编译:金色财经

本文要点:

加密货币市场触底三年后,关于「周期」状态的争论再次出现。但推动加密货币应用的因素——对稀缺数字资产的宏观需求以及监管透明度的提高——依然存在。

9月份,加密货币表现落后于其他资产类别;期货的清算加速了月中下跌。杠杆交易者的持仓目前似乎更加均衡。

美国SEC批准了加密 ETP 的通用上市标准,参议院在市场结构立法方面取得了进展,并且加密 IPO 数量有所增加。

从回报的角度来看,AI Crypto板块主导着其他细分市场。

在上一轮加密货币市场周期中,价格在 2021 年 11 月达到峰值,然后在 2022 年 11 月触底。如今,近三年过去了,一些加密货币市场参与者警告称,当前周期即将结束,估值即将「见顶」。

周期是金融市场的一个特征,也是投资者在风险管理过程中需要考虑的重要因素。但没有理由认为仅仅因为牛市持续了三年,估值就会开始下降。经济学家鲁迪·多恩布什曾说过,经济扩张并非因持续时间长而结束,而是被美联储扼杀了。换句话说,基本面的变化——通常是旨在控制通胀的货币政策收紧——才是可能导致经济陷入衰退的因素。

与所有牛市一样,加密货币估值的最新扩张势头终将结束。但就目前而言,基本面仍指向积极方向:宏观经济失衡正在催生对稀缺数字资产的需求,监管的明确性正在推动机构对区块链技术的投资。我们认为,在这些因素发生变化之前,9月市场回调可能只是暂时的,加密货币市场可能正在走向新的高点。比特币的供应量始终遵循四年周期,但加密货币的估值可能并非如此。

杠杆多头已清算

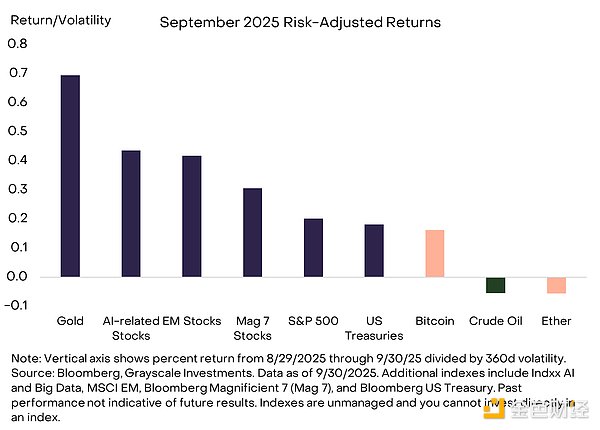

9月份,比特币和其他数字资产的表现不如其他细分市场,尤其是贵金属和与AI密切相关的股票(图表1)。这两大类别以及整个传统资本市场可能都受益于美联储降息以及交易所交易产品 (ETP) 的强劲资金流入。

图 1:9 月份加密货币表现落后于其他资产类别

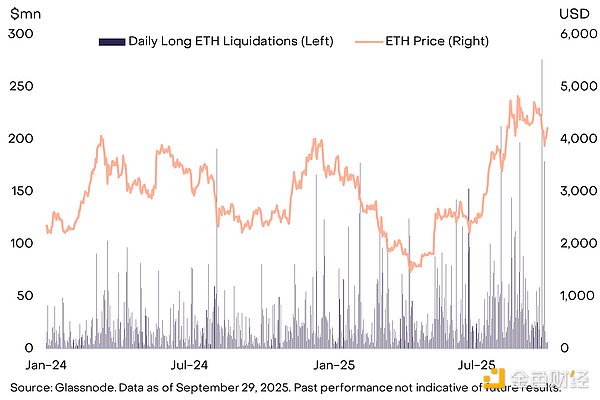

加密资产在9月初升值,但在当月下旬急剧下跌。这种突然的下跌可能与永续期货合约多头仓位的清算有关——这是加密货币市场结构的一个独特特征。例如,根据Glassnode的数据,9月25日,ETH永续期货合约的清算总额达到2.77亿美元,创下自2021年4月以来最大的单日清算额(图表2)。清算之后,融资利率(即持有杠杆多头仓位的成本)下降,价格趋于稳定,这可能表明投机交易者的仓位更加均衡。

