撰文:BUBBLE,律动

9 月 25 日,市场瞩目的 Plasma 原生代币 XPL 上线,开盘后一度涨至 1.6 美元,除了参与预售的人,一开始存款的人也收到了大量空投奖励。加上各大交易平台的空投活动,甚至 Binance Alpha 的空投都可以领取约 220 美元的 $XPL,可以说是阳光普照了。

几乎在疯狂撒钱的 Plasma 在上线后即启动了为期 7 天,持续到 10 月 2 日的大规模流动性激励计划,涵盖包括 Aave、Euler、Fluid、Curve、Veda 等主流协议。用户可以将稳定币存入这些协议或持有相关代币,同样可以获取 XPL 奖励。

如果你错过了存款、错过了预售、错过了链上价差的套利,那你不能错过薅羊毛的机会了。律动 BlockBeats 整理的五个主流矿池,他们中的一些 APR 甚至超过了 35%。

挖前准备

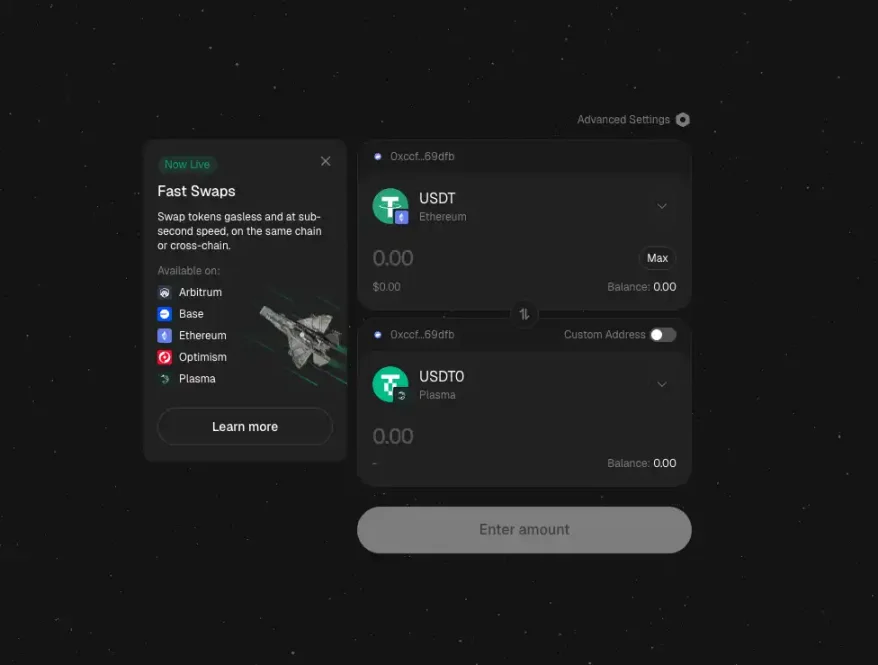

在挖矿开始之前需要完成资产准备,一些协议需要通过 Stargate 将主网 USDT 跨链至 Plasma,获得等值的 USDT0;同时还需要少量的 XPL 作为交易 Gas 费用(EVM 系基本都可以)。

plasma 这次的活动基本上都和 Merkl 合作,我们可以随时登录 Merkl 的 Dashboard 跟踪奖励情况,Merkl 平台会根据用户的存款规模和持续时间自动计算奖励,用户只需定期手动领取即可。

哪些池子好挖?

