Author: Zhou, ChainCatcher

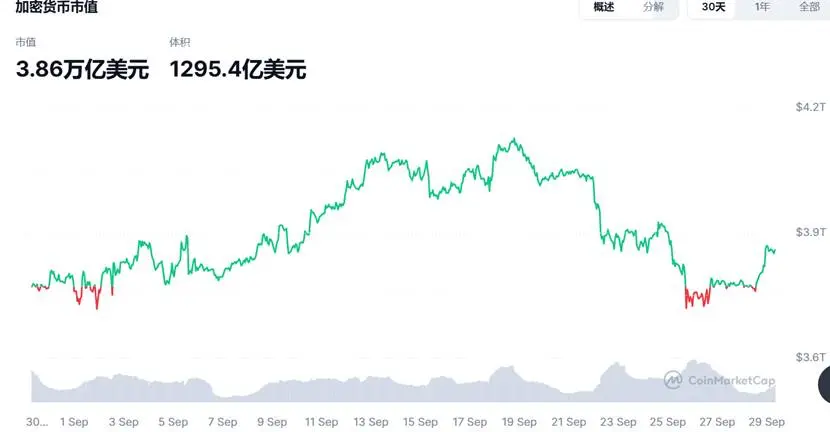

After the interest rate cut in September, the overall cryptocurrency market continued to exhibit the "September curse," showing a downward volatility trend. The global market cap dropped from a high of $4.13 trillion on September 19 to a low of about $3.72 trillion, nearly erasing all gains from the first half of the month, with a total market cap evaporation of over $400 billion. Mainstream cryptocurrencies like Bitcoin and Ethereum faced price pressure but formed a short-term bottom after a slight rebound last weekend. As the end of the month approaches, what factors and major events will influence the upcoming market, and how do institutions view the future market?

1. Market Review

According to CoinMarketCap data, from September 22 to 28, 2025, the total global cryptocurrency market cap shrank from $4.04 trillion to $3.79 trillion, evaporating about $250 billion. Bitcoin fell from a high of about $115,000 at the beginning of the week to $109,500 by the weekend, with a weekly decline of about 5%, testing the key support level of $107,000 during this period. The spot ETF saw a net outflow of $903 million in one week. Ethereum's volatility was even more pronounced, dropping from $4,200 to $3,900, a cumulative decline of 7%, with a net outflow of $796 million from the spot ETF.

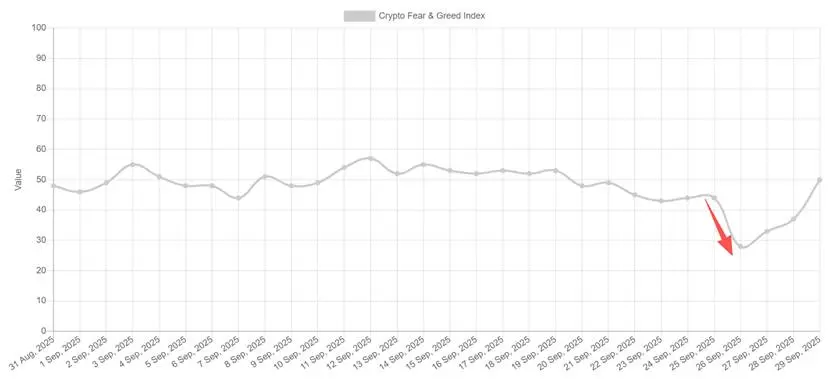

Other mainstream coins showed mixed performance. SOL performed relatively steadily, with a weekly decline of only 2%, closing at $182; XRP fell over 6%, closing at $2.75; BNB fluctuated around $970, with a decline of about 4%. The cryptocurrency fear and greed index plummeted from a neutral 50 at the beginning of the week to a panic level of 28, before slightly rebounding to 37 over the weekend, indicating some stabilization in sentiment.

According to coinglass data, the total amount of leveraged liquidations in the cryptocurrency market last week approached $2 billion, mainly concentrated in BTC and ETH long positions, with $380 million liquidated in a single day on September 22; open interest (OI) fell from a peak of about $50 billion to around $45 billion. On-chain data shows that long-term holders (LTH) realized profits corresponding to about 3.4 million BTC last week, with an increasing tendency to sell, reflecting market pressure.

