作者:BUBBLE

近一个月,大项目像是约好了的似的都决定在 9、10 月启动项目的 TGE,而新币的财富效应在 STBL、0G、Aster、的带领下都相当可观。

正逢国庆假日,如果你无心盯盘,不如抽点时间参与一下打新?律动 BlockBeats 整理了几个近期同样备受关注的项目。

Momentum

Momentum 是由 Sui、Coinbase、Circle 等知名 VC 投资的去中心化交易所(DEX),在今年 6 月 5 日更是让 OKX 等 VC 以 1 亿美元估值投了战略融资。

产品包括多重签名资金管理、代币释放和流动性配置,前身是多签钱包 MSafe(Momentum Safe)的团队,而因其做多签钱包项目出身的原因,在产品上更加侧重于资管安全。

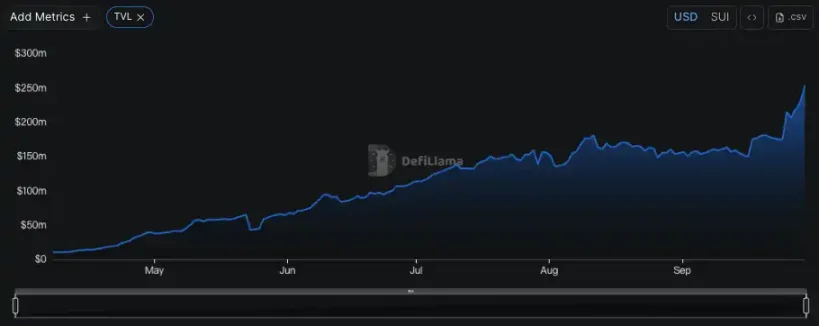

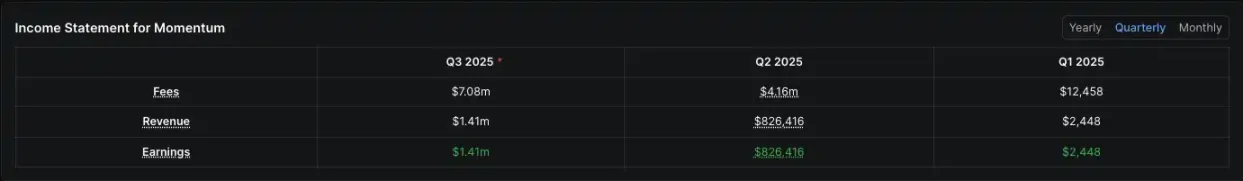

从今年 3 月底测试网启动起迅速积累了用户和资金,目前 TVL 已达约 2.4 亿美元,累计交易量超过 120 亿美元,有超过 170 万用户和 89 万提供流动性的地址。到了今年的 Q3,单季度交易手续费已经超过了 700 万美元。