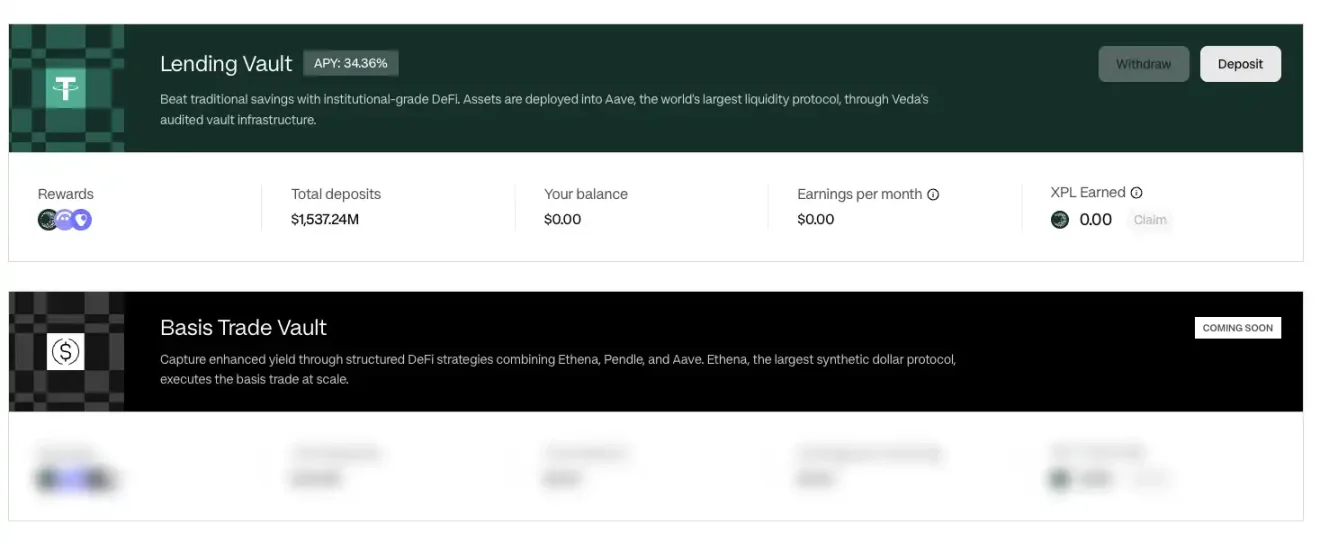

PlasmaUSD Vault

这个活动是 Plasma 官方发起的,在 Veda 协议下的 PlasmaUSD Vault 以持币挖矿的形式发放 WXPL,当前只开放了 Lending Vault,未来也会开放 Basis Trade Vault。

操作也相当简单,只要点击 Deposit 存入 USDT0/USDT,持有该 Vault 的份额,无论在主网还是 Plasma 链上,均可获得 WXPL 的奖励,每 8 小时可以领取,但是借贷后的 USDT0 有 48 小时的提款冷却期。

当前年化收益率约为 34.36%,每日奖励金额高达 140 万美元,值得注意的是其中 100 万的主奖池仅会持续 3 天,到 9 月 29 号结束,不清楚官方之后还会不会持续激励。