In terms of exchange fund flows, CryptoQuant showed that last week there was a net inflow of about 25,000 BTC (approximately $2.75 billion) and a net inflow of about 120,000 ETH (approximately $468 million) into exchanges, indicating strong selling sentiment. Glassnode data indicated that the number of active BTC addresses averaged about 650,000 per week, down 10% from early September; active ETH addresses were about 400,000, down 12%, showing a significant decrease in retail address participation.

Despite this, market sentiment saw a turnaround over the weekend. Santiment data showed that discussions about BTC on the X platform surged by 40% on September 22, primarily around keywords like "dip" and "crash"; by the weekend, discussions around "buy" and "bottom" increased by 25%, possibly indicating a short-term bottom may be forming.

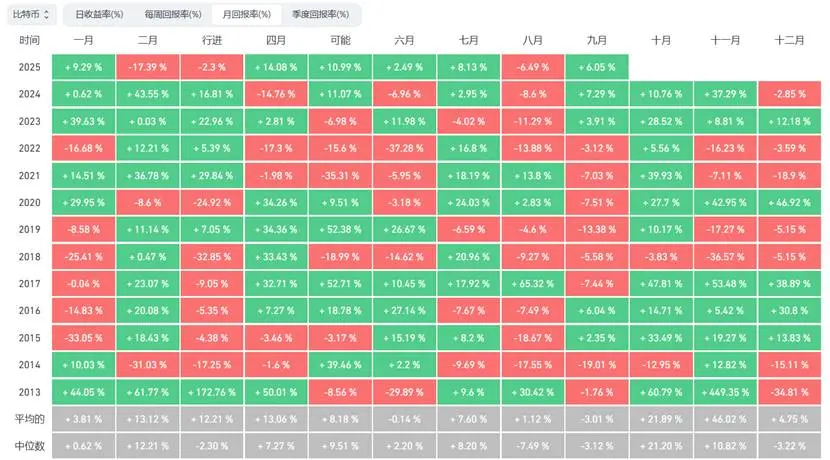

Overall, last week the cryptocurrency market was dragged down by the September curse, with net outflows of funds and a shrinking total market cap, but prices stabilized and sentiment warmed over the weekend, shifting from panic to cautious optimism. Historical data shows that from 2013 to 2024, BTC's average return in October was about +21.89%, significantly higher than September's -3.91%, leading investors to potentially bet on the "Uptober" window.

2. Major Macroeconomic Events This Week

This week is packed with major macroeconomic events that could trigger market volatility. First, a joint roundtable meeting between the U.S. SEC and CFTC was held on September 29. Crypto journalist Eleanor Terrett posted on the X platform that the SEC has requested LTC, XRP, SOL, ADA, and DOGE ETF issuers to withdraw their 19 b-4 applications, as the general listing standards have been approved. This effectively simplifies the ETF approval process. Bloomberg ETF analyst Eric Balchunas pointed out that the likelihood of altcoin ETFs being approved is "now really 100%," adding that new altcoin ETFs could appear at any time.

On September 30, the White House will hold a meeting in the evening, and the Senate will re-vote to decide on government funding after October 1, with the U.S. government facing a risk of shutdown. FP Markets analyst Aaron Hill noted that investors are cautious about a government shutdown, which could cast a shadow over economic data releases and weaken signals from the Federal Reserve. If a shutdown occurs, the non-farm payroll report originally scheduled for release on October 3 will be delayed, increasing uncertainty for the Federal Reserve's meeting on October 28-29.

On October 1, the U.S. Senate Finance Committee will discuss cryptocurrency tax policies, involving adjustments to capital gains tax rates and reporting thresholds.

On October 3, the U.S. will release its September non-farm payroll data, with an expected addition of 145,000 jobs and an unemployment rate of 4.2%. Citigroup expects global economic growth to slow to below 2% in the second half of 2025. Federal Reserve officials spoke intensively last week, with Hammack expecting inflation to reach the 2% target by the end of 2027 or early 2028, suggesting a slowdown in easing measures. JPMorgan CEO Jamie Dimon believes that with inflation remaining at 3%, the Federal Reserve will find it difficult to cut rates further, and the market's expectations for multiple rate cuts are overly optimistic.