图表 2:永续期货杠杆仓位被清算

简化加密 ETP 审批

除了价格表现之外,9月最重要的进展可以说是美国证券交易委员会 (SEC) 批准了加密 ETP 的通用上市标准。该决定为交易所上线加密 ETP 提供了简化的审批流程,前提是基础代币符合在合格场所交易的某些技术标准。Grayscale 预计,将有更多加密资产符合这些标准,投资者可以预期美国交易所提供的单一资产加密 ETP 数量将大幅增加。除了批准通用上市标准外,SEC 还批准了某些比特币期权产品的上市和交易。

美国参议院在加密市场结构立法方面也取得了进一步进展——这是继涵盖稳定币的《天才法案》之后国会的下一个重大举措。参议院银行委员会发布了市场结构法案的新草案。它包括对去中心化金融 (DeFi) 应用程序和开发者的更好保护,这受到了加密行业的普遍欢迎。另外,由 12 名参议院民主党人组成的小组发布了加密市场结构立法框架。该框架也得到了主要利益相关者的积极响应,表明两党合作进程仍有继续的空间。众议院版本的市场结构法案,即《CLARITY法案》,于 7 月在众议院经两党投票通过。

数字资产行业监管的明确性在9月继续推动机构活动。更多加密货币企业上市,包括利用区块链技术提升房屋净值贷款效率的Figure Technologies (FIGR) 和交易所 Gemini (GEMI)。此外,包括贝莱德和纳斯达克在内的多家传统金融机构宣布了与代币化资产相关的计划。此外,还有机构致力于推出新的受监管金融产品,包括「连续型」(即永续型)期货和符合《GENIUS 法案》的稳定币。

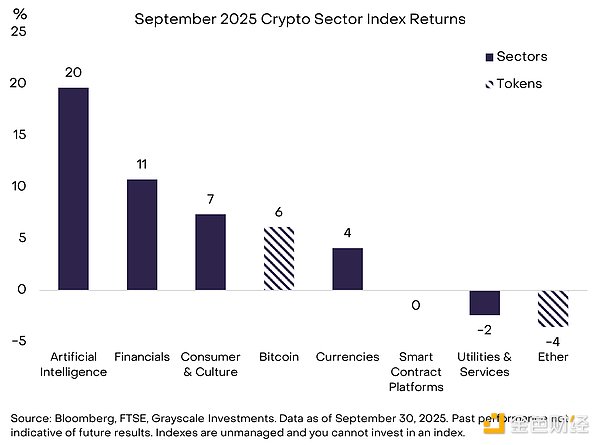

AI Crypto 板块脱颖而出

从加密货币行业的角度来看,人工智能 (AI)是表现最佳的细分市场,这得益于几个杰出项目的推动(图表 3)。强劲的回报主要归功于 Near (NEAR)、Worldcoin (WLD) 和 Aethir (ATH)。NEAR 由人工智能行业的一位领军人物创立,是一个专为人工智能用例量身定制的区块链平台,其 NEAR intents 产品的采用率正在不断上升。Worldcoin由 Sam Altman 创立,旨在提供数字身份解决方案。WLD 代币价格的上涨可能部分与新的数字资产库 (DAT) Eightco Holdings (ORBS) 有关。GPU市场Aethir受益于与 Chainlink 的新合作以及新的 DAT。

图 3:AI Crypto板块表现优异

Story Protocol(IP) 是一个专注于知识产权的区块链,尽管月内波动很大,但它是人工智能加密领域的另一个佼佼者。人们的注意力主要集中在韩国区块链周期间该项目的 Origin 峰会上的公告上。Story 与屡获殊荣的韩国网络漫画品牌 Solo Levelling 合作。此次合作将使 Solo Levelling 能够探索链上知识产权模型,并有可能推出 memecoin。Story 还与游戏公司 Verse8 合作,将 web3 品牌 Moonbirds 和 Azuki 带入人工智能生成的游戏中,使创作者能够通过在链上强制执行许可和版税来重新组合和货币化这些品牌。