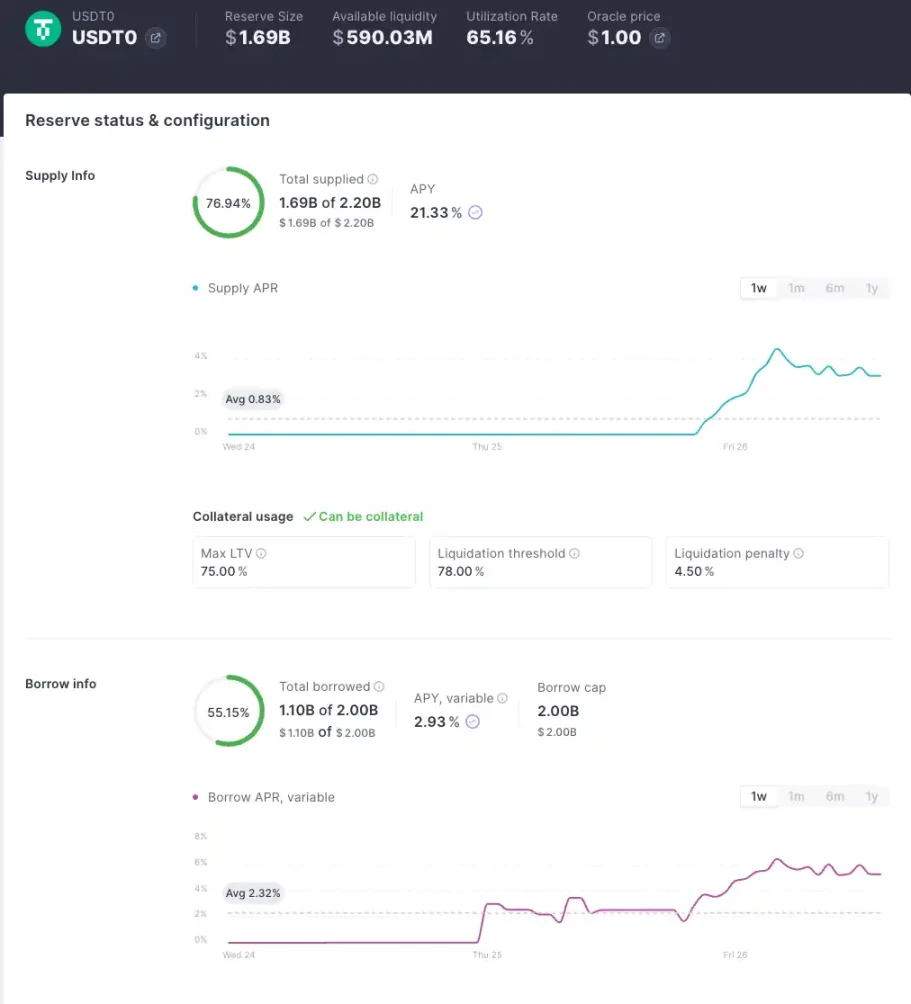

Aave USDT0

与 Plasma 的借贷 Vault 一样,从 Aave 上存入 USDT0 借贷额度也可以获得 WXPL 奖励。当前协议中已经存入了 17 亿美元,年化收益率约为 21.33%(协议本身的 APY 约 3.19% 、WXPL 18.15% APY),每日奖励额度约 70 万美元价值的 XPL。

