一、关税下的实体经济:贸易转移与数据承压

自 8 月 7 日对等关税生效以来,全球贸易格局已发生显著变化。美国进口额大幅下降,全球制造业 PMI 进入收缩区间,实体经济的增长动能明显减弱。不过,关税引发的 “贸易转移” 效应正在显现 —— 中国对美出口虽遇冷,但对东盟的出口呈现快速增长态势,成为缓解贸易压力的重要支点。

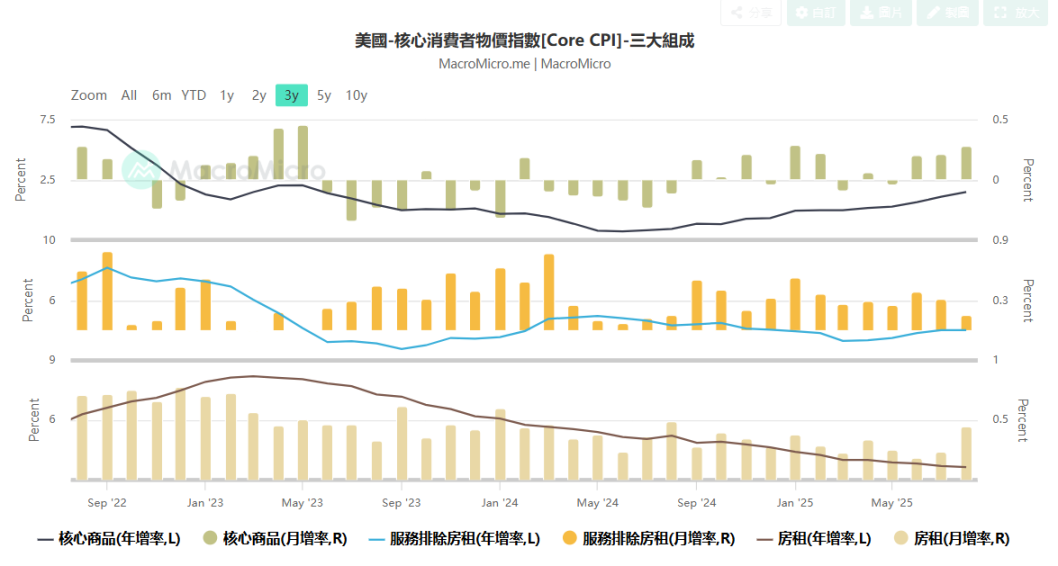

更深层的影响正沿着物价与就业链条传导。美国 CPI 整体看似稳定,核心 CPI 却持续上升,进口商品价格上涨尤为突出,而 10 月 1 日即将生效的 100% 制药关税,预计将进一步推高相关商品价格,对消费者支出形成直接压力。

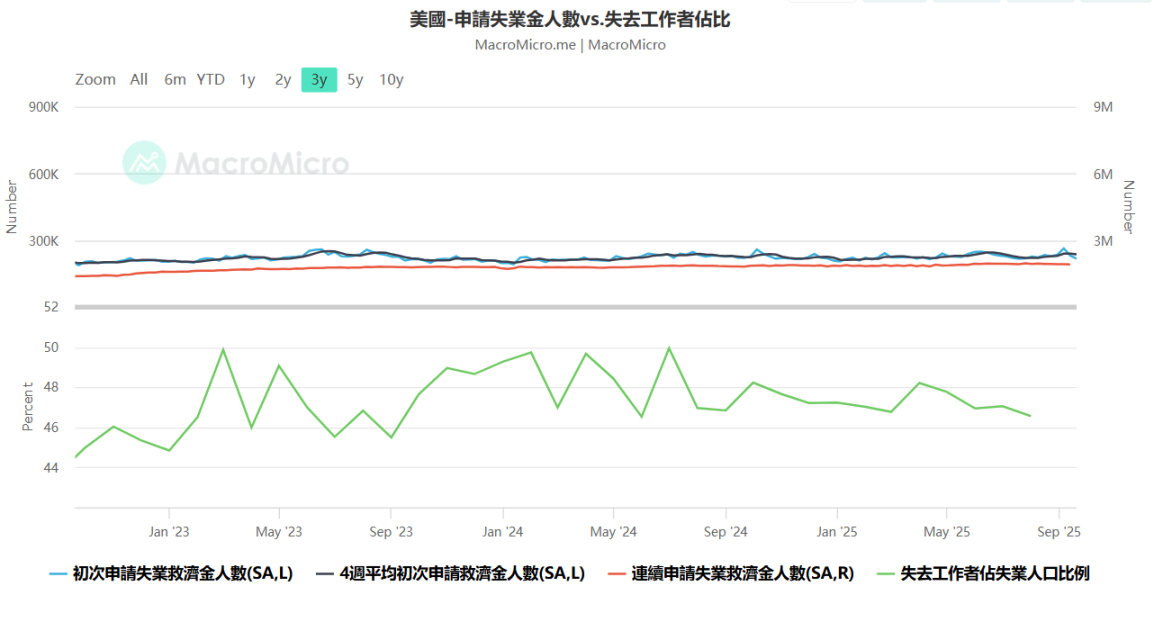

就业市场同样显露疲态:制造业新订单指数仅略有回升,就业增速已出现放缓,消费者信心指数持续走低,9 月密歇根大学 8 月消费者信心指数预期 55.4,较上月的 58.2 继续承压,且上月数据已低于预期的 58.6。

