《拉丁美洲被切开的血管》揭示:五百年来,旧殖民主义与新殖民主义先后把拉美变成“专门输血”的外围,资源越富饶,血管越被切开。今天,区块链的自主节点、开源代码与分布式账本,为拉美提供了重建“血液循环系统”的技术可能:阿根廷、巴西、墨西哥的开发者正发行比索、雷亚尔计价的本地稳定币,用智能合约把跨境手续费压到分厘,让侨汇、贸易融资不再必经美元清算。

正如任何一场技术革命,总有人迅速拥抱新事物,而大多数人要么无法理解,要么对变革心存畏惧。在拉美地区,“加密货币”或“稳定币”这两个词仍会引发复杂情绪;尽管越来越多的人开始接触,浪漫的加密叙事铺开,但真正理解区块链技术及其在日常生活中如何应用的群体依旧只是少数。更不用说 USDT、USDC 仍以九成市场份额覆盖拉美,美联储利率、美国监管一句话就能收紧阀门,新“货币殖民”若隐若现。

在通过之前一文梳理了拉美加密金融支付生态的链上全景之后,本文我们将依托 Frontera, LATAM crypto ecosystem: Leading the New Digital Economy 一文,对拉美新兴加密行业进行深度、客观地分析。

我们将从拉美加密生态的全景图展开,来看加密货币/稳定币在其中的用例:拉美究竟在用什么方式采用加密货币、又是出于何种目的,以及构成其用例背后的加密项目、社区、投资者。然后通过对拉美主要国家(阿根廷、巴西、哥伦比亚、墨西哥、秘鲁)的梳理,来最后推演拉美稳定币支付项目的演化路径。

给大家额外的思考题是:是否 Eduardo Galeano 在书中所详列的史实所昭示的,与现实的差别只在于,过去是殖民地的银矿与种植园,今天是每个人的数字钱包;过去靠枪炮与商船,今天靠代码与节点——但“血管”被切开的角度,依旧指向同一个北方。

一、拉美的加密生态全景

1.1 整体概括

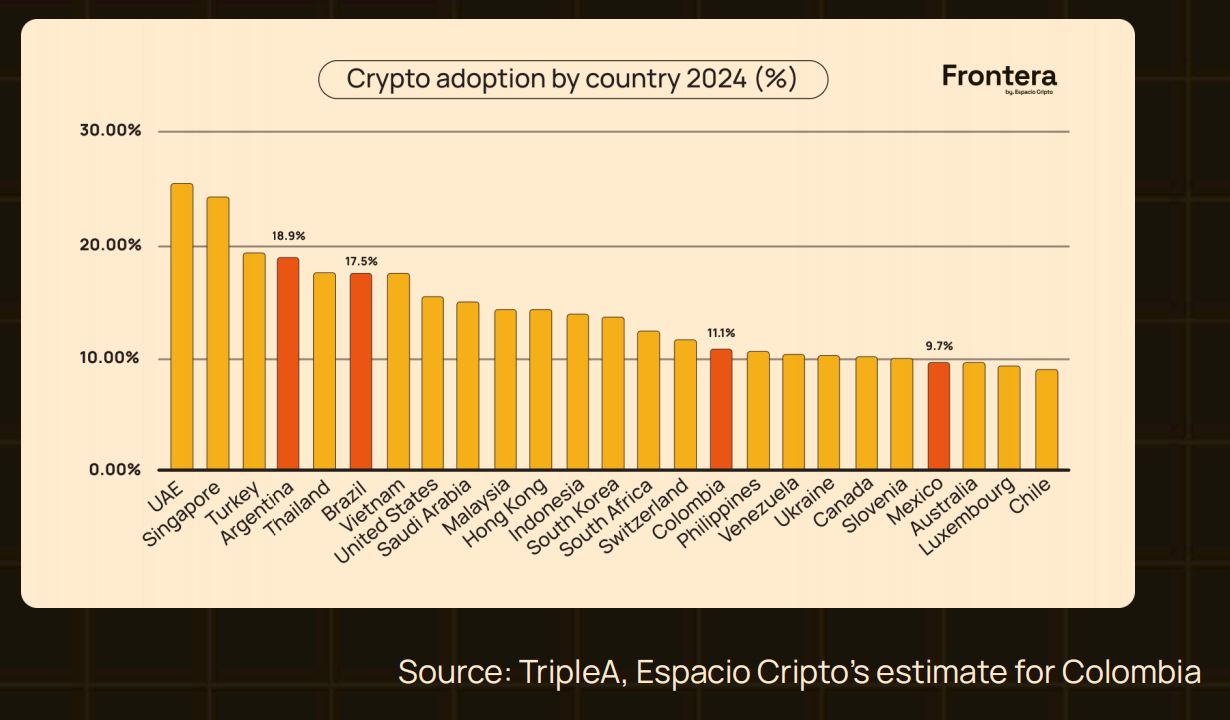

过去 15 年,加密货币从自由主义极客的小众玩具,演变为全球金融版图的关键组成,彻底改变了我们对货币与价值的认知与使用方式。TripleA 数据显示,全球持有虚拟资产的人口已增至 5.62 亿 (2023 年为 4.2 亿),占世界总人口的 6.8% 。

虽然过半用户仍在亚洲,但南美却是去年增速最快的地区,用户量几近翻倍,跃居全球加密采用第三大市场,超越欧洲。在拉美内部,阿根廷与巴西领跑,两国因不同却互补的社会经济因素,成为稳定币采用的双引擎。

阿根廷持续的经济动荡——多年恶性通胀与严格外汇管制——迫使大量民众转向比特币、稳定币等加密资产以求保值。尽管政府推行财政紧缩,通胀仍潜伏肆虐:2024 年 10 月消费者价格同比暴涨 193%,虽为年内最低增幅(9 月为 209%),却是连续第六个月放缓。即便如此,购买力仍日复一日缩水,加密货币遂成救命稻草,稳定币在阿根廷金融生态中的地位愈发稳固。高互联网与移动设备普及率为这一进程提供了技术土壤,使其成为传统金融的可靠替代。经济虽动荡,DeFi、代币化、支付项目却遍地开花。

巴西作为拉美人口最多、最多元的国家,则凭借科技圈的浓厚兴趣与初创/金融科技沃土,加密采用率节节攀升。全国移动渗透率居拉美前列,加密应用与数字钱包触手可及;年轻、懂技术的群体对新事物接受度极高。央行数字货币(CBDC)已上桌,监管框架快马加鞭,投资环境愈发友好。高校与创新中心纷纷开设区块链及加密课程,培育本土人才。加之巴西在拉美金融服务业的龙头地位,加密资产已逐步融入传统金融产品,进一步加速普及。

墨西哥的加密采用则主要受侨汇逻辑支配。作为全球最大侨汇接收国之一,每年数十亿美元从美国回流,美墨间巨额资金流动让传统汇款渠道成本高、速度慢的问题凸显,加密方案恰好提供更快更便宜的选择。相较阿根廷,墨西哥宏观经济稳定,加密更多被视为便利工具与投资标的,而非抗通胀盾牌。金融科技强劲,驱动采用,但多样性稍逊,生态仍待成熟。

哥伦比亚的采用水平虽高,却呈现不同图景。经济虽不及阿根廷动荡,但金融包容需求与侨汇效益驱动着加密社区壮大。大量哥伦比亚人在海外务工,侨汇占 GDP 比重可观,加密汇款更快更便宜,自然受到青睐。政府亦在循序渐进地出台监管,可望为未来采用铺路。

概言之,拉美加密生态的动态由各国迥异的经济、技术、社会因素共同塑造。阿根廷与巴西仍是采用双雄,前者因经济避险,后者因技术红利;墨西哥与哥伦比亚则相对低调,聚焦侨汇与金融包容。

