来源:Coinbase

编译:金色财经

Coinbase认为,本周的宏观数据削弱了市场对大幅降息的预期,美元走强,金融环境收紧。

美国经济分析局(BEA)的第三次预估将美国第二季度GDP年化增长率上调至3.8%,表明潜在需求比之前的数据所暗示的更为强劲。与此同时,8月份耐用品订单环比反弹2.9%(不包括运输业增长0.4%),核心资本货物订单(衡量企业投资的关键指标)环比增长0.6%。当周初请失业金人数降至21.8万,表明劳动力市场正在走弱,但恶化程度并未达到之前数据所暗示的程度。

综合来看,我们认为这些数据表明经济增长和劳动力条件强于预期,削弱了在通胀持续高企的情况下快速放松货币政策的可能性。市场似乎正在消化这种转变:利率小幅走高,美元指数接近三周高点,美元流动性略微收紧,而加密货币价格回落。

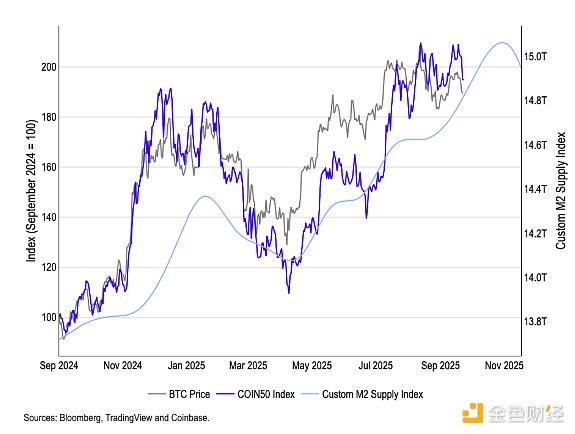

从更全球的角度来看,Coinbase定制的M2流动性指数表明,流动性逆风将从11月开始出现。我们定制的全球M2流动性指数(该指数优化了货币供应量增长,全球M2供应量领先比特币110天)从11月开始向下拐点。由于该指数在1个月至3年的时间范围内与BTC的相关性约为0.9,我们认为拐点很可能预示着年底将出现流动性逆风(图1)。然而,该指数也表明10月份流动性状况良好,这可能在短期内支撑风险资产。

图 1. M2 流动性指数预计11月初开始下降

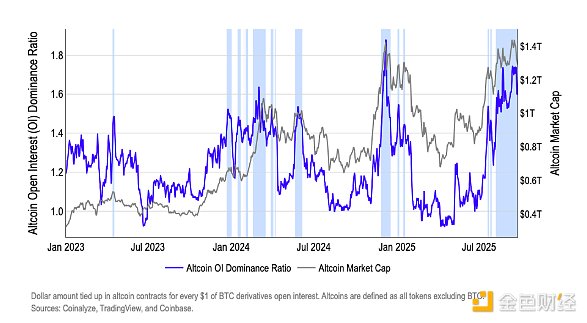

除了宏观因素之外,我们认为本周的加密货币清算是仓位压力导致的,这种压力已经持续了几周,并发出了警示信号。正如我们在之前文章中所讨论的那样,山寨币未平仓合约的主导地位远高于1.4的门槛,而这一门槛通常预示着大规模清算的发生。上周末,该比率达到1.7,随后我们看到约18亿美元的多头仓位被强制平仓,因为整个市场的多头仓位都被清算了(图2)。

即使在平仓之后,该比率仍然保持在1.6的高位,我们认为这凸显了在即将发布的可能影响利率和美元的数据发布之前,仍然需要谨慎仓位。

图 2. 山寨币持仓量主导比率

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。