Founders Fund is driven by a clear investment philosophy and decision-making system.

Written by: Luke, Mars Finance

The airdrop of Plasma ultimately distributed 9,300 $XPL to each participant. Based on a recent high of $1.45, this means an airdrop reward worth over $13,400—regardless of the initial investment.

This astonishing wealth effect has once again turned the market's spotlight on the key investors behind it—Founders Fund. This top VC, founded by Peter Thiel, has almost secured the title of the treasure map for airdrops in the crypto circle, thanks to its precise early investments in projects like Starknet, Avail, and Plasma.

Their success is clearly not accidental. Behind it is a clear investment philosophy and decision-making system. So, what is the core of this system? How does the decision-making team at Founders Fund think? After igniting Plasma, what other projects that align with their "dogma" and have high airdrop potential should we closely monitor?

"The Brain" and "OG": The Dual Core of Founders Fund's Decision-Making

The strong momentum of Founders Fund in the crypto field stems from the perfect complementarity of its two core figures: one is the "brain" providing top-level philosophy and grand narrative, while the other is the "crypto OG" responsible for deep frontline engagement and ensuring tactical execution.

Peter Thiel: The "Brain" and Soul of Investment

As the founder and spiritual leader of Founders Fund, Peter Thiel's personal philosophy is deeply imprinted on every investment decision made by the fund. His "contrarian thinking" and pursuit of "monopolistic technology," conveyed through "Zero to One," form the cornerstone of Founders Fund's investments. Thiel, as the godfather of the "PayPal Mafia," has a long-standing obsession with creating a new generation of financial networks independent of traditional systems. This high level of thought ensures that Founders Fund always focuses on foundational protocols and infrastructure that can reshape industry patterns, rather than chasing short-term application trends. He has set the direction for the fund: to seek teams that are solving the most difficult problems and have the potential to create a brand new future.

Joey Krug: The "Crypto OG" on the Frontline

If Thiel provides the philosophical guidance for "why to invest," then partner Joey Krug addresses the tactical questions of "who to invest in" and "how to invest." Krug is a true OG in the crypto world, having co-founded the decentralized prediction market Augur, where he gained practical experience in building and operating a successful DeFi protocol from the ground up. Before joining Founders Fund, he served as co-CIO at Pantera Capital, accumulating rich experience in crypto investments. Krug has emphasized that he places great importance on a team's "shipping velocity," or the ability to continuously turn ideas into products. It is his deep industry background and keen judgment on technical execution that ensure Founders Fund's grand narrative aligns precisely with the most capable teams.

The combination of Thiel's top-level design and Krug's frontline insights forms the dual core of Founders Fund's decision-making in the crypto field, allowing them to grasp the grandest technological waves while identifying the "surfers" most capable of riding those waves.

