Why Is Amazon $AMZN Price Target Trending? US Job Data Hits 218K Today

Did you know that US Labor statistics can actually have a big impact on big companies like Amazon? Well, today’s work report surprised everyone with a lower-than-expected number of jobless claims at 218K.

This US job data news impact has been worldwide, and it’s also making the $AMZN price target 2025 more powerful than ever before. But how exactly does the US Job Data 218K affect Amazon’s price? Lets explore it

US Job Data 218K: A Key Signal for Amazon Stock Price Move

The United States Initial Jobless Claims data came lower than expected as per the Bitcoin Expert India latest X post .

Actual: 218K

Expected: 233K

Previous Week: 231K

This number is not just a sign of a healthy work market—it also affects how much people spend, which is very important for big consumer-based brands.

When the number goes down, it means fewer people are unemployed, so more people have money to spend. This is exactly why Amazon stock news is trending today .

-

It is a consumer-focused business. It does well when people have extra money to spend on things like online shopping, Prime memberships, and AWS services.

-

More people working means more money to spend, which leads to higher sales.

Because of this, strong US job figures usually makes consumer-focused brands go up in value. This is why top analysts are looking closely at the $AMZN price target 2025.

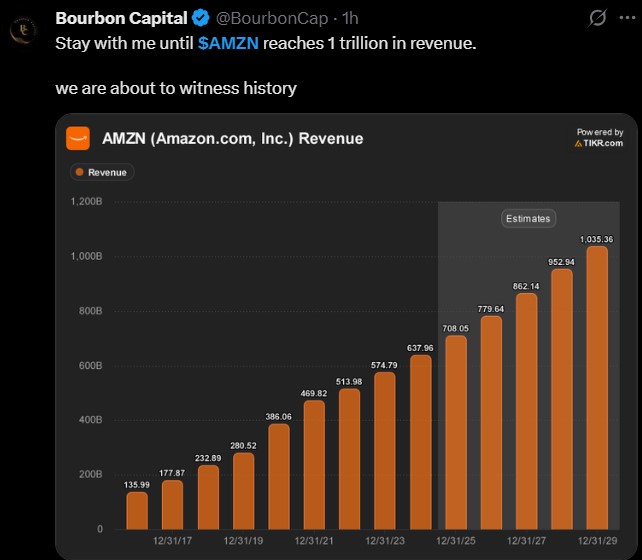

Did Today’s US Job Data Fuel $1T $AMZN Revenue Mark?

Today’s US Job data impact on Amazon has been significant . It supports the idea that the firm is on track to hit the $1 trillion revenue mark by 2029.

Source: Bourbon Capital

As people feel more confident in their positions, this firm is well-positioned to keep growing. This brings the company closer to reaching $1 trillion soon, which means $AMZN forecast today is set to reflect a massive outcome for investors.

Amazon Stock Price Action: What the Charts Are Saying

Looking at the TradingView chart of $AMZN price, we can see that the stock has been going down since April, but it has started to recover recently. Right now, it is trading at $219.72, with a small drop of 0.05% today.

RSI Indicator: The Relative Strength Index (RSI) is at 50.30, which means the market is neutral.

MACD Indicator: It has shown a bullish crossover, meaning the blue line is now above the orange line.

As a crypto analyst, I believe this shows that more buyers are entering the market, and we might see $AMZN price target bullish momentum in the coming days.

Amazon AMZN Price Prediction: What’s Next?

Given the good US job data 218K and positive signs in the chart, Amazon stock price performance has a lot of potential to grow soon.

-

Short Term (Next 1-2 Weeks): With the strong work statistics and bullish MACD crossover, experts like John the Rock believe it could go up to $220-$225. If it breaks past this, it might reach $230.

-

Mid Term (Next 1-2 Months): If things keep improving, it could go up to $240-$250.

-

Long Term (3-6 Months): With a goal to hit $1 trillion in revenue by 2029, $AMZN price target 2025 could go as high as $270-$280 if the economy stays strong.

Conclusion: Amazon and US Job Data—A Perfect Match

The release of US Job data today has made investors more confident. More people are spending money, which could help consumer-focused brands make more money.

The RSI and MACD indicators show that assets might soon start rising again. So, the $AMZN price target looks positive for the next few weeks and months, but keep an eye on the resistance zone.

Disclaimer: This article is for informational purposes only, always conduct YOUR before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。