1.2 拉美用户对于稳定币的青睐

在拆解生态现状之前,我们必须回到其存在的原点:用户。用户是这场加密新风暴的震中,任何叙事都须先回答他们的需求与用例。尽管比特币被赋予“对冲法币贬值”的使命,拉美绝大多数用户仍选择稳定币。Kaiko Research 的最新研究显示,拉美地区超过 40% 的交易以 USDT 结算;在以巴西雷亚尔(BRL)计价的交易中,近半数通过稳定币完成。

由于链下加密交易量难以精确统计,巴西政府的数据成为验证趋势的关键。巴西联邦税务局(Receita Federal)自 2019 年起建立全覆盖报送制度,要求所有在营交易所及大额个人用户逐月申报。官方数据证实稳定币用量飙升:USDT 累计成交量逾 2,710 亿雷亚尔,同期比特币为 1,510 亿雷亚尔,几乎翻倍。

与全球市场相比,稳定币在拉美扮演远为核心的角色。以最大中心化交易所币安的交易量为参照,全球范围内比特币仍占大头;而在拉美,用户对稳定币的偏爱折射出区域特色——本地货币剧烈波动、信心不足,加之通过传统渠道获取美元困难重重,使得“稳定”成为最稀缺的金融属性。

二、加密货币在拉美的具体用例

拉丁美洲的加密货币用户构成多元,涵盖不同社会经济背景的个人、企业乃至政府机构。理解这种多样性,是评估加密资产区域影响的关键。

2.1 个人用户

A. 经济避险

在阿根廷、委内瑞拉以及程度较轻的巴西,民众把加密货币当作对抗恶性通胀的盾牌。阿根廷通胀率一度超 200%,数百万居民改用 USDC、USDT 等稳定币储蓄,避免比索贬值。对于普通人而言,加密资产就是“数字美元”——在资本管制下原本无法获得的稳定价值储存。阿根廷平台 Lemon Cash 顺势推出加密卡,用户可用本地货币消费、后台结算加密资产,还返比特币现金奖励,大受欢迎。

B. 更快更便宜的侨汇

侨汇是萨尔瓦多、墨西哥、危地马拉等国家庭的生命线。传统汇款手续费高、到账慢;加密货币省去中间环节,费用低、几分钟到账,对仰仗海外亲属每一笔美元的低收入家庭尤其重要。墨西哥龙头交易所 Bitso 已占据墨美走廊≥10%的汇款流量。

C. 获得金融服务

拉美大量人口——特别是农村——处于无银行或银行服务不足状态。加密钱包让他们无需传统账户即可储蓄、支付甚至贷款。DeFi 提供了去中心化的银行替代方案,在基础设施薄弱的地区更具吸引力,个人得以自主掌控财务未来。

D. 投资与财富增值

除对冲通胀外,部分拉美人把加密视为投资标的。比特币、以太坊等数字资产高波动、高回报、进入门槛低,成为他们财富增长策略的一部分。

2.2 企业与创业者

A. 加密收付款

为避免传统银行高昂手续费与延迟,拉美中小企业开始接受比特币和稳定币付款。巴西部分商户通过加密结算,既能对冲本币波动,又能对接已熟悉加密支付的亚洲客户,扩大全球市场。

B. 供应链溯源

区块链的透明性正被多行业借用。阿根廷门多萨的 Costaflores 酒庄推出“OpenVino”项目,打造全球首批开源酒庄:从葡萄种植到装瓶,所有数据上链,消费者可验证真伪并了解可持续实践。酒庄还发行“葡萄酒背书代币”,一枚对应一瓶实体酒。

C. 自由职业者与个体工作者

远程办公兴起,使得需要接收海外酬劳的自由职业者大幅增加。阿根廷平台 Takenos 用量激增,许多自由职业者选择比特币或稳定币收款,以避开本币汇率波动。

2.3 政府与机构采用

A. 区块链优化政务

除个人和企业外,一些拉美政府正探索区块链来提升透明度和效率。例如危地马拉利用区块链记录选票,打造不可篡改的选举账本,降低舞弊风险。

B. 央行数字货币(CBDC)

巴西走在区域前列,试点“数字雷亚尔”(DREX),旨在现代化金融系统、降低成本、提高交易效率,尤其服务无银行账户人群。

拉美加密图景正快速演进,用户数量与用例与日俱增,凸显区域独特需求与挑战。从侨汇、日常支付,到通胀对冲、政务透明,加密货币正在全方位重塑拉丁美洲。随着“必要”与“创新”双轮驱动,拉美有望在全球加密市场占据领先席位,并为世界提供可借鉴的实践样本。

三、拉美加密项目、社区与投资人

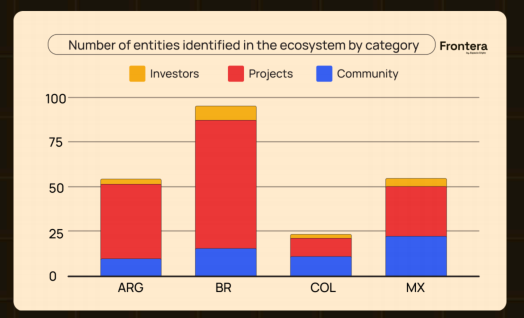

四国对比显示,拉美加密生态呈现差异化格局:

-

巴西以 71 个项目、15 个活跃社区及强劲的机构兴趣领跑,结构完整且多元化。

-

阿根廷(42 个项目)借助经济困境反而成为创新温床,尤其在资产代币化与 DeFi 领域;规模虽小,却凭借韧性与创造力产出高度贴合本土需求的解决方案。

-

墨西哥拥有 21 个加密社区,居四国之首,表明采用率快速上升,但项目数量(29)仍偏少。

-

哥伦比亚仅 10 个项目、11 个社区,处于萌芽阶段,亟需更多资本与时间释放潜力。

多样性是决定加密生态强度与潜力的核心指标。生态越多元,涵盖的项目、参与者与技术路线越广,对监管、经济或技术突变的抗冲击力就越强。多样性带来持续创新、降低对单一赛道或巨头的依赖,并分散风险,使系统更健壮;反之则脆弱且转型迟缓。

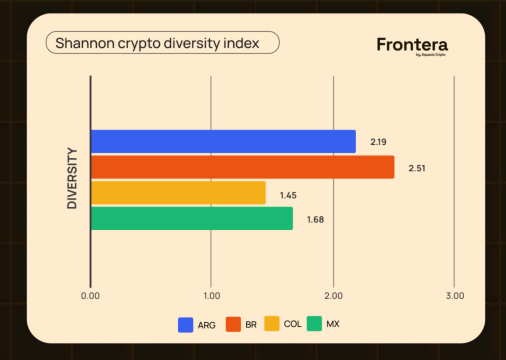

借自生物学的 Shannon 多样性指数可量化这一特征。该指数同时考虑“类别数”与“各类别个体数”,值越高代表越均衡、越多元。指数范围通常 1–3,>2 即视为健康且分布均衡。

对四国加密生态的计算结果:

-

巴西 2.51 —— 区域最高,项目、社区、投资者在各大类目分布均衡,韧性最强。

-

阿根廷 2.19 —— 多样性良好,虽略低于巴西,但生态维度丰富且活跃。

-

墨西哥 1.68 —— 多样性中等,部分赛道集中度较高,存在单一依赖风险。

-

哥伦比亚 1.45 —— 多样性最低,生态集中于少数领域,处于早期培育期,扩容与多元化空间最大。

综上,巴西与阿根廷已形成分布均衡且多元的生态,具备更强的适应性与抗风险能力;墨西哥与哥伦比亚多样性相对较低,在后续扩张中既面临挑战,也蕴含巨大提升机遇。

3.1 加密项目:开发用户所需的产品

拉美加密项目的独特之处在于“极致适应”与“就地创新”。它们往往是对本土社会经济痛点最直接的回应:供应链不透明、融资门槛高、通胀侵蚀储蓄……创业者把区块链当成“补丁”,快速拼出传统系统缺位的环节——从溯源物流到合规 DeFi,从社区代币到跨境支付,用例远超金融单一赛道。

