Boros为永续合约资金费率——创建了一个资本高效的链上衍生品市场。通过将链外交易所的资金费率“代币化”为可交易的“收益单位”(Yield Units, YU),实质上构建了一个功能上类似于传统金融中利率互换(Interest Rate Swaps, IRS)的市场——为猫山王榴莲的果农们实现了一颗榴莲树“赌”3次的交易品类。

该协议不仅为交易者提供了对冲和投机资金费率波动的新工具,也为Ethena等依赖资金费率的Delta中性策略协议提供了关键的风险管理基础设施。

短期来看,Ethena的发展越好,Boros的交易量就越大。

1. 链上利率衍生品的兴起

1.1 永续合约资金费率:一种加密原生利率基准

永续合约与传统期货合约不同,它没有到期日。为了使其价格与标的资产的现货价格保持锚定,引入了资金费率这一核心机制。资金费率是多头和空头仓位之间定期交换的费用。

其经济意义在于,资金费率不仅反映了市场情绪和杠杆需求,还体现了基础货币和计价货币之间的资本成本差异。正费率(多头支付空头)通常表示市场看涨情绪浓厚或杠杆需求旺盛;负费率(空头支付多头)则反之。永续合约市场每日处理数千亿美元的交易量,使得资金费率成为一个规模巨大且此前无法直接交易的收益与风险来源,为围绕其构建的衍生品协议创造了广阔的市场空间。

1.2 与传统利率互换(IRS)的异同

利率互换(IRS)是一种衍生品合约,双方同意在未来一段时间内,基于一个名义本金,交换一系列利息支付流,通常是一方支付固定利率,另一方支付浮动利率。全球利率互换市场规模巨大,每日清算额超过1.2万亿美元。

Boros协议实现了功能上类似的固定换浮动协议。用户可以选择支付一个固定利率(即隐含年化收益率),以换取一个浮动利率(即来自中心化交易所的基础年化收益率),反之亦然。

然而,两者之间存在关键差异:

- 底层利率:传统IRS通常使用如SOFR或ESTR等基准利率。而Boros使用的是永续合约资金费率。

- 基础设施:传统IRS是场外交易(OTC)市场,通常由银行作为中介,并越来越多地由中央对手方(CCP)进行清算。Boros则建立在链上的订单簿。

- 对手方风险:在传统金融中,对手方风险是一个主要问题,通过法律协议和抵押品来缓解。在Boros中,对手方风险通过一套链上的抵押、保证金和清算系统以算法方式进行管理。

1.3 Boros简介:Pendle进军杠杆化收益交易

Boros将“收益交易”扩展至“资金费率”(Funding Rate),并引入了保证金和杠杆机制。

多年来,交易者只能被动地承受资金费率,将其作为交易成本或收入来源,而无法将其作为一种独立的风险因子进行交易。对冲操作间接且资本效率低下。Boros通过提供一种直接、资本高效的工具(YU)和交易场所(链上订单簿),首次实现了对资金费率风险的直接交易。这类似于金融史上信用违约互换(CDS)的诞生,它使得银行可以将信用风险从底层贷款中分离出来进行交易。Boros正在为加密世界的资金费率风险做同样的事情。

现阶段最核心、最强大的应用场景是为Ethena这类管理着数十亿美元资产的Delta中性策略提供机构级对冲工具。Ethena能否为其稳定币USDe提供稳定的固定收益,可能部分取决于其在Boros上对冲资金费率风险的能力。

1.4 一个类比:猫山王榴莲期货市场

为了更好地理解Boros的核心理念,我们可以将其与一个假设的“猫山王榴莲期货市场”进行类比。

想象一下,有一棵猫山王榴莲树。这棵树代表着一个能产生收益的基础资产,就像Binance上的永续合约市场一样。

- 未来的榴莲收成:这棵树未来会结出多少榴莲,其品质如何,都是不确定的。这个不确定的未来收成,就好比永续合约市场未来产生的资金费率。有时收成好(资金费率为正且高),有时收成差(资金费率为负)。

- 榴莲期货合约:果农和水果商希望提前锁定未来榴莲的价格,以对冲收成的不确定性。于是,他们创建了一个市场,专门交易“未来特定日期交付的榴莲”的合约。这个合约,就相当于Boros协议中的收益单位(YU)。

- 期货市场的价格:在这个市场上,榴莲期货合约有一个由买卖双方竞价形成的价格。这个价格反映了市场对未来榴莲收成的集体预期。这个价格,就是Boros中的隐含年化收益率(Implied APR)。

- 实际的收成价值:等到榴莲成熟采摘时,它在现货市场上的实际价值就确定了。这个最终的、真实的价值,就是Boros中的基础年化收益率(Underlying APR)。

