美元

在 Tether 的股东名单上,有一个人比 Van der Velde 更神秘,他甚至有两个名字。

根据 2021 年纽约州检察长的调查文件,2018 年时,一位拥有英国和泰国双重国籍的商人持有 Tether 约 13% 的股份。在英国,他叫 Christopher Harborne;在泰国,他叫 Chakrit Sakunkrit。

这是 Tether 股权结构中唯一的「外部人」。既不是创始团队,也不是高管,却持有与总法律顾问相当的股份。

关于 Harborne/Sakunkrit 的公开信息极其有限。英国的公司注册记录显示,他涉足多个领域,从航空到科技投资。泰国方面的信息更少,只知道他使用 Chakrit Sakunkrit 这个名字进行商业活动。

他是如何获得 Tether 股份的,何时投资的,投资额是多少?这些关键问题都没有答案。

更令人困惑的是,2018 年之后,这个名字彻底从所有 Tether 相关的文件和报道中消失了。

2024 年 Forbes 的加密富豪榜,列出了前述的 Devasini、Ardoino、Van der Velde 和 Hoegner,唯独没有 Harborne。

2025 年的融资新闻中,也看不到他的踪影。13% 的股份,如果按 5,000 亿美元估值计算价值 650 亿美元。假设他仍然有股权,那显然他会成为 Tether 上最成功的隐形投资者。

在一个充满秘密的公司里,这人可能是最大的秘密。

华尔街资本与美国商务部长

机构:Cantor Fitzgerald

投资时间:2024 年 11 月

持股:5%

投资额:6 亿美元

潜在价值:250 亿美元

2024 年 11 月,华尔街金融服务公司 Cantor Fitzgerald 以 6 亿美元购买了 Tether 5% 的股份。

按这个价格计算,Tether 当时估值仅 120 亿美元。作为对比,竞争对手 Circle 的市值约为 300 亿美元,而 Tether 的 USDT 流通量是 Circle 的 USDC 的两倍多。

为什么这么便宜?答案可能藏在时机和人物关系中。

这笔交易的关键人物是 Howard Lutnick,Cantor Fitzgerald 的 CEO。2024 年 11 月完成投资后不久,2025 年 1 月,Lutnick 被任命为美国商务部长。

这种时间线,让收购 Tether 股份的交易蒙上了特殊色彩。批评者认为这是「友情价」交易,Tether 以低估值向即将进入政府的 Lutnick 输送利益。

更有意思的细节是,据财富杂志报道 ,Lutnick 的儿子 Brandon Lutnick 在 Cantor 工作,之前曾在 Tether 瑞士实习。

无论动机如何,从投资回报看,这可能是 Cantor Fitzgerald 历史上最成功的交易之一。如果 Tether 达到 5,000 亿美元估值,6 亿美元将变成 250 亿美元,回报超过 40 倍。即便估值只达到 2500 亿美元,回报率也有 20 倍。

Cantor Fitzgerald 成立于 1945 年,是华尔街老牌金融机构。他们的入股对 Tether 意义重大:这是第一家美国主流金融机构成为 Tether 股东。在监管压力增加的背景下,背书价值难以估量。

同时,过去的 3 年内,Cantor Fitzgerald 一直为支撑 Tether 稳定币的国债提供托管服务,这些国债占支撑稳定币的 1,320 亿美元资产中超过 80%。

据《华尔街日报》 报道 ,该公司因提供这项服务而赚取数千万美元的佣金。

更实际的价值可能在于 Cantor 的金融网络。Tether 长期面临的最大挑战之一就是银行关系。作为在美国受监管的金融机构,Cantor 的加入可能为 Tether 打开新的银行渠道。

从另一个角度看,Cantor 的投资代表了华尔街对加密货币态度的转变。不再只是观望或提供服务,而是直接成为股东,分享增长红利。

Howard Lutnick 有双重身份,投资时是 CEO,现在是商务部长。

无论这是否影响了交易价格,可以确定的是,Tether 现在有了一个在美国政府最高层的间接联系。

国内监狱中的被动富豪

赵东

身份:Bitfinex 股东、RenrenBit 创始人

持股:Bitfinex 5%

潜在财富: 数十亿美元,通过 iFinex 架构间接受益

赵东,可能是 Tether 造富故事中最戏剧性的一个。

2016 年 8 月,Bitfinex 遭遇黑客攻击,损失 12 万个比特币。这场危机中,这位来自中国的比特币大户成了意外的主角。

Bitfinex 为应对损失提出补偿方案,向受损用户发行了 BFX 代币,每个代币代表 1 美元的损失。赵东当时是受损用户之一,但他没有选择割肉离场,而是接受了 Bitfinex 提供的债转股方案。

