The Perp track has existed for a long time, and now is the time for the spotlight to shine on it.

Author: Crypto Weituo

In the past few days, I've seen many experts FOMO into the Perp DEX track because of Aster.

But to be honest, there's no need to rush into it.

Since March, I have been working with a technical team to analyze and reverse-engineer most of the Perps on the market, which allowed me to capture some lesser-known small wins like AVNT. In May, I was fortunate to meet CZ in person and decisively took a position in Aster for a small win.

The more I research, the more I feel that I shouldn't overdramatize things or brainwash myself.

From a perspective of trying not to offend anyone, I will share my understanding of the track, mainly as a reference for friends who are not very familiar with it.

TL;DR

- Perp is not just one type like Hyperliquid;

- The Perp track has existed for a long time, and now is the time for the spotlight to shine on it;

- Exchanges of the same type as Hyperliquid may have fundamental conflicts of interest with large holders;

- The path of Avantisfi is the greatest common divisor of on-chain Perp and exchange interests.

- Whether to participate in points should be inferred from the listing of coins.

What exactly is the Perp track?

On-chain Perps have existed since 2018, such as Synthetix, MUX, and PERP, and are not a new track. Due to historical reasons, there were many ways to implement contracts on-chain, but ultimately two main categories remained: AMM Perp and CLOB (Order Book Perp).

AMM Perp (Jupiter, Avantisfi, GMX):

Uses oracles to quote trading pairs and uses pools as counterparties for all traders. It's like storing money at a casino to earn annual returns because, according to the law of large numbers, as long as there are enough bets, the house will always win.

CLOB Perp (Hyperliquid, edgeX, Lighter, Orderly, Aster, etc.):

Perp exchanges based on order books and matching trades, following the same logic as CEX. The specific difference is that Hyperliquid boasts that its entire order book is publicly available on-chain, while others like Lighter use ZK circuits for verifiability.

But fundamentally, they are all a form of CEX; as the number of nodes increases, it will inevitably affect trading performance and speed.

There are indeed significant differences in usage costs and trading methods between the two, but in my view, there is no "who replaces whom" logic. Perp DEX has an impossible triangle: new asset coverage - liquidity depth - price fairness.

You can only choose 2 out of 3. Hyperliquid has chosen new asset coverage and liquidity depth, sacrificing risk control, because it is inherently a market maker-oriented product. Events like XPL and JellyJelly are not bugs for it but features.

Jupiter has chosen liquidity depth and price fairness, but so far only has three trading pairs.

The vast majority of CLOBs choose new assets and price fairness, which leads to strong opening position restrictions and poor liquidity for long-tail assets.

Each choice is feasible in specific scenarios.

Why was the Perp track not popular before but is now?

The previous Perp DEXs were not ineffective; it was a matter of timing. It should have been the main DeFi infrastructure (leveraged demand) of any ecosystem, but the spotlight was not on them.

There was already an order book in the previous round, $snx became a blue-chip in 2020, and the DYDX airdrop amazed the entire network. In 2023, GMX/GNS saved the bear market, yet you only remember Hyperliquid. The reasons are simple:

- After 2023, many new users entered, most of whom do not know the story of DeFi summer.

- Before the Luna crash, many CEXs secretly catered to European and American users using Perp.