在这个类比中,Boros协议就扮演了这个榴莲期货市场的角色。它不交易榴莲树本身(即不交易BTC或ETH现货),而是为人们提供一个平台,专门交易由这棵“树”(永续合约市场)未来产生的“果实”(资金费率)的预期。交易者可以在Boros上买卖对未来资金费率的预期,就像水果商买卖对未来榴莲收成的预期一样,从而实现投机或对冲。

2. 架构深度剖析:Boros协议的运行机制

本章节将详细拆解Boros的技术组件,阐明其如何将一个抽象的链下费率转化为可在链上交易的金融工具。

2.1 链下收益的代币化:连接CEX费率与链上资产

Boros依赖预言机从Binance/Hyperliquidi等数据源导入实时的资金费率数据。这是一个关键的中心化节点,也是一个潜在的操纵向量,协议通过特定的风险参数来应对这一问题。

Boros的设计巧妙之处在于,它允许用户交易市场预期与实际费率之间的变化或价差,而非费率本身。这将其转变为一个功能强大的预测市场。

2.2 收益单位(YU):基础可交易工具

收益单位(Yield Unit, YU)是Boros中的基础交易工具,代表从当前到合约到期日,一个单位名义本金(例如1个BTC或1个ETH)所能产生的总资金费率收入。

在概念上,Boros的YU类似于Pendle V2的收益代币(YT),因为它们都代表了代币化的未来收益流。然而,与V2不同,Boros没有相应的本金代币(PT),这使其成为一个纯粹的收益方向性交易工具。交易YU允许用户在不对标的资产(如BTC或ETH)承担直接价格风险的情况下,对资金费率的波动性进行投机或对冲。

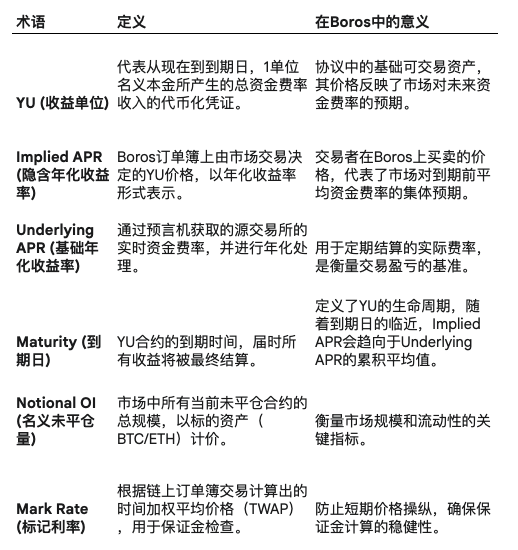

Boros协议核心术语

2.3 费率的二元性:解构隐含APR与基础APR

Boros交易的核心动态源于两种费率之间的相互作用:

- 隐含年化收益率 (Implied APR):这是Boros订单簿上由市场交易决定的YU价格,代表了市场对到期前平均资金费率的集体预期。交易者实际上是在对这个隐含利率进行做多或做空。

- 基础年化收益率 (Underlying APR):这是由预言机从源交易所获取的、经年化处理的实时资金费率。它是仓位定期结算的依据。

仓位的盈利能力取决于结算时Underlying APR与交易者入场时Implied APR之间的差值(白话就是:你赌的是Implied apr):

- 做多YU:如果Underlying APR > Implied APR,则盈利。

- 做空YU:如果Underlying APR Implied APR,则盈利。

2.4 交易基础设施:链上订单簿与结算引擎

Boros采用了一个完全上链的公开订单簿,用于YU的点对点交易。这种设计提供了透明度,但也带来了与Gas成本和潜在抢跑交易相关的挑战。同时,协议也设有一个自动做市商(AMM)来提供基础流动性。

结算过程(也称为Rebase)会按照源交易所的资金费率周期(例如币安为每8小时)定期进行。在每次结算时,系统会计算盈亏(即Underlying APR与Implied APR之间的差额),并直接调整用户的抵押品余额。

这种定期结算机制与套利机会的存在,确保了随着到期日的临近,Implied APR会自然地向Underlying APR的累积平均值收敛。这是因为剩余时间越短,未来费率的不确定性就越小。

2.5 资本管理:交叉保证金与清算系统

Boros支持杠杆交易(初始上限为1.2倍,但设计上可支持更高杠杆),并提供独立和交叉保证金两种账户模式。其保证金系统的设计旨在实现资本高效,使抵押品要求与预期的支付风险(即利差波动)相匹配,而不是与完整的名义敞口挂钩。