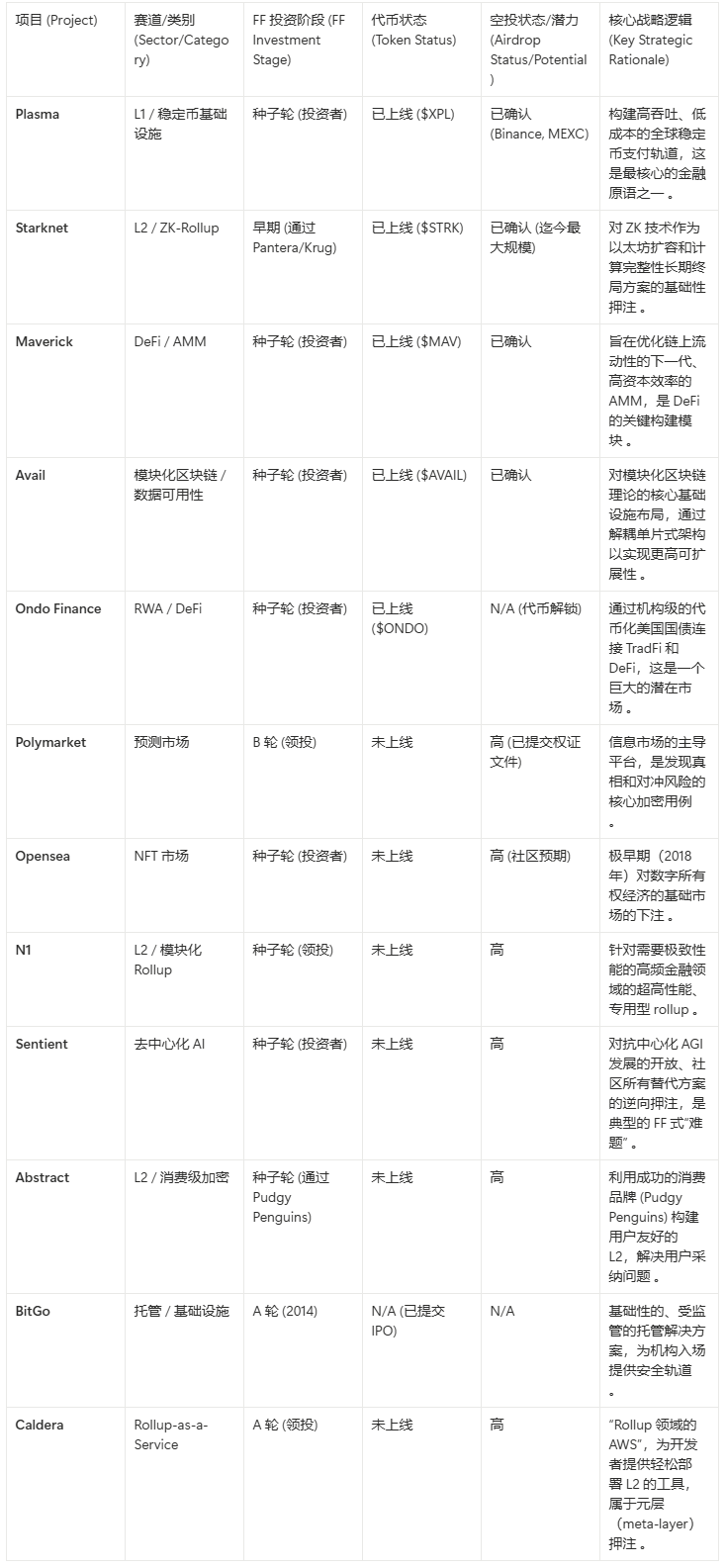

Founders Fund's Crypto Investment Dogma: Portfolio Overview

This table aims to integrate the scattered projects observed by users and the research findings of this report into a structured analytical tool, clearly demonstrating Founders Fund's investment model that prioritizes infrastructure, early involvement, and high potential.

Alpha List: Potential Projects Worth Noting

Based on the aforementioned investment dogma, we can clearly filter out the next batch of projects with high airdrop potential from Founders Fund's portfolio.

1. Polymarket: The King of Prediction Markets

Project Overview: As the absolute leader in decentralized prediction markets, Polymarket allows users to trade on the outcomes of global hot events (such as elections, economic data, regulatory approvals, etc.). It has become an important hub for obtaining information and judging trends in the crypto world and beyond, with daily trading volume and monthly active users consistently high.

Airdrop Expectations: The issuance of tokens by Polymarket is almost an open secret. Firstly, as a decentralized protocol that requires community governance and value capture, tokens are a necessary component of its ecological closed loop. Secondly, and most crucially, its submitted documents to the U.S. SEC explicitly mention "warrants," which are typically seen in investment agreements as granting early investors the right to receive tokens in the future. After recently receiving positive regulatory signals from the U.S. Commodity Futures Trading Commission (CFTC), major obstacles to the compliant issuance of its tokens have been cleared.

Reasons to Watch: The community generally expects that Polymarket's airdrop may follow the model of Starknet and Avail, conducting large-scale retrospective airdrops for early and deeply engaged users of the platform. This is a project that already has a mature product, a large user base, and a clear business model, and the launch of its token will be a highly anticipated value realization.

2. Sentient: AI + Crypto Frontier, A Value Carrier of Grand Narrative

Project Overview: Sentient has a grand vision, aiming to build a decentralized, open general artificial intelligence (AGI) network. In an era where AI computing power and models are increasingly monopolized by tech giants, Sentient seeks to create a permissionless, community-owned AI economy through blockchain technology.