相比于 Plasma,其优势就是可以随时提取,但需要在不持有任何 USDT0 或 USDe 债务的情况下提供 USDT0,意味着无法进行循环贷提升使用率。

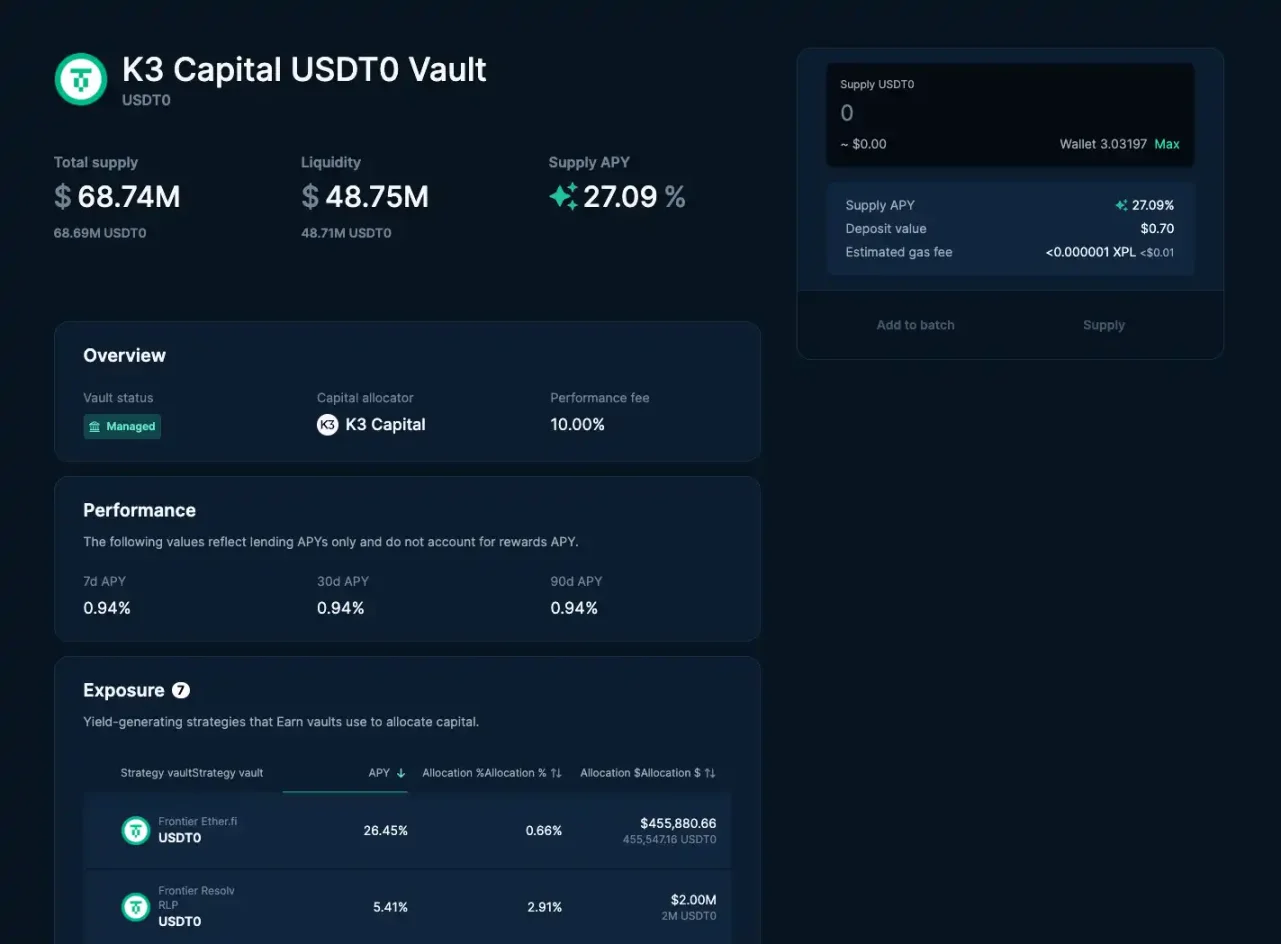

Euler K3 Capital USDT0 Vault

在 Plasma 的 Euler 协议中,由 K3 Capital 管理的 USDT0 Vault 当前年化收益率大约为 27%,每日激励分配约 5.5 万美元等值的 WXPL。