创新之外,“协作”与“社区”是另一生命线。开发者、投资人、用户结成紧密网络,想法一周一迭代,产品一月一升级,市场风向变了,团队连夜换轨。也正因这份协同,拉美项目能在动荡中保持高速进化。

它们同时把目光投向海外,主动对接国际资本与全球节点,用外部资源把本地实验做成可扩张的商业模式。如今,不少项目已出现在全球路演幻灯片里,不再只是“拉美故事”,而是“全球赛道”的必备案例。

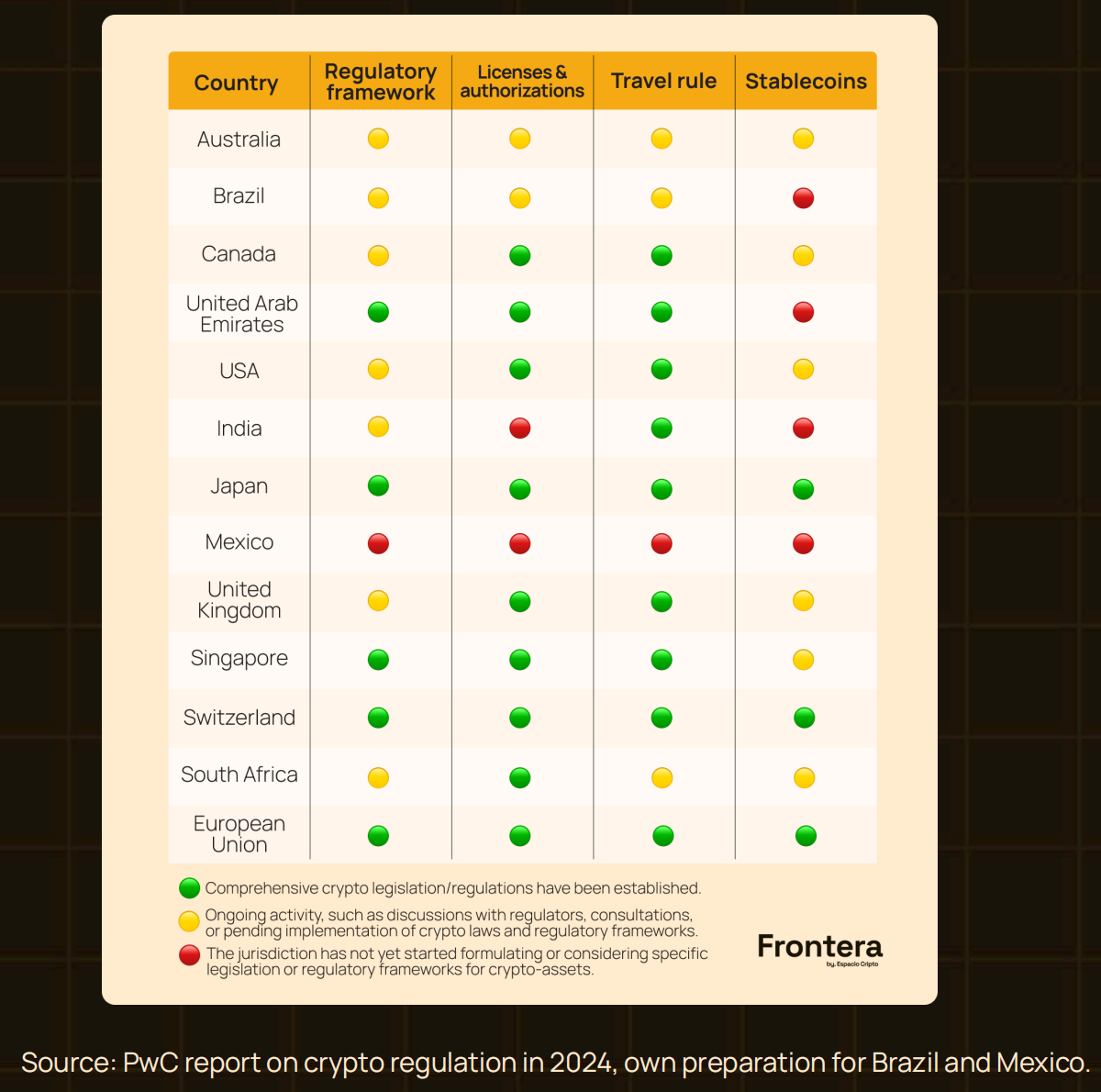

当然,监管灰犀牛仍在路上。法规一日不定,合规成本就一日悬在头顶。但多数团队已学会“边航行边修船”:在条文更新前留好接口,在政策落地时迅速切换。最终谁能跑出,取决于各国监管框架的清晰度。巴西就是“清晰”带来的红利样本。明确的上位法、可预期的合规清单,让全国集聚了区域近半数项目,资本与人才持续南下。相反,在法规多变或缺位的墨西哥,团队把大量精力花在“猜政策”上,创新节奏被迫放缓,生态天花板提前被焊死。

一句话:拉美加密项目凭“痛点驱动 + 社区加速 + 全球嫁接”三连跳,已把地域劣势转成试验优势;下一步,能否把监管不确定性转化为制度红利,将决定它们只是区域明星,还是全球主流。随着各国监管框架逐步成熟,合规项目将获得更大生长空间;而“ Regulatory Arbitrage ”时代结束后的胜者,一定是那些既懂全球规则、又能深耕本地痛点的拉美原生项目。

3.2 社区:为生态注入加速脉搏

社区是拉美加密增长的核心,社区发挥着根本性作用。他们绝非一群对区块链感兴趣的“散客”,而是一个与地区多元社会经济深度交织、充满活力的生态。在这里,激情与生存需求奇妙汇合,形成了独特的化学反应。社区成员包括用户、开发者、创业者、投资者、教育者和爱好者,他们协力把技术推向极限,并推动社会变革。

拉美加密社群的真正独特之处,在于它们的起点:多数源于一群坚信“加密货币能解决本土难题”的热血个体,从零星小群自发集结,最终成长为影响区域话语权的运动。他们并未止步于布道,而是化身为推动全地区采用的引擎。在传统金融体系受限或难以触及的拉美地区,社区充当催化剂:它们普及知识、组织活动、黑客松与工作坊以加速区块链落地,甚至为新兴公司对接潜在投资者,真正实现了机会的民主化。教育者与意见领袖通过 YouTube、Twitter、Telegram 免费输送知识,把原本高墙内的信息拆成大众可消化的“西班牙语+葡萄牙语”版本,完成知识平权。

各国的“推动因素”各不相同:阿根廷社区核心诉求是逃离通胀——加密是生存工具而非潮流;巴西社区更注重创新与 DeFi 技术的落地;墨西哥、哥伦比亚社区的侨汇与金融包容是主要叙事。布宜诺斯艾利斯、圣保罗、墨西哥城、波哥大已成为区域枢纽,定期举办见面会、大会和黑客松,促进人脉与协作。

真正让社群保持黏性的,是“用”而不是“炒”。在墨西哥与萨尔瓦多,侨汇是家庭经济的生命线;加密货币把跨国转账从“天”缩到“分钟”,手续费砍到传统渠道的几分之一。在银行触角未至的偏远地带,社群不仅推销数字资产,更把它当成打通金融包容最后一公里的工具。