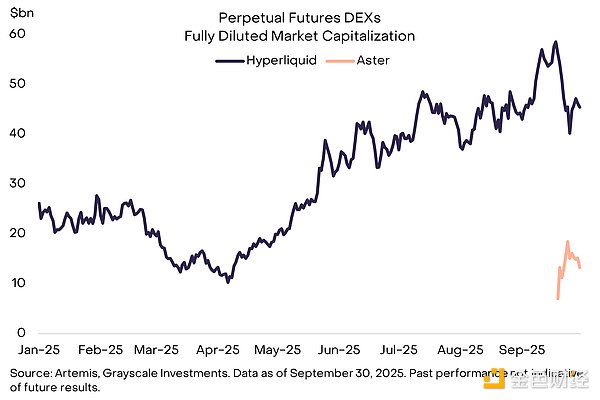

除了与人工智能相关的应用之外,业界最受关注的类别可以说是永续期货的去中心化交易所 (DEX)。其中,Hyperliquid处于领先地位,它已成为加密货币领域三大创收应用之一。然而,Hyperliquid 面临着来自Aster的新竞争,Aster 是由币安创始人赵长鹏支持的永续期货 DEX(图 4)。无论结果如何,看到 DEX 从中心化替代方案中抢占交易量都是令人鼓舞的——去中心化是区块链技术和 DeFi 的核心前提。

图 4:新的永续期货DEX出现

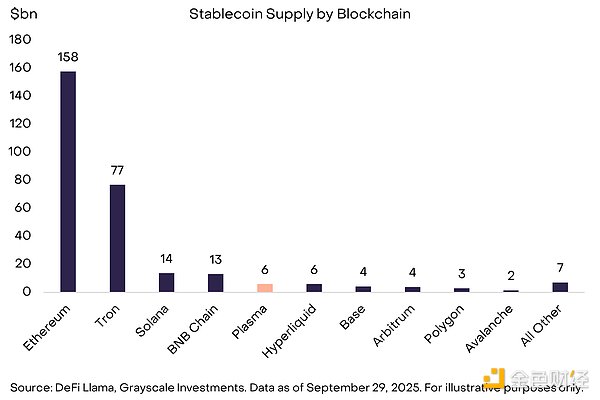

最后,稳定币领域也持续发展。例如,专注于稳定币的 Layer 1 生态 Plasma 于 9 月下旬上线了主网和 XPL代币。一周之内,其稳定币供应量迅速增长至 60 亿美元,成为稳定币供应量第五大的区块链,并领先于 Coinbase 的 Layer 2 生态 BASE(图 5)。与此同时,最大的稳定币发行商 Tether 宣布计划融资 150 亿至 200 亿美元,估值约为 5000 亿美元,这将使其与 OpenAI 和 SpaceX 一起跻身全球最有价值的私营公司之列。

图 5:Plasma,一种新的支付区块链,目前在稳定币供应量中排名第五

未来展望

如上所述,加密货币牛市是由对稀缺数字资产的宏观需求以及支持采用的监管明确性共同推动的。这两个因素很可能在2025年第四季度再次成为投资者关注的焦点。

美联储于9月重启降息,并暗示年底前可能再降息一至两次。在其他条件相同的情况下,较低的利率应被视为对加密资产类别有利(因为它降低了持有比特币等无息商品的机会成本,并可能支持投资者的风险偏好)。

与此同时,各种宏观因素可能会对加密货币估值造成压力,包括GDP增长可能放缓和/或地缘政治尾部风险。当然,美联储意外地从降息转向加息也应被视为加密货币估值的风险因素。

从监管角度来看,积极的市场催化剂可能包括:加密 ETP 可能引入 Staking 功能、更多山寨币ETP 上市,以及参议院通过市场结构法案。话虽如此,这些发展趋势至少已部分反映在价格中,因此任何障碍都可能被视为估值的下行风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。