每日行情重点数据回顾和趋势分析,由PANews出品。

1.市场观察

美联储如期宣布降息25个基点,主席鲍威尔指出,尽管通胀略高,但就业市场的下行风险有所增加,风险平衡的变化促使了此次“风险管理型”降息,并预计年内可能还有两次降息。这一鸽派立场推动了美国三大股指和小盘股指近四年来首次集体收于历史新高。摩根大通以安德鲁·泰勒为首的交易团队认为,此次降息为多头提供了支撑,并建议投资者“逢低买入”,他们将未来的上涨动力锚定在10月的非农就业和通胀数据上,认为若数据理想,美股可能迎来“突破性行情”。

与此同时,一项由特朗普团队策划的宏大产业政策浮出水面,计划利用规模达5500亿美元的日美贸易基金,对半导体、能源、量子计算等关键领域进行政府主导的投资,以重塑美国制造业。在此背景下,行业巨头间的合纵连横也愈发引人注目,人工智能领导者英伟达宣布斥资50亿美元入股竞争对手英特尔,并建立历史性的合作伙伴关系,共同开发定制化CPU,此举被视为对陷入困境的英特尔的重大利好,也得到了已成为英特尔大股东的美国政府的支持。

在整体市场情绪回暖的推动下,比特币价格稳步攀升,逼近关键的11.8万美元关口。多位分析师认为,比特币正处于决定性的突破点。分析师Michaël van de Poppe和Daan Crypto Trades则共同将11.8万美元视为多头需要攻克的最重要堡垒,认为一旦成功将此高交易量区域转为支撑,价格将“很快访问”历史高点。分析师Murphy为新高设定了三大条件:收盘价突破11.7万美元、短期持有者调整后的价格偏离度(STH-RPDZ)超过+1标准差,以及ETF净流入与现货敞口同步放大。目前市场正逐步满足这些条件,分析师Axel Adler Jr.根据市场情绪指标和强劲的ETF资金流入(自9月9日以来净流入28亿美元)判断,比特币在未来两周内创下历史新高的可能性高达70%。然而,市场也存在谨慎声音,AlphaBTC警告称若跌破11.4万美元支撑,可能引发更长时间的调整,而Material Indicators则提示,当前流动性结构更像是一次短期的“退出性拉升”,而非稳固的积累。

尽管比特币吸引了大部分市场目光,以太坊生态系统内部也正酝酿着重要变革。Consensys首席执行官明确表示,旗下广受欢迎的钱包应用MetaMask的代币即将到来,且速度可能“比预期更快”。在此之前,MetaMask已于9月15日正式上线其稳定币MetaMask USD(mUSD)。

近期Solana的表现尤为突出。据分析师Rekt Capital观察,SOL价格已成功突破宏观下降趋势线,并站上250美元,创下近8个月新高。目前,SOL正在周线级别上测试238美元的关键月度阻力位,并将其转化为支撑位。这一测试对推动SOL未来创下历史新高至关重要。其强劲涨势主要得益于企业将其作为储备资产的策略推动,目前企业累计持有的SOL已超过1700万枚,总价值高达43亿美元。尽管链上杠杆需求相对疲软,但期权市场表现乐观,且SEC批准包含SOL在内的多资产加密ETF,进一步提升了市场对未来独立SOL ETF的期待。

此外,其他项目也动态频出,在CZ更改社交账号,社区怀疑其重回币安后,BNB持续上涨,突破1000美元大关,市值超越超过比亚迪、辉瑞等知名企业,全球资产市值排名升至第155位;Trust Wallet(TWT)在公布了涵盖锁仓奖励、手续费折扣等场景的新版经济模型后,Binance创始人赵长鹏转发相关推文并表示,TWT代币最初只是一个实验,如今其用例正在逐步扩展。目前,TWT代币价格为1.18美元,24小时涨幅达52%,最高触及1.33美元;昨晚22:30,SBF的X账号疑似出现异常活动,突然关注大量用户,引发市场关注。受此影响,FTT价格短时突破1.2 USDT,但目前已回落至0.98美元,涨幅收窄至21%。

2. 关键数据(截至9月19日12:00 HKT)

(数据来源:Coinglass、Upbit、Coingecko、SoSoValue、Tomars)