协作是另一底色。这些社群不仅在本国深耕,还主动对接全球项目,把新技术、资金与知识引入拉美;同时,区域内跨国联动频繁,阿根廷开发者、墨西哥创业者、哥伦比亚设计师共写代码、同发代币,形成“无国境”创新带,让本土生态因互联而更抗脆弱。

社会影响力同样显著。在传统金融缺口巨大的地区,加密货币被视作赋权利器:存钱、投资、支付均可绕开银行。众多社区项目把链上透明性用于慈善捐款、用加密支付扶持本地小商户,让“技术红利”直接落到街角杂货铺与乡村学校。

会议与黑客松则是社群的“线下加油站”。LABITCONF (拉美比特币暨区块链大会)等老牌峰会每年吸引全球开发者、基金与监管者南下,把拉美从边缘市场写入主流议程;各国每月的 Meetup 与 Hackathon 继续孵化新团队、新用例,让创新循环保持高速。

当然,热情背后亦有阴影。监管不确定性是最大拦路虎——各国政策口径不一,社群倡议常被突然变化的条文打断。然而,在阿根廷与委内瑞拉等恶性通胀国家,经济崩溃反而成为最佳演示场:社群用“今天工资到账立刻换 USDT”的鲜活案例,把危机转化为加密实用性的公开课,韧性可见一斑。

归根结底,拉美加密社群已深嵌当地社会经济纹理。他们不仅是爱好者俱乐部,更是技术落地的搬运工、金融缺口的修补匠、区域创新的发动机。随着社群持续扩张,他们将在全球加密产业的下一幕里扮演更具分量的角色。

3.3 投资者:为未来注资

风险投资(VC)与各类基金正决定性地塑造加密生态的演进,为最具创新与颠覆性的初创企业提供资金。这些投资者不仅向早期项目注入资本,还凭借战略经验与关键资源帮助其扩张运营。它们正集体把目光锁定拉丁美洲:独特的经济痛点、加密与区块链的飞速渗透,加上本地初创公司抛出的创新方案,共同构成了“下注”理由。过去几年,a16z、软银、红杉等全球顶级机构已重金押注当地加密项目,赌它们不仅能颠覆传统金融,还可能改写其他支柱行业的游戏规则。

本土基金同样不可或缺。Kaszek Ventures、Monashees 等早期玩家持续给种子轮“输血”,帮团队把原型做成可跨区域扩张的产品。然而,经历 2021 年的爆炸式增长后,随着全球加息、流动性收紧,2023 年拉美 VC 进入整合阶段。投资总量虽与疫情前持平,但相较 2021 峰值大幅回落,机构愈发挑剔——只投盈利路径清晰、能在后续融资冷冻期自带现金流的“硬”项目。

这一节奏与全球同步:世界 VC 总量在 2021 登顶后连跌两年,2023 年不足 2021 一半,仅与 2020 持平。但拉美跌幅更剧烈,2023 年投资额仅为 2021 年的 25%。原因在于市场体量小、对全球宏观波动更敏感。尽管如此,资金仍在流入,只是更谨慎;金融科技、电商等“刚需”赛道展现出韧性,证明拉美对风险资本依旧有吸引力。

随着全球 VC 市场逐步企稳,拉美有望迎来新一轮资金回潮,尤其那些针对社会与经济痛点、合规扎实、模式可规模化扩张的项目将成为“香饽饽”。在更挑剔的资本环境中,只有价值主张最强、监管风险最低、商业模型最经得起压力测试的团队,才能拿到通往下一轮的船票。

最后,我们还发现一批传统公司正将加密货币与区块链技术融入自身运营,标志着数字化转型的重要一步。该类别包括银行、电商等成熟机构,它们已将加密服务整合进既有业务,以满足市场对更敏捷、去中心化解决方案的需求。例如:

-

银行推出加密资产托管服务,让客户能够安全地存储和管理数字资产;

-

电商平台直接开放加密货币的购买、托管与出售功能,实现“一站式”加密体验。

四、拉美各国的加密货币采用

4.1 阿根廷

阿根廷已成为拉美加密货币采用的“震中”,这绝非偶然。恶性通胀、比索持续贬值以及对传统金融体系信任崩塌等多重经济因素,迫使数百万阿根廷人把数字资产当作避风港。在此情境下,加密货币不仅是投资工具,更是极端波动中保存价值的手段。与此同时,本地加密社区蓬勃壮大,为去中心化解决方案的创新与落地提供了沃土。这个多元且快速扩张的生态由活跃社区、创新项目、大胆投资者构成,虽挑战重重,却蕴含巨大机遇。

为什么选择阿根廷?作为加密采用无可争议的领跑者,阿根廷以仅占巴西五分之一的人口,却获得了本地区最高的交易体量。凭借成熟的市场,可用于实时测试的最大活跃用户群体,以及具有全球影响力的区块链应用开发者群体,这个国家拥有巨大的创业潜力。现在正是利用这一势头、将阿根廷定位为区块链技术与创新枢纽、生产出具有国际竞争力的产品并进一步巩固其在加密生态中领导地位的时候。

A. 社区

加密社区的壮大是阿根廷生态最具标志性的推手。它们不仅普及教育,更搭建起交换想法、启动颠覆性项目的协作网络。最具影响力的群体包括:

-

Crecimiento:通过聚焦教育与共创空间,成为连接全国创新者与区块链爱好者的枢纽。近期举办的大型活动吸引了行业大咖,也为初创企业与投资人牵线搭桥。

-

Ethereum Argentina:全球以太坊网络的地方分支,通过黑客松与活动推动智能合约与 DApp 普及。

-

Polkadot Patagonia & Polkadot Argentina:专注推广 Polkadot 生态,组织 interoperability 与平行链开发活动,夯实国家技术基础设施。

-

FORK DAO:新兴 DeFi 社区,致力于开发去中心化应用,把 DeFi 作为传统金融的可行替代。

B. 项目

阿根廷项目版图极其多元,从老牌交易所到资产代币化、DeFi 平台应有尽有,折射出本土创业者将区块链适配到各行业的活力。

交易所

-

Ripio:阿国加密“老兵”,除撮合交易外还提供借贷、加密信用卡,把数字资产带入日常消费。

-

Lemon Cash:以“每笔消费返 BTC”迅速走红,让加密支付走进千家万户。

资产代币化

-

Agrotoken:把大豆、玉米、小麦等农产品上链,农民可用代币融资或变现,打通农业金融新通道。

-

R3al Block:专注房地产代币化,让高价值物业可拆分交易,提升流动性并降低投资门槛。

金融解决方案与 DeFi

-

RSK Labs:在比特币之上实现智能合约,生态涵盖借贷、稳定币等,为金融普惠添砖加瓦。

-

Beefy:收益聚合器,通过自动化策略帮助用户在 DeFi 中获取更高收益,成为替代传统投资的新选择。

基础设施

-

Coinfabrik:提供区块链开发、安全审计与平台搭建,是本地生态的“建筑队+安保队”。

-

Sensei Node:运营区块链节点,增强网络去中心化与安全。

C. 投资者

尽管经济环境复杂,本土与国际基金仍将阿根廷视为技术创新的沃土。

-

Alaya Capital:押注加密基础设施与 DeFi 初创企业,助力金融系统向更具包容性与韧性演进。

-

Kaszek Ventures:拉美最大 VC 之一,聚焦金融科技与加密产品,推动区域生态扩张。

-

NXTP Ventures:深耕拉美科技初创,已投资多家用区块链解决本地痛点的公司,帮助项目规模化并改造金融行业。

D. 传统公司困境

监管与经济不确定性令传统企业举步维艰。最大私人银行之一 Banco Galicia 曾尝试上线加密服务,却在央行直接干预下被迫叫停,凸显监管框架缺失与当局对金融机构涉足加密的迟疑。

