撰文:imToken

无论是市值创下历史新高的 PAX Gold、Tether Gold,还是各大平台陆续上线的股票代币,现实世界资产(RWA)都似乎正以前所未有的速度驶向链上。

尤其是 TradFi 机构们开始纷纷下注,从日益壮大的黄金代币、美股代币市场,到贝莱德、花旗等金融巨头的万亿级预测,再到纳斯达克的躬身入局,RWA 不仅是 DeFi 的下一个重要叙事,更可能成为 Crypto 链接现实世界的历史性班车。

也正因如此,在探讨这个风口之前,我们或许应该先回到原点,回答一个根本问题:

为什么 Web3 与 Crypto,如此迫切地需要 RWA?

01 DeFi 突破次元壁的历史必然

自从 2020 年 Compound/Uniswap 引爆 DeFi 盛夏以来,整个 Crypto 世界迎来了长足发展,链上资产的种类与体量在原生资产循环中实现了快速冷启动与指数式扩张。

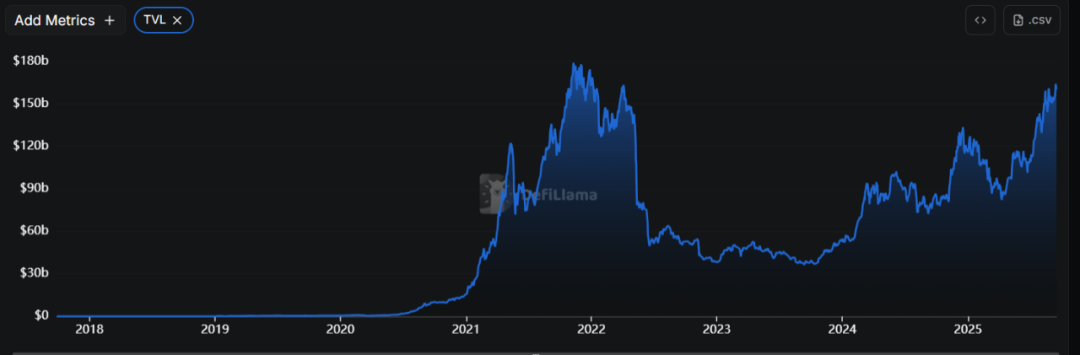

DeFiLlama 统计数据显示,截至发文时,全网 DeFi 总锁仓价值(TVL)超 1600 亿美元,接近 2022 年 11 月 1780 亿美元左右的历史巅峰水平。

来源:DeFiLlama

在这千亿帝国之中,以 Aave、MakerDAO、Lido 为代表的借贷与质押协议,不仅贡献了主要的资金份额,更成为了无数 DeFi 乐高协议赖以生存的关键基础设施。可以说,当今绝大多数的去中心化交易与衍生品协议,都构建在这些底层借贷协议的信用体系之上。

在 DeFi 发展的早期阶段,原生资产之间的「内循环」无疑是一种极具巧思的设计——它不仅解决了生态冷启动的种子资金需求,更极大激发了 Crypto 世界提升资金效率的种种无边界创新,然而,这种「内循环」模式的局限性也日益凸显:

首先自然是资产同质化,抵押品高度集中于少数几种主流加密资产,系统性风险较高,一旦核心资产价格剧烈波动,极易引发连锁清算;

其次就是增长天花板的限制,DeFi 的体量始终受限于原生加密市场的总市值和波动性,难以突破自身的次元壁;

换句话说,单靠原生资产的内循环,DeFi 已难再突破天花板,要想引入更稳定的价值锚点,DeFi 必须向外看,必须把目光投向现实世界资产。

正是在这个背景下,RWA(Real World Assets,现实世界资产)叙事应运而生。RWA,全称 Real World Assets,即「现实世界资产上链」,旨在将房地产、美债、消费信贷、美股、艺术品等现实世界中的资产,通过代币化的方式引入区块链,以释放流动性并提高交易效率。

客观而言,当前 DeFi 和 Web3 市场与传统金融市场的体量相比仍有较大差距,但 RWA(Real World Assets) 代币化的出现,则为 Web3 跨入下一个万亿美元级别市场带来了新的希望。