Federal Reserve's Williams stated on Monday that initial signs of weakness in the labor market prompted him to support a rate cut at the recent Federal Reserve meeting. He believes it makes sense to slightly lower rates and that a moderate easing of some tightening measures will help boost the job market and apply some downward pressure on still elevated inflation levels. Additionally, his model estimates the actual neutral rate at 0.75%, but he emphasized that policy is data-driven.

Moreover, Trump threatened on social media to "fire" Federal Reserve Chairman Powell, increasing concerns about the independence of the Federal Reserve. PGIM Fixed Income Vice Chairman Daleep Singh warned that excessive dovishness under political pressure could drive up inflation, weaken the dollar, and benefit Bitcoin and Ethereum. Gold prices, driven by a weaker dollar and expectations of rate cuts, have reached new historical highs, reflecting market demand for safe-haven assets and indirectly supporting crypto assets.

3. Institutional Outlook on the Market

Most institutions and analysts are optimistic about the market in the fourth quarter, predicting Bitcoin's target price to be between $120,000 and $250,000, and Ethereum between $4,200 and $13,000, with on-chain data and low volatility suggesting a "calm before the storm."

Coinbase CEO Brian Armstrong tweeted that Bitcoin could reach $1 million around 2030, recommending long-term investment. BitMine Chairman Tom Lee predicted at the 2025 Korea Blockchain Week Impact Summit that Bitcoin would reach $200,000 to $250,000 by the end of the year, and Ethereum would reach $10,000 to $12,000, stating that the Ethereum to Bitcoin exchange rate would return to historical averages or five-year highs, with price discovery completing between $12,000 and $15,000 after breaking previous highs, far from a peak. This prediction aligns with Fundstrat Chief Market Technician Mark Newton's targets.

Matrixport analysis pointed out that the greed and fear index is close to a low point, historically corresponding to tradable bottoms, with Bitcoin approaching the convergence point of a symmetrical triangle, potentially breaking out to $110,000. The options market is positioning ahead, but high leverage could lead to volatility or early explosions, with declining trading volumes increasing the risk of forced liquidations, suggesting risk exposure should be controlled. They emphasized that this bull market is institutionally driven, with the 21-week moving average at $109,899 serving as the bull-bear dividing line; maintaining this level would extend the trend.

CryptoQuant data shows that current exchange reserves are close to multi-year lows, with a net outflow of 170,000 Bitcoin over 30 days, and the MVRV ratio is neutral, with funding rates balanced, indicating rising demand before supply tightens. ITC Crypto founder Benjamin Cowen predicts that Bitcoin's dominance will return to over 60%, with altcoins weakening in the short term and liquidity flowing back to Bitcoin. FxPro senior analyst Alex Kuptsikevich believes that Bitcoin breaking through resistance at $113,500 and $115,000 will restore the upward trend; otherwise, the risk of a pullback increases. XWIN Research noted that implied volatility has dropped to its lowest level since 2023, similar to the 325% surge in 2023, indicating a significant market movement ahead. Market analyst James Van Straten stated that derivatives will drive Bitcoin's market cap to $1 trillion, with CME Bitcoin futures open interest reaching an all-time high, reflecting a mature market structure.

However, there are also a few voices warning about inflation and pullback risks. Cryptonomist reported that under inflation concerns, if Bitcoin falls below $104,000-$100,000, it could drop to $80,000-$84,000. Crypto KOL Ansem predicts a 60% chance of Bitcoin rebounding to $90,000, a 20% chance of falling to $75,000, and a worst-case scenario of dropping to $50,000 (5% chance), recommending buying at low levels, with an upward start in the second quarter of 2026. He believes the "four-year cycle" is no longer applicable, and the bear market may last longer. Glassnode released data on social media indicating that the NUPL (Net Unrealized Profit/Loss) metric for short-term holders of Bitcoin has entered the loss zone, suggesting that recent buyers are under pressure. Historically, surrender events among short-term holders often mark the market entering a reset phase, usually laying the groundwork for a new round of asset accumulation.

Overall, the short-term market is significantly influenced by the release of economic data and policy changes. In the long term, institutional confidence in the cryptocurrency market remains solid, especially regarding expectations for a cyclical bull market from 2026 to 2030.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。