E. 阿根廷监管动态

2024 监管落地情况

2024 年是阿根廷加密资产行业监管格局的关键之年。3 月,《第 27,739 号法》生效,对《第 25,246 号法》(防止洗钱、恐怖融资及大规模杀伤性武器扩散)进行了修订。新法首次在法律层面正式定义“虚拟资产”,并设立由阿根廷国家证券委员会(CNV)监管的“虚拟资产服务提供商(VASP)国家注册”,允许其在反洗钱/反恐怖融资框架下合规运营。同时,VASP 被纳入国家反洗钱和反恐怖融资体系,接受金融情报机构(UIF)的监督。

这一制度化转向为一系列监管措施的出台铺平了道路,也为加密与区块链技术在传统场景中的落地打开了大门,并带来了以下里程碑:

-

以加密资产出资设立公司。根据《第 27,739 号法》,VASP 在阿根廷反洗钱体系中扮演关键角色,明确可用虚拟资产(VAs)实缴出资,并指定 VASP 作为“加密股本”验证机构。关键要点:比特币与 USDC 首次被 IGJ 正式认可为合法出资工具,可用于在阿根廷注册公司;透明估值:股份数量按出资当日加密资产对比索的市价折算。

-

阿根廷首次将加密资产纳入税收特赦。2024 年 7 月 8 日通过的《第 27,743 号法》首次在法律层面明确将加密货币列为可申报的应税资产,成为一次性税收规范与资产外化制度的一部分。该制度允许阿根廷公民对最高 10 万美元的未申报资产进行“洗白”:超出部分只需在指定期限内按优惠税率一次性缴税即可合规。参与条件为:相关加密货币必须存放在已在国家证券委员会(CNV)注册为 VASP 的交易所,并提交正式申报。新制度带动 2024 年 9 月加密资产充值量创历史新高,其中比特币充值额达到全年月均水平的三倍。

-

比特币与以太坊 ETF 的 CEDEAR。证监会《第 1030/2024 号决议》为在阿根廷资本市场发行挂钩比特币和以太坊 ETF 的阿根廷存托凭证(CEDEAR)铺平道路。投资者无需直接托管加密资产,即可通过 CEDEAR 获得加密货币价格敞口。与底层 ETF 一样,这些 CEDEAR 须经由 CNV 授权的券商购买,且不涉及标的资产的实际托管或直接使用权。

2025 年监管展望

随着加密生态与资本市场、银行体系等传统领域的联系日益紧密,亟需出台旨在促进这种融合、推动更广泛采用和使用的监管规则;而任何对虚拟资产或其服务商的过度监管都是不必要的。为实现这一融合,应重点关注以下方面:

-

虚拟资产的税收待遇。由于缺乏与时俱进的措施(例如是否将虚拟资产纳入银行借贷税范围尚未明确),阿根廷对虚拟资产的税收待遇仍面临诸多挑战。《第 27,743 号法》朝正确方向迈出了一步,首次将这些资产纳入资产规范与外化制度,但与其他投资工具相比,不平等现象仍然普遍存在。

-

现实世界资产的代币化。股票、金融资产和不动产的代币化需要监管层面的更新,以便利用区块链带来的效率与安全性,对数字形式的所有权进行发行、交易和确权。这一过程已在多个国家展开,能够让人们更敏捷、安全、高效地获得投资机会。为推动这一议题,阿根廷金融科技商会起草了一份改革建议,主张将代币化资产与传统监管框架区分开来。文件强调,区块链通过分布式登记、可验证性、透明度和不可篡改等特性,能够提供与传统机制相当的保障;并指出可利用受自治规则约束的智能合约,包括锁仓/归属条款和自动分红等功能。这种做法将带来流动性提升、资产碎片化、中介成本下降以及投资准入的真正普惠化等好处。

-

以比特币或虚拟资产构建国家战略储备。今年的另一项关键进展是一项草案的提交,该草案提议允许阿根廷中央银行(BCRA)购买、存储并挖掘比特币,并建议将部分央行储备配置于该加密货币。目前 BCRA 章程并未明确涉及加密货币挖掘;至于购买加密资产,现行法规允许交易“金融资产”,但未说明这一定义是否包含加密货币。

-

布宜诺斯艾利斯加密经济特区。2024 年,阿根廷进一步巩固了其拉美加密之都的地位,吸引数百家初创企业、公司和全球开发者进驻位于布宜诺斯艾利斯、被称为“成长之城”(Ciudad de Crecimiento)的 Aleph 科技中心。实现这一目标的途径是:出台一整套量身定制的监管框架,涵盖专门的税收、劳动和社保制度,同时提供基础设施优惠、法律确定性以及针对这项天然超越国界技术的投资激励。

F. 挑战与机遇

随着哈维尔·米莱上台,阿根廷加密生态站在“十字路口”。米莱公开支持加密货币,首提资产合法化方案,允许纳税人无需额外证明即可申报加密资产。若其推进大胆且进步的监管框架,既能保护消费者,又可让阿国领跑区域。然而,宏观指标仍剧烈波动,经济不稳使投资者保持谨慎。一旦政策成功缓释风险,资本信心与流入有望快速回升。DeFi 与资产代币化的旺盛需求,加上阿根廷天生的创业基因,或将催生新一轮市场颠覆者。

G. 未来展望

在米莱任内,阿根廷加密前景将如过山车般刺激。监管若趋于清晰友好,国际资金或蜂拥而入,巩固其“拉美加密之都”地位。一旦跨越监管与宏观双关,阿根廷有望在全球加密版图占据关键席位,成为西语世界的趋势引领者与聚光灯焦点。

4.2 巴西

区块链正以惊人的速度渗透巴西的每一个角落——从里约热内卢的海滩到最数字化的贫民窟,加密货币已无处不在。通胀与金融排斥等经济因素共同推动了这场“无声革命”:昔日的小众赛道,如今已成不可阻挡的全民浪潮。

背后的关键推手是巴西的加密监管法规。该法于 2022 年 12 月颁布、2023 年 6 月正式生效,在拉美具有里程碑意义:巴西央行(BCB)获权监管虚拟资产服务商,而被认定为证券的代币项目则受证监会(CVM)监管。新规不仅保护消费者,也为区域树立标杆,或加速邻国跟进制定自己的监管框架。