Airdrop Expectations: For a protocol aimed at building a global decentralized network, tokens are indispensable. They are not only the core tool for incentivizing AI model contributors, computing power providers, and data validators but also the sole carrier of network governance and value distribution. The $85 million seed round financing also provides ample "ammunition" for building a large ecosystem and executing large-scale community incentive programs (including airdrops).

Reasons to Watch: Sentient perfectly aligns with Founders Fund's investment philosophy of "revolutionary technology." The significance of its airdrop will transcend mere wealth effects, representing an initial distribution of ownership for the future decentralized AI network. For users optimistic about the AI + Crypto track, early participation in its ecosystem and becoming a network contributor may yield extremely high returns.

3. N1 (Formerly Layer N): Next-Generation Financial L2, Revaluing Infrastructure

Project Overview: N1 is a high-performance Rollup network (L2) designed specifically for financial applications. Its goal is not to become a "jack-of-all-trades" universal chain but to provide extreme performance and efficiency for financial scenarios such as high-frequency trading and derivatives settlement through a customized architecture.

Airdrop Expectations: As a project led by Founders Fund, N1 has attracted attention since its inception. Issuing tokens and incentivizing early users, developers, and ecological projects through airdrops has become an industry standard for L2 public chains. Tokens are not only used for decentralized governance but also serve as a core weapon for capturing network value and competing for liquidity and users against rivals like Starknet and Arbitrum.

Reasons to Watch: N1 represents the specialized and refined development direction of the L2 track. Following the successful path of Starknet, N1's airdrop is likely to be closely linked to the depth of interaction with its testnet and early usage of its future mainnet. For users familiar with L2 interactions, this is an opportunity not to be missed.

4. Opensea: The Pending Giant Airdrop

Project Overview: As the "OG" and founder of the NFT market, Opensea has almost defined the entire track. Founders Fund participated in its seed round investment as early as 2018, demonstrating foresight into the "digital ownership economy."

Airdrop Expectations: The community's calls for Opensea to issue governance tokens have persisted for years. The main driving force is that, in the face of competitors like LooksRare and Blur, which have rapidly risen through "vampire attacks" and token airdrops, Opensea needs a strong tool to reward a vast number of historical users and incentivize future platform loyalty. Issuing tokens to achieve community governance and value sharing is seen as an inevitable choice.

Reasons to Watch: The airdrop opportunity for Opensea differs from new projects. It does not rely on testnet interactions but may become an unprecedented "retrospective" airdrop, with reward criteria potentially covering years of trading history, total trading volume, held NFT collections, and created collections. Although the expectations have long existed, its potential massive scale makes it an "asleep giant" that every NFT player cannot ignore.

5. Infrastructure Matrix: Caldera, Citrea, Helius

In addition to the three major star projects mentioned above, Founders Fund's portfolio also hides a group of "water sellers"—key infrastructures that provide core tools and services for the entire crypto ecosystem, which also have an inherent need to issue tokens.

Caldera: A "Rollup as a Service" (RaaS) platform that allows developers to deploy their own dedicated Rollup chains with one click. As "application chains" become a trend, Caldera is expected to become the "AWS" of the future blockchain world, with vast potential for its platform token.

Citrea: A Layer 2 solution focused on the Bitcoin ecosystem. With the revival of the Bitcoin ecosystem, L2 projects that bring programmability and scalability to the Bitcoin network are becoming the focus of market attention. Issuing tokens to incentivize ecosystem building and ensure network security is a necessary path for its development.

Helius: A leading infrastructure provider in the Solana ecosystem. It provides developers with key services such as APIs and nodes. Although it leans more towards B2B, many core infrastructure providers ultimately share the value and governance rights of their protocols with a broader ecosystem through issuing governance tokens.

Conclusion

In a market that is tired of fleeting MEME narratives and is beginning to seek sustainable value again, Founders Fund's investment script offers a clear, validated path. It reminds us that amidst the noise of speculative cycles, those truly committed to building foundational technologies and solving core problems are the cornerstones that can ultimately weather bull and bear markets and solidify value.

Following the footsteps of smart money is essentially following an effective strategy for discovering long-term value. This list provides a clear direction for research and participation, but in the crypto world where opportunities and risks coexist, DYOR (Do Your Own Research) will always be the first principle before participating in any project.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。