用户只需要存入在 Plasma 主网上的 USDT0,将 USDT0 存入(Supply)该 Vault 以开始挖矿。

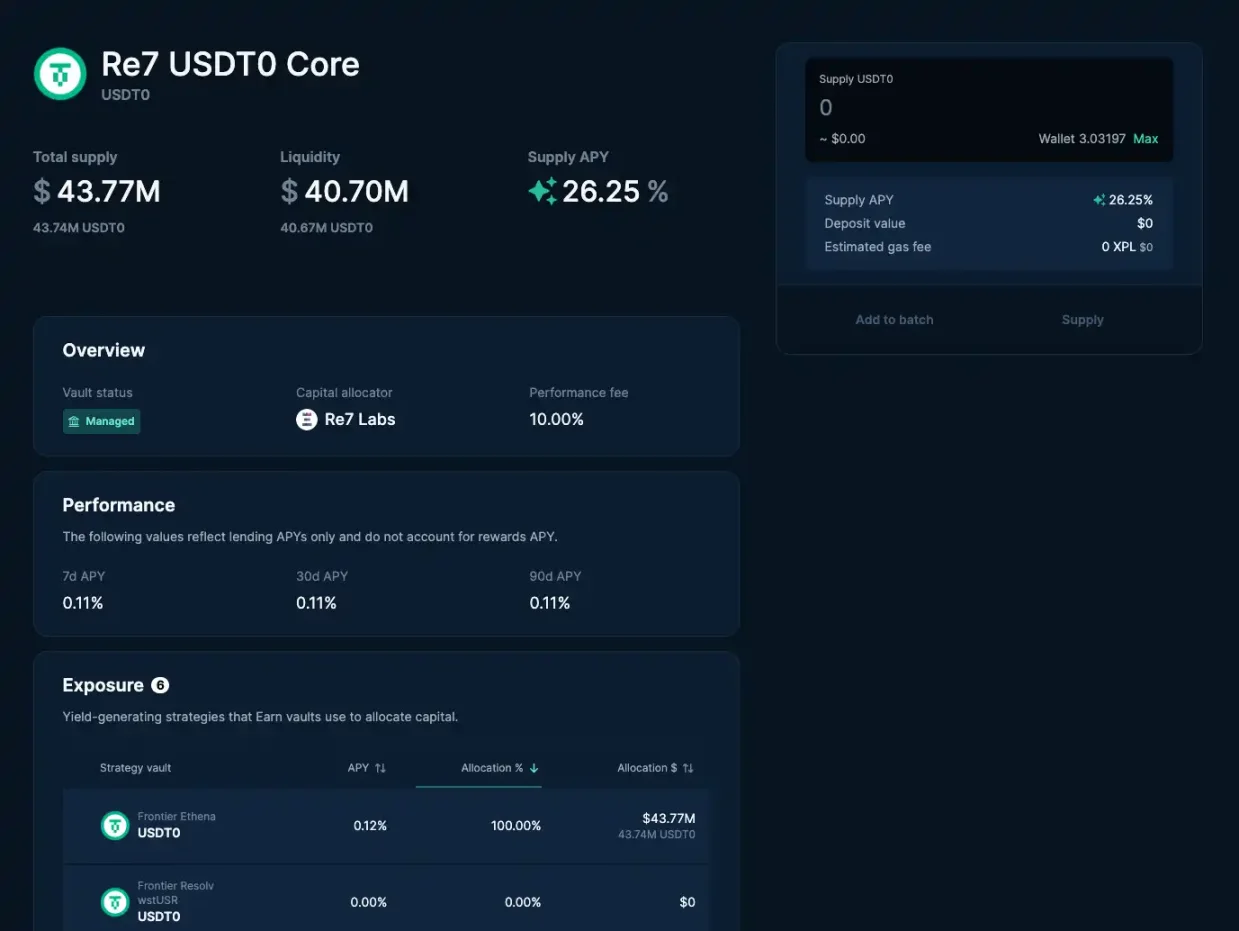

Euler Re7 Core USDT0 Vault

同样在 Euler 协议下,Re7 Core USDT0 Vault 则采用无损活期的借贷模式,用户将 USDT0 存入该 Vault 即可参与。该池当前年化收益率约为 30.43%,每日奖励约为 3.5 万美元等值的 XPL,Euler 的池子虽然 TVL 相对较低,但收益率和奖励水平同样可观,适合散户分散配置。

Fluid fUSDT0 Vault

Fluid 协议的 fUSDT0 Vault 提供用户存入 USDT0 、USDe、ETH 到借贷 Vault 的奖励,以及以 USDai 和 USDTO 为凭证借贷 USDT0 的奖励,意味着可以首先抵押 USDai 和 USDT0 借出 USDT0 获得约 24% 的年化收益率。

再用 USDT0 去借贷池提供流动性,当前年化收益率约为 25%。

值得注意的是借贷 USDT0 的活动大部分 APR 为 Plasma 的活动提供,目前实际借款利率在 3% 左右,如果借款需求上升,利率可能快速上行,挤压你的净收益。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。