A. 社区

巴西加密社区像一台持续轰鸣的发动机,激情与改变现状的渴望是燃料。

-

Blockchain Rio:汇聚开发者、企业与爱好者的年度大会,是拉美最重要的链上“社交磁场”。

-

Ethereum Brasil:通过黑客松与大型活动为智能合约和 DApp 注入持续动能。

-

Praia Bitcoin:把比特币讲座搬到海滩,让加密真正“晒”进日常生活。

-

当地其他活跃节点:Polygon、Solana、Polkadot 等生态也设有葡萄牙语社区,形成多链并进的“桑巴节奏”。

B. 项目

巴西是加密创业的沃土,创意与胆量齐飞。

交易所

-

Mercado Bitcoin:全国最大、拉美标杆,率先打通资产代币化,2021 年获软银 2 亿美元 B 轮。

-

Mynt(BTG Pactual):投行巨头旗下,传统机构直接下场做零售入口。

资产代币化

-

Liqi:地产、股权、农业初创公司“碎片上链”,让高门槛资产变成 100 雷亚尔就能买的代币。

-

Amfi:合规代币发行平台,已落地酒店收益权、私募股权等多宗案例。

稳定币

-

M^0(M-Zero):多发行人模式的“去中心化加密美元”,合格抵押品即可铸币,降低单点风险,目标直指新兴市场的“链上美联储”。

金融解决方案与 DeFi

-

Hashdex:首批加密 ETF 制造商,BITH11(比特币 ETF)与 HASH11(元宇宙 ETF)把 30 万传统投资人带进加密。

-

Picnic:一站式 DeFi 入口,聚合收益、质押与保险,界面“巴西版支付宝”。

基础设施

-

Parfin:Crypto-as-a-Service,为银行、券商提供托管、流动性、撮合 API,客户包括 Itaú、BTG。

-

Cointrader Monitor:实时价格、深度、套利雷达,本土交易员必备“行情神器”。

-

Atomic Fund:做市商,保证 Mercado Bitcoin、Foxbit 等本地交易所深度。

-

Arthur Mining:水电+太阳能矿场,PUE1.05,ESG 叙事拉满。

C. 投资者

-

Canary:2 亿美元早期基金,投出 Hashdex、Liqi、Picnic。

-

Monashees:拉美老牌 VC,重仓 DeFi 与区块链基础设施。

-

Valor Capital Group:专注跨境 fintech,把美国 LP 的“长钱”带进巴西链上世界。

D. 传统企业进场

巴西传统企业之所以积极拥抱加密货币,既有战略考量,也受市场驱动,这使其在区域内独树一帜。一方面,加密资产为雷亚尔持续贬值提供了对冲工具,丰富了投资选项;另一方面,尽管监管框架仍在完善,巴西对金融创新的开放态度已显著降低企业的合规风险。这种宽松环境让传统公司得以顺势扩展服务、吸引精通技术的新客群,并在数字化竞争中抢占先机。加之巴西商界素来崇尚创新与快速试错的文化,加密货币的集成不仅可行,更被视为提升竞争力的战略必选项。

这一趋势的典型案例如下:

-

XP Investimentos:作为巴西最大的券商之一,XP 已上线加密货币相关服务,彰显传统金融机构对加密资产的整合。

-

Nubank:巴西最大数字银行推出加密货币买卖功能,标志着加密服务正式融入传统银行体系。

-

Mercado Libre:这家拉美电商巨头在其支付平台集成加密货币功能,让数千万用户触手可及地进入加密世界。

-

BTG Pactual:巴西顶级投行之一,先后推出交易所、加密投资基金等产品,凸显其在本地市场的重要地位。

E. 挑战与机遇

巴西加密生态面临的最大挑战之一,便是监管框架与财税细则的最终落地——一旦政策过于严苛,可能束缚企业手脚、冷却资本热情。然而,这同样是一次“化危为机”的窗口:巴西有望借此打造一套既鼓励创新、又保护消费者的成熟法规。最具看点的举措当属央行数字货币(CBDC)项目 DREX。若能顺利推出,它将通过降低交易成本、提升金融包容性和系统效率,为巴西经济注入新动能;也将使巴西在拉美率先拥有标杆性 CBDC,为邻国提供可复制的“巴西模板”。

F. 未来展望

巴西具备成为全球加密枢纽的所有要素:活力四射的社区、层出不穷的创新项目,以及开放且渐进的监管框架,正合力推动该国引领拉美下一波金融变革。Liqi、M^0 等本土案例不仅展现了巴西拥抱新兴技术的能力,更证明其创新足以产生全球回响。随着法规落地、项目成熟,巴西有望在去中心化金融的进化中占据 C 位,不止重塑本国经济,也将深刻影响世界加密版图。

4.3 哥伦比亚

凭借充满活力的科技创新氛围,哥伦比亚开始在加密世界开辟自己的道路。尽管面临经济和监管挑战,创造力仍推动着日益壮大的加密生态。然而,缺乏监管清晰度和地区技术差距,短期内限制了其成为真正加密枢纽的潜力。好在波哥大、麦德林等城市的活跃社群、创新项目以及投资者兴趣日增,使哥伦比亚在拉美加密货币版图上占据一席之地。

A. 社区

加密社区是哥伦比亚生态的心脏,致力于教育、协作与创新。最具影响力者包括:

-

ETH Medellín:全国最活跃的以太坊社区,立足“创新之都”麦德林,定期举办黑客松、工作坊,推广智能合约与 DApp 开发。

-

Celo Colombia:聚焦金融普惠,推动 Celo 区块链在移动端的普及,为传统银行覆盖不到的群体打开加密货币大门。

B. 项目

哥伦比亚已涌现出一批旨在用区块链解决本地及全球问题的项目,这些方案具备可扩展性,覆盖金融普惠到 DeFi 采用等多条赛道:

-

Littio:主打“数字美元”储蓄与支付,对接本地商户,使用门槛低,已成为日常加密消费的入门工具。

-

Wenia(Bancolombia 旗下):传统大行直接下场,用户可在银行 App 内一键买卖加密货币,打通法币与数字资产的最后屏障。

-

Tropykus:专注新兴市场的 DeFi 平台,提供去中心化借贷与存币生息,为无银行账户群体提供传统金融之外的可行选择。

-

Kravata:是一家致力于简化 Web3 技术的基础设施服务商, base 哥伦比亚。该公司通过其 “加密即服务”(CaaS) 解决方案,为拉丁美洲企业提供基于 API 的合规化数字资产接入服务,支持当地法币与加密资产的安全、低成本、高效双向兑换。其技术架构帮助拉美地区的个人和企业充分释放去中心化金融(DeFi)与 Web3 的潜力。Kravata 在运营的第一年就处理了 2.15 亿美金。2024 年 3 月,其获得了 Volt Capital、Framework Ventures 及 Circle Ventures 等国际资本的支持,致力于通过区块链技术解决拉美地区的交易基础设施难题。

C. 投资者

多家风投已被哥伦比亚加密生态的潜力吸引:

-

InQLab:聚焦本土区块链初创,通过战略投资推动生态成长。

-

Magma Partners:拉美基金,押注哥伦比亚金融科技创新,助力本地加密企业加速落地。

D. 传统企业进场

哥伦比亚本土巨头亦开始“链上”尝鲜:

-

Rappi:外卖平台已内测加密支付,用户可直接用数字资产下单,体现传统服务与加密的无缝融合。

-

Banco de Bogotá:率先参与央行 sandbox,试点银行账户直充直提加密货币。

-

Davivienda:正积极探索将加密资产整合进现有产品线,以满足日益增长的创新金融需求。

E. 挑战与机遇

哥伦比亚加密生态要跻身区域枢纽,仍面临多重掣肘。首要障碍是监管模糊:政府虽多次表态将立法,但推进迟缓、口径不一,导致投资者与初创企业不敢大举押注。缺乏明确规则保护消费者、界定企业责任,直接抑制了市场扩张。其次,技术鸿沟显著——波哥大、麦德黎等一线城市基础设施先进,偏远地区却网络薄弱,数字化把最需要替代金融服务的农村人口挡在门外。

但机会同样巨大。哥伦比亚侨汇规模居拉美前列,加密汇款可大幅降本增效;大量无银行账户人群则为加密普及提供天然土壤。传统金融机构的试水亦释放积极信号:Bancolombia、Davivienda 等银行已启动加密沙盒,若监管方向明朗,金融主渠道的接入将瞬间放大用户基数。关键在于政府能否在“鼓励创新”与“保护消费者”间找到平衡,出台清晰且友好的政策。

F. 未来展望

哥伦比亚能否在拉美加密版图占据一席之地,取决于监管与数字基础设施的进化速度。若能建立透明法规、补齐农村网络短板,哥伦比亚有望凭侨汇与普惠金融两大场景实现弯道超车,成为区域不可忽视的玩家;反之,则只能继续以“潜力市场”身份旁观他国狂奔。结局如何,尚待政府行动。

4.4 墨西哥

墨西哥正在崛起为拉美加密版图的关键角色。凭借庞大人口与区域经济影响力,该国加密采用与区块链创新显著提速;金融科技的跃升、创业文化的活跃,以及日益高涨的接受度,共同促使墨西哥成为加密蓬勃发展的热土。

