Who exactly spent this 100 billion?

Written by: Wuyi Fan

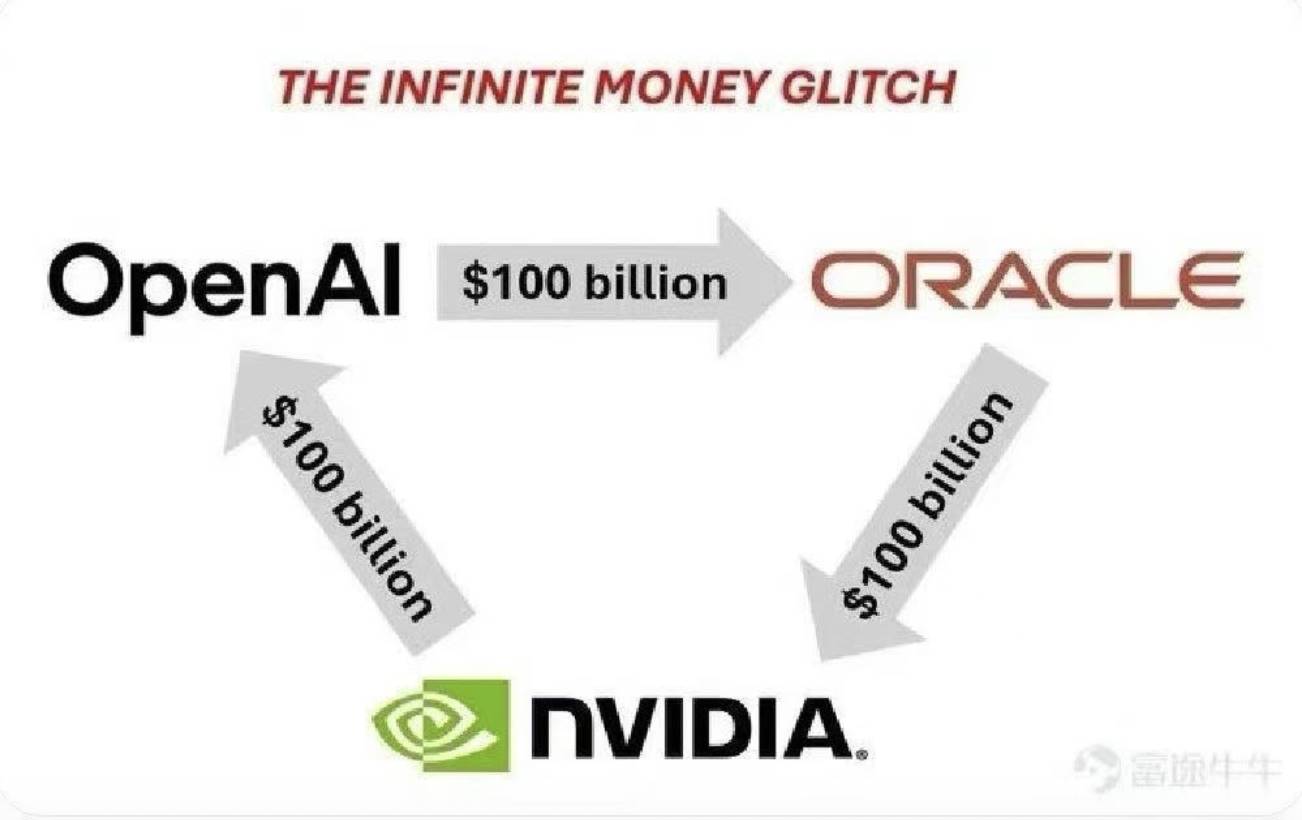

Recently, a joke has been circulating in the U.S. stock market:

“OpenAI invests 100 billion dollars in Oracle for cloud computing services; Oracle invests 100 billion dollars in Nvidia for GPUs; Nvidia then reinvests 100 billion dollars in OpenAI to develop AI systems. The question is, who actually spent this 100 billion?”

Of course, this is just a joke, and the amounts and facts are quite different; it’s not that the three companies are passing the same money around in circles, but it does reflect a new type of capital narrative loop.

In this loop, each link involves real contracts or investments, and every action is amplified by the capital market, leading to trillions in market value increases.

On September 11, Oracle's stock price surged by 36%, marking the largest single-day increase since 1992. Overnight, the company's market value skyrocketed to 933 billion dollars, and founder Larry Ellison briefly surpassed Musk to become the world's richest person.

On September 22, Nvidia and OpenAI announced a strategic partnership, with Nvidia planning to invest up to 100 billion dollars in OpenAI. Nvidia's stock rose nearly 4%, pushing its market value past 4.46 trillion dollars and igniting a rally in tech stocks, with all three major U.S. stock indices hitting new highs.

100 billion dollars seems like a lot, but it triggered a rise of over a trillion in the U.S. stock market overnight, clearly a case of spending a little to achieve a lot.

The U.S. stock market is playing a new type of AI roulette game.

Triangular Cycle: How is the money circulating?

In the real-world investment maze, three names form a perfect capital loop: OpenAI, Oracle, and Nvidia.

First Link: OpenAI's hunger for computing power

The core protagonist of the story is OpenAI. As the creator of ChatGPT, OpenAI processes requests from 700 million users daily. Such a scale of AI computation requires massive computing power.

