Spot Solana ETF Amendments Filed With Staking: SEC Approval MayBe Soon

One of the biggest trends is occurring in the cryptocurrency exchange-traded fund space. Asset managers such as Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary have submitted amendments to launch a Spot Solana ETF with Stake functionality, which is an indication of regulatory approvals in the near future.

Popular Asset Managers Enter Spot Solana ETF Filing

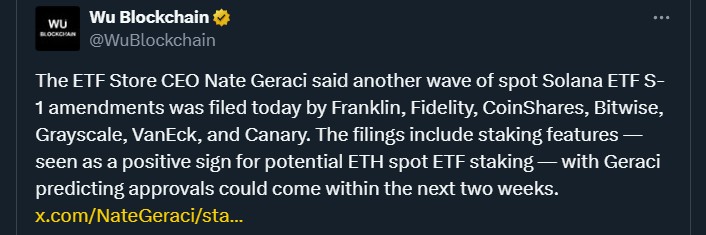

A wave of filings on September 26, 2025, made the cryptocurrency community pay attention. Major companies such as Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary filed S-1 amendments to their spot SOL ETFs.

Source: Wu Blockchain X

Such disclosures would be a necessary process in securing SEC approval that would enable investors to invest directly in SOL through regulated Exchange-traded funds. The recurring filings, which are in some instances called Amendment No. 4, indicate that such managers are harmonizing their proposals with the regulatory requirements.

Latest Update: Staking Features

These features are one of the most thrilling features in these filings. This enables investors to gain rewards through participating in the blockchain network, just as Ethereum staking does.

Asset managers are not only making their Solana ETFs more attractive by offering staking rewards, but also continuing the trend of REX-Ospreytm ETFs + proof-of-stake rewards, which is set to be launched on September 25, 2025, and offer monthly staking rewards to investors. The Ethereum proof-of-stake network has proved this strategy correct and demonstrated that rewards can be used to earn extra income for investors.

Nate Geraci on Solana Exchange Traded Fund

According to analysts such as Nate Geraci, the presence of proof-of-stake rewards in Solana ETFs is an encouraging development when it comes to possible Ethereum spot ETFs with staking. Solana could be approved by regulators; Ethereum of the same type might come next.

Source: Nate Geraci X

This would potentially offer investors an additional opportunity to invest both in capital gains and in proof-of-stake, and this would make the crypto ETF more diversified and appealing to the investor.

Why is watching it closely?

These developments are of close interest to the community and financial markets. The fact that Solana increased its price by 30% in 2024 gives some weight to the fact that SOL-based ETFs are gaining popularity.

The high rate of filings and staking features shows a change in the regulatory mood. Although the SEC has been very reserved about exchange-traded funds in the past, the current momentum is that approvals might be made in the next two weeks, as opined by Geraci.

Recent developments show the crypto market evolving rapidly, with spot XRP and Dogecoin ETF launching, the SEC approving generic listing standards, and Vanguard crypto ETF reversing its stance on spot crypto products. These shifts indicate growing institutional demand, streamlined approvals, and a likely surge of new crypto ETF in October 2025.

Source: X

Conclusion

The submission of S-1 filings of spot SOL ETF and staking by large asset managers is a major milestone in the uptake of cryptocurrency exchange-traded funds. This step would open the door to a wider portfolio of rewards-enabled investments to the common investor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。