他从其他用户手中收购了更多代币,最终将这些代币全部转换为 iFinex 股权。这个决定让他从一个受害者变成了 Bitfinex 的股东。

2017 年 4 月,Bitfinex 完成了所有 BFX 代币的赎回,而选择债转股的用户则成为了这家交易所的永久股东。随着 Bitfinex 和关联公司 Tether 的快速发展,这些早期股权的价值已经翻了数十倍。

根据公开报道 ,Bitfinex CTO Paolo Ardoino 曾表示,赵东在 Bitfinex 的持股比例低于 5%。

虽然比例不高,但考虑到 Bitfinex 和 Tether 同属 iFinex 旗下,共享管理层和股东结构,这份股权的价值可能远超表面数字。

赵东在国内加密圈的地位特殊且敏感。

他是墨迹天气的联合创始人,2012 年成功套现退出。2013 年进入比特币世界,巅峰期据说持有 1 万个比特币。他创立了 OTC 交易平台 RenrenBit,一度是中国最大的场外交易商之一。

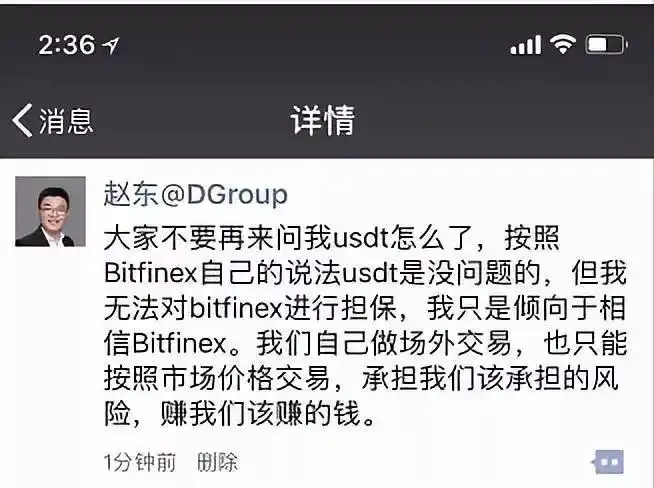

更重要的是,他是 Tether 在中国的非官方「代言人」。

2018 年 1 月,赵东在微博上发文称,在东京与 Tether CFO Giancarlo 会面时,看到了超过 30 亿美元的银行账户余额。作为币圈的知名人物,他的这种表态引发了广泛关注。

2020 年 6 月,一切戛然而止。

据多家媒体报道,赵东被警方带走,罪名涉及洗钱和非法经营。2021 年,有消息称他被判处多年有期徒刑。具体的案件细节从未公开,但业内普遍认为与 OTC 业务有关。

讽刺的是,赵东入狱的这几年,恰好是加密货币市场最疯狂的时期。

2020 年到 2024 年,比特币从 1 万美元涨到超过 7 万美元,USDT 的流通量从 100 亿美元增长到 1700 亿美元。如果他的 Bitfinex 股份还在,价值可能已经翻了数十倍。

如果赵东的 Bitfinex 股份没有被处置,通过 iFinex 的架构,他可能间接受益于 Tether 的估值增长。即便只有不到 5% 的间接权益,在 5,000 亿美元估值下也意味着数十亿美元的财富。

但这一切都是假设。他的「被动持仓」更像是命运替他做了选择。

最后,Tether 如果融资完成,这将会是加密行业有史以来最大规模的财富创造。

不到 10 个人掌控着 Tethter 1,700 亿美元稳定币帝国的绝大部分股权。其中,仅 Giancarlo Devasini 一人就持有 47%;而剩下的大人物们,甚至大多数都不在加密行业的聚光灯下。

这或许就是加密时代的财富密码:

无关去中心化,而是在对的时间,低调的站对风口中心。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。