二、资本外流加剧:从风险资产到避险领域的迁徙

关税不确定性持续放大资本外流压力,成为影响资本市场情绪的核心因素。资金正加速从风险较高的股票市场流出,转向高流动性资产,形成清晰的 “防御性” 迁徙特征。这种迁徙不仅体现在传统资产配置的调整上,更在加密货币市场展现出独特的 “桥接” 效应。

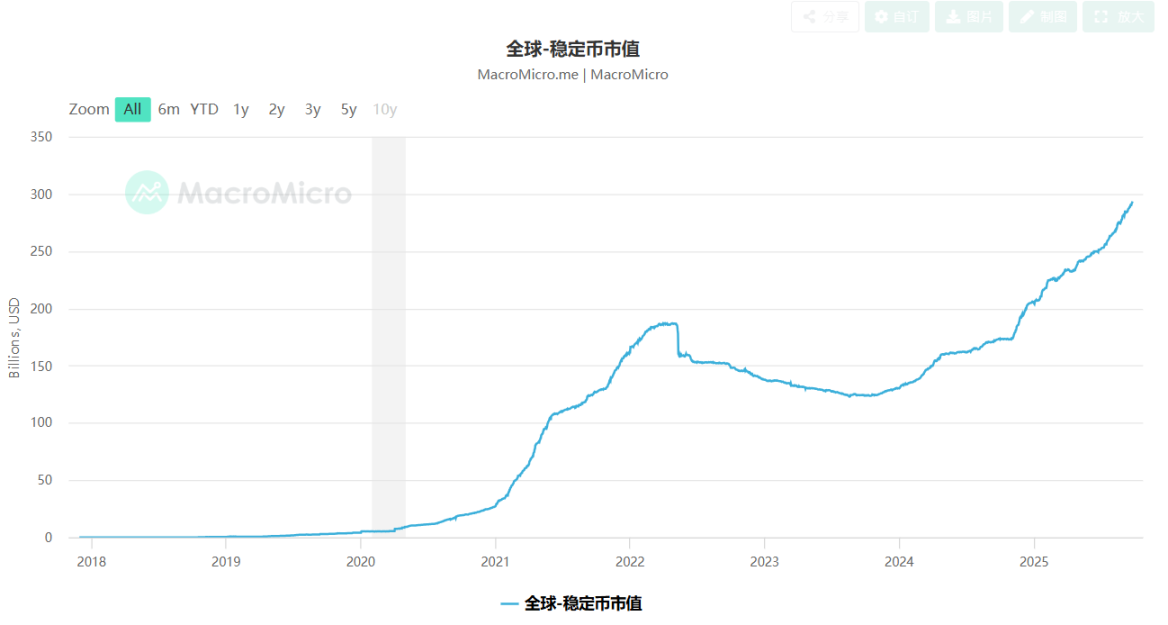

9 月数据显示,尽管加密市场总市值有所缩水,但资本流入的结构性特征显著:稳定币单月流入 25 亿美元,比特币 ETF 净流入 15 亿美元。这一现象背后,是企业与投资者对传统金融体系局限的主动规避 —— 稳定币(如 USDT/USDC)成为跨境贸易结算的新工具,有效对冲汇率波动和支付延误风险;而比特币则被赋予 “数字黄金” 属性,成为对冲通胀与地缘政治风险的重要标的,这与当前全球宏观经济不稳定、地缘冲突反复的背景高度契合。

三、宏观变量交织:政策与流动性的双重扰动

资本转向的背后,是多重宏观变量的复杂交织,其中美联储政策与美国国内政治僵局的影响最为深远。

当前市场核心交易逻辑围绕美联储降息预期波动,利率互换市场预测 2025 年 10 月 29 日降息 25bp,全年将累计降息 50bp,2026 年再降 50bp,中性利率维持在 3.25%。

但 9 月以来的经济数据呈现 “偏空” 特征:8 月耐用品订单月率 + 2.9%、第二季度实际 GDP 年化季率终值 + 3.8% 等超预期数据,均削弱了降息预期,而美联储在第 34-38 周缩减 1287 亿美元资产、持续减持美债的操作,进一步收紧了市场流动性。

更严峻的风险来自美国政府关门危机。两党在临时支出议案上陷入尖锐对立,政府关门概率已飙升至 75% 以上,9 月 29 日参议院复会成为最后窗口期。若关门落地,劳工统计局将在 10 月 1 日关闭,导致 10 月 4 日的就业报告、10 月 15 日的 CPI 报告等关键数据延迟发布,这将显著增加美联储 10 月底议息的决策难度,甚至可能打乱降息节奏。历史经验显示,2013 年 16 天的政府关门后,数据发布延迟持续至第 51 天,这种不确定性将加剧市场波动。