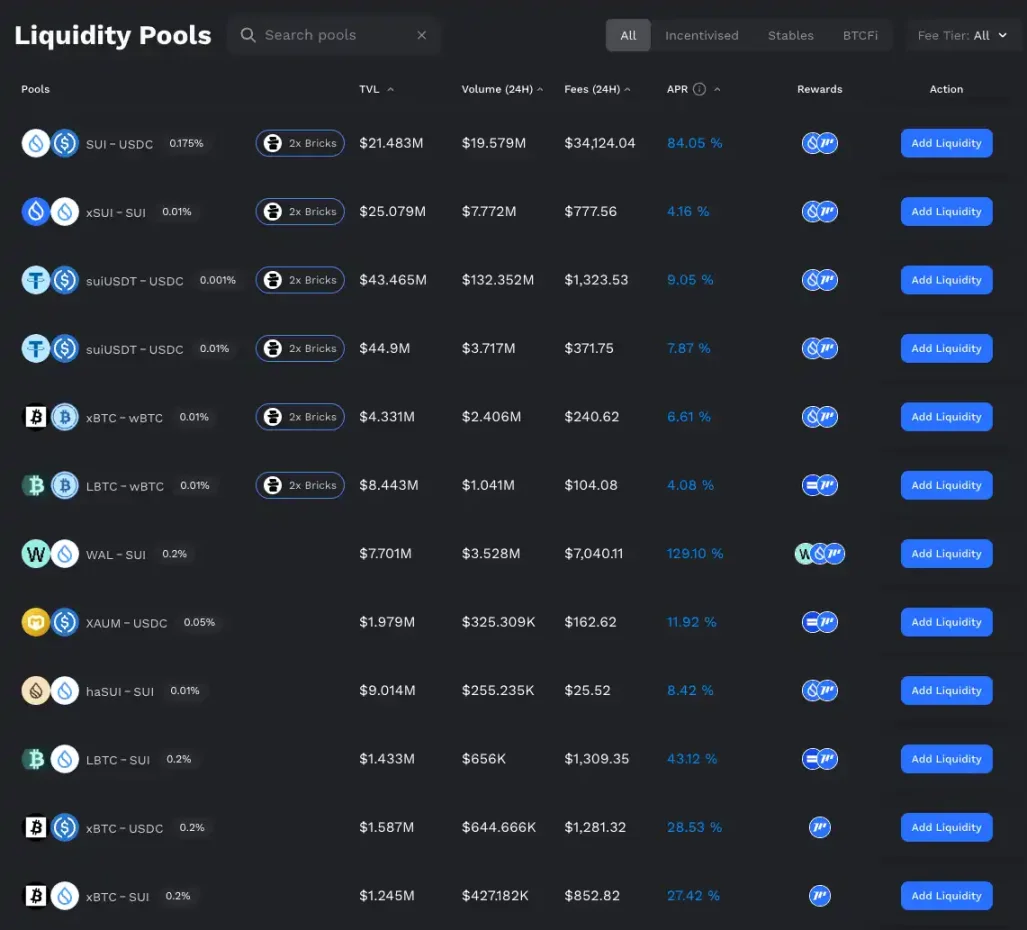

9 月 26 日起到 10 月 19 日,Momentum 联手 BuidlPad 发起「HODL Yield Campaign」活动,为 SUI、稳定币和比特币等流动性池提供高达 155% 的年化收益,参与者还能获得双倍的 Bricks 积分奖励(预售额度和可能的空投机会,官方的说法是现在的支持者将首先受益)。

流程上不难实现,用户只需前往 BuidlPad 的 Momentum HODL 活动页面(官方 Medium 有详细流程)、连接钱包后向指定池子(如 SUI/USDC、xBTC/wBTC 等)提供流动性即可。

活动期间按比例计算收益,用户可用 SUI 或美元稳定币等向池子注资,系统将在活动结束后自动结算并发放 MMT 及 Bricks 奖励。

Yield Basis

Yield Basis 是由 Curve 创始人 Michael Egorov 推出的比特币原生收益协议,在年初时以 5000 万美元的估值获得了 500 万美元融资。

Yield Basis 利用自动再杠杆机制为 BTC 流动性提供者获取交易费收益,同时对冲 AMM 曲率风险造成的无常损失。而 LP 可选择直接获取 BTC 计价手续费,或放弃手续费以换取 YB 代币激励,锁定的 veYB 可参与治理并分享协议费用。