比特币:117,043美元(年初至今+24.8%),日现货交易量375.88亿美元

以太坊:4,551.45美元(年初至今+35.85%),日现货交易量为276.01亿美元

恐贪指数:52(中性)

平均GAS:BTC:1.11 sat/vB、ETH:0.19 Gwei

市场占有率:BTC 57.7%,ETH 13.74%

Upbit 24 小时交易量排行:XRP、DOGE、BTC、ETH、SOL

24小时BTC多空比: 49.56%/50.44%

板块涨跌:GameFi上涨2.94%,L2上涨2.21%

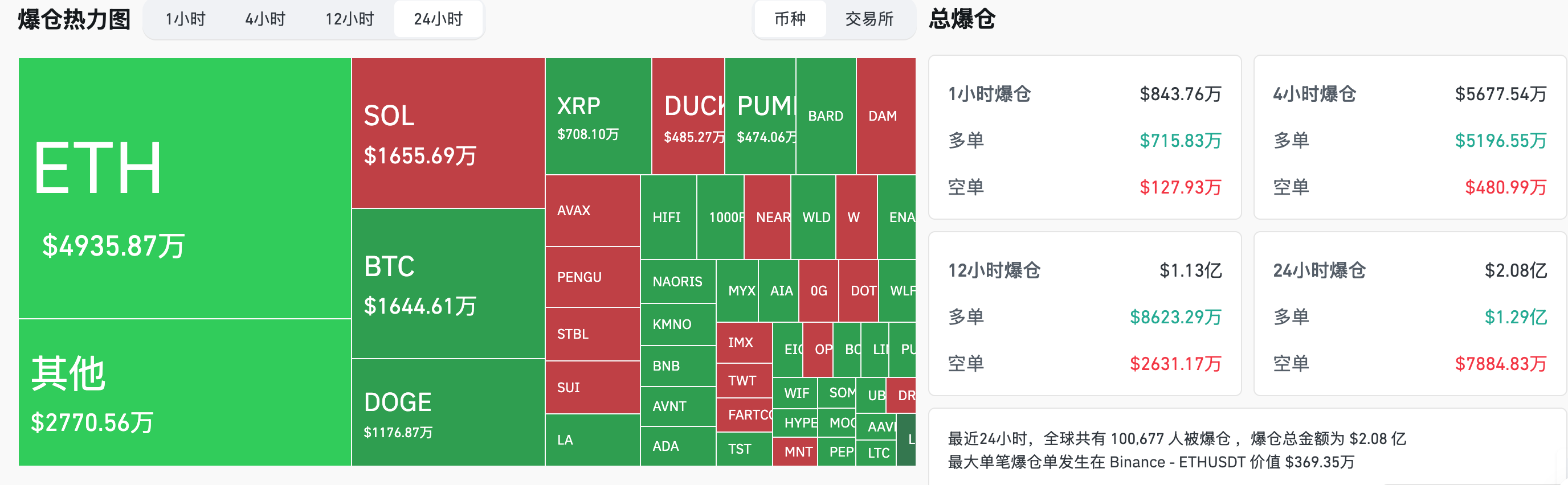

24小时爆仓数据:全球共100627人被爆仓 ,爆仓总金额为2.08亿美元,其BTC爆仓1644万美元、ETH爆仓4935万美元、SOL爆仓1655万美元

BTC中长线趋势通道:通道上沿线(116170.70美元),下沿线(113870.29美元)

ETH中长线趋势通道:通道上沿线(4558.94美元),下沿线(4468.66美元)

*注:当价格高于上沿和下沿时则为中长期看多趋势,反之则为看空趋势,当价格在区间内或短期反复通过成本区间则为筑底或筑顶状态。

3.ETF流向(截至9月18日)

比特币ETF:+1.63亿美元,十二支ETF无一净流出

以太坊ETF:+2.13亿美元,九支ETF无一净流出

4. 今日前瞻

LayerZero(ZRO)将于9月20日晚上7点解锁约2571万枚代币,与现流通量的比例为8.53%,价值约5250万美元;

Velo(VELO)将于9月20日上午8点解锁约30亿枚代币,与现流通量的比例为13.63%,价值约4780万美元;