A. 社区

墨西哥加密社区是整条生态的脊梁,提供协作、教育与人脉空间。它们通过活动、黑客松和工作坊不仅传道授业,更激发创新。最具声量的群体包括:

-

ETH Mexico:聚焦以太坊与去中心化应用,举办大型黑客松和峰会,汇聚开发者、投资人和爱好者,助推本土项目成长。

-

Frutero Club:主打社交+教育,用轻松场景降低加密认知门槛,让新手在聊天中学会用钱包。

-

H.E.R. DAO Mexico:致力于提升女性在加密领域的参与度,通过内部黑客松与工作坊组队做项目,并选送优秀成果参加更大舞台。

B. 项目

墨西哥同样拥有一批重塑数字经济的平台和方案:

-

Bitso,是拉丁美洲领先的加密货币交易平台,成立于 2014 年,总部位于墨西哥,业务覆盖墨西哥、阿根廷、巴西、智利和哥伦比亚等 8 个国家,人称“拉美 Coinbase”。截至 2025 年,其用户量超 900 万,服务包括个人和企业客户,是拉美首家加密独角兽企业(估值 22 亿美元)。公司使命是通过区块链技术推动金融普惠,构建无国界金融生态。

-

C 端支持 100+种加密货币交易,法币 MXN、BRL、ARS、USD 通过 SPEI/PIX/ACH 秒级出入金

-

B 端 Bitso Business 为 1,900 家企业提供稳定币收付、批量薪资及 API 结算,零本地牌照可接入拉美,旗舰产品 Bitso Transfer 用 Ripple 网络+稳定币跨境汇款,到账秒级、费用比 SWIFT 低 50%;

-

推出墨西哥比索稳定币 MXNB,巴西雷纳尔稳定币 BRL1,解决本地法币兑换问题;

-

通过 Pay with Bitso 系统支持加密货币支付,集成线下 POS 机、电商平台、数字娱乐平台、订阅公司等。

-

2021 年 C 轮获 Tiger Global, Coatue, Paradigm 等 2.5 亿美元,估值 22 亿美元。持有直布罗陀与墨西哥双监管牌照,500 人团队遍布 35 国,既是散户买币入口,也是跨国企业打通拉美稳定币支付的基础设施。

-

-

Bando:新兴协议,专注链上支付,用去中心化金融方案降低大众进入门槛。

-

The Ethereans:NFT 艺术团队,在以太坊上发行限量数字藏品,已吸引艺术圈与科技圈双重关注。

-

Kardashevbtc:大型矿企,以可持续与能效为核心,在墨西哥打造绿色算力基地。

C. 投资者

随着金融科技与区块链需求激增,本地及国际风投纷纷押注墨西哥:

-

Angel Ventures Mexico:聚焦高成长科技/金融科技初创,积极布局加密赛道,助力企业抢占数字市场先机。

-

Cometa:秉持长期主义,投资构建下一代金融基础设施的加密团队,推动国家级金融基建升级。

D. 挑战与机遇

尽管增长迅猛,墨西哥仍面临显著挑战。监管缺位是最大障碍:相比邻国虽显宽松,但政策不确定性仍让创业者与投资机构举棋不定。当局对加密资产持“边走边看”的谨慎态度,使传统机构迟迟不敢入场,进而拖慢创新节奏,并削弱国际玩家落地意愿。加之机构投资者对风险溢价的要求居高不下,新项目的资本管道依旧受限。

但机会同样巨大。数字经济蓬勃发展、年轻人口结构优越、金融科技生态火热,为加密普及奠定肥沃土壤。传统支付与汇兑体系难以覆盖全部人群,催生对替代方案的巨大需求——其中侨汇更是头号场景。当前墨西哥加密渗透率仍落后于阿根廷、巴西,而经济总量却居区域第二,这意味着只要政策明朗,增长空间将呈倍数级释放。

F. 未来展望

尽管距离“区域加密枢纽”仍有长路,墨西哥的前景依旧光明。若能出台清晰且友好的监管框架,便可吸引更多投资者与项目落地,逐步确立自己在拉美加密生态中的关键地位;假以时日,有望领跑全区域的加密货币采用与创新浪潮。

然而,现实障碍不容忽视:市场高波动性、政策不确定性,以及部分人口数字技能不足,都是墨西哥必须跨越的栏杆。能否妥善化解这些挑战,将决定该国最终能否跻身拉丁美洲的加密创新中心。

4.5 秘鲁

秘鲁在拉美加密资产接收价值最高的国家中位列第七,同时是该地区增长第三快的加密市场。凭借监管进展、技术整合以及公众对比特币等数字资产日益浓厚的兴趣,秘鲁已稳居美洲最具前景的市场之一。主要里程碑包括:

-

监管下的互操作性:在秘鲁中央储备银行(BCRP)与电子清算所(CCE)的主导下,本地及外国金融科技公司(包括 Lemon)得以与秘鲁金融体系实现对接。

-

金融科技渗透率提升:2024 年金融科技公司数量较 2023 年增长 20%,从 288 家增至 346 家。

直至 2024 年中,市场才迎来爆发式采用,加密应用下载量较上半年翻番,由此带来一波新用户涌入市场进行加密资产交易。

A. 采用率提升的原因

是什么促成了这波突如其来的采用激增?正是 2024 年 9 月“互操作性”获批。自那一刻起,秘鲁在转账笔数以及本地与外资机构参与度两方面均呈现爆发式增长。其中便包括像 Lemon 这样的“双币种钱包”,它让索尔与数字货币得以共存。Lemon 借助互操作性的落地,向秘鲁市场抛出前所未有的价值主张:

这一进展不仅简化了加密资产的准入门槛,更直观暴露出秘鲁民众对加密资产巨大的潜在需求。此前,这片市场几乎由经验丰富的玩家垄断,他们大多通过 P2P(点对点)平台迂回交易。互操作性的到来扫清了采用障碍,使得众多因 2024 年 3 月比特币历史高点而错失买入机会的秘鲁人,得以在当年后续几轮高点中重新上车。

在 Lemon,这股激增的热情被 2024 年 12 月比特币突破 10 万美元时的历史纪录所印证:当月独立用户数量与比特币购买量均创下平台在秘鲁的峰值。塑造 2024 年秘鲁加密生态的另一关键现象是 Worldcoin(WLD)的崛起。

该项目主要吸引了热衷新技术的人群,并凸显出市场对“用户友好型工具”的巨大需求——这类工具需能将加密资产无缝融入日常金融活动。

其热度之高,以至于 2024 年在 Lemon 存入 WLD 的秘鲁用户中,有 1/4 同时也持有比特币;而更常见的行为则是把 WLD 直接兑换成索尔或通过 App 扫码支付。对新兴技术的兴趣与更便捷的生态准入相结合,催生了这场“完美风暴”,或将使秘鲁成为拉丁美洲下一个重量级玩家。

B. 监管动向 2024

2013 年 1 月,《第 29985 号法》颁布,在全国范围内将电子货币视为金融普惠工具,对其基本特征进行规范。该法明确了电子货币的发行指引、界定获授权主体,并确立适用于“电子货币发行公司”(EEDE)这一非金融机构的监管与监督框架。

2022 年,秘鲁中央储备银行(BCRP)通过“互操作性战略”推动数字支付的大规模采用,该战略分四个阶段、不同范围实施。前三个阶段通过《支付服务互操作性条例》(BCRP 第 0024-2022 号通知)落地,针对服务商、协议及支付系统。

2023 年 7 月,BCRP 修订《互操作性条例》(第 0013-2023 号通知),为专注电子货币的第三阶段主体设定完成时限,强制要求数字钱包、即时转账及二维码支付实现互操作。得益于此,Lemon 现已在秘鲁为用户提供完全互操作的功能,使其能够在整个金融体系中无缝获取索尔,并在法币与加密生态之间顺畅操作。