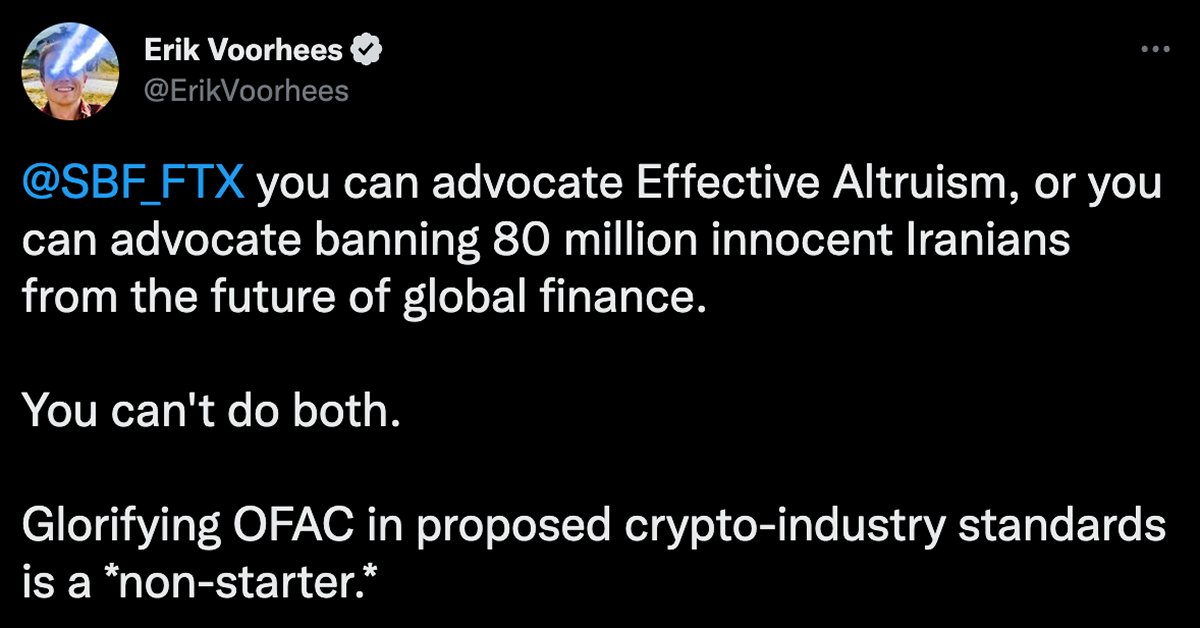

- After the Luna crash, especially after Kucoin faced a crackdown, European and American users had no access to Perp, but the SEC was very unfriendly to DeFi. Buybacks and dividends faced severe scrutiny, and there were even attempts to enforce KYC in DeFi, leading to a lack of investment in DeFi (thanks again to @cz_binance for saving DeFi).

The revival of Perp, or DeFi, has only occurred in the year since Trump took office. For Perp DEXs, the current no-KYC DeFi Perp has become a necessity for users who cannot use Binance, while DeFi tokens are not bound by the compliance history issues of exchange platform tokens, allowing for more creative operations. This creates an asymmetric advantage over CEXs.

Looking at the development history of CEXs to understand PERP DEX

First, think about why a CEX has been able to survive from 2018-2019 to now, and you'll understand what kind of Perp DEX can emerge.

Regardless of whether it is decentralized or not, the core task of any exchange is to serve its LPs, large holders, and liquidity providers well. Only with them can there be trading volume and liquidity, which can attract users.

When we talk about so-called first, second, and third-tier exchanges, and how listing on a certain exchange can support a certain valuation, this is actually an evaluation of the liquidity of that exchange, unrelated to the project.

This is what is known as the pricing power of listing coins.

Conversely, the pricing power of listing coins is also the first step to attracting large holders, because the entire crypto industry is one that prints money and lacks old money. By listing coins, you turn air into real money, creating a large group of big holders around specific assets, and then continuously providing new coins for market-making/structured products to gain APY opportunities (see the three functions of each exchange's large clients, Earn, and institutional sales).

Today, project parties, tomorrow, speculative funds. The relationship between exchanges and project parties, as well as speculative funds, is mutually binding.

Thus, the core competitiveness of CEXs is the pricing power of listing coins, which is mutually binding with the most important KPI of exchanges, liquidity. This is why exchanges like Bybit, Bitget, and BingX, which came from pure contract exchanges, must also engage in spot trading.

The challenges of "Hyperliquid" - fighting against large exchanges

First, CLOB has no liquidity. Due to mechanism issues, it can at most create a strategy vault, making it difficult to establish liquidity, let alone leverage liquidity. This means that CLOB's depth relies entirely on market makers. To retain market makers, project parties need to provide coins and even offer negative incentives.

After the TGE, when the coin price is realized, market makers often withdraw their liquidity. If CLOB does not engage in betting like JLP, then the vault's returns will be very low, resulting in no TVL, and it cannot convert TVL into trading depth. In other words, a purely CLOB is unlikely to attract large clients; its template resembles that of 58Coin or Bingbong from 2019. As we know, the lifecycle of a Perp user is 1-3 months. Therefore, CLOB inevitably falls into a "volume war," competing against all Perp DEXs and CEXs.

Secondly, as mentioned earlier, CLOB is a direct competitor to CEX contract businesses and has the asymmetric advantage of being KYC-free. This raises the question of how Binance or OKX views CLOB: is it simply seen as a DeFi track? Or as a competitor equivalent to CEX? If it is the latter, does that mean that almost all CLOBs may not be able to list on large exchanges (as large exchanges do not list other platforms' tokens)?

There are only two ways to break the above two situations:

In the absence of large exchanges listing coins, artificially inflate your own assets to break into the top 100 or even 50 by market cap, creating liquidity. Turn all early market makers and large holders into your asset management clients for retention (dividend plans - restrict liquidity + raise total sunk costs).

Build an entire ecosystem yourself, with the ability to issue assets, allowing your native token and exchange to have new asset pricing power. This will continuously attract market makers and project parties, forming your own large client system (splitting the market).

Does this sound familiar?

Yes, this is the strategy of Bitget-BGB and Hyperliquid - Hype.