为了进行保证金检查,仓位价值由“标记利率”(Mark Rate)确定,这是一个从链上订单簿交易中得出的时间加权平均价格(TWAP)。这是抵御短期价格操纵的关键防御机制。如果账户的保证金水平低于维持保证金要求,该账户将面临清算,以防止坏账累积。

Boros的架构创造了一个自我参照但又由外部锚定的生态系统。交易价格(Implied APR)由Boros订单簿上的参与者内生决定。然而,系统的价值和盈亏最终是根据一个外生的、客观的(预言机)数据源来结算的。这种内部定价与外部锚定的二元结构是协议的核心引擎。8小时的结算机制扮演了“现实检验”的角色,强制投机价格与链下实际费率进行对账。

3. 应用与市场动态

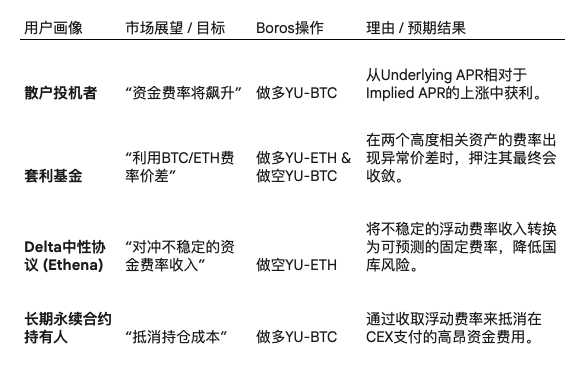

3.1 Boros交易策略框架

交易策略矩阵

除了上表中的策略,交易者还可以利用资金费率的周期性规律(如周末费率较低)进行周期性交易,或在费率偏离历史均值时进行均值回归交易。此外,在重大市场事件(如监管决策)发生前,进行事件驱动交易也是一种常见的策略。

3.2 机构效用:Ethena案例研究与Delta中性对冲

Ethena等协议通过持有现货ETH/BTC并做空等值的永续合约头寸来为其稳定币(USDe)创造收益。其主要收入来源是作为空头持有人获得的资金费率。然而,这部分收入极不稳定;一旦资金费率转为负值,Ethena将面临重大亏损。

Boros为此提供了解决方案。通过在Boros上做空YU,Ethena可以支付(不稳定的)浮动Underlying APR,同时收取(可预测的)固定Implied APR。这有效地将其不稳定的收入流转换为固定的、可预测的收入,从而使其能够降低国库风险,甚至为其用户提供固定收益产品。这种对冲能力对于任何运行“现货-期货套利”或基差交易的实体都至关重要,包括矿工、质押者和套利基金,使他们能够锁定成本或收入,提高运营的稳定性。

3.3 资本效率主张的评估

Boros声称提供极高的资本效率,允许用户用少量抵押品对冲大规模的名义头寸(官方宣传中提到高达1000倍)。这种效率源于其保证金模型。在Boros中,保证金是基于利率支付的潜在波动来计算的,而不是基于底层头寸的全部名义价值。

然而,理论上的1000倍效率是一个极端的营销数字。实际的杠杆率和资本效率受到协议风险参数、保证金要求和初始杠杆上限(例如,上线初期为1.2倍)的严格限制。真正的资本效率是动态的,并取决于市场波动性。

4. 思(fo)考(mo)

Boros的出现,在现有的永续合约市场之上创造了一个“meta game”和新的。它允许交易者不仅对资产价格进行投机,还能对底层永续合约市场中其他交易者的行为和情绪——资金费率进行对(投)冲(机)。

因为资金费率是CEX上多空仓位不平衡博弈后的直接结果。因此,在Boros上交易YU,实际上是对Binance或Hyperliquid等市场上交易者仓位和情绪的杠杆化押注。一个做多YU的交易者,实质上是在押注币安上的杠杆做多需求将会增加/减少。这增加了一个新的复杂性和机会维度,将市场结构和交易者心理本身变成了一种可直接交易的资产。

有趣的是,一个健全的资金费率对冲市场的存在,可能会反过来抑制其赖以为生的波动性。极端的资金费率通常是由拥挤的单边交易引起的。大型参与者往往因为高昂的持仓成本(资金费率)而不敢加仓。有了Boros,一个大型交易者现在可以在CEX上进行杠杆做多(这会推高正费率),同时在Boros上做多YU来对冲这一成本。这降低了参与拥挤交易的负激励。随着Boros流动性的深化,它可能会像传统金融中成熟的IRS市场稳定借贷利率一样,起到稳定作用,压缩资金费率的极端峰值和谷值,又或者把拥挤交易推向另一个极端?

who knows?

yet who cares?

p/s:利益相关,作者持有 $pendle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。