Stablecoins provide short-term benefits to the dollar's status, but in the long run, they still depend on the robustness of U.S. fiscal and monetary policy.

Author: Spyros Andreopoulos

Translation: Deep Tide TechFlow

In the short term, the growth of stablecoins may alleviate U.S. fiscal constraints and further solidify the dollar's position as the dominant currency. However, in the long run, stablecoins only add a layer of complexity to the discussion about the quality of U.S. institutions.

Ultimately, the status of the dollar is still determined by the robustness of U.S. fiscal policy and the ability of its central bank to maintain low and stable inflation.

Source: SpaceX photo on Unsplash

The Trump administration seems to have high hopes for expanding stablecoin demand to offset the federal budget deficit—this demand is one of the main official justifications for the U.S. Treasury shortening the average maturity of its debt (by issuing more Treasury bills while keeping the issuance of notes and bonds unchanged).

By the way, I believe that shortening the average maturity of debt is also a way to increase pressure on the Federal Reserve to lower interest rates.

There is some evidence suggesting that the demand for stablecoins has lowered the interest rates on U.S. short-term debt.

Moreover, the government views stablecoin demand as a key pillar supporting the dollar's dominant currency status.

The reasons are not hard to understand.

Treasury Secretary Bessent predicts that the scale of stablecoins will grow to $2 trillion (I have even seen higher figures). Since the vast majority of stablecoins are pegged to the dollar, the demand for stablecoins is likely to be the demand for dollars.

According to the GENIUS Act, U.S. cash, deposits at U.S. insured banks, and Treasury securities with a remaining maturity of no more than 93 days are listed as permissible reserve instruments, so a large portion of this demand will flow into federal debt.

From a purely domestic U.S. perspective, whether stablecoins will actually increase net demand for Treasury securities is still inconclusive—it depends on what stablecoins are actually replacing.

If people do not hold shares in money market funds that invest in short-term U.S. government bonds but instead hold part of their wealth in stablecoins, then net demand for Treasury bills will not actually increase.

My intuition is—so far, there is no more—that the most important channel generating net demand for dollars and U.S. Treasuries is the international channel: the dollarization channel of stablecoin demand.

Stablecoins make it easier for millions of people outside the U.S. to access dollars, especially in countries with high inflation, weak currencies, and underdeveloped banking systems.

That said, the growth of demand for stablecoins in the non-U.S. private sector may be partially offset by a decline in official demand for dollars. Why?

Stablecoins seem to have the potential to improve global financial stability by increasing the share of dollar assets on balance sheets outside the U.S. However, if this is the case, it may reduce thecurrency mismatch in emerging market countries, which is one of the main reasons for the precautionary demand for dollars by the official sectors in these countries.

Reassessing the Institutional Basis of the Dollar

However, I have deeper concerns about the role of stablecoin demand in supporting the dollar. This relates to the dollar itself and the institutions that underpin it.

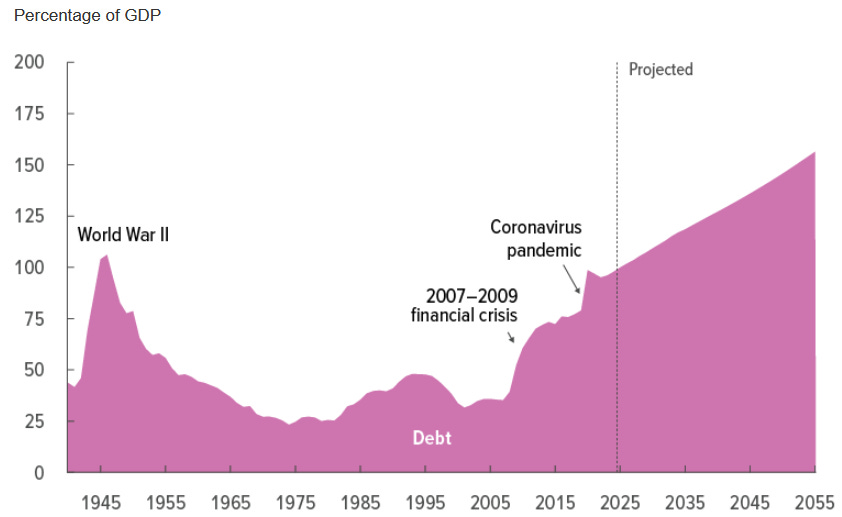

The fiscal situation in the U.S. is well-known, so I won't elaborate further.

Source: Congressional Budget Office (March 2025)

As a European who has long admired the U.S., I may not be alone in diagnosing a "fiscal doomsday machine" triggered by political division.

One key reason this "doomsday machine" continues to operate is the U.S.'s dominant currency status and the resulting demand for U.S. government assets: the dollar's "excess privilege" expands the fiscal space of the U.S. federal government.

But this ultimately does not alleviate the necessity for fundamental fiscal reform. This reform should primarily focus on increasing federal revenue (by the way, this is in contrast to Europe, where fiscal reform should focus on cutting spending).

Now, back to stablecoins.

The increased demand for U.S. government debt due to stablecoins may temporarily ease fiscal policy constraints. But this does not solve any long-term problems—it does not dismantle this doomsday machine.

In fact, it is more likely to hinder the urgently needed fiscal reform.

In other words, I worry that stablecoins may simply be the rope with which American politicians hang themselves—and the accompanying excess privilege.

Then there is the Federal Reserve.

I have always believed that, given the looser constraints of excess privilege on fiscal authorities, monetary policy must also be constrained: monetary policy cannot yield to the demands of fiscal policy (as Trump and his movement have claimed). A necessary (though not sufficient) institutional condition to avoid this is the independence of the Federal Reserve.

The point here is that if the independence of the Federal Reserve is weakened during this period and leads to higher inflation, then stablecoins will ultimately be of no help to the dollar's status.

The Backing of Stablecoins

Ultimately, as Pierpaolo Benigno says, the key lies in the way stablecoins are backed.

In a currency-dominated system (where central banks provide price stability while fiscal authorities are solely responsible for debt sustainability), stablecoins and the Treasury securities behind them are ultimately supported by taxes: "To make stablecoins safe, Treasury securities themselves must be safe."

In a fiscal-dominated](https://open.substack.com/pub/thinicemacroeconomics/p/inching-towards-fiscal-dominance?r=1oa8fn&utmcampaign=post&utmmedium=web&showWelcomeOnShare=false) system, stablecoins are ultimately supported by the central bank. In this case, stablecoins could trigger inflation, as the Federal Reserve may be forced to monetize the corresponding issuance.

My conclusion is that while the growth of stablecoins may alleviate U.S. fiscal constraints and enhance the dollar's status as a dominant currency in the short term, in the long run, stablecoins only add a layer of complexity to the discussion about the quality of U.S. institutions. Ultimately, the ability of the dollar to maintain its status still depends on the robustness of U.S. fiscal policy and the ability of its central bank to provide low and stable inflation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。