This year, OpenAI signed the largest technology contract in history with Oracle, a 5-year, 300 billion dollar cloud computing agreement. According to this contract, OpenAI will pay Oracle about 60 billion dollars annually, equivalent to six times the company's current annual revenue.

What does this money buy? 4.5 gigawatts of data center capacity, equivalent to the electricity consumption of 4 million American households. Oracle will build data center parks for OpenAI across five states, including Wyoming, Pennsylvania, and Texas.

For OpenAI, this guarantees a place and computing power to run models; for Oracle, it ensures revenue certainty for the next five years.

Second Link: Oracle needs chips

After securing the massive order from OpenAI, Oracle faced a challenge: how to build these data centers?

The answer is chips, lots of chips. Oracle plans to invest billions of dollars in the Stargate project to purchase Nvidia's GPUs. Industry estimates suggest that 4.5 gigawatts of computing power requires over 2 million high-end GPUs.

Oracle CEO Safra Catz stated bluntly: “The vast majority of our capital expenditure investments are for purchasing revenue-generating equipment that will go into data centers.”

These “revenue-generating devices” mainly consist of Nvidia's H100, H200, and the latest Blackwell chips.

Oracle has become one of Nvidia's largest customers.

Third Link: Nvidia's reinvestment

While Oracle is frantically purchasing chips, Nvidia announced a stunning decision: to invest 100 billion dollars to support OpenAI in building 10 gigawatts of AI data centers.

This investment will be phased; each time OpenAI deploys 1 gigawatt of computing power, Nvidia will invest corresponding funds. The first phase is planned to start in the second half of 2026, using Nvidia's Vera Rubin platform.

Nvidia CEO Jensen Huang stated in an interview: “10 gigawatts of data center capacity is equivalent to 4 to 5 million GPUs, which is about our total shipment for this year.”

Thus, a perfect capital cycle has formed:

OpenAI pays Oracle for computing power, Oracle uses that money to buy chips from Nvidia, and Nvidia reinvests some of its earnings back into OpenAI.

The wealth amplifier between reality and illusion

The 300 billion dollar long-term contract led to an increase of over 250 billion dollars in Oracle's market value in a single day, while the 100 billion dollar investment resulted in a 170 billion dollar increase in Nvidia's market value in one day.

The three companies support each other, providing mutual endorsement, creating stock price resonance.

There is a rationale behind the stock price increase.

For the capital market, the most scarce resource is certainty about the future.

The contract between Oracle and OpenAI means that part of its cloud revenue is locked in for the next five years, prompting investors to assign a higher valuation.

Additionally, Nvidia is using “GW (gigawatts)” as a measurement unit this time. 1GW is roughly equivalent to the scale of a super data center. 10GW means that Nvidia and OpenAI are building a new generation of AI factories. This new narrative language is more imaginative than “how many GPUs were bought,” making it easier for the market to be driven.

Nvidia's investment in OpenAI essentially says, “I recognize it as a future super customer”; OpenAI's contract with Oracle implies, “Oracle has the capability to support my future cloud computing needs,” allowing OpenAI to secure more financing; Oracle's purchase of Nvidia GPUs indicates, “Nvidia's chips are in high demand.”

This is a stable and prosperous industrial chain.

This cycle appears flawless, but a closer look reveals its intricacies.

OpenAI currently has an annual revenue of about 10 billion dollars but has committed to paying Oracle 60 billion dollars annually. Where does this huge gap get filled?

The answer lies in rounds of financing. In April, OpenAI completed a 40 billion dollar financing round and is expected to continue raising funds.

In reality, OpenAI uses investors' money to pay Oracle, Oracle uses that money to purchase Nvidia's chips, and Nvidia then reinvests part of its revenue back into OpenAI. This is a capital-driven cyclical system.

Moreover, these astronomical contracts are mostly based on “commitments” rather than immediate delivery, which can be delayed, renegotiated, or even canceled under certain conditions. The market sees the numbers of commitments, not the actual cash flow.

This is the magic of modern financial markets: expectations and commitments can create a multiplicative wealth effect.

Who pays the bill?

Returning to the initial question of the joke: “Who actually spent this 100 billion?”

The answer is, investors and the debt market.

Investment institutions like SoftBank, Microsoft, and Thrive Capital are the direct payers in this game. They have invested billions of dollars into OpenAI, supporting the entire capital cycle. Additionally, banks and bond investors have provided funding for Oracle's expansion, while ordinary people holding related stocks and ETFs are the “silent payers” at the end of the chain.

This AI capital rotation game is essentially a form of financial engineering in the AI era. It leverages the market's optimistic expectations for the future of AI to construct a self-reinforcing investment cycle.

In this cycle, every party is a winner: OpenAI gains computing power, Oracle secures orders, Nvidia achieves sales and investment opportunities. Shareholders watch their wealth grow on paper, and everyone is happy.

However, this happiness is built on one premise: the commercialization process of AI in the future can support these astronomical investments. Once this premise wavers, the beautiful cycle may turn into a dangerous spiral.

Ultimately, the bill for this game is paid by every investor who believes in the future of AI, betting today’s money on tomorrow’s AI era.

Let’s hope the music doesn’t stop.

Conflict of interest: The author holds stocks related to Nvidia and AMD.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。