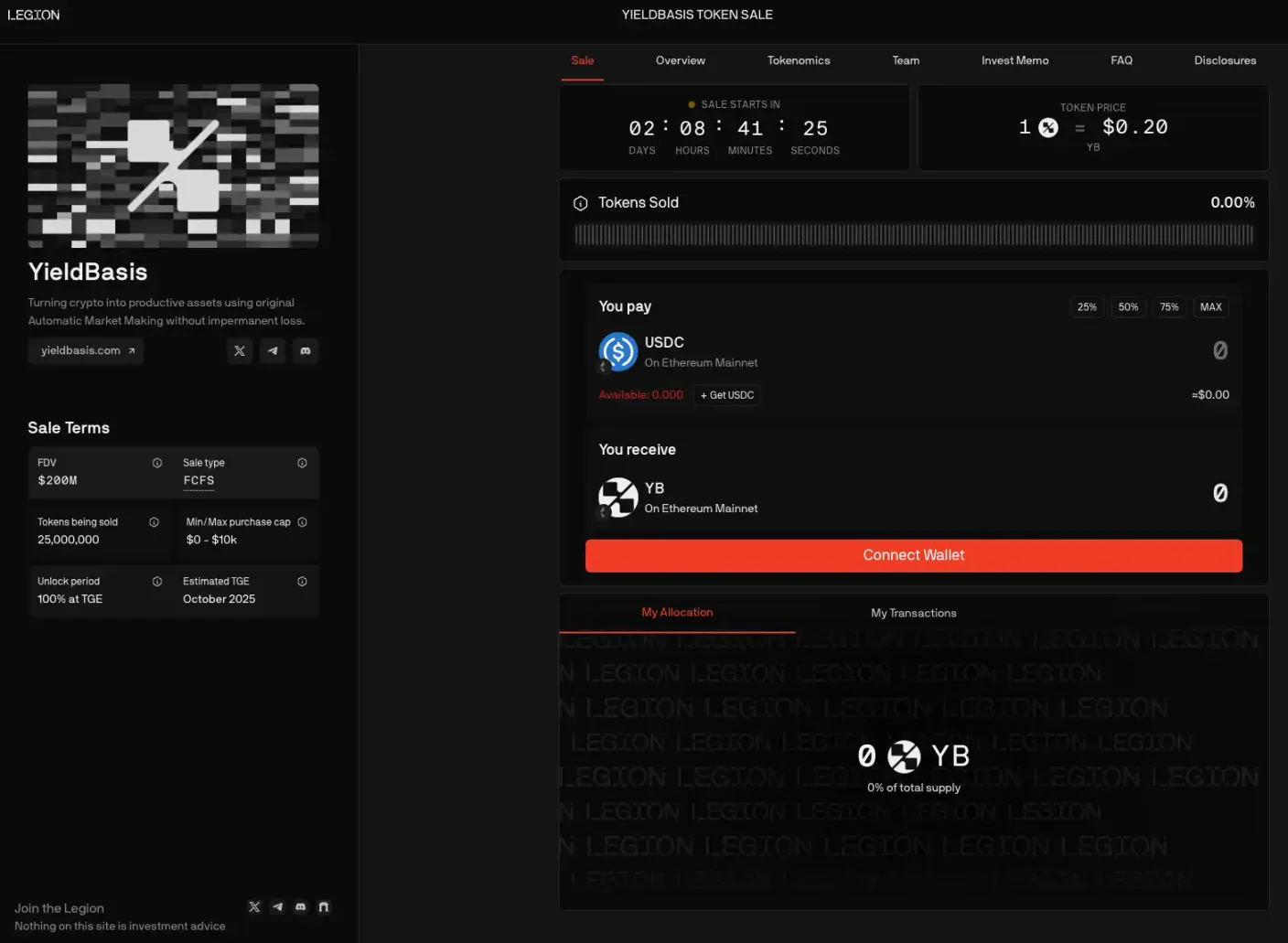

在经历了一天的延迟后,Kraken 宣布与 Legoin 合作 LaunchPad 的首发项目选定为 Yield Basis。因 Legion 的「Legion Score」体系,会根据链上行为、社交媒体活跃度以及开发者贡献来分配额度,对项目方来说能够筛选掉一大部分的多号参与者,以确保真正的建设者和核心用户优先获得认购份额。加上 Karken 的上所通路效应,市场对双方这次的合作十分关注。

当前了解到的预售模式分为两个阶段,首先预留了 20% 代币供 Legion 高评分用户认购(当前已经开放预存款,项目方将根据你的 Legion 分数进行判定额度),而剩余 80% 份额同时在 Kraken 和 Legion 按 FCFS 的模式公开销售,$YB 在销售结束后将直接上线 Kraken。

