比特币价格飙升遇阻力,但图表信号显示抛物线式反弹

加密货币交易者再次回顾历史,以寻找未来走势的迹象。

一项新的分析将今天的比特币图表与2017年著名的牛市进行比较, 相似之处令人难以忽视。

这两种模式几乎完全相同,根据这种观点,加密货币现在已经达到了“目标4”。在2017年,这一阶段标志着最终爆发性反弹的开始。

如果这一模式成立,许多人相信新的比特币价格飙升可能即将到来,可能会使比特币迅速达到新的高点,超出预期。

来源:X(前身为Twitter)

Arthur Hayes预测比特币 将达到200,000美元

BitMEX联合创始人Arthur Hayes是这一看涨观点的最强声音之一。在最近的一次采访中,他表示他不再相信传统的四年比特币周期。

相反,他认为全球资金流动和中央银行的大规模流动性注入将推动比特币的下一次上涨。

Hayes相信,这可能导致比特币价格飙升,远超以往的限制,预计在本十年结束前达到150,000美元到200,000美元之间。

他对投资者的建议是?保持冷静,超越短期噪音。

当前价格挣扎与技术阻力

尽管兴奋,但这款数字货币这一周并不轻松。

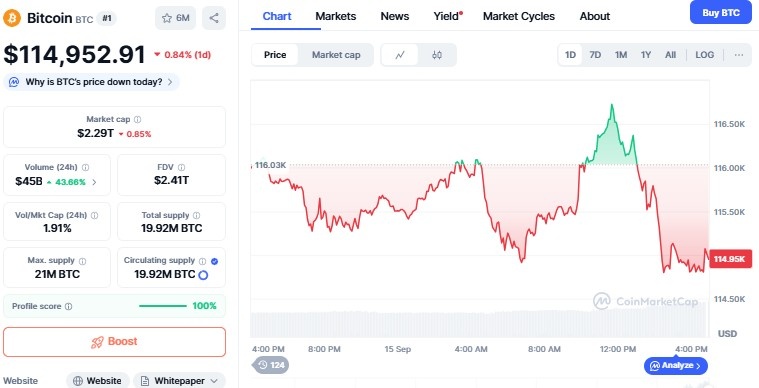

在过去24小时内,价格下滑0.8%,至115,133美元,而更广泛的加密市场也转为下跌。

主要问题是118,600美元的阻力区间,本月比特币在此被拒绝了三次。

交易量激增超过30%,显示卖方活跃。

如果跌破114,269美元,分析师警告可能会滑向112,933美元。

尽管如此,这种下跌在牛市中常常发生,震荡出弱手,随后迎来下一次比特币价格飙升。

来源:CoinMarketCap

根据CoinMarketcap的数据,该币目前交易价格为114,952美元,过去24小时内下降了0.83%。

市场普遍下跌与山寨币轮换

不仅仅是比特币承压。整个加密市场的价值损失近2%,其市场主导地位略微下降至57.37%。

这表明交易者正在将资金转向山寨币,像以太坊、狗狗币和BNB等币种获得了关注。

Michael Saylor与鲸鱼积累

与此同时,MicroStrategy的Michael Saylor再次提到将更多这种加密货币添加到公司持有的想法。他简单的信息“比特币值得信赖”足以引发猜测。

Saylor已经将他的公司变成了最大的比特币鲸鱼之一,如果他再购买更多,这将表明大型机构的强烈信心。这种鲸鱼活动通常为下一次重大行动奠定基础。

CPI数据与美联储决策悬而未决

宏观形势也将发挥重要作用。现在所有的目光都集中在美国9月份的通胀数据上。分析师预计其将为2.9%。如果数据疲软,美联储可能会将利率下调50个基点,这将削弱美元并支持比特币等风险资产。

这可能成为比特币价格再次飙升的火花。但如果通胀数据高于预期,美联储可能会推迟降息,并可能在110,000美元的支撑位附近面临压力。

结论

比特币正处于一个重要时刻。短期的挣扎和阻力显而易见,但历史、鲸鱼积累和宏观趋势都表明,重大比特币价格飙升的布局仍然完好无损。接下来的几周将告诉我们,这种数字货币是否真的准备好书写下一个篇章。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。