在虚拟资产服务提供商(VASP)领域,2024 年 7 月 30 日颁布的 SBS 第 02648-2024 号决议,强化了反洗钱与反恐怖融资措施。该法规适用于已被正式列为“义务主体”并受金融情报机构监管的 VASP——相关地位通过利马《最高法令第 006-2023-JUS 号》予以确认。

五、拉美加密项目的演进思路

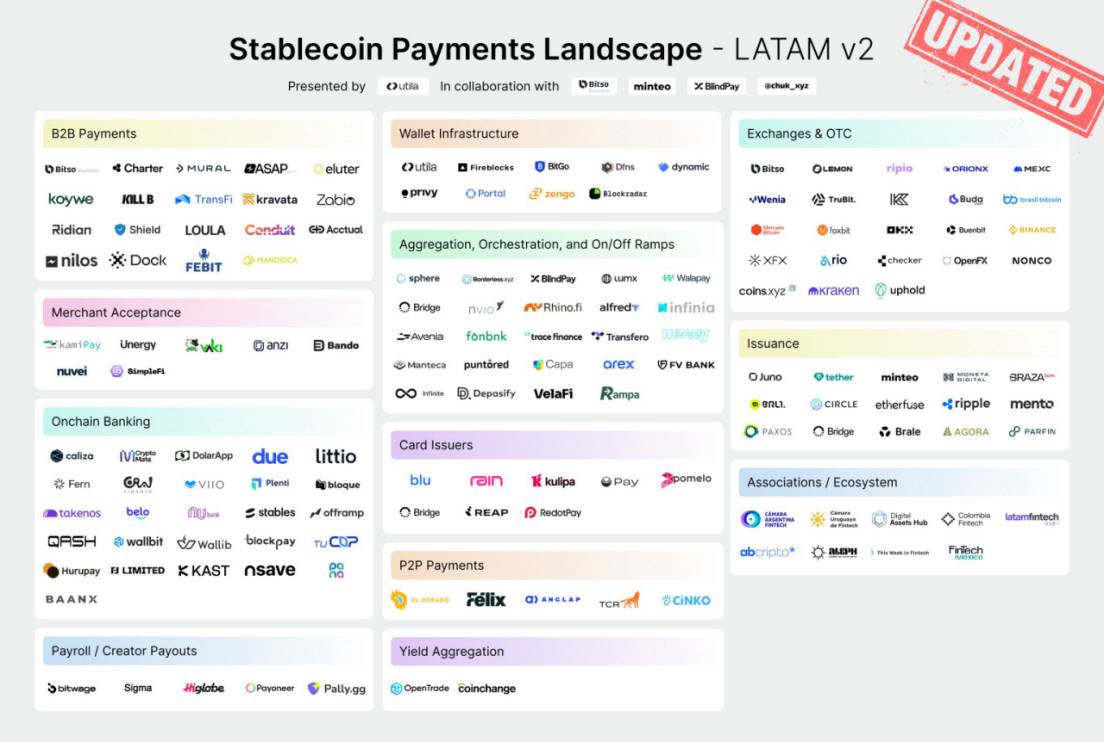

我们也简单梳理了下 Chuk Okpalugo 梳理出来的拉美加密金融生态全景图,从稳定币支付的角度发现:

-

大部分初创公司集中在 2021 年之后,多为 10 人左右的团队,处于早期种子轮阶段,服务本地市场;

-

基础服务以 API 的形式呈现:

-

货币承兑:拉美本地货币与稳定币之间的出入金;

-

全球支付:无论是通过法币的路径(SWIFT + 代理行)还是通过稳定币的路径(OTC + VA 账户能力)。

-

-

在这个基础服务能力之上,去构建不同的场景,如 B2B 企业支付,P2P 出入金网络,C2C 汇款,稳定币收单,类银行服务等。

-

原生项目的演进脉络:早期会以本地渠道为主,马上进入中期,将逐步覆盖拉美几个主要的经济体(如在各地持牌 VASP,然后打通本地的网络 PIX 等);后期将形成打通大洲的渠道(如 Conduit 的拉美——非洲通道),最终会以拉美本地为基础,形成一个全球的稳定币结算网络(Bridge 这种网络)。

-

传统企业将会把加密货币/稳定币,嵌入到他们现有的生态场景中去,这可能最能够实现立竿见影的效果,但是依旧取决于监管的清晰以及市场的教育。例如 Nubank、Mercado Pago、PicPay、RappiPay 等拉美本土“超级 App”已效仿 Revolut、PayPal,把加密资产直接嵌入银行栈,服务数亿用户。

目前依然还很早期,就像 Dune 报告所示:

-

交易所仍是核心金融基础设施。它们支撑着整个拉美的散户采用、机构活动和跨境价值转移:2021–2024 年年度流量激增 9 倍,达 270 亿美元。以太坊用于大额结算,Tron 用于低成本 USDT 支付,Solana 与 Polygon 则承载不断扩大的散户流量。

-

稳定币是拉美链上经济的脊梁。支付应用与稳定币是区域的产品—市场契合点,传统金融体系信任缺失与经济危机催生了需求。2025 年 7 月,USDT 与 USDC 占所追踪交易所成交量的 90% 以上。同时,本币锚定稳定币也在崛起:BRL 稳定币成交量同比 +660%,MXN 稳定币同比 +1,100 倍,成为国内支付新工具。

-

支付应用正进化为“加密原生数字银行” 。加密已成为后台基础设施,支付与储蓄需求强劲。Picnic、Exa、BlindPay 等平台把稳定币余额、储蓄和现实世界消费整合进一个界面。无论是否有银行账户,年轻、移动优先的用户群体越来越多地用加密满足日常金融需求。

六、写在最后

拉丁美洲的加密货币生态已不再是“新生现象”,而是一股正在重写金融规则的不可逆力量。经济动荡、监管真空与创新活力三重共振,使这片大陆成为全球加密版图中最富戏剧性与实验性的战场。阿根廷、巴西、哥伦比亚、墨西哥四国率先突围,各自上演“链上资本再分配”的实况剧:旧财富被重新定价,新机会野蛮生长。

尽管监管是拉美房间里的大象,但是正因如此,机会无处不在。本土初创企业乘势而起,专攻金融包容、跨境汇款、通胀对冲等区域痛点,用稳定币、DeFi、链上征信等产品把“银行网点”直接塞进用户手机。只要手机有电,拉美民众就能绕过传统金融的层层关卡,完成储蓄、借贷、投资、汇款的全套动作。

尽管前路多艰。经济波动、政局不稳、货币贬值像定时炸弹;加密教育缺失更把大规模采用拦在门外,许多人仍把区块链等同于“快速致富”或“快速破产”的轮盘。但未来依然光明。拉美拥有全球最年轻、最懂技术的人口结构之一,创业生态以两位数速度扩张,是天然的创新温室。只要监管框架演进得当,这片大陆完全有机会跳过传统金融的“旧版本”,直接跃迁到加密经济的“最新版”。

巴西已证明:清晰规则=机构资金+合规创新;阿根廷正处新政府拥抱行业的蜜月窗口,若及时立法,可巩固区域龙头;墨西哥一旦监管明朗,庞大的侨汇需求与金融科技积淀将瞬间放大链上流量;哥伦比亚则需先跨过技术与监管双重门槛,才能把潜力变现。

拉美绝非单纯的“新兴市场”,而是一座等待喷发的火山。增长空间巨大,但欲乘势而上者必须快速、敏捷,并做好在不确定中穿行的准备:跨越监管壁垒、教育大众、用贴合区域痛点的创新方案赢得用户,才能在这场链上资本再分配中留在牌桌,而非沦为脚注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。