流动性紧张已成为不容忽视的现实。截至 9 月 24 日当周,美国银行业准备金余额跌破 3 万亿美元,降至 2025 年 1 月以来最低,且外国银行现金资产下降速度快于本土银行。尽管美联储已放缓缩表步伐,但量化紧缩与财政部增发债务的双重作用,仍在持续抽离金融体系流动性,关键隔夜利率从 4.08% 升至 4.09%,凸显融资成本上升压力。

四、市场前瞻:数据窗口与加密资产的机遇期

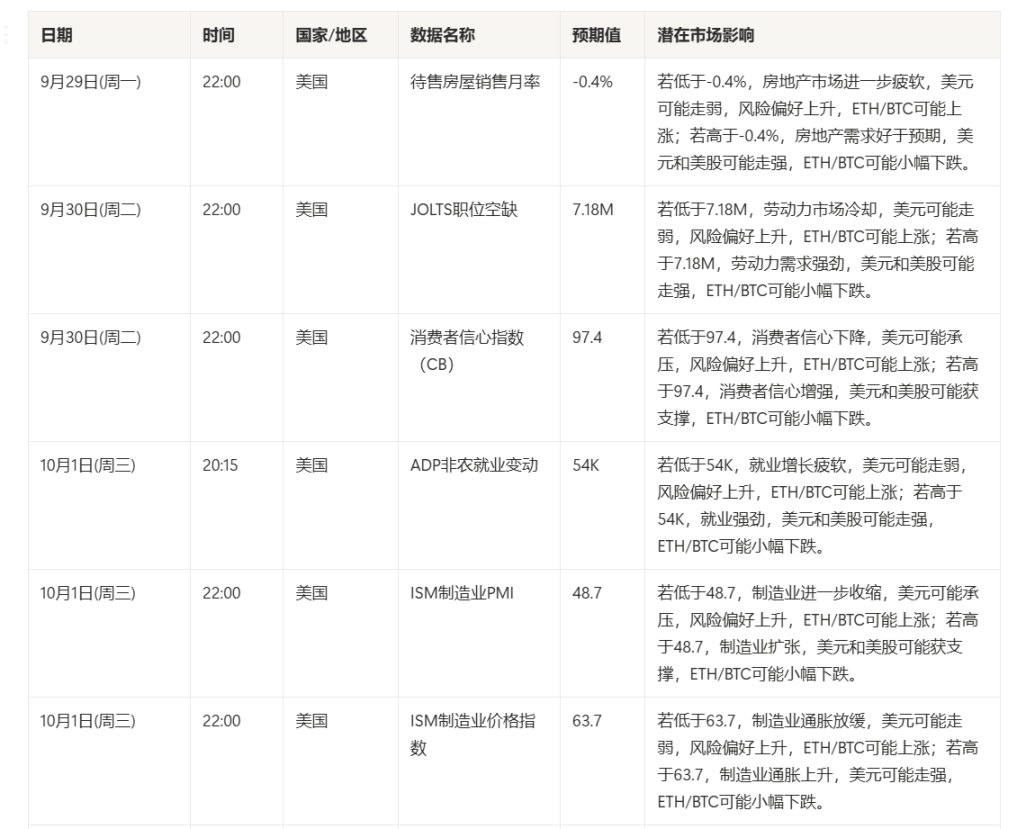

短期来看,密集的经济数据发布将成为市场方向的 “试金石”。9 月 29 日至 10 月 3 日,美国将陆续公布待售房屋销售月率、JOLTS 职位空缺、ADP 非农就业、ISM 制造业 PMI、非农就业变动等核心数据,任一数据偏离预期都可能引发美元与风险资产的波动。以 10 月 3 日的非农就业数据为例,若低于预期的 22K,美元可能走弱,ETH/BTC 有望迎来上涨;若高于预期,则可能压制加密资产表现。

从加密市场技术面看,比特币正处于关键调整期:日线在零轴附近死叉,周线死叉放大并准备冲击前低 107200,目前已从高点回调 7 周,距离上次 12 周的回调周期尚有 5 周左右。理论测算显示,回调底部可能在 84500-89300 区间。但中长期无需过度悲观,全球 M2 已止跌回升,其流动性传导至比特币的时间窗口预计在 10 月 12 日当周,若 M2 持续新高,有望推动比特币周线重新金叉并续创新高。

在宏观经济不稳定与地缘冲突加剧的背景下,各国量化宽松与举债军备的应对策略,可能推动比特币在月线金叉通道内形成第四波周线金叉。对于投资者而言,当前的调整期或孕育着布局机会 —— 若比特币回调至预期底部区间,且日线出现金叉信号,将成为月线上升通道中的优质低吸窗口。

结语

关税摩擦重塑了全球贸易与资本流动格局,实体经济的压力与传统金融体系的不确定性,正在推动资本向加密资产寻找避险港湾。尽管短期市场面临美联储政策摇摆、政府关门风险与技术面调整的三重压力,但从流动性传导周期与资产配置逻辑看,加密货币的 “数字避险” 属性正不断强化。在即将到来的密集数据窗口与政策节点中,密切跟踪宏观信号与市场结构变化,将是把握机遇的关键。

撰稿:WolfDAO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。