这也正是 DeFi 要从「内循环」走向「外循环」、从原生自繁荣走向主流采用的必经之路。

02 烈火烹油:从黄金到美股的 RWA 实践

既然我们已经弄清了 RWA 的必要性,那么不妨再看看当下的市场现状——当前 RWA 市场正呈现出烈火烹油之势,其中最成熟、最典型的代表,莫过于代币化黄金。

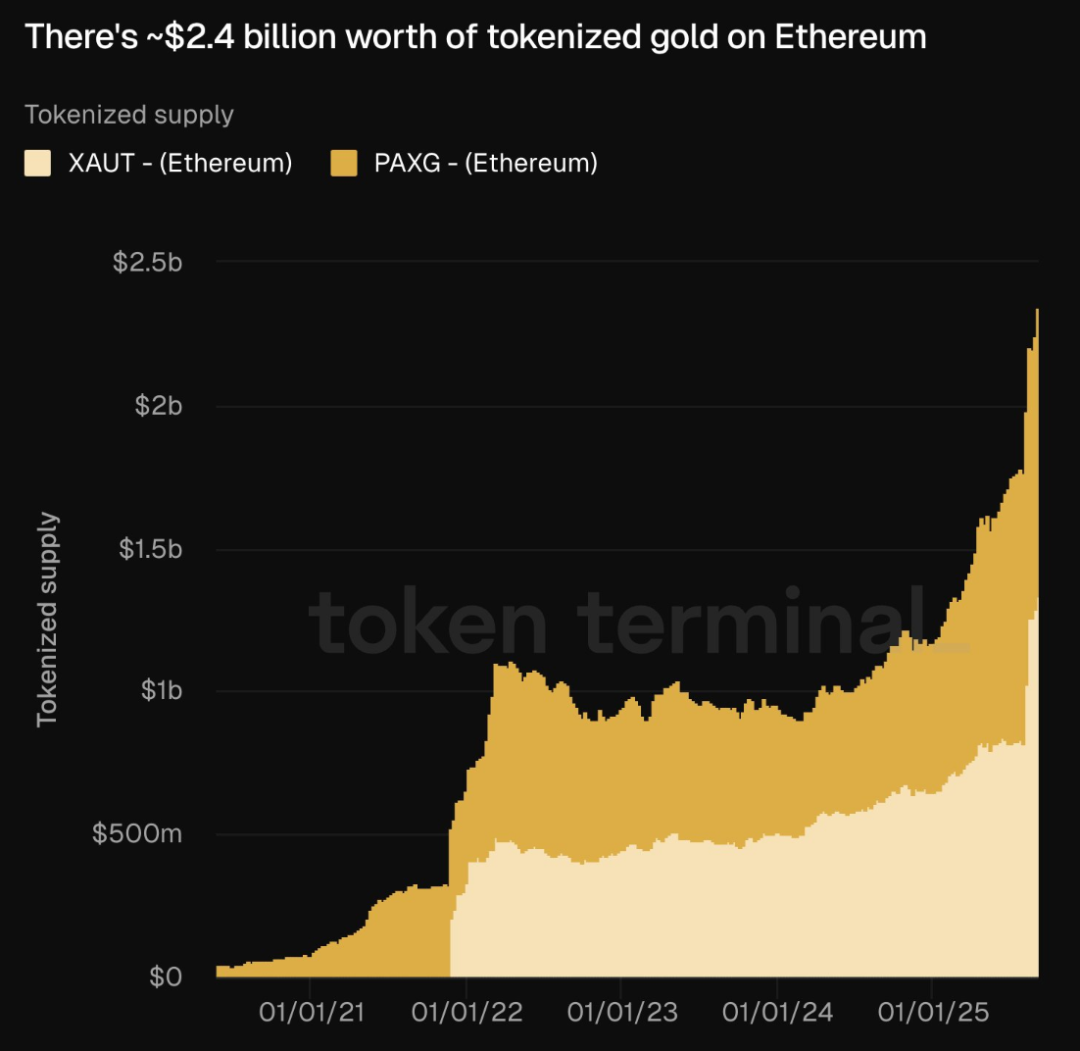

据 Token Terminal 数据,目前以太坊上已有价值约 24 亿美元的代币化黄金(包含 XAUT 和 PAXG),今年迄今为止,代币化黄金供应量增长约 100%,这不仅反映了用户对链上避险资产的需求,更证明了 RWA 模式的可行性。

来源:Token Terminal

更值得关注的是,传统金融权威机构也开始加速布局 RWA 代币化。

据《金融时报》报道,世界黄金协会(WGC)正积极寻求推出官方认可的数字形式黄金,「我们正在尝试为黄金建立起一套标准化的数字层,以便其他市场使用的各类金融产品未来也能应用于黄金市场」,此举可能彻底改变伦敦规模达 9000 亿美元的实物黄金市场。

当然,客观而言,与高达 2310 亿美元的黄金 ETF 市场,乃至估值 27.4 万亿美元的实物黄金总市值相比,代币化黄金确实才刚刚起步,但也正因如此,其未来的增长空间不可估量。

除此之外,将美债、美股等主流金融资产代币化,正成为 RWA 赛道最炙手可热的方向。以 Ondo Finance 为代表的头部项目,已成功将短期美国国债的收益带到链上,为加密用户提供了合规、稳定的收益来源。

而代币化美股,更是近期的香饽饽,它为全球用户提供了一个 7x24 小时无障碍参与全球顶级公司价值增长的通道,从 Ondo Finance 到 Robinhood 再到 MyStonks,越来越多的机构正在将 Apple、Tesla 等热门股票搬上链,为 DeFi 生态注入更丰富的资产类型。