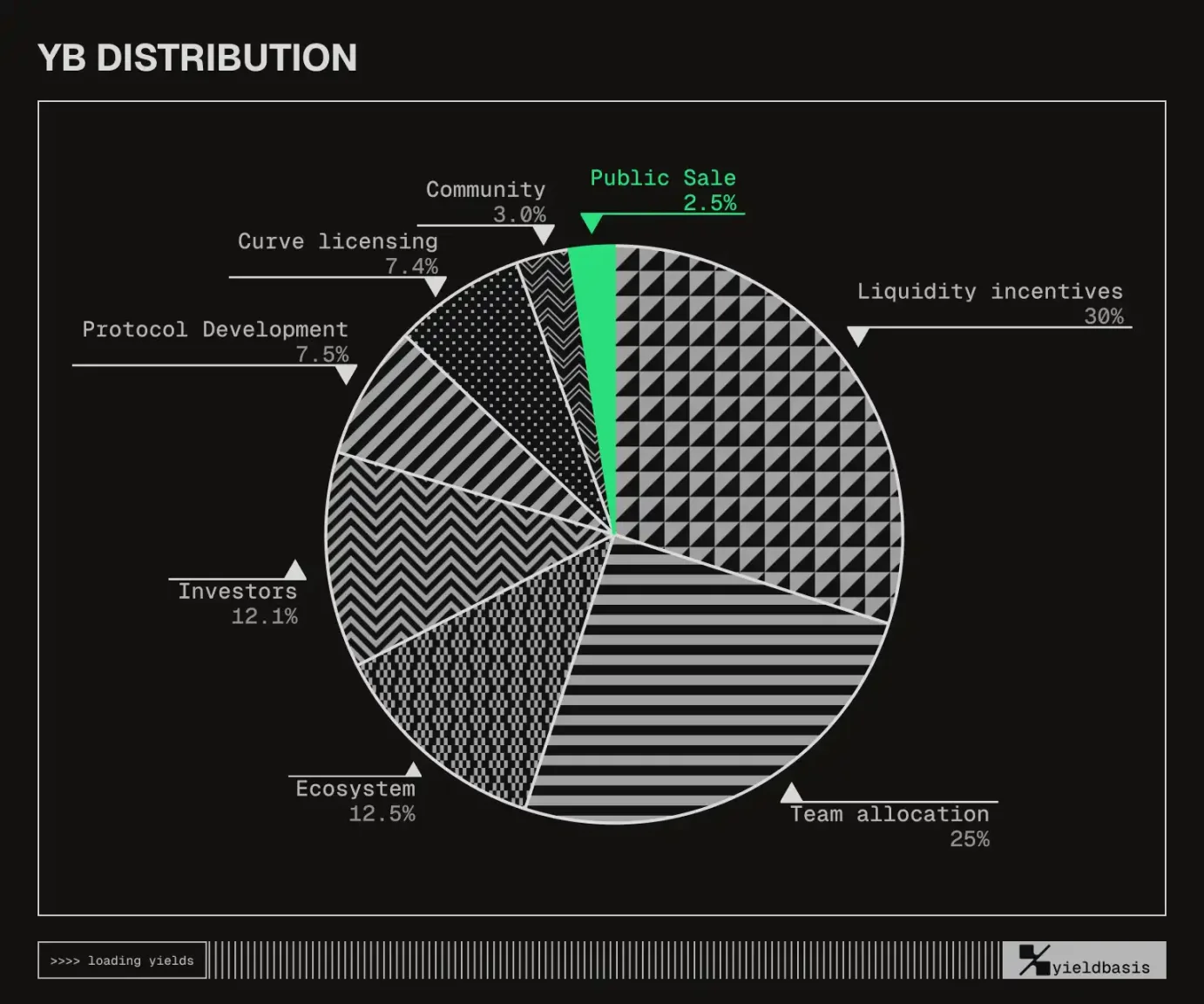

代币总量为 10 亿枚,本次社区销售 2.5%(约 2500 万枚),售价固定为 0.20 美元,每用户最高限购 1 万美元。而代币按照流动性挖矿激励占 30%,团队 25%,生态储备 12.5%,投资人 12.1%,另有 7.5% 分配给 Curve 协议许可费用,7.4% 作为开发者储备,3% 用于 Curve 治理激励的比例分配代币。

值得关注的是,Curve DAO 已投票通过以 crvUSD 为 YB 发放加速资金,用于为比特币池增加流动性。而虽然年初的融资估值仅 5000 万美元,但 Curve 社区的支持以及 Egorov 的影响力加上 Kraken 和 Legion 的情绪溢价,让 YB 以 2 亿美元的估值进行预售,大幅高于此前内部融资估值。

Canton Network

Canton Network 是一条由 Digital Asset 开发的面向机构金融市场的公链,强调隐私保护和多机构间的同步清算。而 Digital Asset 从 2016 年至今共进行了 8 轮融资近 4 亿美元,其中高盛、IBM、摩根大通等传统金融的机构多次领投,在最近的 6 月 24 日的 E 轮融资吸引 Yzi Labs、Paxos、Polychain、Circle 等更 Crypto Native 的 VC 投资。

而我们正好处在 TradeFi 和区块链愈发紧密的节点,诸如高盛、花旗、摩根大通、汇丰、BNP Paribas 等多家顶级金融机构已经开始参与测试和应用。而也已经有一些实际案例的落地,像是 2024 年 11 月替欧洲投资银行(EIB)发行了 1 亿欧元的数字原生债券,2024 年 10 月与 Euroclear 及 World Gold Council 完成代币化测试,涉及的资产包括英国金边债券(gilts)、欧债(Eurobonds)和黄金。

Canton 官方为进一步促进生态应用间的互联互通,推出了原生代币「Canton Coin」($CC)作为支付与激励工具,用于支付全局同步服务的费用。Canton Coin 可由为网络提供算力或服务的参与方发行,用于奖励应用构建者、用户和基础设施提供者。

而此前总供应量 $CC 只有节点挖矿能够产出,前 10 年最多 1000 亿枚 $CC,之后每年 25 亿枚,当前已经挖出了 284.8 亿枚,而分配模型从一开始的为超级验证者提供 80% 的分配会随着时间以及网络稳定后逐步减少,到 10 年后仅剩 5%,同样的应用提供者和其他普通验证者的份额随之上升。也因为如此 $CC 在二级市场的流动性相当薄弱。

而 Canton Network 这次与生态中的 Temple 合作推出的,是首次允许用户完成 KYC 后买卖和管理 Canton Coin 的交易平台,但关于散户具体如何参与、能否参与都还未可知,需要等待进一步的公告。

而我们当前能够参与的是,Canton Network 生态中的钱包项目SEND在 9 月 28 日推出的Canton Wallet的空投活动。官方表示将为了测试 Canton Wallet 将给参与测试的用户分配 $CC 的额度(在填写谷歌表单验证后),具体的流程是买一个 SENDTAG 且持有 7000 个$SEND,并质押 20u 到金库里。这可能是普通人最方便加入的方式,但 Canton Wallet 仅会将自己赚到的 30% 的 $CC 给用户空投,可能并不存在很大的获利空间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。