KAITO(KAITO)将于9月20日晚上8点解锁约835万枚代币,与现流通量的比例为3.15%,价值约1010万美元。

Optimism(OP)将于9月21日上午8点解锁约1.16亿枚代币,与现流通量的比例为6.89%,价值约9340万美元;

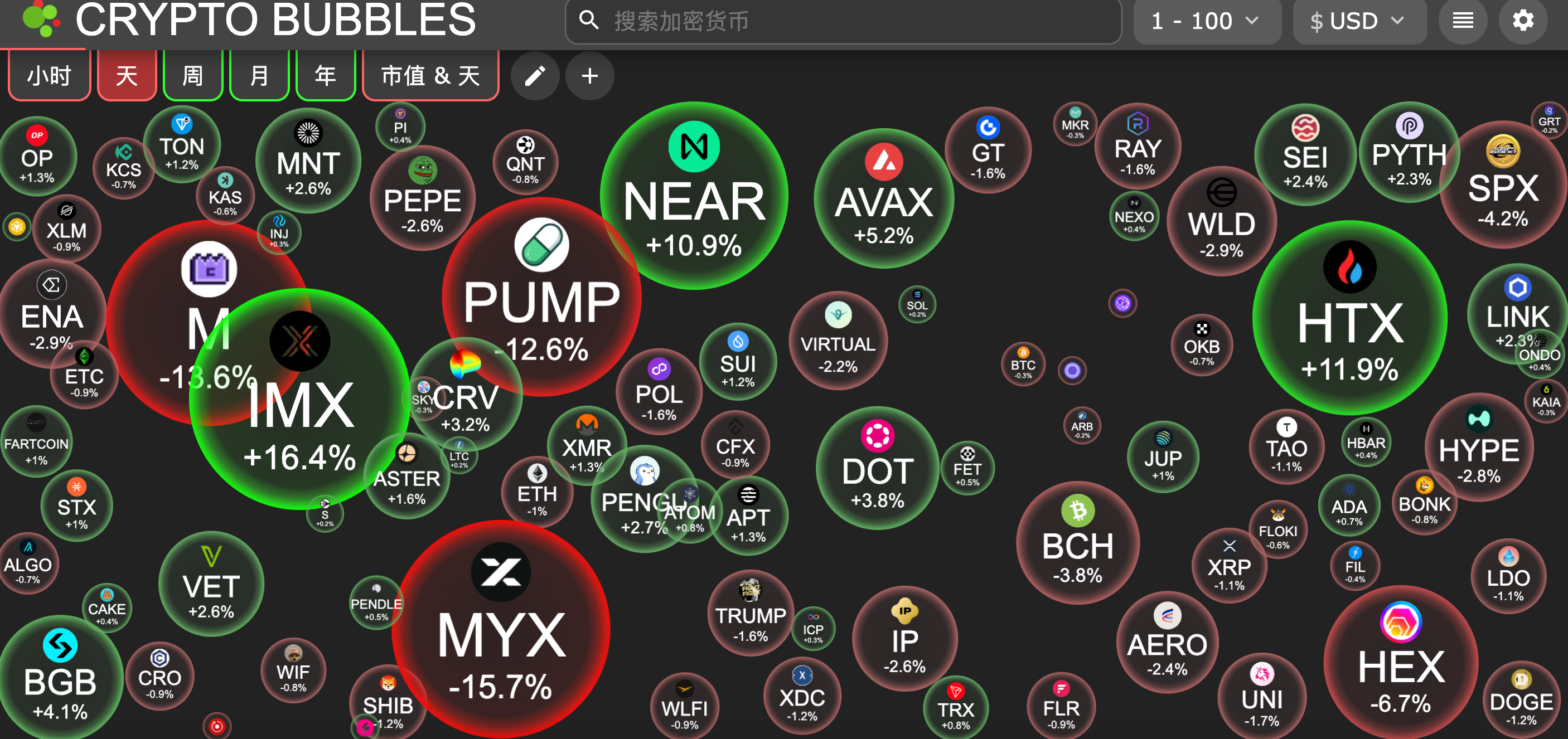

今日市值前100币种最大涨幅:Immutable涨16.4%、HTX DAO涨11.9%、NEAR Protocol涨10.9%、Avalanche涨5.2%、Bitget Token涨4.1%。

5. 热点新闻

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。