Conversely, you can understand why BGB needs to be inflated, why Hype and Aster need to be inflated (the more liquidity is raised, the larger the user base), and why Hype chooses Native Markets to create USDH.

Just like the competition of launchpads is not within the launchpad itself, the war among CLOBs in Perp DEXs is also not about the product itself. How difficult Aster is to use is not important; the key is whether it has resources similar to getting an L1 listed on the first page of CMC.

Among so many CLOB perps, how many have this capability?

AVNT's "alternative path" - being friendly with large exchanges

Many people view AVNT's narrative as Base's Hyperliquid… this statement is completely wrong. It is Base's Jupiter; Hibachi or Synfutures are the ones that resemble Hyperliquid.

The reason many people are not optimistic about AMM Perp is that it has "high slippage," high costs, and slow speeds, unlike CLOB Perp, which can be used by market makers and other institutions.

This is not entirely accurate. In fact, AMM Perp uses oracle pricing, and its trading is essentially slippage-free. However, because it adopts global betting, it requires a "price impact" to be added to large trades to prevent tail risks. This part can also be adjusted based on operational needs, for example, offering free trading for high leverage above 75X while "institutions cannot use it." This stereotype comes from traditional market makers who do not know how to use AMM's liquidity-based pricing, just like many market makers initially did not know how to set market-making strategies for Uniswap. In fact, on-chain market makers are becoming increasingly common, and chains other than ETH have basically solved performance issues.

The true "strength" of AMM types lies in two areas:

AMM spot has pricing power. The reason why Meme/on-chain fair launches can become a long-term user growth point in the market is that they can issue tokens at low cost and effectively without permission, without relying on market makers for pricing. The same goes for AMM contracts; it is the only model that can achieve low-cost, permissionless issuance and pricing without market makers.

It does not conflict with CEXs and will not compete for order book depth and large clients. On the contrary, since "JLP" and "GLP" are themselves on-chain assets with the highest real yield types and have a large depth capacity, they are even complementary to the asset management departments of CEXs (similar to Binance's BTC and SOLV).

If you don't believe it, you can take a look at Binance's listings; there are only three order book types: $inj $dydx $aevo.

Among them, Aevo can be considered a coin based on the pre-market logic of the Binance system, while INJ is based on the public chain.

However, there are five AMM perps (not counting JUP): $GMX $GNS $AVNT $SNX $PERP.

Considering that the number of CLOB projects far exceeds that of AMM, it is hard to say that this point has no impact.

For those interested, you can take a look at the logic of Avantisfi and the latest GMX. The past impression that AMM perps could only support three coins is long gone, just like many people find it "boring" to mention lending as AAVE and Compound, without realizing that KMNO and Morpho are completely different architectures and species.

How to choose points from the perspective of Shandong learning

First, I believe that if you have already invested sunk costs, you should stick to your choice. Aster proves that "continuous investment will yield returns" is still a reality today.

If you have not invested at all, I suggest you think about the following two questions first:

Does the project you choose have a direct conflict of interest with leading exchanges, and will it be treated as a "platform token" and not listed?

Does it have the ability to solve the issues of liquidity and pricing power without the liquidity of large exchanges?

If you choose Orderbook, then I recommend prioritizing:

Obtaining investment from public chain ecosystems (such as Sui, Monad).

A trading system, institution, or individual with significant influence or verifiable financial strength continuously generating public traffic (like CZ for Aster, or major traders/KOLs for Hype).

If it is AMM, then prioritize:

Chains with asset pricing operation capabilities: chains that have clear support from foundations and precedents of high valuation projects listed on large exchanges, such as Sui, Solana, Base, etc. - where the current "dragon one" in this track has not yet achieved results above Binance contracts.

The largest TVL for "JLP/GLP-type" assets: The most important aspect of AMM-type Perps is to have the best liquidity, followed by good taker-side traffic.

Personally, I would like to mention a few less popular projects that I believe could have unexpected rewards:

Ethena's Ethereal: A clear background of real cooperation with large exchanges, the strategic importance of the Binance/Ethena dual system, but the downside is the slow progress.

BasedApp: It is a front-end for Hyperliquid, similar to Axiom in the Solana trenches, and also comes with a HypeEVM launchpad. It is unlikely to be listed on Binance or OKX, but it may belong to the early stages of the Hype pricing power competition.

Phantom: The issuance of tokens by MetaMask means that major wallets can issue tokens in this cycle. This is also the best time for token issuance. Phantom's revenue mainly comes from swaps and the Hyperliquid front end. If Phantom has an airdrop, then the chances for these two are the highest. Fundamentally, there is no reason not to achieve a grand slam (see WCT), even with Hyperliquid elements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。