目前主流的 Web3 钱包也纷纷开始陆续集成代币化美股与黄金等 RWA 资产,以 imToken 为例,现已支持持有并管理 Ondo Finance 提供的股票代币,如 Apple(AAPL)、Tesla(TSLA),其中代币价值锚定其基础资产,并由 J.P. Morgan 等顶级金融机构合作托管,保障资产的合规与安全。

无论是风头正劲的黄金代币,还是蓄势待发的股票代币,RWA 已不再是边缘试验品,而是从幕后走向台前的主流叙事。

03 RWA,Crypto 的历史性班车

单从数据维度看,RWA 叙事,绝对是未来 10 年「区块链 +」最明确的 Alpha 方向。

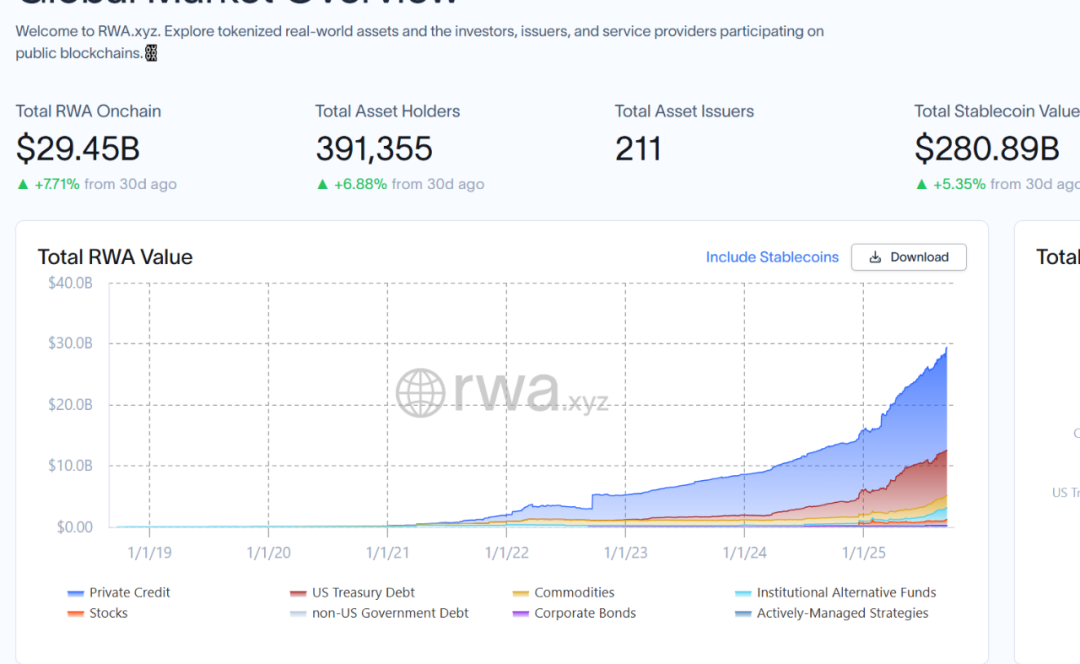

RWA 研究平台 rwa. xyz 统计显示,目前 RWA 总市场体量近 300 亿美元,贝莱德预计到 2030 年代币化资产的市值将达到 10 万亿美元。

换句话说,未来 7 年,RWA 叙事的潜在增长空间或高达 300 倍以上。

这些数字并非空穴来风,它们基于一个简单的事实:全球的现实世界资产(房地产、股票、债券、信贷等)总价值高达数百万亿美元,即便只有极小部分被代币化,也将为区块链世界带来前所未有的价值洪流。

来源:rwa.xyz

而在这场资本流向的变革中,Ethereum 无疑是最核心的主战场——从技术成熟度、资产安全性,到 DeFi 协议生态完整度,都远远领先于其他公链,也正因如此,以太坊联合创始人 Joseph Lubin 甚至直言:RWA 将是驱动以太坊生态未来十年增长的最大引擎之一。

可以说,从美国国债的代币化(如 Ondo Finance),到私人信贷的链上融资(如 Centrifuge),各类 RWA 项目正多点开花。

而 RWA 的真正意义,远不止于简单的资产上链,它标志着一场正在成型的金融范式转型,或将同时重塑 DeFi 与传统金融的底层结构:

-

对于 DeFi:RWA 引入了稳定、低相关且具备持续现金流的优质抵押品。这不仅能从根本上解决 DeFi「内循环」的系统性风险,更能为其带来前所未有的资产多样性和市场深度;

-

对于传统金融:RWA 能够将房地产、私募股权等流动性极差的资产「激活」,通过代币化实现所有权的分割和高效流转,极大地提高资本效率,创造全新的市场;

-

对于整个生态: 以太坊作为这场革命的绝对主战场,正在演变为一个「全球统一结算层」;

从本质上看,RWA 代表着一种「增量资本叙事」,它不仅能为 DeFi 提供更稳定、低相关的优质抵押品,更意味着区块链世界与现实金融体系的第一次真正握手。

未来十年,RWA 或将成为 Crypto 走向现实经济、实现主流化 adoption 的决定性转折点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。